Mike Teavee

Advanced Member-

Posts

4,306 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Mike Teavee

-

Was it to Bangkok Bank?

-

Thailand unveils new visa rules, sparks mixed reactions

Mike Teavee replied to snoop1130's topic in Thailand News

It wouldn’t surprise me if they start forcing people who do back-2-back 60 day visa exempt entries to spend at least one night outside of Thailand (have seen it mentioned that DTV holders cannot come back same day) so a Visa Run company might end up more convenient/cheaper if they can help you get back same day. -

Thai Tax on UK pensions

Mike Teavee replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

Logically UK Gov says your pension will be based on the date you reach State Pension age or the date you move abroad if this is later, which could be taken as if they know you were living overseas before hitting SP age then it would be frozen as at SP age. Practically I'd expect them to not even check & just start paying you whatever the differed pension was & freeze it at that. -

Thai Tax on UK pensions

Mike Teavee replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

Is that still true if HMRC & DWP both know that you're non-UK Resident (in my case HMRC know from my annual Self Assessment Filing & DWP know as I was paying Class 2 AVC/NICs on the basis I was working overseas). -

[QUIZ:]1 August - Entry/Visa/Extension Quiz

Mike Teavee replied to Tod Daniels's topic in The Quiz Forum

I just completed this quiz. My Score 83/100 My Time 49 seconds -

YES... Every time you enter you will be given 180 days permission to stay, if you want to stay longer than this you will need an extension but you can not stay more than 360 days without leaving the country. Once you leave the country, come back the next day & you will be given 180 days again... Rinse & Repeat for 5 years. Edit: Rough Schedule (I'm assuming 30 days per month every month, it's just a rough schedule). Jan-June In Thailand then make a decision, extend for 180 days or leave Thailand for at least 1 night July-Dec In Thailand then If extended last time, need to leave Thailand otherwise can choose to Extend or leave for at least 1 night Jan-June In Thailand then If extended last time, need to leave Thailand otherwise can choose to Extend or leave for at least 1 night July-Dec In Thailand then If extended last time, need to leave Thailand otherwise can choose to Extend or leave for at least 1 night Etc.... for the 5 years.

-

Have you tried asking one of the Agents to do it for you? The one I use in Pattaya charges 100B for a 90 day report & I know you can do it via an Agent after re-entry as I got back from the UK in May, got a new passport end of July & my agent did my 90 day 1st week in August. I used Asia Visa Tours to do my 90 day report when I lived in Bangkok (This was pre-Online system being usable & they had an office on the ground floor of my Condo building), their main office is on Suk Soi 24, 3 min walk from Phrom Phong BTS https://maps.app.goo.gl/fvUGSJhW5mywps3a7. Just checked & they charge 380B (https://www.asiavisa.net/複製-業務内容), which was a lot cheaper (& less hassle) than a round trip to CW from On Nut.

-

No it's not true, you get 180 days permission to stay on each entry after which you can extend (1 time on that permission to stay) or leave the country for 1 night & come back for another 180 days. Technically (assuming you do 180 Days + Extension then one night out of Thailand & repeat) you would only need to spend 1 night out of Thailand in any one 360 day period for 5 years.

-

Worst Joke Ever 2025

Mike Teavee replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

It looks like it's about to tell you you're in Slytherin... -

Thai Tax on UK pensions

Mike Teavee replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

Because it's not been my "Primary Residence" since I moved overseas in 2008 & I've been renting it out since 2010. -

The online site asks you for your last date of entry into Thailand so you'll either need to leave it as the old date (and risk it being rejected) OR update it & trigger an automatic response that says you need to report in Person (at least that's what I got when I tried mine a couple of weeks back).

-

Thai Tax on UK pensions

Mike Teavee replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

Agree 100% & I'm giving serious thought to selling my UK House that same year which would raise Capital Gains that would certainly be assessable (Even after the CGT I would need to pay on it in the UK) but I also believe that, currently, the Tax "Experts" have no more information than us laymen so (personally I) wouldn't consult one until the situation is much clearer (I don't need to make a decision until 2026 so happy to sit back & see what happens). As an aside Thailand's visas have changed so much in the past 6 months It would be silly of me to decide exactly what I'm going to do in 18 months, the LTR could (I'm not for 1 minute suggesting it would) lose it's "Tax Free" remittances or the Non-IMM O could morph into a 5 year Visa/Extension With tax free remittance of pensions (Which to me makes absolute sense for guys from a country that Thailand has a DTA with). But the plan at the moment, is to do an Hotblack Desiato in 2026 🙂 -

