- Popular Post

Mike Teavee

-

Posts

4,306 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Mike Teavee

-

-

2 minutes ago, Mike Lister said:

I think that's extreme. In practise, I doubt the average TRD person will look at remitted savings and wonder where they came from five years earlier, would you? I wouldn't, the further you move away from today, the less likely a check will be made. I think this is especially true when the taxpayer is older or retired and has a consistent income track record....in other words, the sniff test. If the taxpayer is younger or perhaps even middle aged with inconsistent revenue flows, the idea of nomad working and untaxed income would be prominent in my thinking. But pensioners and retirees, I don't think so.

I agree & end of the day it comes down to "Technically" Vs "Practically".

-

1

1

-

-

6 minutes ago, Mike Lister said:

Taking it to even greater extremes, a Capital Gain that is sold and converted to savings in the home country, can't realistically be viewed as being earned income, twenty or thirty years hence. Ten years hence? Doubtful! How about five years hence? I'd be very surprised! If the same year, sure there's a case to be made, so I guess the answer is somewhere between one and five years....maybe.

Thailand doesn't seem to have anything specific around CGT & treats it as Income so I guess as an extreme it would be 10 years as that's the furthest they can go back for Tax Audits?

-

1

1

-

-

1 hour ago, Mike Lister said:

Well spotted! Yes, bed and breakfasting is a good approach to reducing CG liability, it's completely legal and is all done outside of Thailand and doesn't involve any form of manipulation.

But if you don't go that route and instead you decide to sell those shares, how long after they become savings will the TRD regard them as savings? JG started to mention this earlier. If the income from the shares is tax paid in the home country, those proceeds should be regarded as savings straight away but will the TRD view things the same way.

I'm not sure it ever becomes savings if it's "Earned" after 1/1/2024, so maybe "Bed & Breakfasting" is a way to move from a position of having a high capital gain to one where you've got zero/little & so when you came to sell the asset, the money would be as good as "Savings".

To take it to extremes I guess there is nothing to stop you taking all of your income (Dividends, Rent, Pensions, even gains from selling your house), buying assets with it, selling the assets & remitting the proceeds with no/little tax to pay.

-

1

1

-

-

- Popular Post

- Popular Post

I'm up early adjusting the Stop limits on some UK shares that have done well recently & a thought struck me...

If I paid £10,000 for some shares & sold them for £30,000 I've realised a gain of £20,000 but as there's no CGT to pay in the UK, if I remit the £30,000 into Thailand I'm liable for tax on the full £20,000 gain.

However, if I use that £30,000 to purchase some new shares (same company or another) & sell them straight away then I'll lose on the dealing charges & spread between buy & sell price but this won't be anywhere near the tax on 920,000B.

Not planning on doing this anytime soon, but if I do decide to bring significant income from Capital Gains I'll be looking at "Bed & Breakfasting" it in the UK before I do.

[NB UK has a 30 day rule to stop you crystalising CGT gains/losses by selling & immediately repurchasing the same stock but as Thailand doesn't seem to have any separate provisions for CGT but treats it as Income Tax then I'm assuming they don't have something similar].

-

3

3

-

1

1

-

34 minutes ago, ukrules said:

lol, 10 million baht is currently worth $270,000

And I've always thought the FX rates on XE were amongst the best but they also stated...

-

Inheritances above ฿100 million THB (about $335,000 USD),

-

Non Transferable property rights above ฿20 million THB (about $67,000 USD)

Also out by a factor of roughly 10X 😄

-

1

1

-

1

1

-

-

47 minutes ago, JohnnyBD said:

Yes, they said any/all income remitted once you receive your LTR visa is tax exempt. It doesn't mattrer from what foreign source or when it was earned. The Royal Decree 743 states that even if the income was earned in previous year it is still tax exempt. The Decree doesn't state that if you remit monies earned in the same year, that you will have to pay taxes on them. Where are you getting that from?

I thought Income earned between 1/1/2024 and you getting the LTR was still Taxable.

E.g. I plan on going for mine when my pensions start in 2026 and am expecting that I would have to pay Tax on Rental/Dividend income earned in 2024 & 2025 if I remit it.

