Liquorice

Advanced Member-

Posts

4,661 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Liquorice

-

In that case, a confirmation letter from your Embassy or obtaining a Yellow house book, would be an alternative, although more costly and more inconvenient. I've noticed Thai banks have moved away from listing documents required to open an account for foreigners on their websites. Bangkok Bank in particular, where I was informed rather than a single policy, now each branch can construct their own requirements to open an account for foreigners. Times have certainly changed.

-

I suspect the IO's were reluctant (poorly trained/lack of ability/knowledge) to process such applications. Much easier to advise you go out of Country to obtain it, rather than admit they don't know and lose face. I am aware of at least one local expat who managed to obtain a Non O for his son from Immigration, but it wasn't plain sailing.

-

@Maestro is correct. According to the OP, his son entered as a Tourist (VE/TV?) To piggyback his Fathers' extension, he must have Non Immigrant status. He can apply for the change of status (Non O) at his local Immigration office. Procedure here; VE-TV to Non O Dependant.pdf No. 8 on this list; https://bangkok.immigration.go.th/en/issuing-and-changing-type-of-visa/

-

If you ask a bank, they'll tell you most Thais are aware of their spouse ATM card PIN's and withdraw the maximum daily amount until empty, before they notify the bank of their demise. Provided you are the sole beneficiary of the estate under law, then there is no comeback. This is where making a Will is a necessity IMO.

-

For Immigration purposes, the account must be in the foreigner's sole name. You can add a person to your account though by signing a Power of Attorney form that the bank provides, which gives them access to your account, but on statements, letters etc, only your name appears. Hell, Bangkok bank even gave my spouse a separate debit card for my account when I gave her POA. To navigate through the Thai Inheritance laws of succession after death, a simple Will suffices as to who inherits the deceased estate and avoids the probate process. (Unless someone contests the Will).

-

They'll take no notice of a lawyer's letter. She'd need to sign a POA for the OP to conduct affairs on her behalf. My wife has POA to access my account and a Thai Will along with a Thai death certificate, Bangkok Bank assure me funds would immediately be released to my spouse in the event of my death on production of those documents. At minimum, the lady in question will require a Court Order to release said funds to her, after proof she alone is entitled to said funds.

-

There is a legal procedure to follow to have any foreign document accepted as legitimate by Thai authorities. As with marriage to a Thai, the BE can attest an affidavit to marry, but if widowed/divorce you must produce said document. This is because the BE have access to Public records in the UK. (Birth, Death, Divorce) and can authenticate those documents as being genuine. Alternatively, they may tell you that the UK death certificate should be first authenticated by the Home Office in Milton Keynes, then legalised by the Thai Embassy in London. This is then translated into Thai and legalised by Thailand Ministry of Foreign Affairs. Without that vignette being attached by the MFA, the document could be a forgery. I suspect the bank are making enquiries through the British Embassy to authenticate the Death certificate is genuine - could take months. I'd advise you contact the BE yourself.

-

How can a Thai lawyer authenticate a UK death certificate. The correct procedure is to have the British Embassy authenticate the document, then have it translated, then legalised by Thailand's Ministry of Foreign Affairs. Only then will it be acceptable as a genuine foreign document by the bank - hence their enquiries. It's also no longer a 'joint' account per se.

-

Provided you can prove 12 x 65K minimum monthly overseas transfers, you meet the financial criteria. 35-2561 (2019 (changed clause 2.22 of 327-2557 ENG.pdf This was an amendment to the requirements issued after the UK, US and Australian Embassies ceased the Income letters, to accept monthly overseas transfers to a Thai bank as an alternative.

-

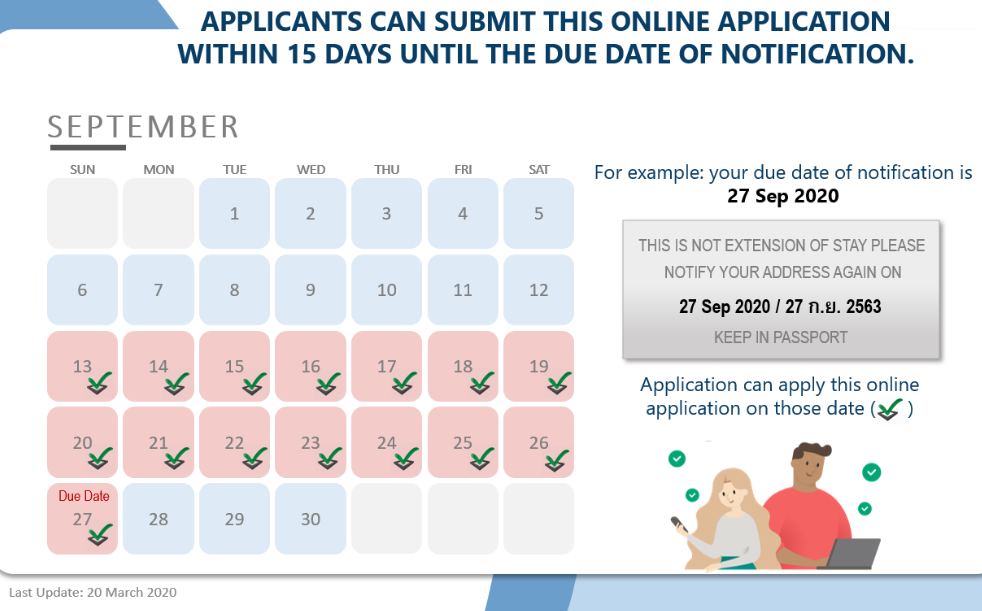

Yep, agreed, but the point I was trying to make went over members heads. If you've exited and re-entered in-between a 90-day report, you're still able to submit online on the due date. The system doesn't know you've exited and re-entered. Of course, you can count 90 days from re-entry and submit within the 14-day window, but my particular IO will not approve these applications, stating foreigners frequently enter the wrong dates, so they insist you go in person the first time after re-entry.