Mike Teavee

-

Posts

4,306 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Mike Teavee

-

-

5 minutes ago, JimGant said:

Yes. The final purpose for the remitted assessable funds makes no difference to its taxability. [However, the jury is still out on whether or not remitted funds that are a legitimate gift are exempt from income tax.]

But If I gave his son in the UK the money, then he (Non Thai Tax Resident) remitted it to his father there would be no tax to pay for anybody?

You might be right but again, it doesn't "Feel" right.

-

1 minute ago, JimGant said:

As a tax resident, it's the sender, if the remittance is assessable income, who is responsible for the income tax. There could be a second, unrelated taxable event, if the receiver gets a gift -- or is being paid for a service or product.

So any money sent from a Non-Tax resident that is not a gift or payment for a service/product is free from income tax for the receiver? - Doesn't "Feel" right to me.

How about, a friend of mine (Works in Thailand, Higher Rate Tax payer) wants to borrow 2Million THB as a Bridging loan, I (Thai Tax Resident) send him 2Million from the UK & he pays me back in the UK when he gets some dividends/capital gains, do I still need to declare the 2Million THB as assessable income even though I won't be seeing any benefit from it? - Feels like he should be the one declaring it as assessable income as ultimately that's where the money is coming from/going to... If not it could be a way for him to pay <25% tax instead of the 35% he'd pay if he remitted it directly

-

10 hours ago, JimGant said:

Why would she be taxed? Her bank account is just your intermediary for receiving funds that you remit to Thailand. Self-assessment says it's you that has the obligation to declare, or not, remitted funds to Thailand as assessable income. These funds certainly aren't your wife's remitted foreign income funds.

To be clear, are you saying that he would be taxed as the ultimate recipient of the money or would be taxed as the sender of the money?

E.G. If a friend (not relatived) wired me money, who would be taxed in the following scenarios

- Tax resident in Thailand wired me 600K THB with a request that I give him 50K pm?

- Non-tax resident in Thailand wired me 600K THB for spends for a 3 month holiday?

- Tax resident in Thailand wired me 600K THB out of the goodness of his heart?

- Non-Tax resident in Thailand wired me 600K THB out of the goodness of his heart?

"Fairness" would suggest he would be taxed in scenario 1, nobody would be taxed in scenario 2 & I would be taxed in scenario 3&4.

-

1 hour ago, jossthaifarang said:

There are always 2 sides to every story, it would be interesting to see the footage leading up to the still image pictured.

Guy who gets punch doesn't seem to have done anything except walk over to speak to him...

-

2

2

-

-

13 minutes ago, bradiston said:

IPC? Can find multiple uses for this acronym but none that seems relevant. His research discussions? Any links to the video? I must have missed it.

UK Gov's International Pension Centre https://www.gov.uk/international-pension-centre

-

1 hour ago, Mike Teavee said:

