Mike Teavee

-

Posts

4,306 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Mike Teavee

-

-

1 hour ago, JimGant said:

John, what's the worst that could happen? You already pay taxes on your worldwide income. If Thailand will now exercise their right under the DTA to collect their share -- with a subsequent tax credit to be absorbed by the US -- your overall tax bill will be the same.

I don't know how it is in the US, but in the UK I could be liable for extra taxes on:-

- Capital Gains from Share Sales (As an Expat, not taxed in the UK)

- Higher Rate Tax on Dividends (As an Expat can use the disregarded Income Rules)

- Tax on Interest, Dividends, Capital Gains in my ISA (ISAs are Tax Free Savings accounts so no Tax on anything you have in there).

Then there's the question of Personal Allowances, in the UK it's currently £12,570 (Approx. 585,000 THB), in Thailand it could be as low as 60K, the tax on the difference of 525,000 THB would be 30,750

- First 150K at 0% = 0

- Next 150K at 5% = 7,500

- Next 200K at 10% = 20,000

- Remaining 5K at 15% = 750

-

1 hour ago, JimGant said:

Negative:

This language is similar to other DTAs -- the situs country has primary taxation rights, but the resident country has secondary taxation rights. ['may be taxed' is treaty language for there being a primary taxation authority, but also a secondary one. If it said 'may only be taxed, ' then there's only an exclusionary taxation authority, no secondary.]

So, submit tax returns to both countries -- with UK collecting all the taxes, and issuing a credit toward Thai taxes. If Thai taxes, after absorbing the UK tax credit, are positive -- well, you'll owe this delta, plus full fare to the UK.

Agreed, "Primary" was a bad choice of word when what I meant to say was that Thailand may have a right to tax it.

Interestingly in another thread @alphasonshared his findings from Sherrings who clarify the use of the word "May" as to mean they would be the only ones who would apply Tax...

The wording around Rental Income is the same as around Property Capital Gains so looking hopeful that only the UK would tax Rental Income, but there's still the question about whether you need to report the income as assessable income even if Thailand doesn't tax it as Section 40, Paragraph 5, Point 2 lists Rental Income as assessable income but is it if it's covered by a DTA & if so, how do you show that it's already been taxed (especially if like me any income from it falls within my Personal Taxation Allowance so I've paid tax on it at nil rate)...

Section 40 Assessable income is income of the following categories including any amount of tax paid by the payer of income or by any other person on behalf of a taxpayer.

(5) Money or any other gain derived from:

(a) rent of property,

https://www.rd.go.th/english/37749.html

-

2 minutes ago, Gottfrid said:

That will not work anymore. It´s old information, from the time the law was not enforced.

I agree, the one site that I found with that information on was an agent (not the official Elite) site https://www.elitevisa.com/thailand-elite-visa-overview & a quick check of the source for that page shows a Published Date of 20/06/2023 which is before the recent change was announced.

-

22 minutes ago, NoDisplayName said:

You could buy an elite visa for 100-150K baht per year and not pay income tax.

I honestly don't believe they're giving you the full story here & a quick search will show reputable companies like Siam Legal saying that TE holders are subject to the same 180 day Tax Residency rules as everybody else (Except LTR holders)...

Visa Status as a Special Tourist

Although the Thailand Elite visa is a privileged tourist visa, you are subject to pay income tax if you have a foreign-source income at the amount required for taxation. For example, a deposit of 1,000,000 THB into a bank account in Thailand may be considered as a foreign-source income required for taxation. The bank will submit a report to the Revenue Department at its request in monitoring any unusual financial activity.

I would want it in writing from Elite themselves that I'm exempt from tax on all remittances before I forked out 900K+ to buy one.

-

2

2

-

-

52 minutes ago, alphason said:

I've been looking into the same thing

I saw an article on Sherrings website regarding CGT on sale of a UK rented property but the wording used is the same 'may be taxed' ...

"(1) Capital gains from the alienation of immovable property, as defined in paragraph (2) Article 7, may be taxed in the Contracting State in which such property is situated."So I contacted Sherrings, and the International Tax Director confirmed to me this would not be subject to Thailand Tax law.

