Mike Teavee

-

Posts

4,306 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Mike Teavee

-

-

1 hour ago, OJAS said:

The reduction in the mandatory minimum health insurance coverage from 3M to 440k will only apply to long-stay visa applicants between September and December, according to the thread at https://aseannow.com/topic/1328402-big-thailand-visa-changes-from-june-1/

What I personally find extremely worrying is that, if we are, indeed, talking about a merger of the non-O and non-OA visas in the case of retirement, the Immigration Bureau might use this as an excuse for extending the health insurance requirement (which will presumably increase back to 3M from 1/1/25) to annual extensions of stay for retirement based on original non-O (as well as non-OA) visas. Not good news for those who have ditched their original non-OA visas so as to avoid the insurance requirement by exiting Thailand, re-entering visa-exempt and then obtaining 90-day non-O conversions at their local offices. And definitely not good news for those who, for whatever reason (age or health issues), are unable to obtain minimum health insurance coverage of 3M.

It would be an increase in Health Insurance coverage for me as my policy has 3.5Million inpatients only so I'd need to pay extra to add on the 40K Outpatients 😞

-

1

1

-

-

Some suggestion (around the 3 minute mark) that you might need to have proof of Employment to get it as a "Digital Nomad" which makes a mockery of it being available for "Freelancers"

-

- Popular Post

- Popular Post

11 minutes ago, Liquorice said:The O-A must still be available, as they announced a reduction in the mandatory Insurance requirement.

Unless they've merged it with the Non-IMM O so the change in insurance requirements would apply to both now.

Not what I want to happen but logically it would make sense for them to do so.

-

2

2

-

1

1

-

1

1

-

2

2

-

- Popular Post

- Popular Post

1 hour ago, Mike Lister said:One liberal estimate puts the total value of all westerns in Thailand at around 3% of GDP per year. Recent surveys have shown that less than 10% of them plan to leave as a result of the tax change, some of that will be talk. Impact? Minimal, is my guess.

But there is also the potential impact of Expats:-

- Choosing not to retire to Thailand

- Spending less than 180 days in Thailand

- Not remitting large sums of money to buy property/cars

- Choosing to holiday more in neighbouring countries

- Simply remitting less

Re: #5, I've already remitted what I plan to remit this year (GBP has been flying 🙂) and it's 25% of what I would normally remit (remainder of my spends will come from savings already in country), which leaves me with with the "Problem" of what to do with the rest of my income in the UK & this is where #4 comes in.

-

2

2

-

6

6

-

1

1

-

Has made it into the UK Press...

Thailand makes sweeping changes for foreign travellers in record tourism bid

https://www.independent.co.uk/asia/southeast-asia/thailand-digital-nomad-students-visa-b2552452.html

-

1

1

-

-

- Popular Post

12 hours ago, Lorry said:The last time Thaksin did this he doubled the necessary amounts iirc

So if you have 800,000 in the bank, please bring 800,000 more - taxable, of course

I think of more concern to a lot of people will be if in simplifying the 17 Non-IMM visa types to 7 types, they merge the Non-Imm O & OA retirement visas forcing non-Imm O holders to get Health Insurance.

If they do then let's hope existing holders are Grandfathered in or they offer an alternative for people who cannot get Health Insurance.

-

3

3

-

1

1

-

2 hours ago, george said:

Not yet announced by The Immigration Bureau , the announcement was done by MFA just yesterday after the cabinet meeting. Immigration is normally not fast with policy updates, so watch this space for updates when it happens.

Presumably it would need to be in Friday's Royal Gazette if it's to come in force by 1st June

-

2

2

-

-

3 hours ago, Mike Lister said:

If you took this question to TRD and asked them what their position would be, I can see TRD offering you money just to go away and not come back! 🙂

I GUESS, a product like this would require annual settlement to figure out the net effect over the course of the year.

Lol... It's actually very straight forward, interest is calculated on daily basis based on how much is owed in the account (i.e. how much you borrowed minus what you've put in there) & then applied to the account monthly.

The settlement amount is whatever you borrowed + any accrued interest and is due at the end of the mortgage so there is nothing to stop you withdrawing up to the amount agreed at any point up until then as log as you pay it back by the end of the term.

When they were 1st launched (Virgin One account in the UK quickly followed by Woolwich Open Account) they were nicknamed an "Aussie Rules Mortgage" so I don't know if a similar mortgage is popular in Australia.