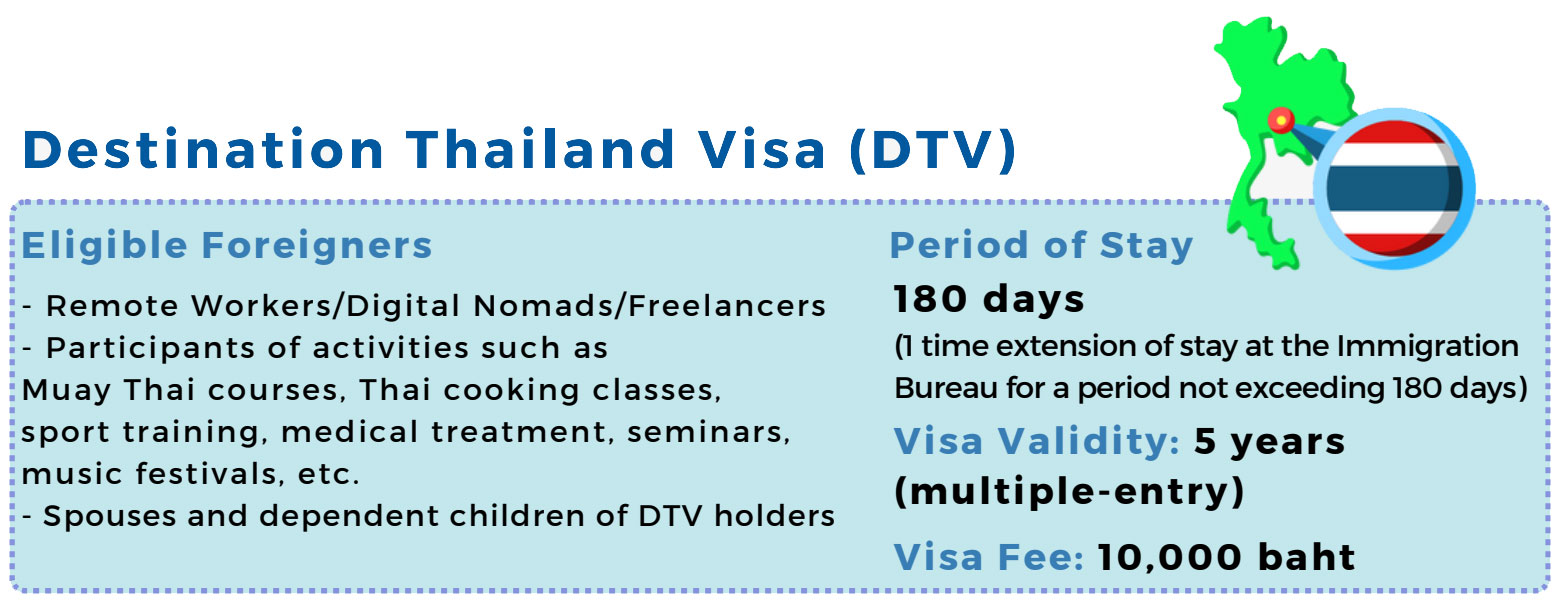

So I can get one of these visas & remit all my rental, dividend, Capital gains income tax free?

Be tempting to not renew my passport before my next extension so my Non-IMM O expire next July & get one of these instead so I can remit income tax free.

Next year take another 6 months & extend then get the LTR in 2026

Apologies, I was out when I posted this but now I've had chance to read the full Siam Legal page they're not saying that foreign income is tax free under this visa, but more as you're staying under 180 days Foreign Income is tax free...

Thailand has always been a haven for digital nomads, those who work exclusively online from anywhere in the world, and now Thailand is making it much easier to make the Kingdom a “workcation” destination. The recent announcement introduced the “Destination Thailand Visa” (DTV), which will be valid for 5 years and allow holders to stay in Thailand for a total of 180 days each year. These days need not be consecutive, and the 180-day limit means that holders will not have their foreign income taxed by Thailand.

NB: Their read is that it's a total of 180 days in one year. Do 90 days in country & leave for 3 days & you don't get another 180 days when you get back, you'll either get another 90 days or 87 days depending on whether they use what's remaining on the 180 days the visa allows OR the original permission to stay.

-

32 minutes ago, El Matador said:

Holders cannot apply for a work permit but can earn untaxed foreign income while in Thailand.

So I can get one of these visas & remit all my rental, dividend, Capital gains income tax free?

Be tempting to not renew my passport before my next extension so my Non-IMM O expire next July & get one of these instead so I can remit income tax free.

Next year take another 6 months & extend then get the LTR in 2026

-

1

1

-

-

37 minutes ago, El Matador said:

It is written in this article which was posted in this thread : https://www.thaiexaminer.com/thai-news-foreigners/2024/05/30/visa-liberalisation-measures-unveiled-with-dtv-visa-for-living-and-working-in-thailand-legally/

It could be a mistake though. But the article is well detailed.

