Mike Teavee

Advanced Member-

Posts

4,306 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Mike Teavee

-

Reform UK Overtakes Tories in Polls for the First Time

Mike Teavee replied to Social Media's topic in World News

Pointing out a fact is not pedantry if it’s true & I’m not arguing against the result as the only numbers that matter are the number of people who voted for/against it. Leave won, end of story but that doesn’t mean you can claim the majority of the British Public voted for it. -

Reform UK Overtakes Tories in Polls for the First Time

Mike Teavee replied to Social Media's topic in World News

Well said but I would just add that not all Brits who live in Pattaya do border runs or sit in a bar all day, I live in Wongamat & it's nothing like what people think life is like "living in Pattaya". -

I suspect the exchange between your Bank & Thailand is part of CRS (Common Reporting Standards) part of OECD that Thailand's signed up for, but I'm curious, does your Bank know that you live in Thailand & have you registered your Thai Tax Identification Number with them? No, any savings you had prior to 1/1/2024 can be remitted to Thailand free of Tax.

-

Well said & I agree with you about the schadenfreude that sometimes comes out on these threads when it comes to people potentially losing their homes due to a change in their Visa/Extension requirements. I wouldn't want anybody to lose their ability to live in Thailand because the rules under which they originally moved here have changed so think everybody should be Grandfathered In on their existing visa conditions. If they were to change the requirements for new Visas then I would have some sympathy for guys who have been waiting to get on the Non-IMM O "Treadmill" (I know from experience the last couple of years can drag!!!) but would have much more sympathy for a 75 year old that's been here for decades suddenly being told to get health insurance or get out.

-

Reform UK Overtakes Tories in Polls for the First Time

Mike Teavee replied to Social Media's topic in World News

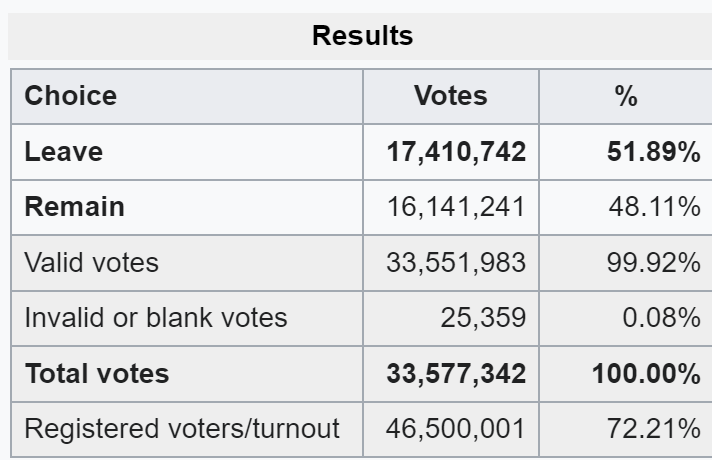

That's just not true... The majority of eligible voters who voted, voted for BREXIT, & as the registered voter turn out was about 72.21% works out to be approx. 37% of eligible voters, no where near "The Majority of British People". https://en.wikipedia.org/wiki/Results_of_the_2016_United_Kingdom_European_Union_membership_referendum -

That's what I would hope for any changes to anybody's Visas, it's just wrong to change the requirements & pull the rug from under somebody's feet when they've been settled here for years, but extensions were specifically included in the post so seem to be saying that they don't believe people should be Grandfathered in.

-

For the change to the way remitted income was taxed, the revenue was able to push ahead with it without any law changes as it's just a re-interpretation of an existing rule which is written in such a way that you could argue was always intended to be interpreted that way. A change to Global Taxation would require a complete change of the Revenue's Rules & new Laws passing giving them the mandate to tax Globally so they simply cannot go ahead with it without going through the parliamentary processes & even getting a Royal Decree. IMHO this will take at least 5 years to implement & is more likely to be quietly dropped.

-

Filing a Thai Tax Return Online

Mike Teavee replied to Mike Teavee's topic in Jobs, Economy, Banking, Business, Investments

Good Idea... Brain is Martered enough already trying to make sense of this stuff 🙂 -

"DTV holders can legally work remotely and avoid local tax obligations" Would be nice to know the Roya Decree that confirms people on a DTV are not liable for Tax on Foreign remittances even if they spend >180 days in Thailand in 1 calendar year (E.g. LTR holders are covered by Royal Decree No 743). Edit: Ignore that, in another part of the article it says "The DTV offers visa exemptions on foreign income tax for stays up to 180 days" so no different than anybody else spending <180 days in country.

