Mike Teavee

Advanced Member-

Posts

4,306 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Mike Teavee

-

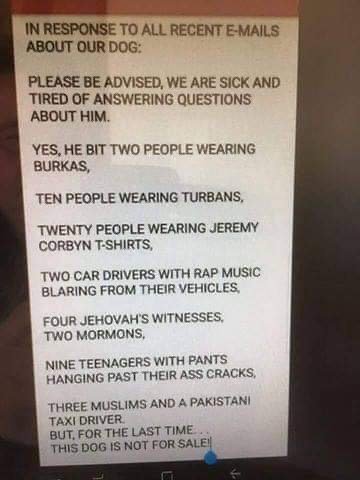

Worst Joke Ever 2025

Mike Teavee replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

Mike Teavee replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

I love everything about Pattaya what about you ?

Mike Teavee replied to georgegeorgia's topic in Pattaya

Me & all of my mates found our way to Pattaya after living in Bangkok for a few years (I came down here 1st as my Partner had close family living in Rayong & we wanted to get out of the city & live by the sea), none of us moved here for the Mongering. It's like judging Bangkok by Soi Nana / Cowboy etc..., or Singapore by Geylang / Orchard Towers (Now gone) etc... Yes it's there if that's what you're looking for but it's not hard to avoid if you're not looking for it. Again, you're talking about one small part of Pattaya City, out by the lakes there are some really nice houses, I live in a really nice beach front condo, there's something for everybody here. -

I love everything about Pattaya what about you ?

Mike Teavee replied to georgegeorgia's topic in Pattaya

A couple of mates have houses near Lake Mabprachan & it's really nice around there but I prefer to live near the beach so live in Wongamat & it's perfect (for me). There are no bars here where "All Expats" spend their days drinking (& no "Girlie" bars), people just live a normal Expat retired life (whatever that is) with maybe the odd trip into town, for me that means 1-2 times per month to catch up with friends over a few "Mad Beers" but most of the time we're out in couples having something to eat or will have a guys night out playing pool at a bar around the Lake, there's a fair few decent places to choose from. Oh & as most of us live here with our long term partners, we don't "Indulge" in the other thing that people who don't know Pattaya think every guy in Pattaya is doing everyday... Pattaya a great city to live in if you actually live here & are not just here on a monger holiday.- 211 replies

-

- 10

-

-

-

-

-

Is there a big bus from Don Mueang airport to Pattaya?

Mike Teavee replied to advancebooking's topic in Bangkok

As others have said, 1,700b is reasonable for a door-2-door service booked by a hotel but if you want to do it cheaper you could book it yourself with Cherry Taxi Services, prices start at 1,400b from DMK... [The hotel will be using somebody like this & pocketing the 300b]. https://cherrytaxiservice.com/services-rates/ -

Watching today's Fabulous 103FM News report & there's a story in there that people have been reporting Immigration (am guessing Chonburi/Jomtien) asking for proof that Income has been taxed at source when doing retirement extensions (presumably using the 65K Income Method)... 2 minutes in... It does go on to say that it's unlikely any income taxed at source will be taxed again BUT makes no mention of what happens if the income hasn't been taxed (Obviously if it is Income & hasn't been taxed then the person remitting the money should have filed a Tax Return & paid tax on it in Thailand).

-

Do you have a link to where that was said? Fact is the only thing that has changed is that income earned from 1/1/24 will now be tax assessable any time in the future (assuming you're Tax Resident) instead of the current "Rules" which says it would only be tax assessable if remitted in 2024. If you do not remit anything that would be Tax assessable this year then there is no need to file a Tax Return in 2024 & if you do not remit anything that is Tax assessable income in 2024, there will be no need to file a tax return in 2025... and so on... Am sure you could file a Nil Return if you wanted to but there is absolutely no need to unless your investigated by the Revenue & if you've not remitted anything that is Tax assessable then you've nothing to worry about.