-

1

1

-

-

8 minutes ago, Mike Teavee said:

I'm assuming you can get a Tax adjustment somehow as the TRD says you can get Tax relief for Gifts, so in your examples where you've already paid PAYE Tax on the income it makes logical sense that you can claim some relief,

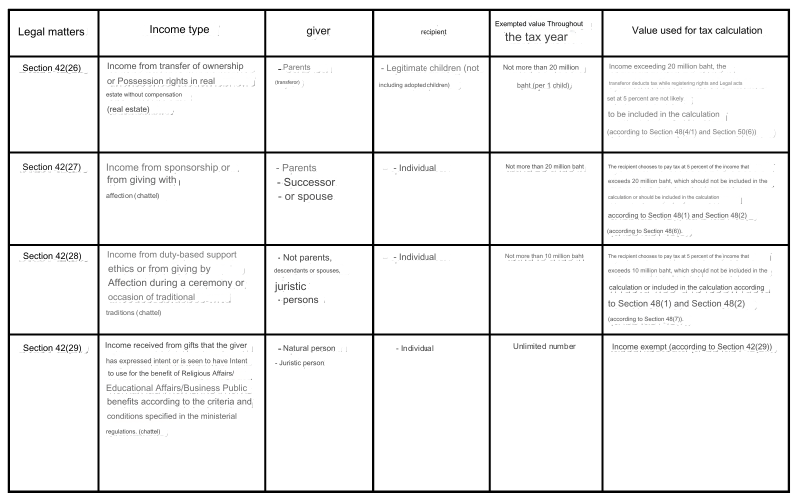

I'm stepping back from any discussions on Tax from any Income arising in Thailand as it doesn't directly impact me but here are the Thai rules around Gift Tax https://www.rd.go.th/43338-1/clear-cut-ภาษีการรับให้-gift-tax-ใครต้องเสียภาษี.html (Chrome should translate it for you).

And here's the translated summary table...

Enjoy 🙂

-

1

1

-

-

4 minutes ago, Lorry said:

So, can they claim it back?

I really don't know, but I doubt it.

I'm assuming you can get a Tax adjustment somehow as the TRD says you can get Tax relief for Gifts, so in your examples where you've already paid PAYE Tax on the income it makes logical sense that you can claim some relief, however the (English Version) of the Tax Return Guide doesn't mention gifts anywhere so again we're back to the question "Can Domestic Gifts be given Tax Free" (I don't see how you could pre-claim it & avoid paying PAYE income but I've never worked in Thailand so wouldn't know) - All the more reason to remit the Gift directly to the Giftee & not send it via your Thai Bank account.

If the answer is "No, Domestic Gifts cannot be given Tax Free" then it doesn't make sense to have a Gift Tax rule at all unless it's for just for Remittances & surely the receiver of a Domestic sourced Gift would not pay tax on it as that income has already been taxed.

Ironically enough there is space on the Tax Return form to claim relief for charitable donations so your donation to the Soi Dog Foundation would (if they're an approved charity) give you some relief...

https://www.rd.go.th/fileadmin/download/english_form/030265guide91.pdf

-

18 minutes ago, Lorry said:

NOooo

The gifter HAS received the money, and then gifts it.

One cannot gift money one has not received first.

And one receives it as a salary from one's work, as capital gains, whatever.

When one receives it one has to pay tax on it.

How one then uses the money (buy beer, gift it to Thai wife, whatever), is irrelevant for ones taxes.

Per the 1st caveat, I was referring to people remitting money to Thailand as a Gift, how they 1st came by this money & what tax was paid on it is of no concern to TRD as long as (per 2nd Caveat) they are not remitting it to themselves before gifting it on.

E.g. I send some money directly to my daughter from the UK as a Wedding Present, no tax implications on me.

I send some money to myself & then forward it on to my daughter as a Wedding Present, I need to declare the money coming in (It can't possibly be a Gift at this point as the Sender & Receiver are the same) and then (try to) claim that the money was ultimately intended as a Gift to my daughter as a Wedding Present (Something I think you'd have no problem doing if you can evidence the money coming into your account and then going into hers).

18 minutes ago, Lorry said:Money Mr X gets is tax-free if Mr X got this money as a gift from a relative.

Talking about Mr X's tax-burden here.

Not talking about the relatives tax-burden.

