-

LTR Visa is Now available for Long Term Residency

The renewal and housekeeping presentation is up on their website: https://ltr.boi.go.th/page/news.html The Tax discussion is not up yet, but fyi the presenter from TRD was: Mr. Kasapon Singprasert, Senior Tax Economist from the Revenue Department steve

-

LTR Visa is Now available for Long Term Residency

As far as I can tell from earlier comments above the BoI is simply following the wording of the Royal Decree (No. 743) B.E. 2565 (2022): Section 5 Income tax under Part 2 of Chapter 3 in Title 2 of the Revenue Code shall be exempted for a foreigner categorised as Wealthy Global Citizen, Wealthy Pensioner, or Work-from-Thailand Professional who is granted a Long-Term Resident Visa under immigration law for assessable income under section 40 of the Revenue Code derived in the previous tax year from an employment, or from business carried on abroad, or from a property situated abroad, and brought into Thailand. This will certainly exempt from taxes for all but current income - simply waiting to the next calendar year would effectively exempt even income from employment, business, or gains from property. I see this as akin to the 2023 asset exemption from 2024 taxation - keeping good records should suffice while remitting current year income will be taxable. Try to think of this as grandfathering in the 'previous year income exemption' that went away a few years ago.

-

LTR Visa is Now available for Long Term Residency

I did answer the BoI survey with my priorities and issues. I took this as an effort to expand the feedback from existing visa holders beyond those attending the community meeting. For the open ended comment I asked them to consider allowing current holders to re-qualify and renew at the end of the initial 10-year term. I mentioned that for Wealthy Pensioners at least some of us will be in our eighties by the time the initial Visa expires.

-

LTR Visa is Now available for Long Term Residency

BoI's reply This event is for in-person attendance only. There will be no online session, and no materials or details will be shared after the event.

-

LTR Visa is Now available for Long Term Residency

I have requested that BoI-LTR provide presentations and any handouts on line.

-

LTR Visa is Now available for Long Term Residency

I live upcountry so responded to the invite with a question if there would be video streaming. No plans for it was the response. Should anyone attend a report would be appreciated.

-

Thai bank account to child upon death?

There is no trusts here so you should research and consider "controller of property". As we do not trust the inlaws with what we would leave our granddaughter we appointed a nephew who did a good job raising his son

-

Man bags

Been carrying the same model Eagle Creek shoulder bag for more than twenty-years. Can carry most of what I need, currently I usually carry phone, glasses case, paper wipes, etc. but there is room for more if need be. If I am traveling out of province I add my passport in a Eagle Creek passport bag which has its stitching needing attention. Buy good quality and it should last for years, style be damned. Still on EBay for $20. https://www.ebay.com/itm/157630400631

-

Are US Social Security payments tax exempt if remitted?