-

I suspect the answer is somewhere in the middle ground, the Schema can be found here https://www.oecd.org/tax/exchange-of-tax-information/common-reporting-standard-xml-schema-user-guide-for-tax-administrations-june-2019.pdf so will see what it says :) Edit: I've looked at the Schema and as far as I can tell it's all about reporting the "Closing" Account Balances (not transactions) & given that the mandatory CRS reporting requirement is annually it's likely that once per year all finance organizations will report the closing balance for all accounts that they hold.... Even if it was reporting daily it would be considered "Amalgamated" (Not transactional) data. Whilst on the OECD site I also noticed this... In light of the rapid development and growth of the Crypto-Asset market and to ensure that recent gains in global tax transparency will not be gradually eroded, in April 2021 the G20 mandated the OECD to develop a framework providing for the automatic exchange of tax-relevant information on Crypto-Assets. In August 2022, the OECD approved the Crypto-Asset Reporting Framework (CARF) which provides for the reporting of tax information on transactions in Crypto-Assets in a standardised manner, with a view to automatically exchanging such information. https://www.oecd.org/tax/automatic-exchange/common-reporting-standard/ Which I guess would rule out any plans to use Crypto to somehow get around being seen to remit money into Thailand.

-

What Movies or TV shows are you watching (2023)

Mike Teavee replied to CharlieH's topic in Entertainment

Probably recommended when it came out 3.5 years ago but I must have missed Series 2 dropping so have been back to watch series 1 & am really enjoying it. We Hunt Together https://www.imdb.com/title/tt10661302/ A gripping twist on a classic cat-and-mouse story, this British drama series explores the intoxication of sexual attraction and the dangerous power of emotional manipulation as two conflicted detectives track down a pair of deadly killers. -

Can you imagine the amount of data that would need to be exchanged if every country signed up to CRS shared detailed information about every transaction made! Added to that, how are you going to Identify Individuals? - Can't be on Passport number as my UK bank doesn't have my passport details (I don't even think I had a passport when I opened the account & if I did, I've had at least 5-6 new ones since & there's no onus on me to tell them), can't be on a Tax Identification Number as my UK Bank doesn't know my UK or Thailand TIN, so you get into the realms of trying to match by names (I sometimes do/don't use my middle name), dates of birth, addresses etc... Which again, is not practical given the amount of data involved. It must be consolidated data exchanged with maybe a mechanism to request the underlying transactions but you still have the problem of being able to accurately identify all transaction for a single individual.

-

Hi Paddy, As this thread is about Tax & is not in the Extension Forum (https://aseannow.com/forum/1-thai-visas-residency-and-work-permits/) it could be a lot of the guys who are using the 65K Income method might not be reading it. I'm sure if you started a topic in that forum (Or maybe a Mod could use your above post to start a topic on your behalf) you'd get a much better response to your questions. FWIW everybody I know that's on a Retirement Extension either uses the 800K in the Bank or uses an agent to "Assist With The Finances" but I did look into switching to the 65K pm Income method when it was first announced & decided it wasn't for me as I don't have a regular/monthly income so I would need to amortize it from other Income. At that time I don't recall Jomtien IO wanting to see anything more than the monthly Xfers but I could be wrong and/or it could have changed since then. HTH MTV

-

Do you have a link to the IO Website you quoted? I thought for the income method you had to prove you were remitting at least 65K every month from overseas (Income earned in Thailand doesn't count). Different IO offices may have different policies about whether they ask you to support this with proof of overseas income but some are only interested in the 65K being remitted (i.e. You could be sending it from savings).