A practical example:

Noi works at True call center, 35,000 per month

Daeng is a manager at a bank branch, 60,000 per month

Pat is an executive at a company, 120,000 per month

Som is a surgeon at a private hospital, 350,000 per month

Tik is a smart investor and makes about 1m a month

They all gift all their income to their parents. According to your logic, they all wouldn't pay any taxes.

Thais would have found out about this tax-avoidance scheme a long time ago.

I will have to ask some Thais whether this works. Unfortunately, I don't know Tik, the smart investor, and Som might be reluctant to talk about her taxes. Noi probably knows nothing... Anybody can help here?

Again: I'm referring to money being remitted into Thailand not income from work inside of Thailand, all the people in your example would pay PAYE Tax on their income & would need to try to reclaim any money "Gifted" back via a Tax Refund claim.

What @Mike Teaveemeans is, basically you can deduct up to 10m resp. 20m for gifts for relatives from your taxable income.

I am @Mike Teavee 🙂

The opposite opinion is, only the giftee doesn't have to pay taxes on gifts.

Any middle class Thai or Thai tax adviser should know the answer...

-

52 minutes ago, Lorry said:

Caveat1 My answers below are my opinion on overseas income being remitted into Thailand as a legitimate Gift & meeting all the criteria of being a gift, in particular the ones around not receiving any direct/benefits from it.

Caveat2 I'm assuming that they Gifter sends the Giftee money directly from their overseas account, if they sent it to themselves 1st then I'm assuming that they would need to declare it as personal income (you can't make a Gift to yourself), possibly pay tax on it & then (try to) claim it back.

As dogmatix has said, we should read the Thai wording of the law, not the English wording of someone else. I can't read the Thai law, so I try to read the English as given by PWC.

I agree, but like you I can't read Thai so rely on the wording on the TRD website as well as articles from the large accounting firms, all seem to be more or less in agreement about the rules on taxing Gifts.

They are talking about taxes exempt from personal income tax - but WHOSE taxes?

Gifter as if they gift the money to somebody else instead of receiving it then there is no tax to pay on it, so they'd be in the same tax position as if they hadn't given he gift

Giftee as if they receive the gift with no tax obligations.

The second paragraph says, what is "exempt from personal income tax".

It is 1. "Income derived from the transfer of..."

Now, WHO has income derived from the transfer of property? Certainly not the gifter. The giftee has income from that transfer and doesn't have to pay PIT. Nothing in this sentence says anything about the gifter's tax burden.

Per above, the Gifter has no Tax Burden & the Giftee doesn't have to pay tax on the Gift, however if that Gift (e.g. Property) then started to generate an income, they would have to pay tax on the income.

Income exempt from personal income tax is also

2. "Maintenance income ...from ..."

WHO has maintenance income that would be taxable if it weren't tax exempt? The recipient of the gift. They are talking about the recipient's taxes, not about the giver's taxes.

The person who is receiving the Maintenance would be liable to tax if it wasn't exempt.

Tax exempt is also

3. "Maintenance income derived..." The giver doesn't have any maintenance income that now is tax exempt. The recipient has.

And last

4. "Income from gifts ..." The Soi Dog Foundation has a lot of income from gifts and doesn't have to pay taxes on it. I, who loves soi dogs so much, get all my income from work. I have no income from gifts. I get no tax exemptions if I give all my money to the Soi Dog Foundation.

If the Soi Dog Foundation is a registered organisation that is adjudged as offering a Public Service then Gifts to it would be exempt from Tax

I originally thought like Mike Teavee, it was JimGant's Soi Dog Foundation who made me understand all this.

I thought @JimGant was in mainly in agreement on the rules around taxing of Gifts so I'd be interested in why you & he think it's any different than I've posted above.

2 caveats:

- I don't know the Thai wording of the law

- I don't know how the RD sees things. Dogmatix has said he is not aware of any other gift tax cases. And anyway, with gifts from abroad the view of the RD might change, for practical reasons. Nobody knows.

That part we can all agree on !!!

I've answered as best I can inline in your post...

-

42 minutes ago, jvs said:

I just made my last will not too long ago using a Thai Lawyer.

I have no last will for my assets over seas but that will be dealt with under that countries inheritance laws.

There will not be a lot left there any ways.

I have seen some opinions where people think that saying"all of my assets in Thailand or abroad i will leave to so and so"

That is not good enough,Thai law can only deal with anything inside of Thailand.

