Mike Teavee

Advanced Member-

Posts

4,306 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Mike Teavee

-

I don't include my "Room No." but do include the unique postal number. E.g. when I lived at Riviera Wongamat, my Room number was 1407 but the unique postal number for that unit was 285/866, with 285 being the number for the building & 866 being the number for my unit. So I would report... The Riviera Wongamat Beach, 285/866 Naklua Soi 16, Na Klua, Bang Lamung, Chonburi.

-

Seeing as you can only apply a maximum of 15 days in advance of your reporting date, you would be just about out of time (maybe 1 day left of the 7 day grace period) if it had remained pending for 21 days. As an aside, I applied online at 8:36am on Monday, got the approval at 10:45am on Tuesday, it was my 1st online 90 day report since moving condo & re-entering Thailand so I did have some concerns it would get rejected, but no problems... Pattaya based so Jomtien IO.

-

NES = Native English Speaker (or Nintendo Entertainment System 😊).

-

Soi 13/2 (Soi Post Office, they are directly across the road from the Post Office) @Pattaya57has posted that they asked 6,000b for a 30 day extension (includes the 1,900 immigration charge), I have heard other guys say that is what they charge for it so I would go with that.

-

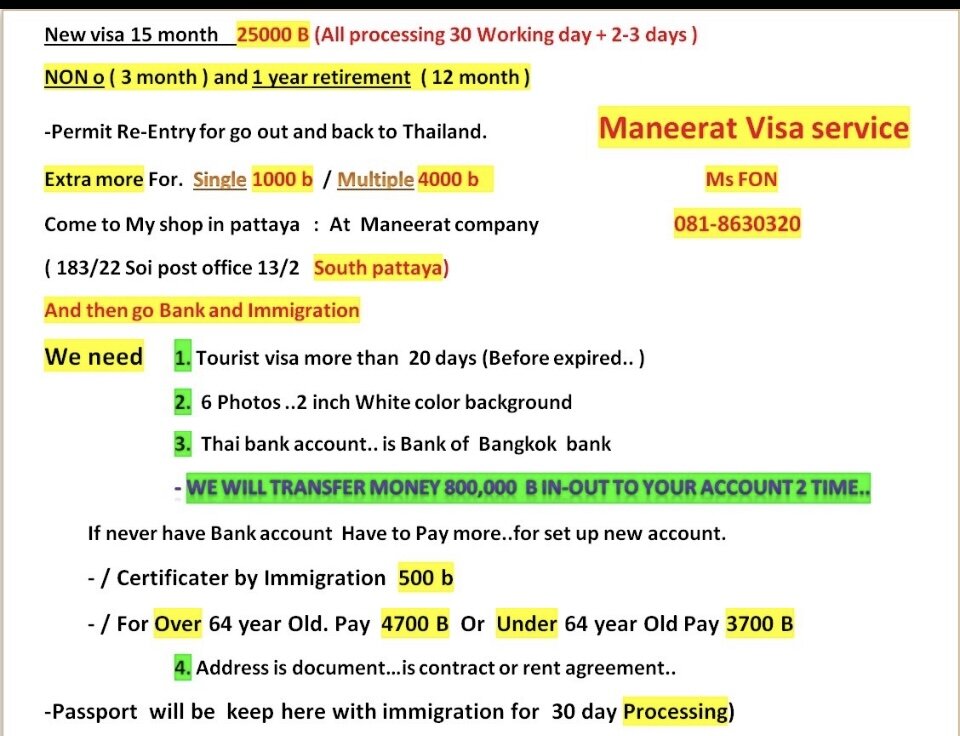

As other’s have said, I don’t think any agent would do a 30-day extension for 2-400b, Agents charge 500b to do a TM30 & it’s a lot less work for them than an extension, even a Residency Certificate is 500b, which when you take off the 300b immigration charges means the agent is getting 200b for doing it for you. I mention the prices as I thought you were looking for a 12 month extension rather than a 30 day one & at 12k (assuming no finances) Maneerat is cheaper than any other agent I’ve seen as is the 25K to do the non-O conversion + 12 month extension.

-

I've used Maneerat for my last 2 Extensions (Actually last time it was Extension + Multi Reentry Permit, plus TM30 as I was moving Condo + 90 day report) & have always found their service to be excellent which is why they're always recommended by other members on here. I think the only issue I've seen posted in this thread was the fact that they were charging 6,000b to do a 30 day extension so it wasn't so much a service issue but more of a cost issue. Maneerat's Costs are:- Extension (Non-Imm O "Retirement") - 8,000b (I keep 800K in the bank all year round, I believe it's 12,000 if you don't) Multi Re-Entry permit 4,000b (I get this at the same time as the extension so may be a little bit more if you get it separately, I seem to recall when I needed a Single Re-Entry permit outside of my normal extension cycle, the cost was 1,300b) TM30 - 500b Residency Certificate (I needed this to open a new Bank Account) - 500b 90 Day Reporting 100b (Though they did it for free with my extension, seem to recall they did the same last year even though I didn't need a new report). I believe some agencies do your extension in a different province, mine was done at Jomtien as I needed to go there on the day to have my photo taken at the immigration counter. Again, I can only speak highly of them & have recommended them to my friends who would say the same.

