Liquorice

Advanced Member-

Posts

4,866 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Liquorice

-

BKK Bank 4 months banked method??

Liquorice replied to homemade514's topic in Thai Visas, Residency, and Work Permits

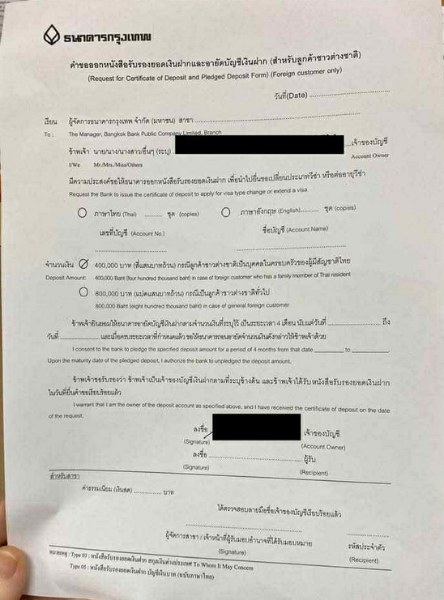

Have you not read page 1 of this thread. They will issue it providing he signs the Pledged Deposit form. -

BKK Bank 4 months banked method??

Liquorice replied to homemade514's topic in Thai Visas, Residency, and Work Permits

A further excuse for agents to raise their prices. -

BKK Bank 4 months banked method??

Liquorice replied to homemade514's topic in Thai Visas, Residency, and Work Permits

If you read above, they have you sign a form agreeing to freeze the funds for 4 months. From reading previous posts, it appears agents are now using Krungsri bank, suggesting they've had issues with the other banks. I suspect BOT will be issuing directives to all banks to scrutinise opening new accounts. -

BKK Bank 4 months banked method??

Liquorice replied to homemade514's topic in Thai Visas, Residency, and Work Permits

Déjà vu situation. Corrupt officials feeling the pinch from corrupt and illicit practices. -

BKK Bank 4 months banked method??

Liquorice replied to homemade514's topic in Thai Visas, Residency, and Work Permits

Nothing to really be concerned about, in my opinion. Using the 800K funds method for retirement, the 800K has to remain in the account for 5 months anyway. If using the 400K funds method for Thai family, then the 400K has to be in the account for 2 months and for the under consideration period, which is dated 30 days after the 90 day permission of stay from entry with a Non O = 4 months. -

BKK Bank 4 months banked method??

Liquorice replied to homemade514's topic in Thai Visas, Residency, and Work Permits

'Mule' accounts Jack. -

BKK Bank 4 months banked method??

Liquorice replied to homemade514's topic in Thai Visas, Residency, and Work Permits

There is a much bigger picture to all of this if you've been reading and watching current news over the last 3 months. There was the issue of the 'call centre' scams operating in Myanmar and Cambodia, amongst other identified scams, many of which were setting up Thai bank accounts using fraudulent ID, in order to launder money. These call centres and scams were being run by foreigners. Thai banks are tightening restrictions on foreign nationals opening and maintaining bank accounts primarily to combat financial fraud, particularly the use of "mule accounts" in scams. This crackdown aims to prevent criminals from using bank accounts for illicit activities. Bangkok bank is the biggest bank in Thailand and a leading bank in SE Asia, with an extensive International network. I believe they've been hit harder due to more fraudulent accounts being opened with them than other banks. As usual the criminal element now makes it harder for the genuine honest foreigners to now open a bank account. -

How to open a Bank account in 2025?

Liquorice replied to BS25's topic in Thai Visas, Residency, and Work Permits

Sometimes it's not what you know, but who you know that makes the difference. -

How to open a Bank account in 2025?

Liquorice replied to BS25's topic in Thai Visas, Residency, and Work Permits

Yeah, you can use that as proof of being single and then marry a bank official to open a bank account -

How to open a Bank account in 2025?

Liquorice replied to BS25's topic in Thai Visas, Residency, and Work Permits

Kor Ror 22 is a registration of an overseas marriage. Kor Ror 2 is a registration of a marriage in Thailand. -

How to open a Bank account in 2025?

Liquorice replied to BS25's topic in Thai Visas, Residency, and Work Permits

That was in reference to Tourists not needing a bank account and the alternatives. If you still have a registered address overseas, you can get the Wise debit card. -

How to open a Bank account in 2025?

Liquorice replied to BS25's topic in Thai Visas, Residency, and Work Permits

The topic is how to open a bank account, not whether it's a requirement to have one, but just to answer some of your points. Embassy Income letters! 30 and 60 day extensions require no proof of funds. 'Wise' International debit card and many credit cards offer an alternative to needing a Thai bank account. -

Breaking down the 90-day report rule

Liquorice replied to Issa Compass's topic in Thai Visas, Residency, and Work Permits

Now you've rumbled a hornet's nest ........... didn't your IO inform you 'extend visa', silly! -

Breaking down the 90-day report rule

Liquorice replied to Issa Compass's topic in Thai Visas, Residency, and Work Permits