Not 100% true as your overseas Will could (I know UK Wills can) be recognised in Thailand but believe it needs to be registered with MOFA before you die...

There's a discussion on it here

But saying that, I think most lawyers would recommended to have separate Wills for each Jurisdiction.

-

1

1

-

-

23 minutes ago, JimGant said:

I can't seem to find the 'remitted income' exception anywhere in that pub. A little help, please. Thanx.

True, it doesn't say "Remitted Income" so I might be wrong about not being able to use Gifts as a way to limit tax on Income earned in Thailand, but that document (& the crux of this thread) is aimed more about Expat's being taxed on money remitted into Thailand for which Gifts can be used to limit how much Tax you need to pay.

Edit: Having a quick look through the TRD document, it doesn't mention remitted income in there either so strengthens the argument that Gift's can be used to reduce tax on income earned in Thailand.

Section 42 The assessable income of the following categories shall be exempt for the purpose of income tax calculation: para 27...

https://www.rd.go.th/english/37749.html

Edit: Just struck me that your question might be more around only domestic Gifts being eligible, this article is all about remitting money to Thailand & lists the same criteria listed many times before... https://www.xe.com/ar/blog/money-transfer/sending-a-large-money-transfer-to-thailand-what-to-know-about-taxes/

Gift Tax

For many decades, Thailand did not tax gifts, just income. But that changed in 2016. The government not only imposed taxes; it also changed the definition of a “gift.”

Any property, including money, which is transferred to another person, and there is no expectation of any tangible return, is a gift. Interest-free loans and property sales at substantially below market value are also gifts.

In many countries, gifts also have relational components. But in Thailand, you can give a gift to anyone, at least for tax purposes, if it exceeds the following amounts:

- Inheritances above ฿100 million THB (about $335,000 USD),

- Non Transferable property rights above ฿20 million THB (about $67,000 USD), and

- Any property transfer, including foreign remittances, which meet the gift criteria discussed above.

A number of exemptions apply. This list includes:

- Gifts from relatives under ฿20 million THB

- Gifts from non-relatives under ฿10 million THB (about $33,000 USD).

- Gifts made for educational or religious purposes (such as college tuition payment transfers)

Although relationship does not enter into the definition of a “gift,” there is a relational aspect to the amount of the tax. Thailand’s gift tax is 10% in most cases, and 5% if the recipient is a descendant or ascendant. Most relationships via marriage, such as step-siblings, do not qualify for the reduction, at least in most cases.

-

1

1

-

1

1

-

17 minutes ago, JimGant said:

Got a source for that?

PWC Doc attached in the post above...

-

2 minutes ago, Mike Lister said:

This comes back to the old issue of whether Gift tax can be used to escape assessible tax on income. I don't believe a person can remit assessible income as a Gift to avoid paying Thai PIT on that income because the loss to Revenue is too great, potentially it reduces the tax from 35% to 5% or even 0%..

Gifts can be used to avoid tax on remitted (not domestic) income as long as the relationship between the person giving/receiving the gift & the purpose of the gift fall within the approved criteria.

Gifts cannot be used to evade tax on domestic income.

-

20 minutes ago, Mike Lister said:

Unless I'm missing something, the PWC statements don't say anything different to what we've agreed thus far?

TBH the discussion about Gift tax has gotten a bit confusing (not helped by the fact I was travelling back from the UK so skim-read posts to catch up) but a few of the guys (e.g. @Lorry, sorry I'm not singling you out) seem to be saying that Gifts to your Wife are liable for PIT & need to be reported on your return

-

1

1

-

-

- Popular Post

- Popular Post

FWIW, here is where I get most of my Tax information from (due to the fact that the Global Bank I worked for used PWC to assist us when working in a number of different countries including filing local & UK Tax Returns for us).

From page 13 of the attached PDF.

Gift Tax

Gifts that are given by a living person are subject to personal income tax under the Revenue Code. The income tax is levied on the value of the assets or the amount given to parents, ascendants, descendants, spouse or others that exceeds the prescribed threshold, which depends on the type of gift and donor.

The assets or amounts given that do not exceed the threshold and will be exempt from personal income tax are as follows:

- Income derived from the transfer of ownership or possessory right in an immovable property without any consideration to a legitimate child, excluding an adopted child, in the amount not exceeding Baht 20 million in respect of each child throughout a tax year.