Thanks, I missed this...

Strange that they would announce a new Visa type that is bound to draw a lot of interest & then say that it won't be available for at least 1 year.

Only reason I can think of for it taking so long to bring in is they need to make some changes to the Immigration Systems which might add weight to the argument that the Visa is a Cumulative Visa (I.E. Multi-Entry up to a maximum of 180 days in any one year with 1 extension allowed so you could spend 360 days in one of the 5 years).

Again, pure speculation until we know more information but I suspect things will go very quiet on this for awhile if it really is going to take 1 year to bring it in.

-

1

1

-

-

- Popular Post

6 minutes ago, Thingamabob said:Question is what has the UK govt done with the contributions I made for over 50 years ?

There is no “Pot of Monry”, your contributions were used to pay Pensions for people who retired while you were working & People who are working/contributing today are paying your pension

-

3

3

-

2 hours ago, michael888 said:

Has anyone come in and got 60 days exempt yet? If so, please post from where and how it went. Add relevant details as well please. thanks.

There have been a couple of reports in the other thread saying people have been getting 30 days at BKK Airport

-

2

2

-

-

2 hours ago, DaLa said:

Would it make more sense to lobby the Thai government to enter into a reciprocal social security agreement with the UK government. An increase in all those 'frozen' pensions would result in £ entering the country and ฿ in the economy. If the Philippines have the facility/legislation then it can't be rocket science for it to be introduced here.

I believe Australia tried to do this & UK government refused to enter into discussions so I wouldn’t fancy Thailand’s chances.

-

1

1

-

1

1

-

-

3 minutes ago, Pattaya57 said:

That dtv site is just a made up site by some random. Why do you think it's official?

I don't claim it's an Official site, just saying that the site has been updated to say the Visa will be available later this month/early July in response to somebody stating (without posting any links) that it won't be available until June 2025.

-

DTV site has been updated to say the Visa is expected to be available from later this month or Early July

The new DTV visa is expected to take effect in late June or early July 2024 as part of their short-term measures

https://dtv.in.th/en#availability

-

1

1

-

-

On 5/30/2024 at 2:05 PM, El Matador said:

"At this time, the government has announced that the visa will only be available from June 2025."

Well it seems we can forget the digital nomad visa for next winter. And they have the time to change 10 times their mind.

I still take that 2 months visa exemption instead of waiting weeks for the evisa.

"In 2024, foreign tourism on track to generate ฿1.254 trillion, far short of nearly ฿2 trillion generated in 2019. Cabinet wants ฿3 trillion in receipts"

Interesting to see that despite a high number of tourists, the money coming from tourism has dropped by a lot. It gives an idea about the current opening towards Russian, Chinese and Indian tourists. It hasn't attracted wealthy tourists.

DTV site says it will be available later this month or early July...

The new DTV visa is expected to take effect in late June or early July 2024 as part of their short-term measures

It also suggests that you can use it to enter Thailand for up to 180 days each year for 5 years...

-

1

1

-

-

3 hours ago, Phillip9 said:

That's how every current multiple entry visa works. Nothing released officially states or even suggests this visa will be any different, so why would you think this one would be different?

If it worked like existing multi re-entry visas then you could:-

- Enter Thailand

- Day 179 leave Thailand do a border bounce

- Day 179 re-enter Thailand

- Day 358 leave Thailand do a border bounce

- Day 358 re-enter Thailand

- Keep repeating until the day before the 5 years expires, do a border bounce & get another 180 days so the Visa would be good for approx. 5.5 years.

Honestly cannot see this being how it works as you've just killed off the Thailand Elite 5 year visa (the other perks are worth nowhere near 900K).

I would think that it would be more like a a Single Use Visa with multiple re-entries during the span of the permission to stay. I.E.