He said regarding Article 14, paragraph 1, of UK Thai DTA. The words "may be taxed" do not have the usual laymans meaning, instead the legal meaning of these words is that because the UK's tax law has Capital Gains Tax legislation, then the immovable property in the UK is subject to the Capital Gains Tax legislation in the UK, and not subject to Thailand's tax law.

That's certainly looking a lot more positive though I'd like to see a few people go through the process before I sell my UK House & bring the money over, it's bad enough getting stung >18% in the UK!!!

The "May" wording for Article 7 Rental Income is the same so it would be great if we can get the same confirmation as since this whole thing kicked off, Rental Income has been used as an example of one of the things we might be taxed on.

-

1

1

-

-

23 minutes ago, Jonathan Swift said:

I wouldn't even do the 800,000 baht. That is the crazy way to do it. I just show income of $65,000 per month. That is money I can spend and live on, rather than park a huge amount of money uselessly in a bank.

Ironically, 800K is not a huge amount of money to me, but having to prove that I earn 65,000 THB (Never mind USD 🙂 ) every month is a problem as I live on Dividends/Rental Income which whilst over the 12 months averages out at >65K pm, I can't prove that I earn this every month.

Even if I could use the income method, I'd still just park the money in the Bank as it's easier than having to worry about a payment failing, happening early/late so not hitting in the right month (Somebody mentioned this concern in connection with US Social Security in another thread) , not quite sending across 65K etc...

I don't know about everybody else, but I like to keep a proportion (2 years spends) of my "Assets" in cash as I don't want to find myself having to "Fire Sell" assets if I needed some money quickly, so I just look at the 800K in the bank as part of this "Oops Fund".

-

1

1

-

-

3 hours ago, OJAS said:

Your UK rental income is (IMHO at any rate) covered by Article 7 of the DTA, meaning that it does not need to be included as assessable remitted income in any tax return you file with the Thai Revenue Department.

The UK-TH DTA says "(1) Income from immovable property may be taxed in the Contracting State in which such property is situated." which only says that the UK can tax you on it, it does not say that only the UK can tax you on it so you might have to pay tax on it if you remit it to Thailand.

Either ways, Section 40, paragraph 5, point A of the Thai Revenue Code says that Rental Property is assessable income & so should be included in any tax return you file...

Section 40 Assessable income is income of the following categories including any amount of tax paid by the payer of income or by any other person on behalf of a taxpayer.

(5) Money or any other gain derived from:

(a) rent of property,

https://www.rd.go.th/english/37749.html

I've decided to err on the side of caution & not remit any rental income until it's made clear whether I will be taxed on it or not.

-

1

1

-

1

1

-

-

4 hours ago, shdmn said:

The retirement visa. There is one that you can apply for outside of the country and one you can apply for inside. Saying "to enter Thailand" is irrelevant when you are already in Thailand. In that case it would be used to re-enter.

When you do a conversion to a Non-IMM O inside Thailand your old Visa/Permission to Stay is cancelled & you are "Stamped-in" on your new visa as if you were entering Thailand and the Single 90 day Non-IMM O that you converted is immediately marked as used. You cannot "Re-enter" on that Visa/Permission to Stay unless you get a Re-Entry Permit.

-

36 minutes ago, Sheryl said:

(2) have to worry about timing. My SS has arrived regularly between 1-4th of each month so far but I recall past reports of people who received their September payment on August 30/31 (because the 1st is a US holiday) and lost their extension accordingly because IO was rigid about transfer every calendar month.

If I were to switch to the monthly income method, I'd set up a recurring transfer on Wise to send the money over 2nd week of the month, that way I could guarantee 65K would hit my account (though how much I pay to Wise would differ with FX rates) & the monies would always hit around about the same date in the middle of the month.

-

1

1

-

-

27 minutes ago, Sheryl said:

Tax credit can certainly be applied if you are taxed in UK on this, but there is also a chance the wording of the UK-Thai DTA gives UK and not Thailand right to tax rental incomes from UK sources.

Absolutely essential to read your DTA. Watching and waiting will nto tell you what is in it, and reports from people of different nationality and/or different financial position may not apply.

IIRC (It's been a few months since I looked at this), Thailand has primary taxing rights on UK Rental Income & whilst you might be able to use any tax paid in Thailand to offset against what you pay in the UK, there could be a couple of things that mean you end up paying more tax overall:-

- UK Taxes you on your net income after all expenses, Thailand doesn't seem to allow you all of the same expenses (e.g. in the UK you can offset a certain % for maintenance whether you pay it out or not)

- If (Like me) you don't pay tax on your rental income as it falls under your Personal Taxation Allowance there will be nothing to offset the Thai Taxes against.

