Mike Teavee

Advanced Member-

Posts

4,306 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Mike Teavee

-

Trust me as an ex-owner of a UK LTD company that paid dividends, the Tax I misunderstood was actually the company offsetting profits against corporate tax not me as an individual.. I really got things wrong on this one (Hold my hand up). Anyways, I'm done on this thread, apparently discussing UK Tax related issues is frowned upon on here so I'm bowing out (as I've noticed Mike L has already done). Good luck to all....

-

Under Thai Law Gifts given to an individual are normally considered Sin Suan Tua (Personal Property) unless explicitly stated as joint (Sin Somros)... https://thailand.acclime.com/guides/marital-property-assets/ The "Rub" comes in if a guy gives his partner a "Gift" & gets a benefit from it (E.g. Let's say I send my GF the years rent to pay then obviously I'm benefitting from it & it's not really a gift). Edit: I do wonder, I send my GF 210K (I asked her to give up her job working in a Central mall so we could live together so 30K over what she was earning) & know that's ok but a mate of mine sends 10K pm to his wife's 2 kids back home & I'm thinking he could send her grandmother (who he sends the money to) 120K pa without it being taxable for anybody

-

Worst Joke Ever 2025

Mike Teavee replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

Looks like you’re carrying some emotional baggage there. -

I’ve taken the approach of only remitting up to my (& my GF’s) TEDA (total of 445K between us) & spending down savings I already have here to make up the rest of the money I need. Should be able to do this for another 3 years by which time I’m hoping things like tax on Capital Gains & UK Private Pensions (mine kick in Feb 2026) will be a lot clearer.

-

Sorry too late with my edit, this thread was started by a Brit but thus far has been open to all for discussions, lets not let one page of discussions about a single country spoil it for all of us (Yes I am a Brit but I'm also interested in how US SS is treated & especially dividends in Australia).... Just scroll on if the post is not of interest to you. It's inevitable that people will go into details about their own circumstances but I think we can all learn something from each other so would be a shame to have this kind of discussion in a country specific thread

-

WTF... We were discussing tax on remitted income (granted, from the UK but we have the same questions as you Aussies) so absolutely on point for this thread. LMFAO, Australia is one of the few countries that does have a Withheld Tax (Franking) on Dividends so that discussion should have been of interest to you.... Assuming you have any. PS. This thread was started by a Brit so maybe you Dingos should go start your own thread...