- Enter Thailand get 180 days

- Day 30, Take a 3 day trip out of Thailand, come back & be stamped in for 147 days (180 - 30 days already in country - 3 days away)

- 60 days later take another 3 day trip, come back & be stamped in for 84 days (Total of 90 days in Thailand - 6 days outside)

- 30 days later take another 3 day trip, come back & be stamped in for 51 days

- 30 days later take another 3 day trip, come back & be stamped in for 21 days

... Extend (once) & repeat...

Which effectively means you'd be getting a new visa every year & doing an extension every 6 months, not great but feels better than what <50s singles need to do today.

-

5 minutes ago, Pattaya57 said:

This is getting silly now. By your understanding that would make 60 day tourist visa a non-immigrant visa.

Thai cabinet was talking about reducing 17 non-immigrant visa categories to 7. That is "non-immigrant" is in the title of the visa

I take your point.

I was answering to the point that an LTR (& a Tourist Visa for that matter) are technically "Non-Immigrant" Visas as they don't bestow permanent residency (i.e. you cannot become an Immigrant on one) but in terms of this context then yeah, it's probably not on their list of 17 being reduced to 7, whereas the OX "Retirement" visa (which is the same 5+5 years visa) is on the list.

Still curious to see one though if somebody could post a pic (redacting their personal details obviously).

-

3 minutes ago, khunjeff said:

"Thaiembassy.com" is not a Thai government website, and routinely contains inaccurate information.

Then maybe somebody could post a redacted picture of their LTR & we’ll see if it has “Non Immigrant” on it.

Or simply look up the definition of “Immigrant”

a person who comes to live permanently in a foreign country.

Nothing permanent about a 10 year visa.

-

1

1

-

-

2 hours ago, Mike Teavee said:

Of course the LTR is an Non-Immigrant Visa, only PR & Citizenship would be considered "Immigrant"

Seems some people are easily confused or believe that the LTR is not a Non-Immigrant Visa...

Non-Immigrant Visa

This is normally a single-entry visa into Thailand that’s valid for 90 days. Depending on the type of Non-Immigrant visa you can also get a work permit and open a bank account.

This visa can be extended to a long-term visa, depending on the type of Non-Immigrant Visa you apply for.

Depending on the purpose of stay, there are various types of Non-Immigrant Visas available from Thai embassies and consulates or at the immigration, some including:

- Non-B Business Visa

- Non-O Retirement Visa

- Non-O Marriage Visa

- Non-B Investment Visa

- Long-Term Residence Visa

https://www.thaiembassy.com/thailand-visa/thailand-visa-types

-

1

1

-

1

1

-

1

1

-

27 minutes ago, connda said:

Nothing good.

That's my fear, I would much rather they just left things as they were or at least commit to "Grandfathering In" people who have lived in Thailand for many years.

It's easy for me to say "I'm all right Jack" as I'm in my 50s & already have Health Insurance but guys who have lived here for 20+ years & are now in their 70s would find it really difficult/expensive/impossible to get it if it became a requirement.

Unfortunately the last time they did this (To the Non-IMM OA holders) they didn't "Grandfather In" existing holders so the track record isn't looking good.

-

1

1

-

-

21 minutes ago, connda said:

Mine too. The year that they required insurance for Non-OA, the IO at my immigration office was literally rubbing his hands together, "You come on Non-OA so need insurance!" <snicker snicker snicker> The guy was literally smiling.

I pointed out in the passport that I came in on a Non-Imm B, worked for three years, and then went on extensions based on marriage. So the underlying visa is still a Non-Imm B. I've no plans on leaving, and Immigration and the Thai government in general seems much more friendly to those on Non-Imm B visas anyway. Why change?Your "Stay" is based on your extension not your original Visa so if you were originally on a Non-IMM B & extended on the grounds of being married to a Thai then you would be considered as staying under a Non-IMM O Marriage.

It's impossible to change to a Non-IMM OA without leaving the country to get that visa & even then, guys who live here on a Non-IMM OA Marriage don't need Health Insurance.