Again, it's been at least 3 months since I went through the UK-TH DTA so I may have misremembered what I worked out at that time, I just know that I worked out that there was a good chance I was going to have to pay tax on it if I remitted it to Thailand so decided I wasn't going to bring it over.

-

- Popular Post

- Popular Post

3 hours ago, rocketboy2 said:Spending savings already in Thailand for the next one or two years.

see what comes by then.

Not going into panic mode yet.

You've missed the point a little, living on savings will save you from the recent change to tax money you remit into Thailand but this latest proposed change means you'll be taxed on any income whether you bring it into Thailand or not so even if you bring no money over, you're still potentially liable for tax on any income you earn anywhere

-

1

1

-

4

4

-

20 minutes ago, shdmn said:

It's a 5-year multi-entry visa that gets you a 180-day stamp in your passport. That is probably all there is to it.

I would assume it will also say that you cannot use it more than once in a 360-day period, except for a one-time 180-day extension, in that 5-year period.

So your vote is for 180 days (+ 1 extension) over the 5 year period?

My vote is for a 180 days each calendar year (+ max of 1 extension).

Time will tell 🙂

-

1

1

-

-

16 minutes ago, ThaiVisaCentre said:

The current information about the visa is a bit unclear and speculative. We're doing our best to keep track and provide updates as they come.

Currently, there are two main theories on how the visa will work:

Theory 1: You get a 5-year visa that allows unlimited re-entries during this period. Each entry grants a 180-day stamp, which can be extended for another 180 days.

Theory 2: You get a 5-year visa that starts upon your first entry. It's only valid for 180 days after this initial entry, with the possibility of a one-time extension for another 180 days. You cannot apply for this visa again until the original 5-year period passes or the visa is canceled. Every re-entry would not change the original duration of the visa stamp.

Our advice is to avoid making any plans related to the DTV until the details are fully finalized, which should be within this month.In your "Theory 2" is that 180 days (+ 1 extension) over the lifetime of the Visa or 180 days for each of the 5 years that it's valid (+ a single extension to one of those stays)?

-

37 minutes ago, ChumpChange said:

Interesting. I wonder where the 200K comes from though. Didn't it used to be that 400K was required (prior to 1998) for an extension on the basis of retirement?

I thought the 200K requirement was for a family visa when married to a Thai, which was then also increased to 400K in 1998?

Have to admit that I always thought it was 400K that was doubled to 800K but that PDF is from the official Immigration website & a quick check on the Bangkok IMM site has exactly the same criteria...

See Item 22 "Visa Extension in case of Retirement", Point 7

7. An alien entering the Kingdom before October 21, 1998 and has been consecutively permitted to stay in the Kingdom for retirement, shall be subject to the following criteria:

(a) An alien must be 60 years of age or over and have an annual fixed income with a deposit maintained in a bank account for the past 3 months of no less than 200,000 baht or have a monthly income of no less than 20,000 baht.

(b) If less than 60 years of age but not less than 55 years of age, an alien must have an annual fixed income with a deposit maintained in a bank account for the past 3 months of no less than 500,000 baht or have a monthly income of no less than 50,000 baht.https://bangkok.immigration.go.th/en/visa-extension/#1610937479150-0456cfd8-f864

-

3 minutes ago, ChumpChange said:

Thank you for that input. I didn't know some people were grandfathered in on the financial requirements when they doubled them in 1998. I wonder if 25 years later people on these old visas are still only required to show 400K?Yes, it's 200K & the rule is still in the Immigration guidelines for guys who entered before October 1998 & have maintained the same Visa (i.e. done annual extensions on the basis of Retirement) since then...

(7) An alien, who entered into the Kingdom before October 21, 1998 and has been consecutively permitted to stay in the Kingdom for retirement, shall subject to the following criteria:

(a) An alien must be 60 years of age or over and have an annual fixed income with a deposit maintained in a bank account for the past 3 months of no less than 200,000 baht or have a monthly income of no less than 20,000 baht.