-

Worst Joke Ever 2025

Mike Teavee replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

Then you'd know why I feel blue -

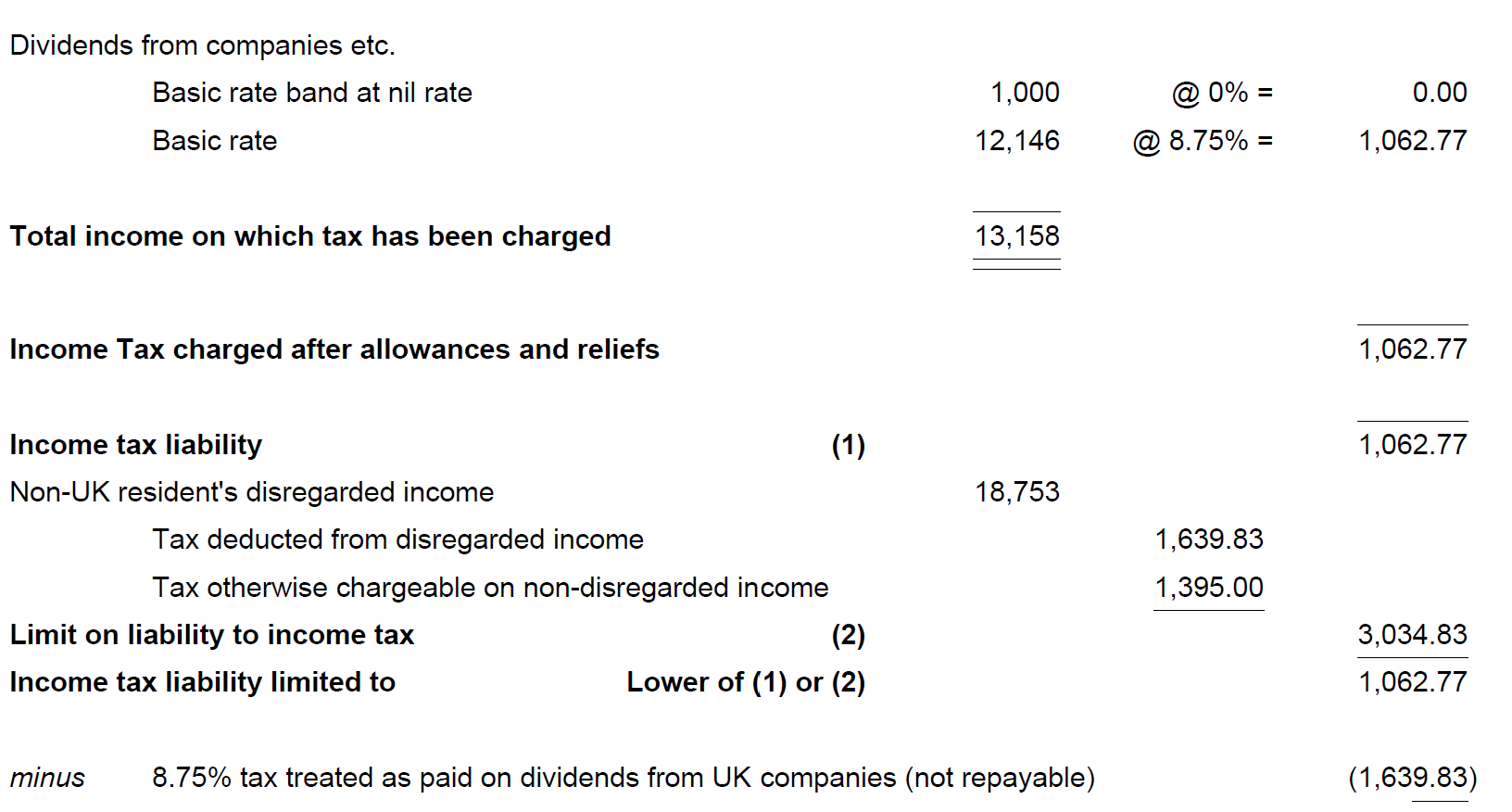

Yeah, I think I've confused the Withheld Tax that a Company reports to HMRC (Pre IR35 us UK IT Freelance guys would set up a limited company & pay ourselves in Dividends to reduce Tax/National Insurance & part of the dividend would include Withheld Tax) & "Disregarded Income" that a Non UK Tax resident can claim... As mentioned, when I used to receive Dividends (from FTSE 100 companies) in the form of a Cheque they would come as a Dividend "Warrant" that showed how much "Tax had been Paid" but I now believe this to be by the Company & not the Individual so not relevant to Thai Tax discussions... https://www.oxfordreference.com/display/10.1093/oi/authority.20110803095723779# Thanks to all for the discussion, I think remitting Dividend Income is off the table for me now unless I'm Non (Thai) Tax Resident or manage to get an LTR visa 😞

-

The more I think about this, the more I'm thinking the "8.75% tax treated as paid" is more to do with the disregarded income rules and not the tax that is withheld on dividends by the Company so if that is the case then I have the answer to my question & do not have any UK tax that I could offset against Thai Tax on remitted dividend income.

-

It's not like you have 10,000 shares & they declare a 10p dividend so you get £1,000 & then they take 8.75% off you, the total dividend that the company declares to HMRC is approx. 10.96p & 8.75% is withheld so you get your 10p per share. Years back when I had dividends sent to me as cheques they would come with a Tax Credit attached to them, but this tax is never reclaimable. https://community.hmrc.gov.uk/customerforums/pt/d0f9057b-3d87-ee11-a81c-000d3a86dfe6#:~:text=Individuals who are non resident,is known as disregarded income).

-

No, I have filed an NRL (Non Resident Landlord) but when I 1st became Non-Tax Resident I still owned my own company in the UK & planned to return after a couple of years Plus My accountant always seems to make it so I don't pay any tax so never seriously looked into it. Will be a different story when my Pensions kick in so should probably start to look into it, any pointers/links for where to get more information. NB doesn't affect withheld tax on dividends anyway as this is never reclaimable irrespective of your Tax code.