-

Just now, AreYouGerman said:

Because it would be a smart move! Young in & old out! 😂

Or maybe, Young in on Non-IMM O, Everybody over 75 gets a free LTR , (Can we make that everybody over 57, I'm only 58) 🙂

-

1

1

-

1

1

-

-

8 hours ago, george said:

- Restructuring and reducing the number of Non-Immigrant visa categories from 17 to 7, starting in September 2024.

Why did I just get a chill down my spine!!! my Non-IMM O extension is due 26th September, think I do it as early as I can.

8 hours ago, george said:- Adjusting the criteria and conditions for the Long Stay visa for elderly people who wish to spend their retirement in Thailand, starting in September 2024.

And then a hopeful feeling again - Maybe I'll wait to see the new LTR requirements 🙂

-

1

1

-

1

1

-

-

18 hours ago, Mike Lister said:

R) An offshore loan remitted to Thailand is not assessable income. There are many instances of this.

If a foreigner takes out a loan in their home country and remits those funds to Thailand and says they represent non assessable income, because the funds are borrowed, that might be the end of the matter as far as taxpayer and TRD are concerned, ot it might not.

If the foreigner subsequently pays off that loan, in their home country, using income that would have been assessable to tax in Thailand, had it been remitted, there is no requirement for the loan repayment to be reported in Thailand. Yet the status of those funds has now changed, they are no longer borrowed funds and the foreigner has just committed tax evasion......or has he? According to the above, no, my sniff test says yes.

Before anyone has a go at me for discussing tax evasion, according to an entirely credible post above, remitting a loan in this manner is not assessable, the purpose of this post is therefore to determine is that is true or not.......I say it is not.

I've been thinking about this a lot as I have a "Current Account" Mortgage which works by taking off anything you have in the account from the Capital owed when calculating Interest (E.g. I have approx. £500 over the amount I borrowed in there & they pay me interest, if I took out £1,000 I would pay them interest on the £500 I would then owe).

So if I were to take £50K out, would it be savings (I put the money in there to pay off the mortgage 18 years ago) or would it be a Loan (It is a mortgage)? Either way it feels non-assessable.

If I were to remit that £50K then add it back from selling some shares so I was in credit again (incurring 1 day's worth of interest) would that be me remitting savings/a loan or could it be seen as me cycling the share sale proceeds that I used to replenish the account.

No chance of them being able to "Catch Me", just curious as to what people's views are on this, I believe I'm just remitting savings that I've had in a Bank Account since 2004 (only catch is the Balance would only show approx. £500), how I then go on to repay my mortgage is of no concern to Thailand.

-

11 hours ago, Dogmatix said:

I find the advice to get a gift agreement drawn up and notarised overseas strange and I am not sure who suggested it, since it is unattributed. Certainly there is no basis for it under the RC or the Civil and Commercial Code. There is no public notary law in Thailand and technically there are no public notaries. Has anyone ever come across a Thai government department asking for a notarised documents? There are Thai lawyers that call themselves notaries and provide notary services for use overseas but that is based on an internal regulation of the Lawyers Association of Thailand, not national law. Thai government departments ask for things to be certified by another government, not by a notary. There is no requirement to get loan documents notarised, even in countries that have notaries and there is far greater likelihood of a dispute over a loan than a gift. So why for a gift document? Personally I think it would suffice to draw up a simple gift agreement which could be drawn up retroactively, if needed.

A couple of the Expat Tax firms have recommended that the best way to "Gift" money to your spouse is to do it overseas & draw up a document (in the country where you're making the Gift) that clearly states the gift is to them & you have no vested interest in it.

I don't think it's been mentioned that this needs to be notarised but obviously the more "Formal" the document, the more weight it would carry, as mentioned, this would be done in the country of gifting so not usually a problem to get it notarised if you wanted to.

It's certainly not a Thai regulation, just a "Belt & Braces" approach to adding weight to the fact that the "Gift" is really a "Gift", i.e. if TRD challenged the Gift you'd have something to show them to prove that it was a Gift - No guarantee they'll accept it but the more formal the document the more likely that they would over something written on the back of a fag (cigarette) packet which is better than nothing at all.

-

1

1

-

1

1

-

-

2 hours ago, ThiAmo said:

Sorry if the following or something similar has already been discussed.

