Mike Teavee

Advanced Member-

Posts

4,306 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Mike Teavee

-

As usual there is a difference between what the "Rules" say (You should file a return if you have > 120/220K in assessable income) & the practicality of it (TRD isn't interested in you unless you owe tax & would prefer you not to file as it's more work for them). Edit: Apologies, I've just seen @chiang maipost above saying the same thing.

-

Tax Return 2025

Mike Teavee replied to John Phuket's topic in Jobs, Economy, Banking, Business, Investments

You can transfer as much as you like as long as it was earned before 1/1/2024. -

An "NT" Tax code means you do not pay Tax on most income (Government Pensions being an obvious exception) in the UK as the UK believes you'll be taxed on it in your country of residence. https://www.cjfinance.co.uk/nt-tax-code-hmrc-how-to-apply-nt-tax-code-for-non-uk-residents/#:~:text=NT Tax Code implies that,tax from this income source. Edit: To clarify, you wouldn't pay UK Tax on your private pension if you had an NT Tax code.

-

Any tax you've paid on your pension in the UK can be offset against tax owed in Thailand so (by some rough calculations I did on another thread) unless you're earning 42K (likely to put you below your TEDA) to 49K (at this point you're likely to be paying more tax in UK than you would owe in Thailand) THB per month you won't have any tax to pay. Obviously your personal circumstances re: Tax & allowances may be different but as a rough rule of thumb. most guys who are only receiving UK pension income won't have anything to pay. If you do manage to get an "NT" tax code in the UK, please let us know how you did it... My UK accountant friend tells me I have little chance of getting one now I live in Thailand & I should have gone for it when I lived in Singapore 😞

-

Unlimited 60-day Visa Exempt for US Citizen

Mike Teavee replied to TimLMT's topic in Thai Visas, Residency, and Work Permits

Do you have a link you can share confirming that? The only thing I've seen was a statement made by a guy from MFA (Ministry of Foreign Affairs) & whilst they set Visa policies, they don't set Immigration Policies. End of the day an Immigration Officer can refuse you entry if they believe you're living in Thailand without a valid longer term Visa & continuous 60 day (even worse 60 + 30 day extension) border runs (by land or air) is liable to get you knocked back sooner or later. If it were me I would get a DTV whilst they're still available for "Soft" (Their word not mine) reasons... -

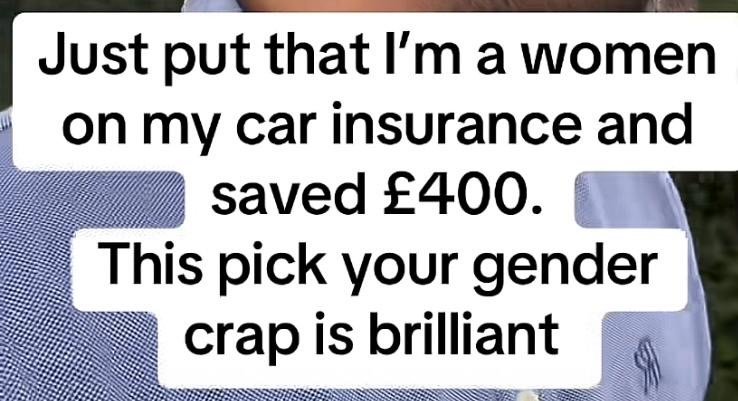

Worst Joke Ever 2025

Mike Teavee replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Thailand overstay 32 Days

Mike Teavee replied to Dande's topic in Thai Visas, Residency, and Work Permits

As Immigration office was closed Sunday/Monday, could he have gone to immigration & done his extension today with no overstay/fine? -

Blowback begins about latest visa exemptions and DTV discretion

Mike Teavee replied to webfact's topic in Thailand News

If the President of Thai Travel Agents is speaking negatively about visa changes that make it easier for people to visit Thailand for longer, you have to wonder what the Head of Immigration thinks about them... I agree with the final sentence in the Pattaya Mail Article... It will be most surprising if the visa-free extensions and the DTV emerge unchanged after the current review period. -

Tax Return 2025

Mike Teavee replied to John Phuket's topic in Jobs, Economy, Banking, Business, Investments

There are no exemptions for Elite or DTV holders so if you're staying 180+ days in Thailand in any one calendar year then you will be affected. Only Visa that does have an exemption is the 10 year LTR Visa so could look into getting one of them if you meet the income requirements. -

Apologies, I said there was no penalty but I’ve just remembered that Bangkok Bank charged me approx. 580THB to move 552,429.15 from my Fixed Deposit to my normal savings account so am guessing it’s 0.1% fee +7% VAT. Edit: the exact numbers I transferred was 562,624.24 & after fees I received 562,042.24 so fees were 582 THB.

-

No penalties for early withdrawal, you just lose the interest that has accrued so far. Have you considered using Dee Money https://www.deemoney.com/ (Granted they're in Bangkok but I'm sure you at least used to be able to open an account online) ? Friends of mine use them to send money back to the UK & they seem to get very good rates with quite a low commission charge.