(b) If less than 60 years of age but not less than 55 years of age, an alien must have an annual fixed income with a deposit maintained in a bank account for the past 3 months of no less than 500,000 baht or have a monthly income of no less than 50,000 baht.

[Obviously there will be nobody who was on a Non-Imm O "Retirement" in 1998 who is under 60 now]

-

1

1

-

-

9 minutes ago, kaufmanski said:

Do you mean over 120,000 foreign earned income as per USA? I file income exclusion in USA. Are you a tax guy? Send me an <personal email removed per forum rules, please use PM system>

Sorry, I meant 120,000 THB which is the limit at which you are supposed to file a Thai Tax Return.

I'm not a Tax guy, but spent 30 years working in IT for a couple of Global banks, part of which included coding a lot of Tax related rules so have some experience of how Tax works in the UK & have been doing a lot of reading up on how it works in Thailand, other guys on here are much more familiar with the US tax system.

-

52 minutes ago, zzzzz said:

so ur only allowed to purchase the 5 year DTV ONCE every 5 years?

and use it for a max stay of 360 days in that 5 years>

Obviously we don't know the full rules yet but as the Visa is valid for 5 years & as you cannot have 2 valid visas at the same time getting a new one would seem to be dependant upon them cancelling the existing one.

I think you can use it for 180 days every year & an extra 180 days in one of the 5 years or for an extra 180 days after the 5 years.

-

2 hours ago, sometime said:

If the amount increases it will be grandfathered like last time, I have friends who only need 400.000 in the bank

I hope you’re right but they didn’t “Grandfather In” Non-IMM OA holders when they introduced the Health Insurance requirement so there is a chance that they won’t “Grandfather In” existing Non-IMM O/OA holders if they were to increase the required money in the bank.

Also worth noting that they only "Grandfathered In" people who had been on the same Visa for 4 years.

To the OP, I keep an "Oops" fund so nothing would change for me unless they tripled the requirement (or I had an "Oops" Event)

-

1

1

-

1

1

-

-

2 hours ago, AreYouGerman said:

Why nobody can read anymore?

"180 days, [..], with a 10,000 baht filing fee each time."

You go out, you come back 180 days = 10,000 THB

The full paragraph says...

However, it is important to note that the DTV visa does NOT allow 'any' digital nomad to stay in Thailand for five years. It can be used within a five-year period for 180 days, and extended once for another 180 days, with a 10,000 baht filing fee each time.

Which I read as saying the fee is 10,000B for the Visa & another 10,000B for the extension, it doesn't say it's 10,000B for each of the 5 years of the Visa.

I don't think there is any chance you'll be able to use it to live in Thailand permanently for 5 years, best you can hope for is you'll get 180 days & be able to extend this then get a new Visa the next year (Though as the Visa would still be valid this might cause problems) - I personally believe it's going to be a maximum of 180 days in-country per year for each of the 5 years with the ability to extend 1 of the 180 days to 360.

-

1

1

-

-

- Popular Post

- Popular Post

35 minutes ago, kaufmanski said:USA has a DTA with Thailand. So does that mean if I file in USA, I am exempt from paying taxes in Thailand from foreign earned income? I work in countries other than Thailand and USA. But I am an American citizen.

Not necessarily, it all depends on what's been agreed as part of the DTA, it is possible that you'll need to pay Tax in Thailand if:-

- The income is not covered in the DTA

- The income is not taxed in your home country (Could be a Tax Free investment product or something like Capital Gains which aren't always taxed for Non-Residents)

- Thailand has primary rights to tax the income (unlikely with the US DTA but with other country's DTAs it's very possible) - In this case you would pay the tax in Thailand & should be able to claim a tax credit for the other country to offset any tax you've paid there.

- Thailand has higher rates of tax than you've already been taxed, in which case you should be able to offset what you've already paid & pay the difference to Thailand.

NB Even though you might not have any tax to pay, you are still supposed to file a return if your assessable income is > 120K (Single).

-

1

1

-

2

2

-

- Popular Post

- Popular Post

7 hours ago, saintdomingo said:Does it make a difference if the 800,000 is from previous savings, current year earned income or pensions.?

Yes...