-

There's been at least 1 report of somebody going into their Tax Office and asking if they needed to File as all of their income was not taxable by Thailand under a DTA & they were told that they didn't have to. I think a lot of people will be filing non-taxable reports if this guidance was wrong (Plus a lot of US guys who thought they didn't need to file are going to be very upset).

-

The Tax is taken out before you get your Dividend and the rate/yield of the dividend is always quoted as the after Tax amount but Withheld tax has been considered as taken already. This is taken from my 2023/24 UK Tax return prepared by my accountant... NB the final line "8.75% tax treated as paid on dividends from UK companies (Not Repayable)".

-

I was thinking more a scenario where somebody:- Bought some shares several years ago for £10,000 Sells them for £20,000 making a Capital Gain in the UK of £10,000 which (as an Expat) is not taxable. Instead of remitting the money, spends the £20,000 on new shares & sells them shortly after for £19,900 (£100 lost on Dealing fees + spread between buy/sell price). Remits £19,900 to Thailand Have they remitted £10,000 of "Savings" + £9,900 of Capital gains OR zero capital gains as they made a small loss on the second purchase?

-

As I mentioned, I don't see anything in the TRD regs that prevents them asking a Non-Tax Resident to file (or more likely a returning Tax Resident to file for the previous year when they were non Tax Resident if they see a large remittance) & if that income was "Earned" when you were a Tax Resident then they could argue a case that it is assessable income. But practically I can't see this happening, I'm just taking a "Belt & Braces" approach when it comes to a large remittance. Would be great if somebody who's planning on speaking to a Tax Advisor could get a definitive answer to this & a couple of other points:- Are Capital Gains cumulative? E.g. If I made a gain on the sale of some shares, put all of the money into some other shares then sold those for a small Capital loss, would the Gains I got from the 1st sale count? Can the 8.75% withheld tax on UK Dividends be offset against Tax owed in Thailand (if yes then I'd guesstimate you could bring in approx. £22,500 dividends before any Thai tax would be due).

-

You're probably right & I'm over thinking it but any income you earn during the time you are Tax Resident in Thailand is potentially liable for Tax when you remit it & I don't see anything in the TRD rules/laws that prevents them from asking you to file a return even if you're not Tax Resident should they see a large remittance or more likely, asking you to file one for the previous year when you become Tax Resident again.... All feels like too much of a gaping loophole to me so even if they don't move to a Worldwide Income taxation model (which would be a game changer) then I think they'll close it quickly. Anyways I figure it's not worth taking the risk of having to pay >6.5Million THB in tax when I remit my PCLS/Capital Gains from the sale of my house so I'll be Non-Tax Resident in the year the income is earned & remitted.

-

I think @ballpointsummed it up nicely above... As usual the TRD rules around this are "Open to Interpretation" & we had a discussion on this point in one of the main Tax threads (possibly even earlier in this one) which I came away from with the knowledge that I am potentially liable for Tax on any remitted Income earned whilst being a Thai Tax Resident & the view that Technically I could have to pay it even if I remitted it in a year when I wasn't Tax Resident but Practically I wouldn't be filing a Tax return so don't see how they could Tax me. Now TRD could argue that even though I'm not Tax Resident I am remitting taxable income so I should be filing a return but again, practically I can't see this happening. In any case for large remittances (E.g. the sale of my house) I will be making sure to be non-tax resident in the year the gain is realised & the year it's remitted... I feel much more confident that realising the Gain in a year I'm not tax resident is not taxable but again, wouldn't want to take the chance with a large sum of money.

-

Some Visas (e.g. Tourist / Non-IMM O) have an "Enter Before" date which means you need to enter on the Visa (or Use by) this date... From pics posted of the DTV eVisa, there is no such limitation so presumably you could make your 1st entry just before the 5 years was up.

-

No, I was talking just about remitted income so when you remit the £250,000 4 years of that were earned when you were Tax Resident so technically it's assessable income just as if you'd remitted it each year it was earned - In fact it's worse as you would have lost the opportunity to use your annual TEDAs.