-

That's true if you meet the $80,000 pa income requirement but if you don't & need to invest $250,000 then I'd say the LTR is way more expensive in terms of opportunity costs. But it's still a great visa so I'm still planning on going down the route of showing > $40K income & investing $250K as the benefits are worth more to me than the lost opportunity costs.

-

Again, I was joking but clearly it fell flat (maybe I should cross post it to the "Worse Joke" thread 🙂 ) My thinking is... One of the very few details released about the Visa is that it can be extended one time which I believe means you can extend it at the end of the Visa to get an additional 180 days so 5 years of border bounces + one 180 day extension which you cannot extend. But it may well be that the "Extended One Time" refers to each permission to stay in which case you will get 5 years of Border Bounces/Extensions + 1 Border bounce & 1 Extension at the end. As I posted above, with the exception of TE Visas I don't recall reading of anybody extending a Visa whilst it was still valid, many reports of Non-IMM OAs doing a border bounce just before the end of the 1st year to get an extra year & Multi Re-Entry Non-IMM Os doing border bounces every 90 days. I started my Visa Journey on a Multi Re-Entry Non-IMM O "Retirement" visa but was working in Singapore & only visiting Thailand for a few days at a time so had to time things at the end to enter just before the visa was expiring, get my 90 days & a re-entry permit then returned 45 days before that permission to stay ended so I could get my 1 year extension.

-

I was joking (hence the smiley face) & it was in response to a pretty definitive statement that you would get 6 years out of the visa... We are all making this stuff up as there have been few details released from Immigration about the visa... At the moment opinions seem to range across.... A total of 180 days + 180 days extension over the whole 5 years which makes no sense to me as you'd get more time in Thailand using Visa Exempts + you could see yourself blocked from entering Thailand as you would have a valid visa (enter before date still valid) which gave you no days in country. 180 days in each calendar year - Similar model to India & US where people are allowed to spend 180 days and then need to leave (India for 90 days, US until next calendar year) with 1 extension at the end of the Visa so 5 x 180 days + 180 extension 180 days per visit which can be extended for 180 days by doing a Border Bounce & at the end of the Visa you can extend for 180 days. 180 days per visit which can be extended for 180 days by doing a Border Bounce or (one time) extension at Immigration. 180 days per visit which can be extended for 180 days by doing a Border Bounce OR extending any of the stays at Immigration. I was leaning to #2 & you'd get 180 days in country each year for 5 years & then be able to extend the visa for another 180 days on the basis #3,4 & 5 would kill the 5 year TE visa, BUT since reading the (speculated) requirement of needing proof of employment I'm now thinking #3 and you will be able to use it to stay in Thailand for almost 5.5 years by doing Border Bounces every 180 days and then doing an extension at the end of the visa - So very similar to the BOI/Smart Visa but easier on the Employer requirements. As an aside, except for TE Visa Holders, I've never read of anybody extending a permission to stay on a Multi Re-entry visa while the Visa is still valid (E.g. You don't read of Non-IMM OA guys extending towards the end of the 1st year) I have read a few times of guys who were on a Multi Re-entry Non-IMM O "Marriage" doing border runs every 90 days, but that could be because they preferred doing that to having to mess about at Immigration or just fancied a holiday away from the wife 🙂

-

Just curious about how difficult it is & what I would need to file a Thai Tax Return online next year. I already have my TIN & access to the Revenue online site and will transfer in <235K this year so I know there is no tax to pay but as I'll have >8K of withheld interest this year, if it's simple to do I might as well claim it back. If I have to photocopy/upload tons of documents (like I had to do when filing my return in person) then I won't bother but if it's just a simple case of filing in an online form then it would be worth doing. Thanks MTV

-

Took me about 40 minutes when I got mine at the Naklua Office (The day before I'd tried at the Jomtien Office but was told that as I lived in Wongamat I had to get my TIN from Naklua, then when it came to filing the return I was told at Naklua I had to file it at Jomtien :s ) Most of that time was them questioning me (via the GF) as to why I needed one as I wasn't working in Thailand, told them I needed one for my UK Bank (sort of true) & I was planning on buying a property so believe I would need one to pay property tax & they relented.

