Liquorice

Advanced Member-

Posts

4,855 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Liquorice

-

Medical certificate

Liquorice replied to kevtheblue's topic in Thai Visas, Residency, and Work Permits

It appears he intends to apply for a 1 year extension of stay based on retirement, but will off course require a Non Immigrant type visa first. It also appears his intention is to enter Visa exempt, apply for the Non Imm O at Phetchabun Immigration, then the 1 year extension. The advice though was to obtain the Non Imm O prior to entry ............ but none of the above has any compulsory Health Insurance requirement. Probably a red herring and just looking for some voluntary Health Insurance policy. He may well be aware of his intentions, but doesn't explain it very well. -

Medical certificate

Liquorice replied to kevtheblue's topic in Thai Visas, Residency, and Work Permits

I'm guessing you're from the UK ? I'm also guessing you're applying for a visa to enter Thailand from a Thai Embassy ? Which type of visa are you applying for ? -

Tm30-new passport

Liquorice replied to RotBenz8888's topic in Thai Visas, Residency, and Work Permits

Strange, as the TM30 form is just a report of your place of residence and doesn't even request your passport number. -

Do a combo for i.e. englishmen

Liquorice replied to glegolo18's topic in Thai Visas, Residency, and Work Permits

My Immigration accept the combo method, but their interpretation of the orders are that a minimum of 400K deposited funds in a Thai bank must be maintained throughout the year, the remainder of the required 800K to be provided by proof of 12 x monthly overseas transfers. 12 x 35K monthly transfers would be enough. If you haven't already started making monthly transfer to your Thai bank account, I suggest you start. When the UK, US and Australian Embassies stopped issuing income letters, Immigration sent an instruction to all offices to show leniency to those affected. -

As described above by @treetops The first email which you have received is merely a detailed copy of the TM47 you submitted online. Once accepted, you'll receive a further email with the TM47 fully completed and notifying your next 90-day report date. I print that, tear off the bottom section which is the receipt and notifies the next due report date and staple it in the rear of my passport. Alternatively make a note on a calendar or on your phone of the next due report date.

-

Extension Based on Marriage

Liquorice replied to MangoKorat's topic in Thai Visas, Residency, and Work Permits

Bangkok Bank can update your book to the current date without the need of a deposit. -

Extension Based on Marriage

Liquorice replied to MangoKorat's topic in Thai Visas, Residency, and Work Permits