- Maintenance income or gifts from ascendants, descendants or spouse, in the amount not exceeding Baht 20 million throughout a tax year.

- Maintenance income derived under a moral obligation or gifts made in a ceremony or on occasions in accordance with established custom from persons that are not ascendants, descendants or spouse, in the amount not exceeding Baht 10 million throughout a tax year.

- Income from gifts which will be used by the person who receives them for religious, educational or public benefit purposes according to the intention of the donor under criteria and conditions referred to in ministerial regulations.

Income in excess of the above thresholds will be subject to personal income tax at the rate of 5% and will not need to be included together with other income when computing the annual personal income tax liability.

Seems pretty clear cut to me that a legitimate gift (up to the limits mentioned) to your Wife, Daughter etc... is exempt from PIT so does not need to be declared on your Tax Return, and if that Soi Dog Foundation mentioned was a registered charity deemed to be providing a public benefit then donations to them would be exempt from PIT also.

So, in a nutshell, it does matter who you're sending the money to & what the money is for but it's for you to assess that & report it accordingly, TRD will only assess it if you're audited.

-

3

3

-

- Popular Post

- Popular Post

4 minutes ago, Lorry said:If JimGant and Etaoin are right, then you are wrong.

I now am convinced they are right, see the discussion of the last pages.

I must admit, that even the RD guy in Klonko's video seems to muddle through these things and not clearly differentiate the different scenarios.

He sounds a lot like you. But what he says is not clear at all.

What Somchai, the tax inspector, will do is anyone's guess

Obviously you're free to believe whoever/whatever you like but the only ruling on Gift Tax I'm aware of was where Thaksin's wife was sentenced to 3 years for Tax evasion, part of which (IIRC approx. 15Million Baht) was a gift to their daughter as a wedding present (The fact that they argued this proves that there is an argument to be made that you can Gift money to relatives)

https://www.reuters.com/article/idUSSP223799/

And before you argue "But she was found guilty"...

- I've read [can't find it now] that the TRD argument was that the gift was made 2 years after the wedding, so in their eyes wasn't a legitimate wedding present.

- This was one small (IIRC approx. 3%) part of an overall charge of 546 Million Baht Tax evasion

- Her conviction was overturned on appeal (Though I wouldn't read too much into this fact 🙂)

-

2

2

-

1

1

-

11 minutes ago, Lorry said:

Wrong.

"(Legitimate) Gifts are not assessable income" - they are not assessable income of the giftee.

But they can come from assessable income of the gifter, and this has to be declared.

Look at it from a purely domestic perspective, everything inside Thailand:

Mr Gifter works very hard for a Thai company, has a decent salary and made 5m last year. All salary. He has to pay taxes for these 5m.

He decides to gift these 5m to his daughter, Ms Giftee, as a wedding gift on her wedding day. He still has to pay personal income tax for the 5m. Ms Giftee doesn't have to pay gift tax, though.

Gifting your money to someone else does not ease YOUR tax burdrn

Firstly, we are talking about tax on remitted income (not domestic) but in your example Mr Gifter does have to pay Tax on his Income (& would probably do so under PAYE) but when he gifts the post tax monies to his daughter as a wedding present he does not need to pay tax on it again.

If Mr Gifter was working for 6 months overseas (still Tax Resident in Thailand) & remitted 5Million as a wedding present to his daughter then he'd have no tax to pay on it (or need to declare it), nor would she. However, if he were to remit the money to his landlord to pay for his rent then he & his landlord would need to declare/pay tax on it.

-

24 minutes ago, Lorry said:

This part is still not correct, but the rest is a very good summary, and very clear. Thank you.

This part should read somehow like this:

funds that you remit to another person, from overseas, might be intended as a Gift, but for your own tax declaration this intention does not matter. If the funds you remitted to another person are from your assessable income as listed in RD 161/2566 you have to declare them and you will have to pay personal income tax for them.

The recipient of the Gift, may need to report the Gift and pay Gift Tax on the amount. Gift tax for customary gifts from close relatives is only due if the gift is more than 10m THB (20m for legally married wife, parents or descendants)

I disagree slightly with this part...

