-

Posts

1,409 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by DrPhibes

-

-

Hi all, have a finally fully torn my rt ACL and want it repaired. Has anyone used Bangkok Hospital in CM for such? If so, how were the results and experience? Thanks in advance!

-

On 5/2/2025 at 2:54 AM, Sheryl said:

Costs will vary greatly by hospital. Sripat probably the least costly Bangkok or Ram Hospitals the most. At the top end this would cost at keast 350k, I am not sure how much less at Sripat.

See this doc at his private clinic https://chanakarn.com/

He has privileges at more than one hospital so you can discuss comparative pricing with him.

Thank you for responding. While cost is kind of a factor, it's ultimately about relaying personal experiences with results as my primary goal. Thanks again.

-

Anyone have full ACL reconstruction in Chiang Mai? If so, which hospital, approx cost, and how were the results? Thanks in advance!!

-

Hi all, buddy and I take a guys trip for a couple of weeks somewhere on the islands each year to get out of Chiang Mai and away from family life. Remarkably, we just realized neither of us have ever been to Koh Phangan. We are looking for rustic beach side bungalows similar to White Sand Beach resort bungalows on Koh Chang. We have spent a chunk of time looking at resorts online but would love to hear some personal experience recommendations if you don't mind. As always, thanks in advance!

-

1 hour ago, ChipButty said:

Not allowed to call them hostess no more,

Your right "Bring on the Stu's baby" A. Powers

-

On 3/13/2025 at 11:53 PM, sqwakvfr said:

Oh no. I just walked by there yesterday and the only thing that could offer a glimmer of hope is to build a casino complex where KSK and the Lotus Hotel used to stand. That propery has stood vaacnt now coming on 3 years and I really do not see anything else to build except for something like this. The property would sell for a steep discount as well.

And re-open the bowling alley!!

-

Saw this and thought of Nemo's Sword of the Seas from the League of Extraordinary Gentlemen!

-

On 2/17/2025 at 5:27 PM, NorthernRyland said:

I saw that signs so many times before but I never knew what it was. Thanks!

https://www.facebook.com/route66cnx/

Pit Stop is my normal go to but the Belly Buster carries me all the way to dinner.

-

Yes! Bring back the 9pm disco ball/music and Changs in the dining car on the overnight BKK to CNX train!!

-

1

1

-

-

33 minutes ago, Woke to Sounds said:

Crypto going to crash buddy... it's all hot air and eventually hot air backed by nothing gets used up.

Best to invest in tangible companies that actually make stuff and pay monthly/quarterly dividends.

Cheers buddy

Ya, guess he's never played musical chairs.

-

3 hours ago, Presnock said:

my bank deposits say that the pension money is "civil service pension deposi from OPM"

Social security going into it's own account in the US and tranferred over to Thailand for me.

-

On 2/13/2025 at 8:15 PM, Jim Blue said:

Makes you wish for the good old Wuhan Covid days !

Or better yet, when SARS came through. Traveled to Phuket to go diving and boy were the hotels cheap and the girls hungry!!

-

1

1

-

-

15 hours ago, EVENKEEL said:

Is anyone here actually contemplating handing over 1099r's to Trd? Trying to make a paper trail to Thai authorities is absurd.

The day they ask for my US tax return is the day we head back to the US. The US social security earned by myself, my wife, and our 7yr old is more than we bring in to Thailand. If they want to see the non-assessable SS 1099's and compare those to what I bring in, I'm OK with that, but they are nor getting the return.

-

1

1

-

1

1

-

-

-

- Popular Post

19 hours ago, zepplin said:It’s such typical piss poor planning, Thais are absolutely the best at this, land of the flip flop!

f muppets couldn’t organize a pissup in a brewery

And the government wonders why they can't attract the wealthy. When your changing the rules every other day, who would want to settle here and bring money in that is sometimes hard to get out.

-

1

1

-

2

2

-

Make'm Som Tam flavored and they will definitely get used, hopefully not for bubble gum though!