-

Having a DTV wouldn't help you or change what you might owe in taxes if you use it to spend 180+ days in Thailand in any one calendar year & if you don't spend 180+ days in Thailand then there is no difference between having a DTV & any other kind of Visa. End of the day you are either Tax Resident (180+ days in country) or you're not (<180 days in country) & with the exception of the LTR visas it doesn't matter on what basis you're staying in Thailand (Even Visa Exempt) your tax position would be exactly the same. Edit: Now I re-read your post, I think what you might have being trying to say was you would use DTVs so you could bring the 800K in gradually over a few years, If it were me I would simply bring it all over in a year where I spent < 180 days in Thailand.

-

As mentioned 1 & 2 are scenarios I've found myself in when I was a tax resident of Singapore & also needed to file returns in the UK, everything was fully reported by PWC in Singapore & my UK Accountant so no Tax evasion/money laundering was involved. #3 was a bit tongue in cheek after all the discussions about "Gifts", but I think you gifting your Wife the full proceeds of the sale in the UK & her remitting it to herself in Thailand wouldn't be assessable income for either of you.

-

I agree, but if that was confirmed to be the case then there would be nothing to stop me from selling a stock, buying a different stock (in the UK it would have to be different or I would need to keep it 30 days) and then selling this reporting whatever gain I made on the 2nd sale only... I can see a conversation with TRD where they ask me where the money I remitted came from, I say sale of an asset & show them the purchase/sale contract notes to show no Capital Gains but I can't see a scenario where they then go on to ask me where i got the money from to purchase the 2nd asset as where would that end... E.g. Where did I get the money from to purchase the asset that I sold to purchase the asset that I sold to purchase the 2nd asset... etc... to the very 1st asset purchase (> 35 years ago)! We're talking forensic accounting type investigations, not something I can see TRD having the will/manpower to

-

On the surface, the Rules are very clear but the devil is always in the detail. E.g. If I made a £10,000 gain on 1 stock & a £10,000 loss on another, as far as the UK is concerned It's a wash, but Thailand doesn't recognise Capital Gain losses so if I were to remit the money from the 1st sale would I still have £10,000 of Capital Gains to Report? What if I made the Gain in December 2024 and the Loss in January 2025, would this change anything due to the tax year difference? Or what If I took the money (including the Gain) &... invested it in Singapore for a couple of years, would the gain still count if I sold/remitted the money to Thailand or would it have been reset when I moved it to Singapore? Gave it to my Brother as a bridging loan to buy a property & he gave it back to me when he sold his property, is the Capital Gains still there or is this simply the repayment of a loan? Just gave it to my brother as a Birthday present & the following year he gave me the same amount of money for my Birthday, is the gain still there? I know, some outlandish scenarios (though 1 & 2 are ones I've done) but you can see how things become very unclear unless you just sell, remit the money & declare the gain.

-

[QUIZ] 4 August - Brand Logo Pictures

Mike Teavee replied to Captain Flack's topic in The Quiz Forum

I just completed this quiz. My Score 80/100 My Time 62 seconds -

I've posited this a few times now but would welcome your views... Let's say I made a £10,000 Capital Gain from selling some shares (fully taxed in the UK in that they don't tax Expats on CG from shares) & used it + the original principle to buy some different shares, then sold these making a small capital loss (price spread + dealing charges) & remit the full proceeds to Thailand. Do I need to declare the £10,000 (- small CG loss) as Capital Gains or have I made a small loss so nothing to report in Thailand?

-

As with all of these "Avoid Tax" schemes the problem will be if (< 0.00001% chance) TRD decides to Audit you because they see that you've not remitted any money or spent anything that you already had in Thailand, how are you going to explain what you've been using to live on? I took it out of an ATM - Whoops... Tax Evasion I gave it to my wife so she could give it back to me - Whoops... Tax Evasion Reality is that most people (I'm not one of them) will pay more tax on their income in their home country than will be owed in Thailand so no need to worry (I'm not worried & I pay no tax in my home country but have organised my remittances to Thailand so I don't pay tax here either).

-

Thai Tax on UK pensions

Mike Teavee replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

Sorry, I was asking if you had already moved before then & told HMRC & DWP that you were non-resident (I did when I was 42) would you be able to claim deferred Pension rights at 67+ (For me). FWIW I believe if I claimed a deferred state pension at 68 (58 now) I would get my pension as though I'd deferred it & was 68 in the UK. -

Per post above, the 100K is “Income Expense” (no need to prove) so you could send 210K direct to your wife (400K if she is also >65) which with your 500K TEDA your tax liability would be on a max of 390K. Could even play about with the numbers so that you max out the Income Expense by splitting it with your wife (you can each have 100K but it’s limited to a max of 50% of each persons assessable income).

-

Married & Over 65, your TEDA is at least:- 60k (your Personal Allowance) 60K (Allowance for your wife) 190K (> 65) 100K (Pension Expense) 150K (0% Tax Band) = 560K so you would be taxed on the remaining 440K which works out as 41,000 (150K*5% + 200K*10% + 90K*15%= 7,500 + 20,000 + 13,500). Then most people are covered by a DTA & can offset any tax they've already paid on the income in their home country, e.g. If that 1Million THB income came from UK Pensions then that's approx. £22,200 on which you would have paid £1,924.20 (Approx. 87,000 THB) so you would have no Tax to pay (Unfortunately you cannot claim back any extra tax you've paid in the UK).