- Popular Post

Mike Teavee

-

Posts

4,306 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Mike Teavee

-

-

- Popular Post

- Popular Post

-

2

2

-

2

2

-

8

8

-

- Popular Post

- Popular Post

21 minutes ago, jayboy said:But the vast majority of people who actually live there and not on monger holiday are former mongers or reformed mongers.

I've no objection to the Sin City concept but the sheer dreariness and vulgarity is hard to stomach.

Me & all of my mates found our way to Pattaya after living in Bangkok for a few years (I came down here 1st as my Partner had close family living in Rayong & we wanted to get out of the city & live by the sea), none of us moved here for the Mongering.

It's like judging Bangkok by Soi Nana / Cowboy etc..., or Singapore by Geylang / Orchard Towers (Now gone) etc... Yes it's there if that's what you're looking for but it's not hard to avoid if you're not looking for it.

Again, you're talking about one small part of Pattaya City, out by the lakes there are some really nice houses, I live in a really nice beach front condo, there's something for everybody here.

-

2

2

-

2

2

-

- Popular Post

- Popular Post

6 minutes ago, georgegeorgia said:Look , I checked out the Darkside on my last trip , I did enjoy that big park over there near the football ground but apart from that it doesn't suit me , transport wise

A couple of mates have houses near Lake Mabprachan & it's really nice around there but I prefer to live near the beach so live in Wongamat & it's perfect (for me).

There are no bars here where "All Expats" spend their days drinking (& no "Girlie" bars), people just live a normal Expat retired life (whatever that is) with maybe the odd trip into town, for me that means 1-2 times per month to catch up with friends over a few "Mad Beers" but most of the time we're out in couples having something to eat or will have a guys night out playing pool at a bar around the Lake, there's a fair few decent places to choose from.

Oh & as most of us live here with our long term partners, we don't "Indulge" in the other thing that people who don't know Pattaya think every guy in Pattaya is doing everyday...

Pattaya a great city to live in if you actually live here & are not just here on a monger holiday.

-

4

4

-

1

1

-

2

2

-

3

3

-

As others have said, 1,700b is reasonable for a door-2-door service booked by a hotel but if you want to do it cheaper you could book it yourself with Cherry Taxi Services, prices start at 1,400b from DMK... [The hotel will be using somebody like this & pocketing the 300b].

https://cherrytaxiservice.com/services-rates/

-

Watching today's Fabulous 103FM News report & there's a story in there that people have been reporting Immigration (am guessing Chonburi/Jomtien) asking for proof that Income has been taxed at source when doing retirement extensions (presumably using the 65K Income Method)... 2 minutes in...

It does go on to say that it's unlikely any income taxed at source will be taxed again BUT makes no mention of what happens if the income hasn't been taxed (Obviously if it is Income & hasn't been taxed then the person remitting the money should have filed a Tax Return & paid tax on it in Thailand).

-

1

1

-

-

11 minutes ago, Ben Zioner said:

Here, was clear right from the beginning.

That doesn't say that everybody will have to file a Tax Return, it just highlights what I said about income earned from 1/1/24 being Tax Assessable if remitted in later years.

-

2

2

-

-

- Popular Post

- Popular Post

18 minutes ago, Ben Zioner said:Not need to get rabid. They don't need to mention expats, they said that all residents for the purpose of taxation (strictly more than 179 days in country) will have to file a tax return. Why would you think that this wouldn't include the so called expats?

Do you have a link to where that was said?

Fact is the only thing that has changed is that income earned from 1/1/24 will now be tax assessable any time in the future (assuming you're Tax Resident) instead of the current "Rules" which says it would only be tax assessable if remitted in 2024.

If you do not remit anything that would be Tax assessable this year then there is no need to file a Tax Return in 2024 & if you do not remit anything that is Tax assessable income in 2024, there will be no need to file a tax return in 2025... and so on...

Am sure you could file a Nil Return if you wanted to but there is absolutely no need to unless your investigated by the Revenue & if you've not remitted anything that is Tax assessable then you've nothing to worry about.

-

1

1

-

3

3

-

28 minutes ago, Mike Lister said:

Poster @Ben Zioner seemed to have different views.