Thai Tax on UK pensions

Mike Teavee replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

My main reason for bringing the money over is as a $250K "Investment" to support my application for an LTR Visa so a Tax Firm being able to "Hide" this remittance for me wouldn't help. I can show an income of >$40K pa today, but I need to invest the $250K to get the visa & my PCLS will get me there (or at least close enough where I can make up the difference from money I'm currently not remitting to Thailand because of these tax changes - sincerely hope they wake up & realise that people are not bringing money in because of the current tax situation). -

Thai Tax on UK pensions

Mike Teavee replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

Agreed, some people's circumstances are going to be different (e.g. somebody may have additional allowances in the UK & their UK tax paid would be lower that the numbers I quoted) so it's important to use the actual Tax paid in the UK & not the numbers that I gave but hopefully the examples give people a feel for what their Thailand Tax Liability would be. It will be interesting to see how the 25% tax free allowance from UK Pensions are treated. Will TRD treat it as income that has had no tax paid on it (probably as they're unlikely to understand what it is) or will they make some allowance to exclude it from assessable income (Highly doubtful) - I'm on a Defined Benefits / Final Salary pension and when I take my PCLS (25% Tax Free Pension Commencement Lump Sum) it's a one shot deal so I'm planning to be non-Thai Tax resident that year. -

Thai Tax on UK pensions

Mike Teavee replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

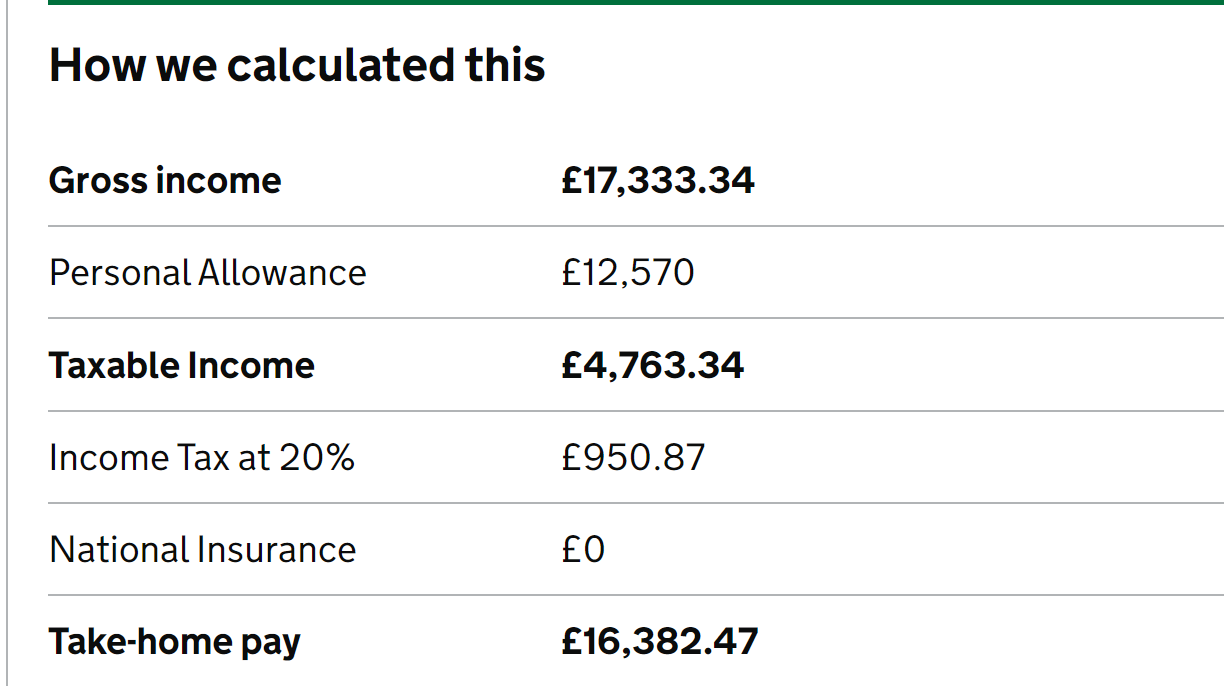

I used HMRC "Estimated Take Home Pay" calculator... https://www.tax.service.gov.uk/estimate-paye-take-home-pay/your-pay which has the 2024/25 personal allowance at £12,570... Using the 65K pm / £17,333.34 pa example... [No NI to pay as I clicked the link saying "Over the State Pension age"] -