I am currently in the process of buying a house for my Thai wife here in Thailand with resources from abroad. The land title (chanote) will be entirely in her name.

In your estimated opinion will this transaction (with fund transfer to her Thai bank account) be regarded and accepted by the TRD as a Gift for the spouse and thus be non taxable income-wise? Or does my co-inhabitation as husband infringe the requirement that the giver of the gift can't benefit in any way of the donation him/herself.

If accepted as a gift, would wife have to pay tax on the gift anyway?

Do I need a tax consultant?

Thanks a lot.

If your wife has an account in your home country then it would be safer to make a Gift to her there (drawing up a document that details the Gift) and have her remit the money over.

If she doesn't then I believe a Gift is a Gift & your wife would not have to pay tax on it if you sent her the money directly to her account in Thailand, however others have made an argument for it being assessable income for you even if you send it directly to your Wife so advisable to seek some help from a qualified tax accountant.

As to whether you living in the house that she is buying with the "Gift" means you're receiving a benefit, I personally don't think it is as you could argue that you pay for all the groceries, utilities etc... but if needs be you could draw up an agreement whereby you pay your wife "Rent" each month (though this might mean she needs to pay tax on the Income) - Again, a decent Tax consultant should be able to advise how best to approach it.

If the Gift is > 20Million, your wife would need to pay 5% Gift Tax on it unless you split it over different tax/calendar years

-

1

1

-

1

1

-

-

10 minutes ago, Pattaya57 said:

I said the guy in black shirt was trying to calm things down. He's the only one of the 3 who didn't get a beating. Guy in grey shirt looked aggressive to me

From the video inside the bar & other commentary it looked like the guy in the black shirt (believe it was actually blue ) who looks like he's trying to calm it all down outside was actually the one who didn't pay his bill (Hence White shirt was adamant he'd already paid his & wouldn't pay again) & he was also the guy who shoved the other Farang outside.

-

1

1

-

-

Just now, bob smith said:

how do you know the brits didn’t accept their culture?

by refusing to pay another persons bill??

that deserved a fatal kick to the temple?

what an absolute idiot you are!!

bob.

Don't get me wrong as they do look like Brits, but has it been confirmed anywhere that they are British or are people just repeating an unconfirmed fact based on their personal bias.

-

2

2

-

-

51 minutes ago, Klonko said:

I am not mixing up anything and I am consistent with your post because, if read thoroughly my statement implies that it is 50% tax assessable income because it it not a gift for 50% though declared as gift.

But it wouldn’t be declared as a Gift as it’s not yours to Gift, you would only declare half of it as a gift.

In my Example of £100K in a joint bank account, the gift is £50K which if remitted is 100% a gift.

if she remits her £50K on top of this, then that has absolutely nothing to do with Gifts.

-

1 hour ago, Klonko said:

Gifts made outside of Thailand and remitted to Thailand up to THB 10/20m by the receiver are not safe per se. If the gift comes from conjugal property such as income from personal property under Thai marital status, IMO 50% of the remittance are tax assessable income of the receiver.

I have set up a gift scheme for myself, but I will watch closely and decide before year end if my scheme is still viable. If viable, I will remit tax assessable income to my account resulting in a tax netted by the withholding tax on my Thai bank accounts. If not viable, the income tax on the "gifts" will also be netted by the withholding tax. I deliberately forego a refund of the withholding tax. To file or not to file is an open issue. My gift scheme gives me 50% more years I can live off savings before I have to use the 179 day rule.

If gifts are used without the required assertions from TRD, I recommend being prepared for taxability as plan B. Hopefully, more TRD guidance will be available before year end.

Re f): THB 10/20 mill

I think you might be mixing things up a little, you can't gift something to somebody that they already own so in the case of overseas conjugal property you can only gift your half.

E.g. I have £100K in a jointly owned bank account with my Wife, I can't gift her £100K as £50K is already hers so I would Gift her £50K which she could then remit into Thailand tax free.

If she chooses to remit £100K then she is remitting the £50K Gift that I gave her (Tax Free) & £50K which has nothing to do with Gifts so would be subject to normal assessable income rules, but again, that is nothing to do with Gifts as that £50K wasn't a gift.