-

5 hours ago, Misty said:

That would be good to know, if true. Could you provide a reference from the agreement saying Thai residents who are also US citizens are exempt from US information sharing?

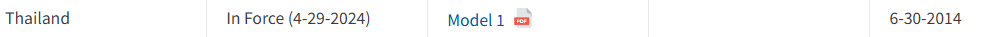

The Thailand-US IGA is a Model 1 agreement.

https://home.treasury.gov/policy-issues/tax-policy/foreign-account-tax-compliance-act

If you open a bank account using your Thai ID in the US, that US institution will report your info to the Thai gov. If you opened an account in your US passport in Thailand, that Thai institution will report your account to the US. They don't make any kind designation as to residency for you.

-

On 1/29/2025 at 6:26 PM, Misty said:

The Thai government should now be receiving information on accounts in the US.

Although the Thai-US FATCA IGA was signed in 2016, it only came into force last year. The IGA includes reporting obligations that go both ways (Thailand to US, and US to Thailand). Specifically Article 2 of the IGA, item 2b explains about what US financial institutions need to report to Thailand. https://www.mof.go.th/th/view/attachment/file/3134303034/FATCA_IGA_Us.pdf

Yes, there is a 2 way exchange of information. For the US, they report the information of Thai residents that hold US accounts to the Thai gov. For the Thai side, they report the account information for US residents to the US gov. The US does not report information of accounts held in the US by US citizens to the Thai authorities. That is tier 1 FATCA reporting.

-

1

1

-

-

14 hours ago, The Cyclist said:

Every foreign account in Thailand is subject to CRS reporting.

It is the account, in a CRS Country that matters, not the Nationality of the account holder.

Some of you Americans are nowhere near as speshul as you seem to think you are.

But since the US does not participate in CRS, the Thai government is not receiving any info of my accounts in the US. Just reports my single Thai account to the US under FATCA rules. That account is now receiving only US social security money since the 1st of this year from my wife, underage child, and I. Way more than enough for our Thai needs and wants. Not special, just different.

-

1

1

-

-

2 hours ago, The Cyclist said:

Correct,

You as an Individual ( Even an American Individual ) remitting money into a CRS Country on the other hand, is a different story.

Does not submit me to CRS reporting, and since the US does not participate in CRS, accomplishes what exactly?

-

- Popular Post

- Popular Post

3 hours ago, OneManShow said:I thought perhaps these duc will be useful for those who are from "double tax treaty" countries.

https://www.rd.go.th/fileadmin/user_upload/lorkhor/newspr/2024/FOREIGNERS_PAY_TAX2024.pdf

https://www.rd.go.th/english/38361.html

I'm not submitting my US tax returns to the Thai revenue dept in order to support a tax credit under DTA. Looks like staying under 180 days in Thailand us my only option.

-

2

2

-

1

1

-

- Popular Post

- Popular Post

4 hours ago, Yumthai said:CRS rules apply to FIs, FIs should apply CRS requirements to all their customers regardless of their citizenship. That's the case worldwide.

Now, who knows how Thailand will operate.

I'm a US citizen. The United States is not part of CRS, they have FATCA. Financial information of US citizens with accounts in Thailand will have their info shared with the US by Thai institutions. Thai citizens with accounts in the US will have their info shared with Thailand. The US will not share US citizen US accounts with Thailand. I will not sign anything having to do with CRS.

-

1

1

-

2

2

-

On 1/14/2025 at 9:04 PM, BritManToo said:

So out for my normal 25km loop this morning at 6:45. 8c going out, 9c at 8am cycling back. In 15 years I've never known it to be this cold.

Shrively!! What is your route, always looking for more safe road 😉

-

On 1/18/2025 at 8:50 PM, Rob5060 said:

Anybody got any recommendations for Dentist in the area around Meechok

There is a dentist in Raumchok on the 1st floor who is pretty good.

Bangkok Hospital ACL reconstruction

in Chiang Mai

Posted

Thanks for the response, I'll research him. Hope all well!