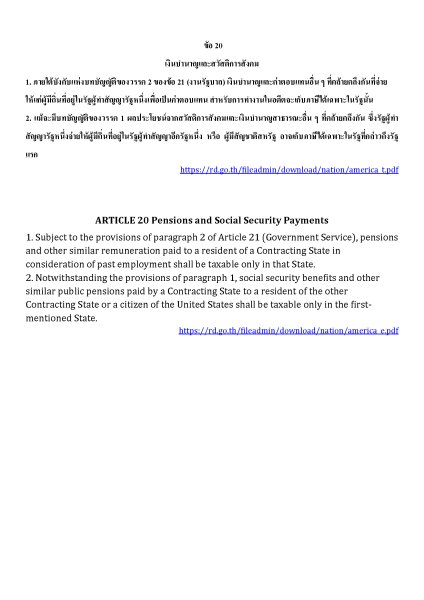

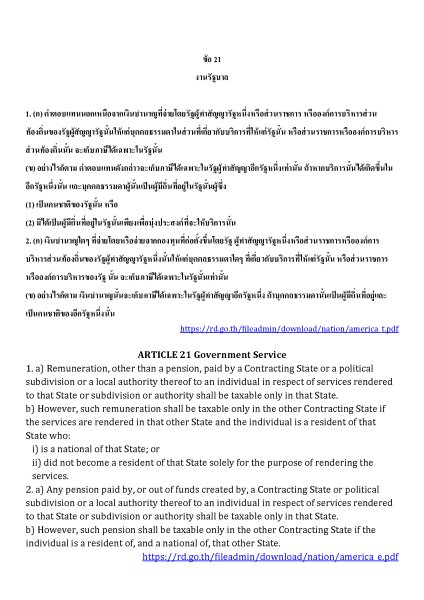

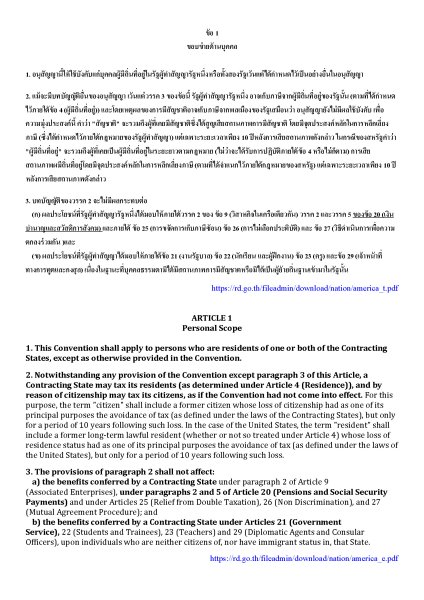

I find that presenting a questioning TRD officer with their own version of the DTA in both Thai and English to be helpful. Here is are jpg converted from from a Word document via Acrobat of Article 20 covering Social Security. You might find the next article (21) which covers non-government pensions, including company pensions and retirement accounts helpful in arranging your finances. Article 1 Paragraph 3 exempts your SSA benefit from the savings clause.

-

2026 US Social Security Deposits

Remember it is not five days on holiday but the need for retraining

-

What minimum balances do you keep in Thailand?

A few notes about my current situation here. I carry Pacific Cross health insurance, continue to pay Medicare Part B, and have a long term insurance policy - why so much insurance? I don't want to live here without my wife. should she go before me or we divorce so can easily return to my home country. Our living expenses are covered mostly by my US Social security benefit ~65k ThB paid into my BBK account. My wife will collect a similar amount as a survivor after I die so I don't need to worry about what I leave her. Main US assets are a Roth IRA and a brokerage account, both of which have her as sole primary beneficiary which removes them the need for probate.

-

How many kilos could you stand to lose?

My comeback to anyone who asked or noted I had lost weight was to ask in return if they had found the aforementioned pounds. Dirty looks followed.

-

Goddam it, my fridge just broke!

We very much like our Panasonic refrigerator - double door with the freezer on the bottom. We have a small Samsung in the dining room that gets lots of opening to get out cold water and yoghurt drinks - saves wear and tear on the more expensive Panasonic that actually has food in it. Double drawers in the refrigerator section - one for meats/seafood, one for vegetables. https://www.panasonic.com/th/consumer/kitchen-appliance/refrigerator/2-door-bottom-freezer-refrigerator.html No complaints except for the little bit of groaning as the freon circulates, that and needing to brace the overflow reservoir that was vibrating - a rubber washer fixed that. Assume it will keep going longer than me. Not cheap (today's prices seem to run around 20K - , but I have some faith in the brand from my many Lumix digital cameras and other things over the years.

-

Overseas U.S. voters: FVAP discontinues Fax service

We have be relying upon FVAP's fax service back to our election office for years. When I looked to see why our ballots had not been received our Registrar of Voters had this to say: Military and Overseas Voters Alert! Effective August 1, 2025, the Federal Voting Assistance Program discontinued their service of faxing overseas voters’ election materials to county election officials. You can no longer send your voting materials to fax[at]fvap.gov. We are going back for a short visit in October so we can drop our ballot in the drop box outside of City Hall, but for next year does anyone have any trusted fax service? I will see if ACS at the embassy has any options (we are going to be at the Bangkok Consulate before we leave, so ACS could actually perform a Service for American Citizens. Steve

-

Anyone else having problems doing the Bangkok Bank App ?

Had no luck inside, went to the porch with better light and got it to work.

mudcat

Member

-

Joined

-

Last visited