- Previous Savings (Pre-2024) - No Tax

- Savings from Income earned after 1/1/2024 - Taxable unless covered by DTA

- Current Year Earned Income - Taxable unless covered by DTA

- Pensions - Taxable unless covered by DTA

-

2

2

-

1

1

-

12 hours ago, kaufmanski said:

If you bring in 800,000 for your retirement visa or let's say to purchase (gifting the funds to your wife) a home are these taxable income? That's to say any money you bring to Thailand is taxable income??

If the 800K is for your retirement extension then it needs to be in your name so cannot be a "Gift" to the wife & would be assessable income (taxable) if it wasn't from pre-2024 savings or covered by a DTA.

[I'm obviously assuming you're going to have spent >179 days in Thailand and so are Tax Resident]

-

1

1

-

1

1

-

-

11 minutes ago, Pib said:

Yes, one

Not sure where above snapshot is from....possibly from older BOI LTR required docs information.

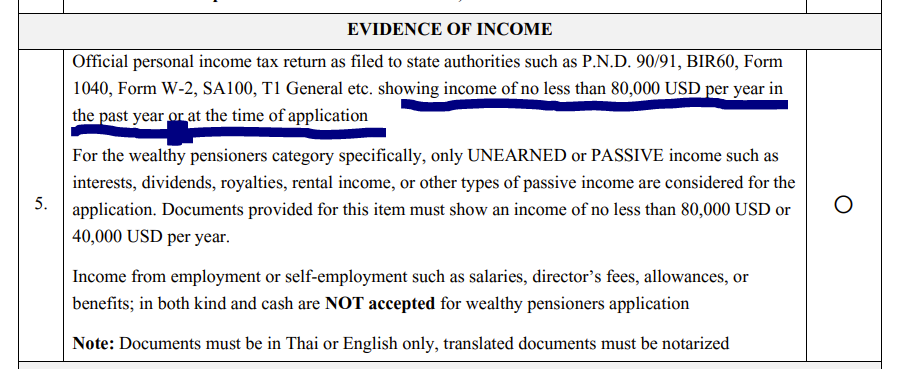

For a LTR Pension visa only one year of tax returns "OR" at time of application. See below BOI weblink/snapshot....it's from the BOI LTR website as of 5 June 2024/today under the Required Docs icon/sub-link.

Even if your most recent tax return shows you under the required income requirement if recent events such as a Cost of Living Adjustment (COLA) which is common with a lot of retirement pensions now puts you over the requirement income level then then documents showing your new income amount such as pension/annuity monthly statement, benefit letter, etc., will provide the necessary proof.

Now BOI will probably still want to see your most recent tax return which like if you were submitting an application today/5 June would be for the tax year of Jan-Dec 2023 but even if the amount on the tax return is below the required income amount as long as the "current" documents from your pension/annuity payor show you the current amount has increased like due to COLA then that will satisfy BOI--I was in that exact situation for my LTR application in late 2022 and my LTR-P was approved.

Tax returns merely serve as secondary proof/support of your income in some situations especially when they do not yet show income increases like from COLA of a current pension, just starting a new pension, just starting a Required Minimum Distribution (RMD) from a 401K/IRA type saving plan, etc. This is when documents/benefit letters/month statement/etc., from the pension/annuity paying agent become the primary proof.

https://ltr.boi.go.th/documents/Required-docs-Wealthy-Pensioners-14-05-2024.pdf

Many thanks for this, giving me some confidence that I'll be able to apply as soon as my Pensions kick in (Feb 2026) instead of having to wait for a full year or even worse until I've filed my UK Tax Return the following year (I normally file in June/July).

As an aside, it seems Capital Gains has been removed from the example of Unearned/Passive Income & a quick search of the pdf shows the word Capital doesn't appear anywhere.

-

57 minutes ago, BusNo8 said:

Visas can be extended. It's commonly referred to as a 'visa extension'

It's good to keep language precise, but this is a nitpick

Not Nit-Picking but Visas cannot be extended, it's your permission to stay granted by that Visa which is extended.

Your Visa expires on 1st use if it's a Single Entry or at the Visa Expiry date (often called "Enter Before Date")

-

1

1

-

1

1

-

A Question For Retirees On A Retirement Visa Extension In Thailand

in ASEAN NOW Community Pub

Posted

There's not been anything to say that it wouldn't be assessable for tax (same with bringing money over to buy property/cars etc...) so if the monies didn't come from pre-2024 savings & weren't covered by your countries DTA with Thailand then it would be taxable.