norbra

Advanced Member-

Posts

1,437 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by norbra

-

If driver cancels they are "off the air" for 2 hours, if customer cancels no penalty.

-

Passenger Surge at Suvarnabhumi Airport for Upcoming Chinese New Year

norbra replied to snoop1130's topic in Thailand News

5:00pm today BKK immigration was not bustling it was a traffic jam,all counters open still took an hour to get stamped in. -

4 hours later following a spicy dinner and a 490ml can of Singha BP down to 110/66

-

My barber in Amphawa charged 40 baht a cut, if you tried to pay with a 100 note there was drama as he only accepted 40 baht and he would not give change of 100. So he would suggest settle up next visit.

-

Cheap is right,my Australian meds bought in Bangkok 2000baht every month ,Amlodipine 300 baht for 200 doses.

-

Mine was similar PSA 42,MRI at Chula confirmed, Had external radiation 36 doses over 6 weeks,that was 12 years ago,no side effects apart from discoloured semen for about a month after radiation course finished

-

I was taking 10mg Amlodipine BP 110 / 60. Too much edema in ankles reduced to 5mg before breakfast daily. No more edema, BP @14:45 134/66, I believe the new norm for 80yo is 140/60-70

-

Australian Aged Pension

norbra replied to VOICEOVER's topic in Australia & Oceania Topics and Events

Come on if you are in Thailand for more than 180 days you are a thai tax resident and obliged to pay any tax relevant levies -

Australian Aged Pension

norbra replied to VOICEOVER's topic in Australia & Oceania Topics and Events

My view.I am an Australian national,I am a tax resident of Thailand, I accept that my Australian Aged Pension is ASSESSABLE to be taxed by Thai legislation. Them's the facts. -

Australian Aged Pension

norbra replied to VOICEOVER's topic in Australia & Oceania Topics and Events

Jees how long has it taken to exclude irrelevant 19 from this thread -

Australian Aged Pension

norbra replied to VOICEOVER's topic in Australia & Oceania Topics and Events

Again I will point out that Centrelink Aged Pension has no association with article 19,which is all about Government "Service" pensions for those employed by the government in various fields -

Australian Aged Pension

norbra replied to VOICEOVER's topic in Australia & Oceania Topics and Events

Section 19 is all about government SERVICE pensions ,Those receiving these pensions should be aware that Australian tax is applied prior to distribution -