I suspect the answer is somewhere in the middle ground, the Schema can be found here https://www.oecd.org/tax/exchange-of-tax-information/common-reporting-standard-xml-schema-user-guide-for-tax-administrations-june-2019.pdf so will see what it says :)

Edit: I've looked at the Schema and as far as I can tell it's all about reporting the "Closing" Account Balances (not transactions) & given that the mandatory CRS reporting requirement is annually it's likely that once per year all finance organizations will report the closing balance for all accounts that they hold....

Even if it was reporting daily it would be considered "Amalgamated" (Not transactional) data.

Whilst on the OECD site I also noticed this...

In light of the rapid development and growth of the Crypto-Asset market and to ensure that recent gains in global tax transparency will not be gradually eroded, in April 2021 the G20 mandated the OECD to develop a framework providing for the automatic exchange of tax-relevant information on Crypto-Assets. In August 2022, the OECD approved the Crypto-Asset Reporting Framework (CARF) which provides for the reporting of tax information on transactions in Crypto-Assets in a standardised manner, with a view to automatically exchanging such information.

https://www.oecd.org/tax/automatic-exchange/common-reporting-standard/

Which I guess would rule out any plans to use Crypto to somehow get around being seen to remit money into Thailand.

-

1

1

-

-

Probably recommended when it came out 3.5 years ago but I must have missed Series 2 dropping so have been back to watch series 1 & am really enjoying it.

We Hunt Together https://www.imdb.com/title/tt10661302/

A gripping twist on a classic cat-and-mouse story, this British drama series explores the intoxication of sexual attraction and the dangerous power of emotional manipulation as two conflicted detectives track down a pair of deadly killers.

-

1

1

-

-

4 hours ago, Mike Lister said:

Yet others persuade us that CRS is one one thing, which they they know because they are a consultant who works with such data every day and are expert. But when others post confirmation that CRS is something else entirely and they are invited to debate the matter and fight their corner, they hide under rocks and in dark corners. It is not so much a question of who is right and who is wrong, it is more a question of what is correct. Will my transactions be recorded and be capable of being viewed at the detailed level asks poster A. Oh no, how can it be, CRS is consolidated data. Hmm, not so says another, here's the record layout from CRS. Personally, even though I'm not an "expert" tax consultant, I'm going with the latter because there is evidence and the poster is credible but I'll leave it for those involved to argue the toss. We have no horse in this race but it would be good to understand the truth, especially when it comes from the mouths of "experts", allegedly.

Can you imagine the amount of data that would need to be exchanged if every country signed up to CRS shared detailed information about every transaction made!

Added to that, how are you going to Identify Individuals? - Can't be on Passport number as my UK bank doesn't have my passport details (I don't even think I had a passport when I opened the account & if I did, I've had at least 5-6 new ones since & there's no onus on me to tell them), can't be on a Tax Identification Number as my UK Bank doesn't know my UK or Thailand TIN, so you get into the realms of trying to match by names (I sometimes do/don't use my middle name), dates of birth, addresses etc... Which again, is not practical given the amount of data involved.

It must be consolidated data exchanged with maybe a mechanism to request the underlying transactions but you still have the problem of being able to accurately identify all transaction for a single individual.

-

1

1

-

1

1

-

-

1 hour ago, paddypower said:

there must be a fair % of posters who have been reporting for a visa extension, on the pension income basis. Surely a few of you can make the time to kindly describe what proof of income you have been asked for in the past? To be brutally honest, it appears to me that there is so much space devoted to the proposed tax. Yet, I bet anyone that it will get dropped (either by way of a public back-tracking, or by the usual Thai way - inertia).

Hi Paddy,

As this thread is about Tax & is not in the Extension Forum (https://aseannow.com/forum/1-thai-visas-residency-and-work-permits/) it could be a lot of the guys who are using the 65K Income method might not be reading it.

I'm sure if you started a topic in that forum (Or maybe a Mod could use your above post to start a topic on your behalf) you'd get a much better response to your questions.

FWIW everybody I know that's on a Retirement Extension either uses the 800K in the Bank or uses an agent to "Assist With The Finances" but I did look into switching to the 65K pm Income method when it was first announced & decided it wasn't for me as I don't have a regular/monthly income so I would need to amortize it from other Income. At that time I don't recall Jomtien IO wanting to see anything more than the monthly Xfers but I could be wrong and/or it could have changed since then.

HTH

MTV

-

1

1

-

-

15 minutes ago, paddypower said:

this may have been covered already - but I cannot find a reference to it. I am switching from the 800k TD to the income method for my OA retirement visa extension, early next year. An IO officer quotes one set of requirements and the official IO website quotes another set of rules:

IO: (i) to prove your pension income, you must present copies of the foreign bank account into which the pension payments are received.