-

15 hours ago, Srikcir said:

Where is the non-immigrant Long Term Resident visa?

I would guess that it would be included in (5) Category Non-Immigrant Code O (Others)

Thai Elite visas are classed as "Tourist" visas for the purpose of immigration

-

1

1

-

-

11 hours ago, oldcpu said:

The LTR visa is not a non-immigrant visa.

Of course the LTR is an Non-Immigrant Visa, only PR & Citizenship would be considered "Immigrant"

-

1

1

-

1

1

-

-

On 5/26/2024 at 6:41 AM, BusNo8 said:

My monthly rock bottom general spend living in central Bangkok is about 27.5k up from 22.5k due to inflation. Add another ten percent for holiday fund, medical dental. I need two dental implants so that comes out of another bucket.

Food is still cheap. Open market for veggies. Breakfast at home. Dishes with fried egg over rice b70. Having said that my wife will bring meals home which we'll both agree still have good value. B10 for a fried egg I'm not happy with and it's rarely fried for me but rather sitting about.

It's more expensive but I'm very happy I'm here and not in the US for a dozen reasons

I think the fact inflation has meant your monthly spends have gone up by roughly 20% should be ringing alarm bells for anybody planning on retiring to Thailand on that sort of Budget, especially somebody like a UK Pensioner living on a Frozen pension.

Once retired, we've made our beds & have to live with it, but I would recommend to anybody considering the move to pick a number, double it & then add in a "Fudge Factor", I ended up working 1 more year in a job I hated so I had the "Fudge Factor" & am so glad I did as I realised that I needed to add an extra 25% to my budget to have the lifestyle that I wanted in retirement.

One question though, if you are living on pretty modest means, why live in Bangkok? Why not live somewhere where your money goes a lot further?

-

2

2

-

-

29 minutes ago, Yellowtail said:

Does anyone know with any level of certainty:

1. If my wife transfers cash from our joint account in the US, to her personal account in Thailand, would the money be taxable?

2. If my wife transfers cash from her personal account in the US, to our joint account in the US, and then to her personal account in Thailand, would the money be taxable?

3. If my wife transfers cash from her personal account in the US, to her personal account in Thailand, would the money be taxable?

It depends on whether the cash is assessable income or not, not where she sends it from

E.g. If the cash in question was savings from before 2024 then No Tax, If the cash in question was from US Social Security no Tax (DTA), if the Cash was from some other source then it's possible that there may be some tax due but highly unlikely as she's probably already paid more Tax in the US than would be due in Thailand (Again, covered by DTA).

-

1

1

-

UK warns British tourists to behave in Thailand or face jail time

in Thailand News

Posted

You've only been in Thailand 2 weeks so wouldn't have seen this... https://www.khaosodenglish.com/news/2024/03/06/a-swiss-man-seriously-hurts-thai-woman-in-trang-supermarket/

TRANG – Another dispute erupted between a foreigner and a Thai in Trang Province, southern Thailand. A Swiss man attacked a Thai woman, breaking her nose and making her face bloat in the supermarket. She needed to be hospitalised immediately.

Mr. Kritphong Khikkham, 25, of Village No. 1, Ban Khuan Subdistrict, Mueang District, Trang Province, and his family reported to the tourist police on Tuesday evening, March 5, that a Swiss foreigner had attacked his mother, age 53, and caused serious physical harm in the middle of a mall in Trang Municipality.

According to Kritphong, his mother developed a nerve condition as a result of having the wrong tooth moved. As a result, she will need to heal for some time. She needs to use a walker to go around, and she can’t walk very well.... อ่านข่าวต้นฉบับได้ที่ : https://www.khaosodenglish.com/news/2024/03/06/a-swiss-man-seriously-hurts-thai-woman-in-trang-supermarket/

Not just old, but an invalid with a walker... What a man...

BTW Which country are you from?