-

A couple of years back, GF & I looked at buying some land in Satun as a future income stream (renting out to people to grow Rubber/Palm oil crop) for her & there was a massive difference in the price of land depending on whether it had "Paper" (Chanote?) or not. IIRC there was 1 plot of 4 Rai going for 1.5Million with "Paper" & another 20 Rai plot going for 1Million without "Paper". I don't understand the significance but she seemed adamant that she wanted land with "Paper", something about somebody (Government?) could claim the land back without it, TBH I'd lost interest in it at that point so didn't get into anymore details.

-

As the Thai Tax Year is Jan 1st - Dec 31st & the UK Tax Year is Apr 6th - Apr 5th, I was thinking of doing 1 year none Tax Resident in Thailand whilst I bring over the proceeds from the sale of my house by spending... Jan - Apr in UK* (am only allowed 90 days before I become UK Tax Resident due to having 2 "Economic Ties" in the UK). Apr - June in UK (This would be in a different Tax Year so am allowed another 90 days) July - Dec in Thailand The next year spend a full year in Thailand but not bring over any money above the tax free allowances (235K for me). Any year I need to replenish funds or bring over large chunks of cash (Tax free element of my pension in 2026) I repeat steps 1-3. *NB by UK I mean outside of Thailand, in reality it would be more like a month in Bali, a month in Europe & a month in UK during Jan-Apr & a month in Europe, 2 months in UK during Apr-June, the idea is to maintain my Non-UK Tax Resident status at the same time as being Non-Thai Tax Resident. Edit: I stay with my parents when I visit the UK so no rental costs there & have friends with apartments in Spain who would happily put me up for a month or 2 as both of them spent at 6 months staying with me when they were working in SG.

-

Is the online 90 day reporting link still https://tm47.immigration.go.th/tm47/#/login & is it working? I try to logon (Have cached credentials so no reason for Password to be incorrect ) & I get "Invalid Data" So I try resetting password & again get "Invalid Data" So I try re-registering & no surprise, "Invalid Data" 😞

-

Was buying a new TV in Singapore & the store had what looked to me to be identical Samsung TVs with very different pricing, when I asked why one was cheaper I was told “That’s the Chinese Model”, fundamentally the same but uses cheaper components)

-

Gillette Razors & shaving foam/gel are way cheaper in the UK so on my trips back I always pick up 5-6 cans (approx 90b each compared to >400b) & a couple of packs of blades (can’t recall how much they cost but again way cheaper than in Thailand).

-

Might be too late at 70 but is there anything you can do in your home country that could set up annuity style payments for your partner? Mine will receive 1/2 of my private (not State) pensions when I die which should give her enough money to have a reasonable lifestyle even if she spends/sells everything else she’ll get.

-

Open a Thai bank account on tourist visa

Mike Teavee replied to qwab32's topic in Thai Visas, Residency, and Work Permits

I used Siam Legal (Bangkok) in 2015 to open my account (on a Visa Exempt, staying at my mate’s condo) & was also given a UnionPay card so approx 18 months later I went into my branch (Asok) to ask for a credit card as I needed to be able to shop online in Thailand & they switched me to a Mastercard (Debit) free of charge. Have just got my new Mastercard & IIRC it was 300b. The 3 guys I know who have opened accounts (Pattaya Beach Road Branch) within the past 18months have all been given Mastercards without asking & they also used Maneerat. -

Open a Thai bank account on tourist visa

Mike Teavee replied to qwab32's topic in Thai Visas, Residency, and Work Permits

OP, if you want to convert your Tourist Visa to a Non-IMM O (+ 1st 12 Month extension so good for 15 months) In-Country, Maneerat can also do that for 25K… -

Open a Thai bank account on tourist visa

Mike Teavee replied to qwab32's topic in Thai Visas, Residency, and Work Permits

Do note that the Residency Certificate has to include the name of the Bank you want to open an account with so if you got one for KBank & they said no so you wanted to try Bangkok Bank, you’d need a new cert. -

Open a Thai bank account on tourist visa

Mike Teavee replied to qwab32's topic in Thai Visas, Residency, and Work Permits

Maneerat (Pattaya Soi 13/2 aka Soi Post Office, they’re directly across from the Post Office). 3,700 if < 64 & 4,700 of 74+, both include ATM card & 500b left in you account but do not include a Resident Cert so add on another 500b Do make sure you have more than 20 days left on your permission to stay. -

Thats what I’m thinking but logically the process would go your Executors present your will to a Thai Court who then check with MOFA if you have a registered Will with them, if not then they proceed with the Will presented. I guess if that’s your only Will (I.e. Your UK Will) then it comes down to whether MOFA will approve it after your Death. Again, I’m probably thinking too Logical about this & am sure your Thai lawyer will guide you through the process

-

I’m not a lawyer but I would have thought that if the Will hasn’t been approved by MOFA on your death then by definition it’s not an approved Will & approving it afterwards would be changing your Wills after your Death. Then again Maybe I’m just thinking too much 😊

-

I edited my reply to include a link that says it needs authorising by MOFA (presumably before your Death) & will be settled in a Thai Court.

-

When I looked into this I was told that I would need separate Wills for UK & Thailand even though I plan to leave everything to the same person. Has your Will be translated, motorised & accepted in Thailand? Quick Google says your UK Will could be valid in Thailand as long as it’s been translated & approved by Ministry of Foreign Affairs & even then it can only be settled in a Thai Court. https://www.samuiforsale.com/knowledge/inheritance-laws-thailand.html#:~:text=Legal foreign wills are acceptable,subject to a court procedure.

-

Whilst it’s technically possible for a Will in 1 country to cover assets in certain other countries, I don’t believe Thailand is one of those & so don’t think they’d be interested in the contents of your other Wills.