(ii) not interested in copies of Thai bank account, showing incoming funds for the 12 months

(iii) not interested in Inward Remittance Notices for the year

(iv) your Thai dividend income does not count in the earnings calculation.

(v) from another source (my Thai tax accountant) rental income from a Thai property does qualify, if it is a professionally managed property, if not you are classified as working and risk losing your retirement visa status

Note: this is irrelevant to me - I have rental income but I do not need to include it in my income calculation. I just mention it, because it was surprising to learn this.

IO publised regulations: documents required, as proof -

proof of 800TD, or a combination of TD and income equalling at least 800k in the previous year.

''income'' is defined as - ''pension, interest & dividend income'' .

any feed-back would be appreciated.

Do you have a link to the IO Website you quoted?

I thought for the income method you had to prove you were remitting at least 65K every month from overseas (Income earned in Thailand doesn't count).

Different IO offices may have different policies about whether they ask you to support this with proof of overseas income but some are only interested in the 65K being remitted (i.e. You could be sending it from savings).

-

7 minutes ago, Yumthai said:

No. Only resident citizen are subject to tax on their worldwide income.

Alien (resident or not) are subject to tax on their Philippines-sourced income only.

I thought that was a little ambiguous which is why I put "Might"

This seems much clearer...

US Expat Taxes in the Philippines

As a US expat living in the Philippines, it’s important to know your tax obligations in both the US and the Philippines. As a resident of the Philippines, you are subject to income tax on all income earned, including income earned outside of the country.

However, the Philippines does have a tax treaty with the US to prevent double taxation on your income. It’s important to keep track of all income earned and any taxes paid to ensure compliance with both countries’ tax laws.

Additionally, US expats in the Philippines may be eligible for certain tax credits and deductions, such as the foreign tax credit, which can help reduce their overall tax burden.

https://www.greenbacktaxservices.com/country-guide/expat-taxes-for-philippines/

-

1 hour ago, JimTripper said:

I may take a trip to the phillippines to see what's up. Hearing good things about Dumaguete.

I don't want to file at all, even if I don't end up owing.

Be careful as if you spend more than 2 years in the Philippines you would be considered a "Resident Alien" & so might be subject to tax on your worldwide income...

Liability for income tax

The liability of aliens for Philippines tax is determined by their residence status. Generally an alien who is present in the Philippines for at least 2 years is a resident alien. An alien who stays in the Philippines for less than 2 years is considered a non-resident alien.

There are two classifications of a non-resident alien:

- engaged in trade or business in the Philippines

- not engaged in trade or business in the Philippines.

A non-resident alien engaged in trade or business (NRAETB) is one who stays in the Philippines for an aggregate period of more than 180 days during any calendar year. If the individual stays in the Philippines for an aggregate period of 180 days or less, the individual is considered a non-resident alien not engaged in trade or business (NRANETB). The taxable income of citizens, resident aliens and NRAETB is defined as gross compensation and net business income less personal allowances. The taxable income of NRANETBs is their gross income.

Non-resident citizens and aliens are subject to income tax on Philippines-sourced income only.

Resident citizens are subject to Philippines income tax on worldwide income. Non-resident citizens and aliens are subject to Philippines income tax on their Philippines-sourced income only, such as employment income and passive income

https://kpmg.com/xx/en/home/insights/2021/07/philippines-thinking-beyond-borders.html

-

1

1

-

Just now, TheAppletons said:

Pretty sure the OP was asking about visa agents in CM.....hence his phrasing of the question "any agents up here" and his posting of the question in the CM sub-forum.

Sorry we posted at the same time, I realised he was looking in CM so deleted my post :)

-

Deleted... I thought you were looking for an Agent in Pattaya but realise now that this is the CM forum & you're looking for one "Up North"

-

14 minutes ago, TallGuyJohninBKK said:

And of course, according to the explanations given, all LTR visa holders are going to be exempt from the entire new foreign income taxation scheme.

From what I've read, LTR holders are exempt for years that they hold an LTR so get one in 2026 (Which is my plan), you're still liable for tax on income earned in 2024/2025.

I plan on being Non-Tax Resident in 2006 (for other reasons), so hopefully I'll be able to bring enough funds over to support my LTR in that year & from then on not have to care about this stuff.