Australian Aged Pension

norbra replied to VOICEOVER's topic in Australia & Oceania Topics and Events

Forget section 19 it has nothing to do with the aged pension period. -

Australian Aged Pension

norbra replied to VOICEOVER's topic in Australia & Oceania Topics and Events

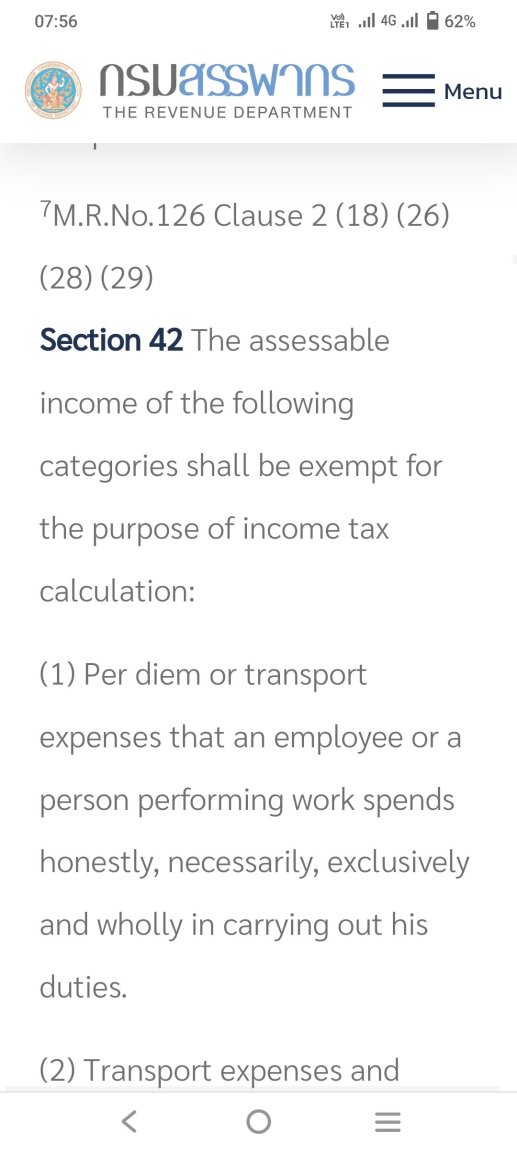

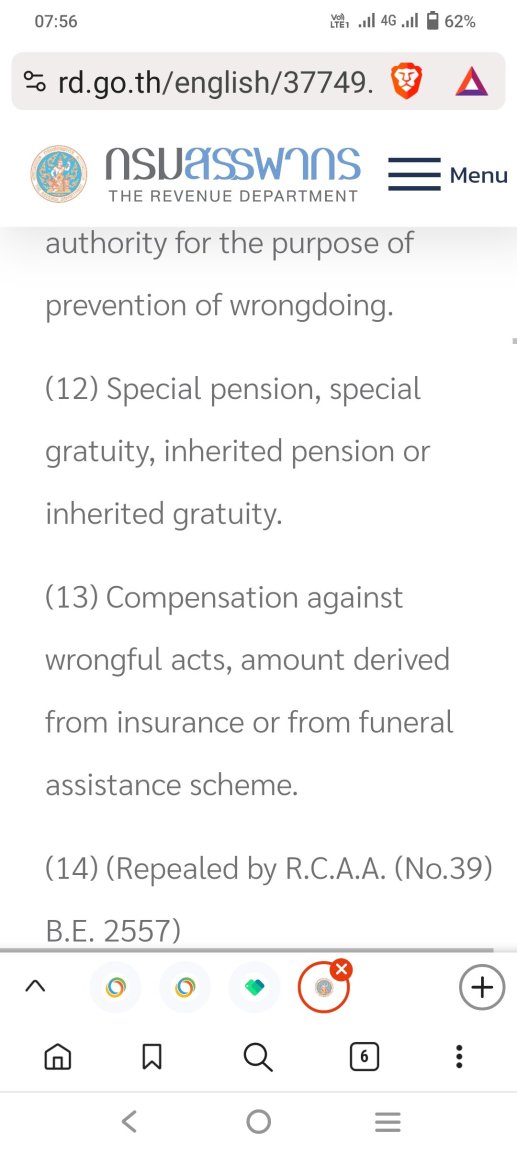

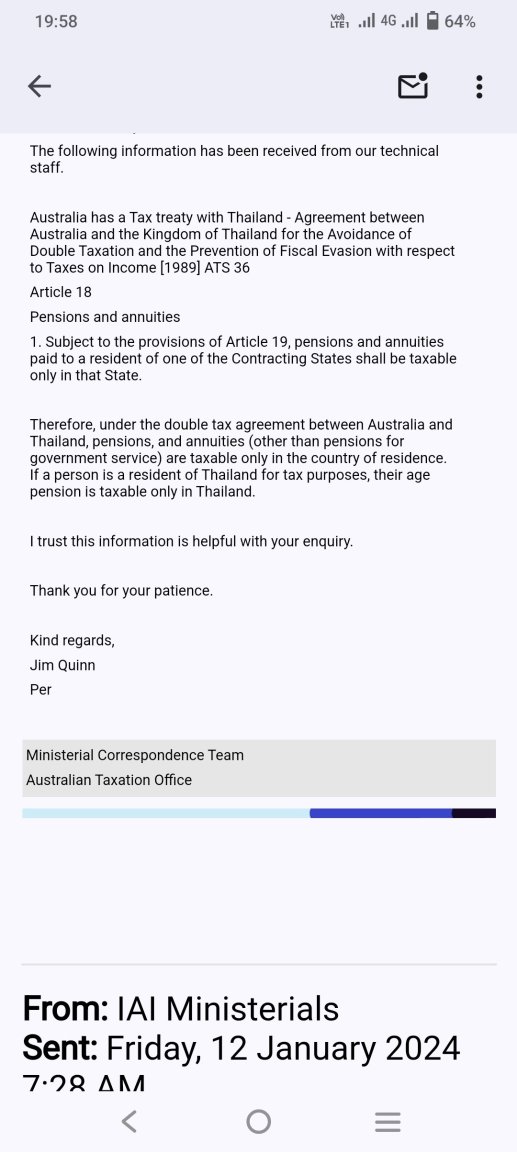

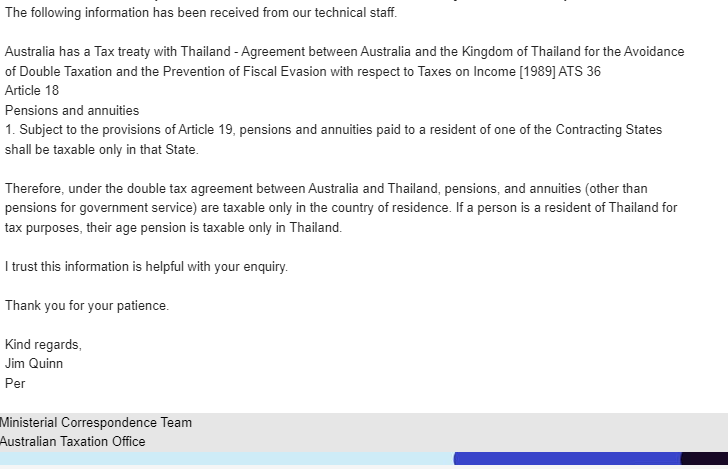

While I am comfortable,as a Thai tax resident, with ATO's advise that for those with Thai tax residency the Centrelink Aged Pension is ASSESSABLE for tax purposes by Thai revenue department. The Thai RD advise that "special pensions" Code 42-12 are exempt from tax, I have searched far and wide but cannot find definitions of this "special pension",any further information would be helpful in my endeavours to get a grasp on what might be relevant to all. Re DTT section 19 this has no relevance to Centrelink Aged Pension,period. It is all about government SERVICE pensions -

Australian Aged Pension

norbra replied to VOICEOVER's topic in Australia & Oceania Topics and Events

Only for you I would guess,as the response from the ATO in their closing paragraph mentioned Aged pension, also government (service)pensions excluded as they have been taxed in Australia. -

Australian Aged Pension

norbra replied to VOICEOVER's topic in Australia & Oceania Topics and Events

-

Australian Aged Pension

norbra replied to VOICEOVER's topic in Australia & Oceania Topics and Events

There seems to be a lot of misconception with ATO definitions. Foreign non resident is a foreign national on a bridging or similar visa. A foreign resident is a foreign national maybe married to an Aussie. Australian Expats living overseas for more than 180 in a single country are considered Tax residents of that country,ATO not interested in aged pension tax as levied by that country due to DTT. -

Best Bangkok hospital for facial skin cancer?

norbra replied to Roo Island's topic in Health and Medicine

Can't be too careful,in the last 8 years I have had 5 Squamous cell carcinomas on my brow ,neck and ear, resulting in 3 skin grafts,my skull thickness reduced by 1.5mm,removal of lymph nodes and my ear reduced by half. The grafts and lymph nodes all done under general anesthesia. Followed by 6 weeks of daily radiation treatments. Skin grafts done in Australia, lymph nodes and ear done in Thai government hospital @100,000thb -

You can pay to me if you like,seriously you do not have to pay tax to Thai revenue dept if you do not bring funds to Thailand. If your home country assesses your pension as taxable,and you are already paying tax to them,then do nothing. If your pension is below assessable threshold in your home country then do nothing. Since I am not aware of your circumstances the above is for general info only