Thai Tax on UK pensions

Mike Teavee replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

Apologies I know it's bad form to quote yourself but out of curiosity I ran the numbers on a few scenarios & was surprised to learn that only people remitting Assessable (Non-Gov) UK pension incomes (NB I'm only doing the calcs on UK pensions as that's the topic of this thread) of approx. 42-49K pm would have any Thai Tax owing, below this & your TEDA + 150K @ 0% would cover you, above this and the Tax you've already paid in the UK more than covers any Thai tax due. Basic assumptions, a Single person, over state pension age so has 355K TEDA (60K personal allowance + 195K >65 allowance + 100K allowance for "Expenses") and £1 = 45THB. 50K pm Income... Remitted income - 600,000 Taxable Income after 355K allowance = 245K Tax due = 150K * 0%, + 95K * 5% = 4,750 Thai Tax UK Tax already paid on £13,333.34 = £150.87 = 6,789 THB which can be offset against the 4,750 to leave no tax liability. 65K pm Income... Remitted income - 780,000 Taxable Income after 355K allowance = 425K Tax due = 150K * 0%, + 150K * 5% + 125K * 10% = 20K Thai Tax UK Tax already paid on £17,333.34 = £950.87 = 42,789 THB which can be offset against the 20K to leave no tax liability. 100K PM Income Remitted income - 1,200,000 Taxable Income after 355K allowance = 845K Tax due = 150K * 0%, + 150K * 5% + 200K * 10% + 250K * 15% + 95K * 20% = 84K Thai Tax UK Tax already paid on £26,666.67 = £2,817.53 = 126,788 THB which can be offset against the 84K to leave no tax liability. 500K PM Income Remitted income - 6,000,000 Taxable Income after 355K allowance = 5,695,000 Tax due = 150K * 0%, + 150K * 5% + 200K * 10% + 250K * 15% + 250K * 20% + 1,000,000 * 25% + 3,000,000 * 30% + 645K * 35% = 1,490,750 Thai Tax UK Tax already paid on £133,333.34 = £46,203 = 2,079,135 THB which can be offset against the 1,490,750 to leave no tax liability. ... Obviously as you get higher numbers you're taxed 45% in the UK Vs 35% in Thailand so the difference between what you pay in the UK will be even greater than what you would owe in Thailand Edit: And this is why I believe TRD will end up giving a "Pass" to things like UK Pension income as they know the effort involved in processing every return isn't worth the small amount (<3K) they would get from the guys in the 42-49K pm range. -

Thai Tax on UK pensions

Mike Teavee replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

Nobody is trying to "Prove a Worse Case Scenario" we're just trying to explain the facts & if you believe differently then that's up to you.... I don't believe you'll get caught either but that doesn't mean that you're vindicated, it just means you got away with it & unless you're remitting >100K pm you're getting away with nothing as you wouldn't owe any tax anyway so it doesn't make sense not to include it IF you're filing a return anyway. FWIW, I have no facts to back this up but honestly believe we'll see them giving a "Pass" to people who are only remitting pension income from countries like the UK where they know they've already been taxed (& I count the State Pension as already taxed albeit at 0%) & a DTA can be used to offset tax already paid against what's owed in Thailand but until then State Pensions are assessable income. -

How to retire in Thailand

Mike Teavee replied to CharlieH's topic in Thai Visas, Residency, and Work Permits

There's been no announcements to say it would be treated any different than you sending any other money over (Same is true when sending money for a Condo purchase which you'd also think they would want to encourage0. If you have spent no time in Thailand this year & came on 5th July then you would be non-Tax resident for the year so free to bring over anything you like... Obviously if you've already had a 2 week holiday here earlier in the year then the date would be pushed out to 19th July etc... -

How to retire in Thailand

Mike Teavee replied to CharlieH's topic in Thai Visas, Residency, and Work Permits

