-

Posts

1,723 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Misty

-

Unfortunately not sure we have many data points yet. For me, the NY consulate said up to "15 working days" via FB message, but then they ended up approving and emailing it the same day I made the LTR e-visa application. Maybe shoot LA consulate a FB message and let them know you've applied. Ask if they might be able to approve in time for holiday travel.

-

It sounds like you've received the final approval and are on the BoI site now. Congratulations! Choose 1 - this is the selection for telling the BoI that you wish to receive the visa outside of Thailand. (2 is if you're in Thailand and will go in person to the BoI's Bangkok office.) If you are in a place where e-visas are issued (such as the US), then it will automatically be an e-visa. If not, then you would need to apply in person at the consulate. After making this selection, you'll receive the Notification Letter from the BoI addressed to the overseas consulate. You'll need this letter to apply for the e-visa. Once you have the Notification Letter, you then go to https://www.thaievisa.go.th/ to start the e-visa application process.

-

In phone calls, the BoI said my application was "approved" by the BoI by the 3d week of Sep. But it still wasn't marked "Approved" overall until 4 Oct. In late Sep the BoI said they'd forwarded the application to, and were waiting on, Immigration. Finally on 4 Oct the online system marked the application as "Approved" and I was asked to confirm where I wanted to receive the LTR visa. So if BoI hasn't asked anotherexpat4444 where you want to receive the LTR visa yet, suggest checking to see what the BoI meant by saying your application is "approved" . Maybe it's still with Immigration.

-

In one of my calls in Sep/Oct time frame, the BoI staff explained that my application had been approved by the BoI, and was now with Immigration for final review. The staff member also explained that the "20 working days" was for the BoI process only, and didn't include any additional time that other agencies might spend on the application. After a few days or a week, I received the final "approval" from all the gov't agencies in Thailand, and was asked where I would like to receive the LTR visa (in Bangkok or from a Thai consulate outside the country). So I wonder if "Consideration by Govt Agencies" could mean that the BoI has approved the application, and is waiting on Immigration. It wouldn't surprise me if some of the delay current applications are experiencing now are at the "gov't agencies" level (I.e. Immigration) and not internal to the BoI.

-

Can't believe I didn't mention this important point for US citizens regarding investing in Thai mutual funds. Thai mutual funds (or any "foreign"mutual fund) will almost certainly be considered PFICs under the US tax code. PFICs require special US filing and are subject to a very unfavorable US tax rates as compared to US mutual funds, even if the best option of treatment method is selected. Any US citizen considering a Thai mutual fund purchase should be aware of what they're getting into before making this type of investment, assuming you can find a Thai asset manager willing to sell you one. That's not to say US citizens should never purchase Thai mutual funds, but it would be important to get good US tax advice ahead of time. Consider what asset class the investment will be in, as well as how that may fit in with other investments.

-

Thanks for the figures, it is interesting to know how many have been issued thus far. Do we know how many applications have actually been rejected (versus not yet granted, requesting more detail etc)? Whatever the actual rejection rate, though, I see things a bit differently. I've seen no sign at all of the BoI being picky or rigid. Trying to stick to the legal requirements is more likely, in my opinion. I would applaud them for that. If the legal standards are too rigid, then the lawmakers need to adjust them. But that isn't the BoI's call.

-

When I entered Bangkok in mid-Nov the TM6 card was not being used. I went through the Fast track section and used my LTR e-visa print-out. The IO was able to stamp me in within about 5 min, after consulting with a colleague. If the TM6 is introduced by the next time I enter Thailand at the end of Dec, I'll put "LTR" for purpose of visit. Still plan to use Fast track. Hopefully no issues with Immigration.

-

After nearly 30 years living and working in Thailand on mostly NonB visa extensions, and owning and operating a Thai company for about half of that, definitely agree that it's wise not to count on really much of anything here, and to plan for a wide variety of potential outcomes. That said, I see a huge difference between a NonB visa good for 90 days only, but extended annually, and a 10 year visa program under the BoI. I'm not saying there won't be changes, but to me these simply are not at all the same thing.

-

I'm also not sure this program has been widely advertised outside of Thailand. Perhaps that was a good thing initially, since there seem to be many kinks that need working out. From IT hiccups to no ability to open local bank accounts to no digital work permits, there have been a number of program items not yet really ready for prime time. So maybe what has happened so far has been more of a "soft opening."

-

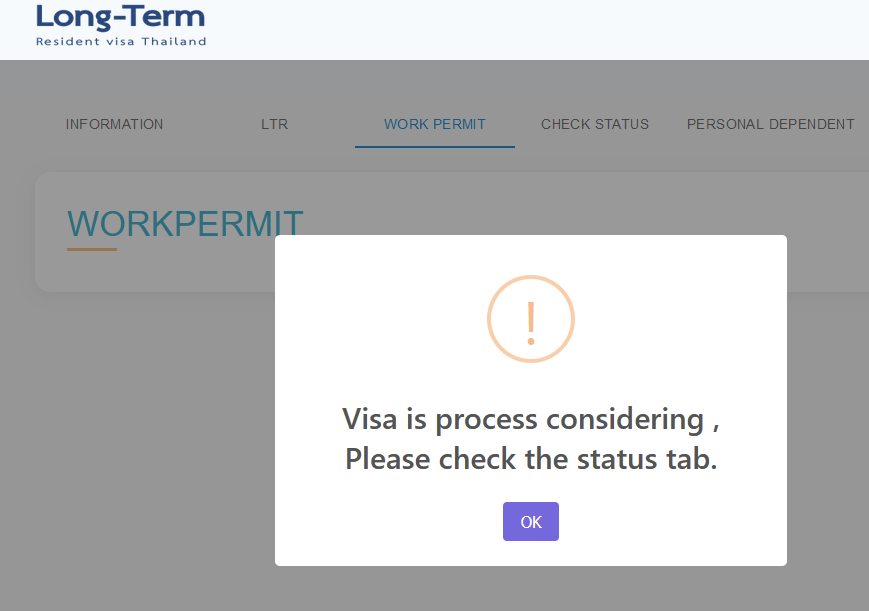

Could be...to me it looked like the programmers replaced it with "Work Permit". I took the "My Agency" to mean if the applicant was using an intermediary agent. It does seem like there's an attempt being made to get third party agents involved to help applicants and smooth the process. I have mixed feelings on that - it may indeed help applicants, which is good. But if using "agents" starts to pervert the system in some way, not for that at all.

-

Could be an error, I wondered about the dates when I saw them. If it is an error, presumably BoI will correct the stamp at some point. I'll ask when I'm next in touch, probably whenever they finally get issuing the digital work permits underway. With many years to go, should have some breathing room.