-

I thought that was a little ambiguous which is why I put "Might" This seems much clearer... US Expat Taxes in the Philippines As a US expat living in the Philippines, it’s important to know your tax obligations in both the US and the Philippines. As a resident of the Philippines, you are subject to income tax on all income earned, including income earned outside of the country. However, the Philippines does have a tax treaty with the US to prevent double taxation on your income. It’s important to keep track of all income earned and any taxes paid to ensure compliance with both countries’ tax laws. Additionally, US expats in the Philippines may be eligible for certain tax credits and deductions, such as the foreign tax credit, which can help reduce their overall tax burden. https://www.greenbacktaxservices.com/country-guide/expat-taxes-for-philippines/

-

Be careful as if you spend more than 2 years in the Philippines you would be considered a "Resident Alien" & so might be subject to tax on your worldwide income... Liability for income tax The liability of aliens for Philippines tax is determined by their residence status. Generally an alien who is present in the Philippines for at least 2 years is a resident alien. An alien who stays in the Philippines for less than 2 years is considered a non-resident alien. There are two classifications of a non-resident alien: engaged in trade or business in the Philippines not engaged in trade or business in the Philippines. A non-resident alien engaged in trade or business (NRAETB) is one who stays in the Philippines for an aggregate period of more than 180 days during any calendar year. If the individual stays in the Philippines for an aggregate period of 180 days or less, the individual is considered a non-resident alien not engaged in trade or business (NRANETB). The taxable income of citizens, resident aliens and NRAETB is defined as gross compensation and net business income less personal allowances. The taxable income of NRANETBs is their gross income. Non-resident citizens and aliens are subject to income tax on Philippines-sourced income only. Resident citizens are subject to Philippines income tax on worldwide income. Non-resident citizens and aliens are subject to Philippines income tax on their Philippines-sourced income only, such as employment income and passive income https://kpmg.com/xx/en/home/insights/2021/07/philippines-thinking-beyond-borders.html

-

Sorry we posted at the same time, I realised he was looking in CM so deleted my post :)

-

Deleted... I thought you were looking for an Agent in Pattaya but realise now that this is the CM forum & you're looking for one "Up North"

-

From what I've read, LTR holders are exempt for years that they hold an LTR so get one in 2026 (Which is my plan), you're still liable for tax on income earned in 2024/2025. I plan on being Non-Tax Resident in 2006 (for other reasons), so hopefully I'll be able to bring enough funds over to support my LTR in that year & from then on not have to care about this stuff.

-

How do you know the money has already been taxed & if it was taxed, at a rate similar/higher than Thailand would tax it. Simple example, let's say I sell some shares for £3,000. made a £1,000 capital gain and there's no CGT in UK (Which there isn't as I'm non tax resident there). I then use that £3,000 to purchase a BKK-MAN ticket on Qatar... If I used a UK Credit card then the money will go from my UK Stockbroker account to the UK credit card (Same company) & the only involvement Thailand has in this is I live here & the flight is from BKK, I'd fully expect there to be no tax to pay. If I used a Thai Credit Card & remitted the money over from the UK to pay the bill then I would expect it to be assessable for tax. If I buy that ticket using a company based in Thailand then surely I'm remitting the money to pay for it so it would be assessible for tax.

-

Worst Joke Ever 2025

Mike Teavee replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

My brother went into a video store, looking through the £1 video bin he picks up a Michael McIntyre video & asks the assistant "Is this Any Good" Assistant replies "It's better than a sh1tty stick in the eye" He buys it, 1 hour later comes back & asks.... Have you got that Stick :P -

The guys who meet the LTR visa are exempt from Tax for income earned while they have the LTR Visa & I'm sure they're smart enough to order their remittances accordingly The guys on an Elite Visa (I guess) will either move to the LTR or order their affairs so they pay minimum tax... I'm honestly in the middle of "Peon" (No/Little Tax) & cannot afford the LTR but I have a very simple plan where I don't need pay any taxes Thailand... Put simply I'll do 6 months outside of Thailand when I remit funds to last me the next 3 years... I appreciate not everybody has the flexibility to do this but I'm the kind of guy who will travel at the opening of an envelope...