-

1 hour ago, Ralf001 said:

The source of funds if from money earnt... will have already been taxed.

Seriously doubt Thailand will ignore a DTA... assuming country of origin has a DTA in place.

How do you know the money has already been taxed & if it was taxed, at a rate similar/higher than Thailand would tax it.

Simple example, let's say I sell some shares for £3,000. made a £1,000 capital gain and there's no CGT in UK (Which there isn't as I'm non tax resident there).

I then use that £3,000 to purchase a BKK-MAN ticket on Qatar...

If I used a UK Credit card then the money will go from my UK Stockbroker account to the UK credit card (Same company) & the only involvement Thailand has in this is I live here & the flight is from BKK, I'd fully expect there to be no tax to pay.

If I used a Thai Credit Card & remitted the money over from the UK to pay the bill then I would expect it to be assessable for tax.

If I buy that ticket using a company based in Thailand then surely I'm remitting the money to pay for it so it would be assessible for tax.

-

1

1

-

1

1

-

-

33 minutes ago, Ralf001 said:

How can money spent be possibly be considered as income ?

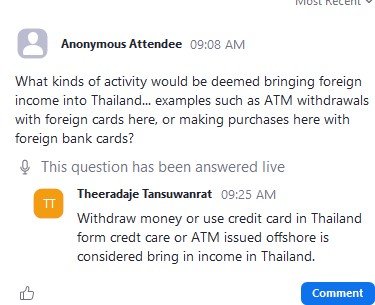

Sorry, you seem to have missed the previous posts about Foreign ATM/Credit card charges potentially being considered as bringing money into Thailand as obviously you're either taking that money from (Potential) Income overseas or have to pay the bill (with potential Income) at some point.

-

7 minutes ago, TallGuyJohninBKK said:

The expat tax advisors who did the presentation also indicated they expected that foreign card ATM withdrawals and even foreign card (debit or credit) purchases made in Thailand likely will end up being considered importing foreign income -- though they acknowledged the Rev. Dept. hasn't specifically opined on that issue as yet.

Though even if that ultimately were to become the Revenue Department's ultimate position, many of us remain skeptical about their ability to actually track and trace what clearly would be a huge number of such transactions, and separate out those belonging to expats vs. tourists -- especially since the current bank info sharing agreements internationally seem more aimed at tracking and sharing info on EARNINGS as opposed to SPENDING.

So I spend £3,000 on a Qatar flight to the UK, book it on the Qatar website using my UK Credit Card (with a Bank that I've not registered myself as Thai Tax Resident) & Thailand is somehow going to see this as income?

Just incase they can/do, I'll be using a VPN...

-

1

1

-

1

1

-

1

1

-

-

- Popular Post

- Popular Post

1 hour ago, Crossy said:Now deny that you have one

My brother went into a video store, looking through the £1 video bin he picks up a Michael McIntyre video & asks the assistant "Is this Any Good"

Assistant replies "It's better than a sh1tty stick in the eye"

He buys it, 1 hour later comes back & asks.... Have you got that Stick :P

-

1

1

-

3

3

-

31 minutes ago, John Drake said:

From what I can tell, for peons like me, there isn't going to be much impact, if any. But the guys and gals with income levels that meet, for example, the Long Term Visa or Elite Visa, those people are going to get taken to the cleaners.

The guys who meet the LTR visa are exempt from Tax for income earned while they have the LTR Visa & I'm sure they're smart enough to order their remittances accordingly

The guys on an Elite Visa (I guess) will either move to the LTR or order their affairs so they pay minimum tax...

I'm honestly in the middle of "Peon" (No/Little Tax) & cannot afford the LTR but I have a very simple plan where I don't need pay any taxes Thailand...

Put simply I'll do 6 months outside of Thailand when I remit funds to last me the next 3 years... I appreciate not everybody has the flexibility to do this but I'm the kind of guy who will travel at the opening of an envelope...

-

15 minutes ago, Mitkof Island said:

A mass exodus is coming ! see ya!

I doubt many guys will be too impacted by this & so few will leave.

Besides, if you did leave where are you going to go?

-

1 hour ago, Neeranam said:

I get 60,000 allowance for my spouse(wife).

I expect there will be a lot of activity at temples if this law is enforced!

As you know, a common method of tax avoidance here.

You do get 60K if you're wife doesn't file her own Tax Return

Worst Joke Ever 2025

in Jokes - Puzzles and Riddles - Make My Day!

Posted