-

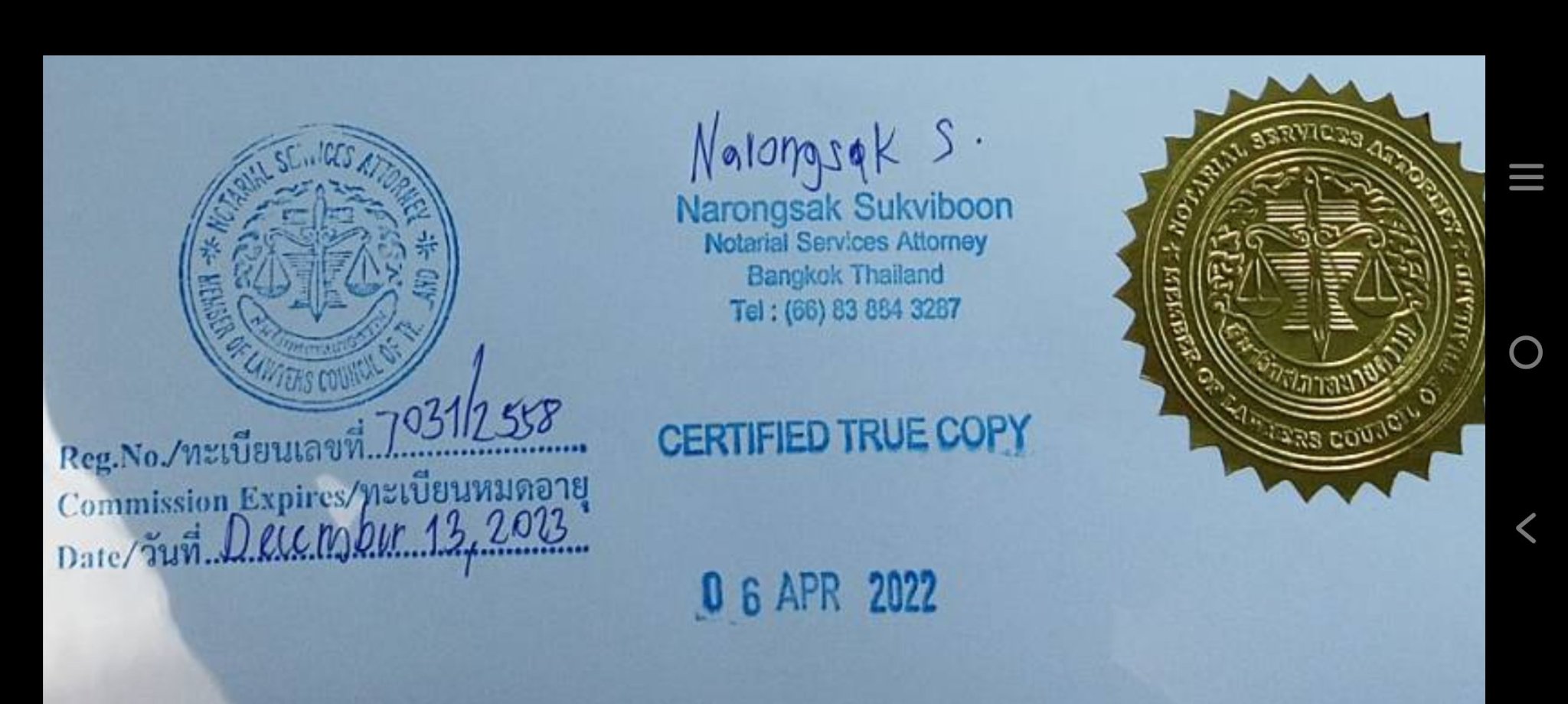

apostille and or notary service

norbra replied to Vampyteuthis's topic in Visas and migration to other countries

-

Hacked LINE account, how to block access by another

norbra replied to notrub's topic in Mobile Devices and Apps

Open Line , select home ,select settings (top right)select privacy,here you can set your account parameters. Back to settings, select friends, here you can block/ delete and prevent others from communicating.

.png.3b3332cc2256ad0edbc2fe9404feeef0.png.8488ab72b8bb2e508209bfe3211b6e08.png)