You obviously missed the new regulation issued by Thai Immigration, amending section 38 of the Immigration Act regarding when a new TM30 had to be filed. Unfortunately, I cannot post the PDF, but I can copy and paste it. This regulation was printed in the Royal Gazette. Regulation of Royal Thai Police on notification of a householder, owner or possessor of a dwelling place or hotel manager, who takes in, as a resident, an alien permitted to temporary stay in the Kingdom. It is deemed expedient to amend the regulation of Royal Thai Police on notification of a householder, owner or possessor of dwelling place or hotel manager, who takes in, as a resident, an alien permitted to temporary stay in the Kingdom dated May 25, 1979 (B.E. 2522) in order to conform with the directions of national development and strategies for transforming government sector to digital government as well as to facilitate aliens staying in Thailand under the maintenance of national security standards. By virtue of Section 38, Paragraph 3 of the Immigration Act B.E. 2522 (A.D. 1979) the Commissioner General of Royal Thai Police herby issues the regulation prescribing notification of a householder, owner or possessor of dwelling place or hotel manager, who takes in, as a resident, an alien permitted to temporary stay in the Kingdom as follows: 1. Repeal the regulation of Royal Thai Police on notification of a householder, owner or possessor of a dwelling place or hotel manager, who takes in, as a resident, an alien permitted to temporary stay in the Kingdom dated May 25, 1979 (B.E. 2522); 2. Notification of a householder, owner or possessor of dwelling place or hotel manager, who takes in, as a resident, an alien permitted to temporary stay in the Kingdom must proceed as follows; 2.1 Notify a competent official at an Immigration office located in a locality in which the house, dwelling place or hotel is located within twenty-four hours from the time an alien has taken residence. In case that house, dwelling place or hotel, where an alien has stayed, is located in Bangkok Metropolis locality, such notification shall be made to a competent official at Immigration Division 1 of Immigration Bureau. 2.2 After a householder, owner or possessor of dwelling place or hotel manager already made a notification according to 2.1, then the alien goes to occasionally stay somewhere else and return to stay at the original place within the notified period of stay that has not yet ended, such householder, owner or possessor of dwelling place or hotel manager is not required to make a notification again. The alien mentioned in paragraph 1 shall include any alien receiving a multiply entry visa, who departs the Kingdom and returns within the validity of visa and any alien permitted to re-enter into the Kingdom with a valid re-entry permit. 3. Subject to the article 2, a householder, owner or possessor of dwelling place or hotel manager may make notification in person or assign others to submit a letter of notification or send it by registered mail or via the electronic notification system of Immigration Bureau. 4. Notification of receiving an alien to stay as a resident according to the article 3, shall be in accordance with the criteria, conditions and supporting documents as prescribed by Immigration Bureau. 5. A competent official who receives a notification shall issue an evidence of notification for those who notified. 6. The notification form attached to this regulation shall be used in case of making a notification in person or assigning others to submit a letter of notification or sending it by registered mail. An evidence of notification and receiving a notification via the electronic system shall be in accordance with the form prescribed by Immigration Bureau. This regulation is effective from June 30, 2020 onwards. Issued on June5, 2020 Police General Chakthip Chaijinda Commissioner General of Royal Thai Police -

Breaking down the 90-day report rule

Liquorice replied to Issa Compass's topic in Thai Visas, Residency, and Work Permits

Deleted -

It means another user has already registered that address, owner, previous tenant etc. You'd have to call into your local IO to sort it out.

-

Random Immigration Checks

Liquorice replied to Jake72's topic in Thai Visas, Residency, and Work Permits

Correct, but Immigration orders dictate the marriage must be de jure and de facto. "De jure" and "de facto" are Latin terms used to distinguish between what is legally recognized versus what exists in reality. KR2 proves the 'de jure' element, whilst a home visit proves the 'de facto' element, as in living together. -

How to open a Bank account in 2025?

Liquorice replied to BS25's topic in Thai Visas, Residency, and Work Permits

Er, Immigration don't accept crypto accounts. The topic is about a bank account acceptable to Immigration. -

Random Immigration Checks

Liquorice replied to Jake72's topic in Thai Visas, Residency, and Work Permits

Kor Ror 2, yes, but that only proves since registering your marriage there is no record of divorce. It doesn't prove you're living together in a de jure and defacto relationship ....... hence the visit. -

800k Not In the Bank Method

Liquorice replied to Forever Young's topic in Thai Visas, Residency, and Work Permits

Jomtien? Samui? You questioned it, right? -

How to open a Bank account in 2025?

Liquorice replied to BS25's topic in Thai Visas, Residency, and Work Permits

Exactly which part of the topic "How to open a bank account" don't you understand. -

800k Not In the Bank Method

Liquorice replied to Forever Young's topic in Thai Visas, Residency, and Work Permits

E-visa application is universal, offering all the same visa types. https://www.thaievisa.go.th/visa/retirement First option on the list is for the Non O, second option Non 0-A. -

800k Not In the Bank Method

Liquorice replied to Forever Young's topic in Thai Visas, Residency, and Work Permits

Health Insurance is not required for a Non O, or extensions of stay. -

800k Not In the Bank Method

Liquorice replied to Forever Young's topic in Thai Visas, Residency, and Work Permits

I'm guessing by 'checking' account you mean the 'Savings' account (Blue book) which comes with a debit card. It's the Fixed term deposit account that offers the higher interest rate. (Orange book). No debit card, accepted by Immigration as funds are immediately accessible if required. A 12 month fixed term account will typically offer a 1.25% or a 24 month FTD a 1.55% interest rate. At the end of the 12/24-month term, the account will automatically revert to the standard 'Savings account' rate, unless you request the bank to 'roll' the FTD account over for another fixed term. https://www.bangkokbank.com/en/Personal/Other-Services/View-Rates/Deposit-Interest-Rates -

800k Not In the Bank Method

Liquorice replied to Forever Young's topic in Thai Visas, Residency, and Work Permits

Yes.