It doesn't matter when you apply, it matters how long you spend in Thailand in the calendar year you apply (Time in country on a Visa Exempt stamp counts as much as on any other Visa). Whether it will be taxable or not depends on:- If you're Tax Resident (i.e. spend 180 days+) in the year you remit it - If not, no tax. What the source of that income was, E.g. if it's from pre 1/1/2024 income/savings then no tax. What it says in your country's DTA around income that's already been taxed (i.e. can you claim any tax paid in your home country as a credit against Thai Tax) ... For points 2 & 3 don't forget that you'll be remitting money to live on so this would need to be added to the 800K when calculating your total tax bill. FYI, A Single UK guy <65 remitting 1 Million THB of assessable income that has already been taxed in the UK would be roughly tax neutral when it came to owing Thai Tax. -

Thai Tax on UK pensions

Mike Teavee replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

You seem to be the only person that believes that & as several of us have posted information (including links to the DTA & Expat Tax companies) that says it's not true we'll have to agree to disagree, it's been argued enough in the other threads already.. I had "Trivial Commutation" once, Worked for EDS for a couple of months (Ironically at DWP) & had a small (IIRC the limit was/is <£10,000) pension that they were moving to another provider so I had the choice of taking it tax free... so I did. -

Thai Tax on UK pensions

Mike Teavee replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

Can you provide a source for that statement so we can understand it's context more.... Doesn't really matter as the DTA says... Any pension paid by the Contracting State or a political subdivision or a local authority thereof to any individual in respect of services of a governmental nature rendered to that State or subdivision or local authority thereof shall be taxable only in that State. So for the purposes of Thai Taxation, State Pensions are Tax assessable whereas "Government Pensions" like Military, Civil Service, NHS, Council Worker etc... pensions are not. Edit: Playing Devils Advocate, State Pensions are mainly paid for out of Employer & Employee National Insurance contributions so where the Employer wasn't a Government department could be argued are not being paid for by the Government. -

Thai Tax on UK pensions

Mike Teavee replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

Sorry, I didn't want to repeat myself from the post directly above the one you quoted where I said:- State Pensions:- Are not considered a Government Pension, these are things like Civil Service & Military etc, not the pension of your average Joe. Are taxed, it's just that they're the 1st thing that's added to your total income so are covered by your Personal Allowance which is considered taxed at 0%. The fact that they are considered assessable income has been discussed many times (too death) in the other Tax threads but here's a Q&A from ExpatTax... (Search for State Pension)... UK DTA: I’ve got two pensions and I transfer money to a Thai bank account every 5 months. Do we need to worry about tax as Thailand and the UK have a DTA, plus the money is already being taxed in the UK? Potentially, yes. This is dependent on the tax rate in the UK and if it was remitted into Thailand. State and private pensions in the UK are taxable in Thailand, but you can use tax already paid as a credit. Even if your tax rate is high in the UK, and even if there is no tax to pay in Thailand for your situation, you will still have to file a tax return. I have a retirement visa. I am UK citizen living in Thailand. i have no assets in UK. I have a UK state pension and a small private pension. I pay tax in UK on my combined pensions by PAYE. My pensions are paid into my UK bank account. I transfer cash each month to my Thai bank account. Are there any circumstances where I would need to pay tax in Thailand? Both your state pension And private pensions are classed as assessable income If you transfer To Thailand. You will likely have To file a tax return. Our Assisted Tax Filing Service will help you to claim the tax credits for tax paid In the UK. This is called assisted tax filing. Click here to learn about foreign sourced assessable income. Show me where it's not-Tax assessable & if you can't then by default it is Tax Assessable. # -

Thai Tax on UK pensions

Mike Teavee replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

The UK has 1st dibs on taxing State Pension (but as it's below the basic personal allowance doesn't get anything from it) so they're not giving up any rights. I'm sure if they were to update the DTA today, State Pension would be exempt but as things stand it is considered Assessable Income in Thailand. -

Thai Tax on UK pensions

Mike Teavee replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

State Pensions:- Are not considered a Government Pension, these are things like Civil Service & Military etc, not the pension of your average Joe. Are taxed, it's just that they're the 1st thing that's added to your total income so are covered by your Personal Allowance which is considered taxed at 0%. All of that is irrelevant to the OP though as the UK tax he's paying on the equivalent of 80K THB pm would be higher than what he would owe in Thailand & the DTA means he can offset UK Tax on income so nothing to pay. I did the maths on 84K pm for somebody who only had the 60K personal allowance & 100K "Expense" allowance & it came to <1,000 THB owed, the fact that his military pension is not Taxable in Thailand means that he's way below the point where he would owe Tax here even without his other allowances (e.g. the 195K > 65 allowance).