-

Non-IMM O & OA holders when they changed the financial requirements for money kept in the bank, can't recall the Marriage figures but for Retirement they 1st moved from 200K to 400K & then from 400K to 800K but people who were on the same Visa for at least 4 years at that time still only need 200K in the Bank today. They didn't Grandfather In the last changes to rules around money kept in the bank (i.e. having to have 800K for at least 5 months of the year & at least 400K for the remainder of the year) which meant that people who were spending down their 800K over the year & topping it up just before their extension had to bring extra money into Thailand for living expenses effectively raising how much money they needed in the Bank when the change took effect. Also there was a subtle change for people who use the Income method, when Embassy letters were available you only needed 65K Gross Income, changing it so you had to bring 65K pm into Thailand means that this has to be net of tax & any expenses you have in your home country, again No Grandfathering for people impacted by this change. We all know that they didn't Grandfather in Health Insurance changes for Non-IMM OA retirement holders, most guys who couldn't/didn't want to switch to a Marriage Visa either went the agent route (I know a guy who pays an extra 2,500B for his extension as he cannot get health insurance) or left the country & came back to get a Non-IMM O Have to say, the recent history around "Grandfathering" isn't looking to good for us.

-

I 100% agree, what they did to existing Non-IMM OA holders about Health insurance was shocking & IIRC Phuket refused to implement it so NON-IMM OA holders there do not need to show Health Insurance when extending. Last time they uprated the financial requirements (twice) they "Grandfathered In" people who have been on the exact same Visa for 4 years, if they do change anything, let's hope they just "Grandfather In" everybody who already has a Visa.

-

Apologies if I've already posted this in this thread, I've certainly posted it somewhere on AN before. Thailand considers the Non-IMM OA to be a "Long Stay" Visa & the Non-IMM O to be a "Short Stay" Visa, probably due to the fact that the Non-IMM OA gives you 1 year permission to stay on entry & the Non-IMM O only gives you 90 days (Even if you have a 1 year Multi-Entry Non-IMM O you are only given 90 days on each entry) - NB I'm talking about the Visa itself & not re-entry on an extension. So it's possible the statement in 2 above only applies to the Non-IMM OA Visa & as they've already announced the changes to Health Insurance requirements that might be it. Personally I'm hoping it means they soften the criteria for the LTR "Wealthy Retiree" Visa but am not getting my hopes up

-

Equal marriage rights for men and women

Mike Teavee replied to kwilco's topic in Marriage and Divorce

If I could have a Civil Partnership in Thailand I wouldn’t need to get one in the UK, but that is my Plan C as looking at the hassles involved in getting a Civil Partnership in The UK, it’s probably easier just to marry her in Thailand. And who said romance was dead 🙂. Joking aside I just want to make sure she’s well taken care of should anything happen to me. -

Equal marriage rights for men and women

Mike Teavee replied to kwilco's topic in Marriage and Divorce

I would hope that the same sex foreign spouse of a Thai would be able to get a Marriage Visa if they wanted/needed one. -

Equal marriage rights for men and women

Mike Teavee replied to kwilco's topic in Marriage and Divorce

I understood your question & do believe it's about time that a Foreign Male married to a Thai Female got the same rights as a Foreign Female married to a Thai Male. Will be interesting to see how/if the introduction of same sex marriages changes anything or whether they will have the same discrimination with a Foreign Male married to a Thai Male Vs a Foreign Female married to a Thai Female. As an aside it would also be good if we could have Civil Partnerships in Thailand, I simply don't believe in getting married (never had) but my Thai GF won't be able to inherit my pension unless we're in a Civil Partnership or married so am going to have to do something about it over the next couple of years. -

I seem to recall they just said "Long Term Visa" in the same paragraph as changes to Non-Immigrant Visas & although the LTR is technically a Non-Immigrant Visa (It doesn't make you an Immigrant to Thailand), it isn't classified as one in the Thailand list of Non-Immigrant Visas. Hope I'm wrong as I would welcome a "Softening" of the rules for the "Wealthy Retiree", currently I have to wait until my pensions kick in (2026) to be able to apply for one.