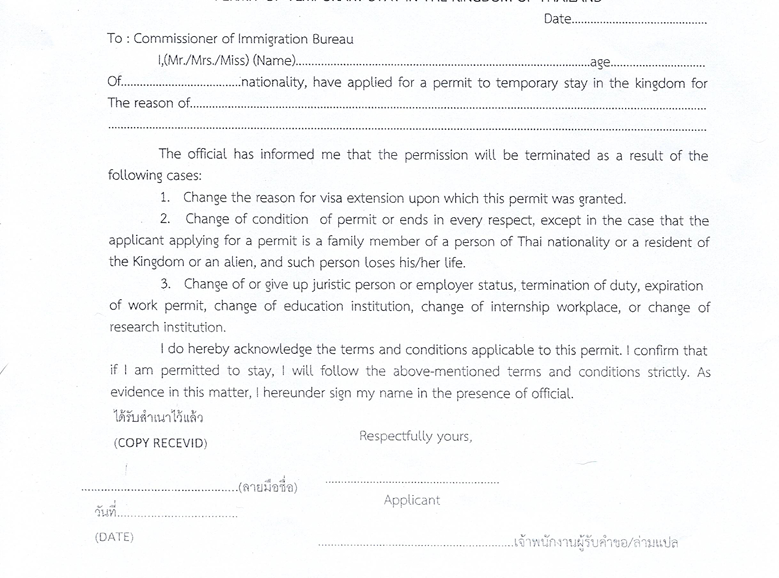

On entry, you are granted a period of stay, often referred to as an 'entry stamp', but is a permit allowing temporary permission of stay. The visa is either 'used' on entry and therefore invalid, or in the case of multiple entry it has an 'expiry' date, after which that is also invalid. The only relevance of that now invalid visa is it denotes your Immigration status in Thailand, as in 'Tourist' or 'Non Immigrant' and the category for the reason of entry. This is explained by Thailands Ministry of Foreign Affairs website. https://www.mfa.go.th/en/page/general-information?menu=5e1ff6d057b01e00a6391dc5 7. Please note that the period of visa validity is different from the period of stay. Visa validity is the period during which a visa can be used to enter Thailand. In general, the validity of a visa is 3 months, but in some cases, visas may be issued to be valid for 6 months, 1 year or 3 years. The validity of a visa is granted with discretion by the Royal Thai Embassy or Royal Thai Consulate-General and is displayed on the visa sticker. 8. On the other hand, the period of stay is granted by an immigration officer upon arrival at the port of entry and in accordance with the type of visa. For example, the period of stay for a transit visa is not exceeding 30 days, for a tourist visa is not exceeding 60 days and for a non-immigrant visa is not exceeding 90 days from the arrival date. The period of stay granted by the immigration officer is displayed on the arrival stamp. Travellers who wish to stay longer than such period may apply for extension of stay at offices of the Immigration Bureau To extend your stay, you must meet any requirements and complete form TM7, which should be self-explanatory by its title. APPLICATION FOR EXTENSION OF TEMPORARY STAY IN THE KINGDOM. That should make it evident you are applying to extend your period of stay, but granted subject to the type of visa originally obtained and meeting any financial criteria. When you submit an application to 'extend your period/permission of stay' you are also required to submit and complete form SMT2, which is an 'ACKNOWLEDGEMENT OF TERMS AND CONDITIONS FOR PERMIT OF TEMPORARY STAY IN THAILAND', which you are duly requested to sign acknowledging the terms and conditions. It's clear from the opening paragraph you are applying for a 'permit to temporary to stay in the Kingdom'. Under 3) you then sign acknowledging the terms and conditions applicable to this permit (for which you are applying). Entry stamps and extension stamps are 'permits' allowing a period of temporary stay. You don't have to be a Guru, if you have the ability to read and understand what you've read. Now who's talking garbage and in denial of the facts. -

Tm30-new passport

Liquorice replied to RotBenz8888's topic in Thai Visas, Residency, and Work Permits

Well, I certainly haven't read of different policies throughout Immigration offices with regard to transferring stamps to a new passport. At the same time, they'll update your details with your new passport number. -

Tm30-new passport

Liquorice replied to RotBenz8888's topic in Thai Visas, Residency, and Work Permits

No idea what is meant by 'things being how they are' and 'what the situation is NOW'. It's your local IO in the Province where you register as residing that will process/approve a TM30 or 90 day report. Provided you update your office with any changes, such as a new passport, then you won't have any problems. In the case of a new passport, they will transfer the stamps from the old passport and change the details on their system. -

Tm30-new passport

Liquorice replied to RotBenz8888's topic in Thai Visas, Residency, and Work Permits

Provided you've taken the new passport to your IO to have the stamps transferred, then your new passport number will be changed on the system. No need to file a new TM30 and no issue with further 90 day online reports. However, if you haven't transferred the stamps to a new passport, then the 90-day online will not work. -

Which form to renew Non-O

Liquorice replied to OzMan's topic in Thai Visas, Residency, and Work Permits

You cannot extend a visa. The Non O granted you temporary permission of stay for 90 days. You will be extending that temporary permission of stay exactly as noted on the TM7 form. -

The link is to the Thai Embassy, Manilla. If you then click on the links provided at a) and b), it details (in a PDF) which nationalities require permanent residency status. If your nationality isn't listed, then you do not require PR to apply for an e-visa. a. Applicants from the following countries are required to hold a valid Philippine permanent resident visa before applying for an E-Visa. -- Please click here > Applicants from the following countries are required to hold a valid Philippine permanent resident visa before applying for an e-Visa with the Royal Thai Embassy, Manila: Afghanistan** Algeria Bangladesh Cameroon Central African Republic China Congo Republic Democratic Republic of the Congo Egypt Equatorial Guinea Ghana Guinea India Iran Iraq** Lebanon Liberia Libya Nepal Nigeria* North Korea** Pakistan Palestine Sao Tome and Principe Sierra Leone Somalia Sri Lanka Sudan Syria Yemen b. Applicants from the following countries who do not hold a valid Philippine permanent resident visa will be subject to approval with the Ministry of Foreign Affairs which will take 4 weeks. -- Please click here > Applicants from the following countries who do not hold a valid Philippine permanent resident visa will be subject to approval with the Ministry of Foreign Affairs which will take 4 weeks, if they wish to apply for an e-Visa with the Royal Thai Embassy, Manila: Angola Benin Botswana Burkina Faso Burundi Cabo Verde Chad Comoros Côte d'Ivoire Djibouti Eritrea Ethiopia Gabon Gambia Guinea-Bissau Kenya Lesotho Madagascar Malawi Mali Mauritius Mozambique Namibia Niger Rwanda Senegal Seychelles South Africa South Sudan Swaziland Tanzania Togo Uganda Zambia Zimbabwe