-

- Popular Post

- Popular Post

I selected "Wait and see what happens. Take no action. Carry on same as before." as that's the closest option to what I'm doing but it's not really accurate as I'll be:-

- Reducing how much money I bring into Thailand to ensure that I stay below the number where I might have to pay Tax

- Remitting money directly to GF's bank account ensuring that she stays below the number where she might have to pay Tax

- Taking more overseas holidays paid for on my UK credit cards & using the £7,500 I brought back from the UK with me as spending money there.

- Spending down the savings I already have in Thailand

Estimate I'll be bringing in approx. 25% of what I would normally bring in.

-

2

2

-

2

2

-

1

1

-

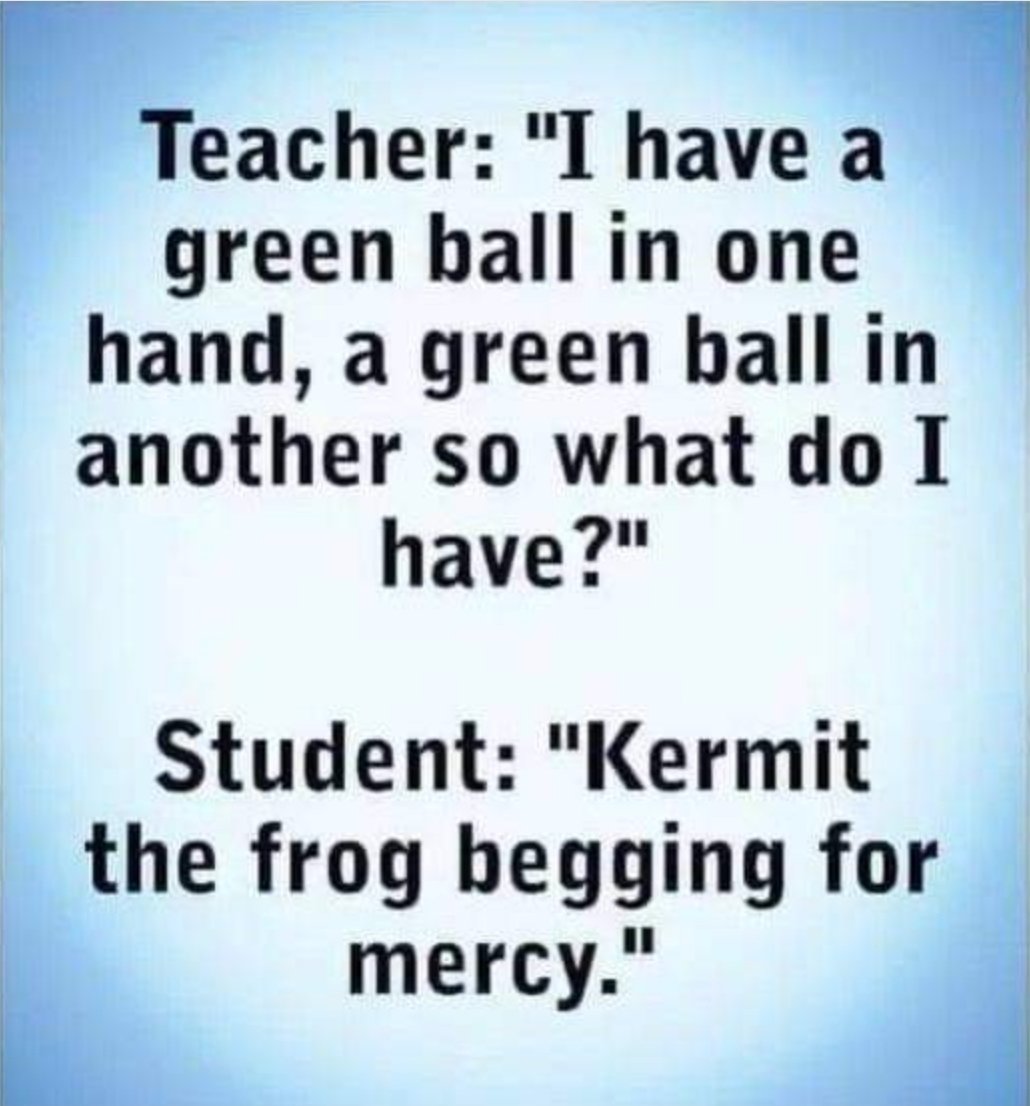

15 hours ago, ravip said:

lol, I remember that joke from when I was a kid but it went,

Q) You have one green ball in one hand & another green ball in the other hand, what do you have"?