If you make a legitimate gift (one you receive no benefits from) to anybody then you do not need to declare it on your Tax Return but they would need to file it on theirs if they/the gift doesn't fall into one of the eligible categories (E.g. I send my mate 1 Million THB because I'm a nice guy).

-

7 hours ago, JimGant said:

You can call it a fried banana, as far as taxation implications go. You remit income into Thailand -- it's purpose (as we've scrutinized to absurdity) is not important. You report your assessable income remittances on your tax return -- where nowhere is the purpose of the remittance recorded, thus nowhere to get a tax exemption for a gift purpose. If the landlord you remitted your rental fee to wants to call it a gift, or if you want to call it a gift, makes no never mind to the bottom line of your tax bill. However, the only tax implication is whether or not the landlord calls it a gift, and not actually the income it really is -- and (mis) files his tax return accordingly.

You only report assessable income and as (Legitimate) Gifts are not assessable income, you don't need to get a tax exemption for them as you don't need to report them.

A "Legitimate" Gift is something that you (as the person making the Gift) receive no direct benefit from & your Landlord (as the person receiving the Gift) provides no direct benefits for, so if you're living there then it obviously wouldn't be a "Legitimate" Gift & if not declared would technically be tax evasion on both sides.

Assuming you're not related in anyway to your "Landlord", if you sent them money & don't use their property in anyway (Live, Store your things, Reserve the property for future use etc...) then (technically) they should declare/pay tax on it but you would have nothing to pay/declare as you've not received any benefits from the monies.

-

4 hours ago, stat said:

1. What would it take to be designated and accepted as a gift by TRD according to your view? In my understanding if I receive 5 Mio baht in my Thai bank account designated as gift from my father that should be taxfree. But I am no expert in this area.

As I understand it if you were sent 5Million THB as a Gift by your father then you would 1st assess this as a gift and decide not to declare it on your Tax Return (assuming you filed one).

IF TRD somehow notice this large remittance & decide to audit you, it would be on you to prove that it was a gift which came from your father & not from one of your own overseas account [I use this example as I have exactly the same name & UK address as my father on one of my UK accounts so it would look like I was sending money to myself].

-

1

1

-

1

1

-

-

Mrs. Davies

A bit weird but helped yesterday's 11 hour flight pass by much quicker... https://www.imdb.com/title/tt14759574/

Sister Simone partners with her ex-boyfriend Wiley on a globe-spanning journey to destroy Mrs. Davis, a powerful artificial intelligence.

Cypher: https://www.imdb.com/title/tt7759130/

Will Scott, one of the NSA's leading crypto-analysts is hired by the FBI to crack a heavily coded document. He soon discovers it's a hit list, putting him in the cross-hairs of the bad guys who want it back.

-

1

1

-

-

4 hours ago, JimGant said:

So, TRD will use expensive resources to screen all farangs, not just tax residents -- in order to determine who's a tax resident, or a tourist, so they can then restrict their questions to just tax residents?

Who said that? Not me.

I suggested that they would flag people who are reported as having brought in a significant amount of money, what that limit is, I’ve no idea.

As I said, I’m planning on bringing in 235K & not filing but if I brought in 2,350K then I’d file.

-

2

2

-

-

3 minutes ago, JimGant said:

--then check with Immigration to see whether or not these high money folks actually stayed in Thailand for 180 days. And, also, whether their country's DTA with Thailand also excluded many categories of income as non assessable income. Blah, blah.

They (TRD) don’t need to check with anybody, they just need to ask you about your Tax affairs & it’s you that will need to prove you were non-tax resident & explain why you don’t need to pay any tax.

-

2

2

-

Thai gov. to tax (remitted) income from abroad for tax residents starting 2024 - Part I

in Jobs, Economy, Banking, Business, Investments

Posted

(Technically) he is liable to tax on income remitted during the year he was not tax resident if the income was "Earned" during a year when he was tax resident... E.g. Earn income in 2025, be a non-Tax resident & remit the income in 2026 & (Technically) you're still liable for tax on it.

Flip side is true also, earn income in 2025 when you're not a tax resident & remit it in 2026 when you are, no tax to pay.

FWIW I be taking no chances when it comes to remitting my pension tax free lump sum and/or proceeds from the sale of my UK house, I'll be getting the money & remitting it in the same year when I'll be non-Tax resident.