-

Extension Based on Marriage

Liquorice replied to MangoKorat's topic in Thai Visas, Residency, and Work Permits

With a Fixed Term Deposit account, the interest rates are higher than the Savings accounts, plus a debit card isn't issued for it. To withdraw funds, you have to physically go in the branch with the bankbook and your ID. It also prevents those 'accidental' withdrawals that take you under the financial requirements. -

Extension Based on Marriage

Liquorice replied to MangoKorat's topic in Thai Visas, Residency, and Work Permits

Your wife could also have other family members registered in her TB. Would Immigration also request their ID. The fact is if you're applying based on Thai spouse and have to show 400K deposited for 2 months in a Thai bank account, then the children are not part of the application and should not be part of the process. -

Extension Based on Marriage

Liquorice replied to MangoKorat's topic in Thai Visas, Residency, and Work Permits

Folks only report when they've had an issue, rarely are non issue reports posted. -

Extension Based on Marriage

Liquorice replied to MangoKorat's topic in Thai Visas, Residency, and Work Permits

@IvorBiggun2 hasn't applied based on Thai children > section 2.18 Clause 5 He applied under section 2.18 Clause 6 > Thai spouse but given them details of all the children, which wasn't actually required. Immigration will just repeat that process each year now. -

Extension Based on Marriage

Liquorice replied to MangoKorat's topic in Thai Visas, Residency, and Work Permits

Thais yes, foreigners no. You only need to declare the wife registered in the Tabien Baan (homeowner) if your extension is based purely on Thai spouse. By giving them all the family registered in the TB, I'm sure they've processed your application based on staying with Thai family. -

Extension Based on Marriage

Liquorice replied to MangoKorat's topic in Thai Visas, Residency, and Work Permits

You probably gave them a copy of every page of the Tabien Baan, which would include every Thai registered at that address, but not necessarily living there, so your IO assumed you were applying based on Thai family, rather than just Thai spouse. The financial requirements are the same. All you needed to supply is the front page detailing the address, then the first page with your wife's details as the 'householder'. -

Extension Based on Marriage

Liquorice replied to MangoKorat's topic in Thai Visas, Residency, and Work Permits

I'll be submitting my next extension based on Thai spouse next week. Changed from retirement to Thai spouse 8 years ago without any grief. Most encounters I've experienced with an issue with an extension application based on Thai spouse have been the fault of the applicant not submitting the correct documents. -

Extension Based on Marriage

Liquorice replied to MangoKorat's topic in Thai Visas, Residency, and Work Permits

Sounds as though your extension is being processed based on Thai family, rather than just Thai spouse. Who told them you had children in the first place? -

Extension Based on Marriage

Liquorice replied to MangoKorat's topic in Thai Visas, Residency, and Work Permits

I think you and your friend have confused each other. No such visa category has ever existed. Perhaps you meant the Non O visa, or the Non O-A visa. You just described the 'combination' method, part funds deposited in a Thai bank, and part monthly overseas transfers ................. which is only applicable for extension based on retirement. Extensions based on a Thai spouse have always been 'either' funds deposited in a Thai bank (400K) .......... OR............. evidence of monthly income, (40K) but never both. The only reason you'd have to visit your Immigration office every 90 days is to submit a 90 day report, which is merely a confirmation of your address and there is no requirement to submit proof of any financials. The British Embassy also would not have provided proof of his monthly pension. Your post is very confusing with details. -

Extension Based on Marriage

Liquorice replied to MangoKorat's topic in Thai Visas, Residency, and Work Permits

Thailand has just passed the Marriage Equality Act now recognising same-sex marriages as of Jan 23rd, 2025. Theoretically, the same conditions should apply for extensions based on a foreign female married to a Thai male, but as yet the waters haven't been tested.