A) Total control of the Jolly Green Giant

https://www.exploreminnesota.com/profile/jolly-green-giant-museum/6465

-

1

1

-

1

1

-

1

1

-

-

23 minutes ago, Mike Lister said:

I have updated the document to reflect the Sin Suan Tua aspect:

77) Two additional points on this subject are: 1) Funds that are gifted, must be for the use of the person to whom they are gifted. 2) Gifts can be revoked later and reclaimed, under specific circumstances, such as if the receiver of the gift defames the Gifter or fails to take care of their serious medical needs. However, Gifts to a spouse become Sin Suan Tua or the sole property of the spouse, under marital law the gift is not regarded as conjugal property. Until the circumstances surrounding Gift Tax and all it entails, becomes more clear,, it is critical that anyone wishing to use Gift Tax, seeks professional advice.

I think one thing we can all agree on is a Gift would be free of Thai Income Tax for both the person giving & receiving the Gift if:-

- The Gift is made outside of Thailand (E.g. I gift my Wife £500K in the UK).

- The Gift is documented as a Gift (The more formal the documentation the better).

- The Wife remits a maximum of 20Million THB in any one year or she pays 5% Gift Tax on everything over this, In the example of £500K she could choose to leave approx. £65K / 3 Million THB in the UK & remit it next year, or she can pay approx. 150K THB Gift Tax)

I don't know about other countries, but nowadays, it's hard enough for UK Expats to open a UK Bank account for themselves never mind a non-UK Citizen who doesn't live there, but people who are planning the move might be able to arrange to set up accounts before they become fulltime Thai Expats.

-

1

1

-

10 minutes ago, Misty said:

However, capital gains from trading or a sale of assets might not qualify.

Capital Gains can be included (something that doesn't really make sense to me TBH)...

Unearned or passive income includes, but are not limited to pension, rental, capital gain, dividend, and interest payments

But I'm not sure how you prove the gain if you don't need to report it on your home country tax returns.

-

1

1

-

-

4 hours ago, RayWright said:

Recognised the name Hannah Waddingham but couldn't place her (old age creeping in), then clicked, Tonya Dyke from Benidorm.

Rebecca Welton from Ted Lasso 🙂

-

1

1

-

-

Just now, JimGant said:

My apologies. I didn't read deeply what you said, but I guess it had to do with applicability to gift taxes, since you've put to rest the notion that remittances that become gifts somehow have an exemption from income tax. Thank you for shutting that door.

I've done no such thing as I still believe Gifts remitted into Thailand are exempt from Income Tax but we all agreed that we were not going to agreed to park it pending "Official" confirmation one way or another.

As it's been brought up again, I will just state my argument for why I believe this & people can believe what they want until it's proven one way or another.

- The Thaksin Wife case shows that at that time there was scope for remitting Gifts tax free into Thailand with no limit on the amount that could be gifted, there was no income tax due on the Gifter at that time.

- The law was changed in 2016 to add the 20/10 Million limits, add a 5% Gift Tax for gifts over that value & put some criteria about what is & what isn't a gift, to the best of my knowledge there was no change to the fact that the Gifts could be remitted free from Income Tax

I hear the argument about it being a big loophole that people can exploit but that's why limits were included & if anything I expect TRD will reduce these over time rather than abolish them all together.

That's me out... (Literally, the GF is nagging me to go shopping)...

-

1

1

-

3 hours ago, JimGant said:

***Removed by Moderator***

[Mike, this is not a recommendation to do something illegal -- since there is no legal guidance out there defining tax exemptions on gifts. Thus, in the absence of any guidance, why not advise the readers of their options to give themselves the best deal on a grey area. Yes, when, or if, something more definitive in law comes along, then, you can remedy the guidance on this forum to conform to the latest law.]

By snipping my post you've completely misrepresented what it said, I was answering the question around whether Gifts are conjugal property, there was no mention of the (what I thought was parked) argument about whether the Gifter needs to declare the Gift assessable income.

Reduction in number of NON-Immigrant visa types from Sep 2024

in Thai Visas, Residency, and Work Permits

Posted

Can you post a link as to where it says this as if it's from an Embassy site then these are unlikely to have been updated yet.