4myr

Member-

Posts

183 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by 4myr

-

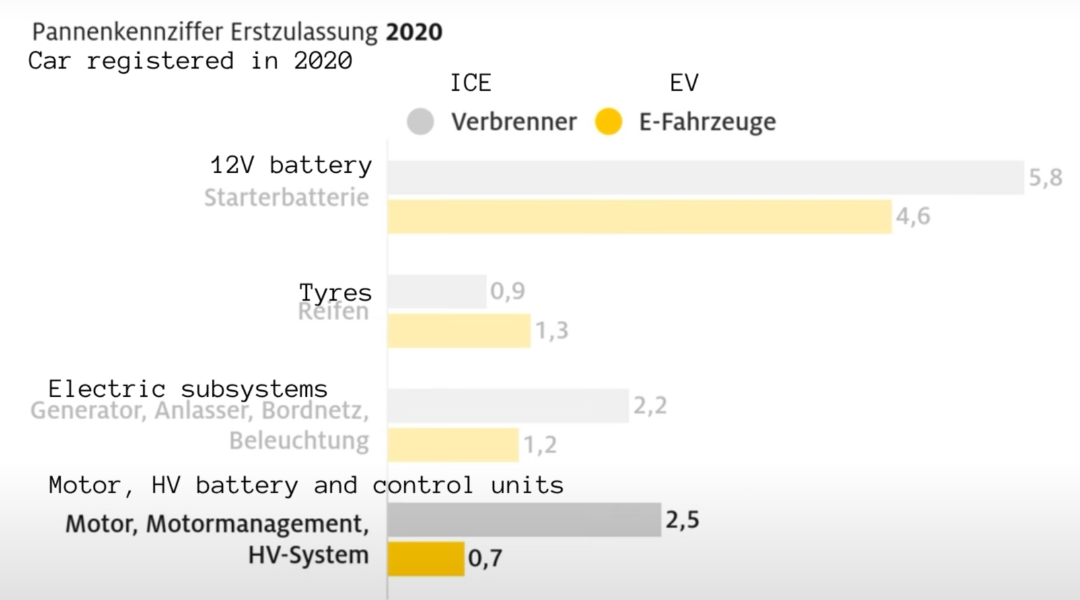

More evidence that EV's are more reliable than ICE. In this case a recent 2025 study from the renowned German motorway breakdown repair service of the car association ADAC. They've looked into 2 groups of 2 till 4 year old ICE and EVs and compared the type of breakdown and how many per 1000 incidents. And the car models that reach the minimum statistical quota of above 7,000 car registrations per group are in this study primarily European, US and Korean. No Chinese like MG or BYD yet. I can only think of only one EV, the Renault Dacia Spring, imported from China, known in China as Dongfeng Nano Box. It got a no 3 rating [2.9 incidents] within the category of budget cars. Unfortunately the road infrastructure context of Germany is not comparable to Thailand. Germany has quite an extensive motorway network, where on some stretches there is no speed limit. The climate is different, cold in winter and summers are less hot and humid than Thailand. This is the main takeaway: Number of Incidents with 12V battery are almost the same between ICE/EV. EV's have slightly more incidents with tyres. Do higher motorway speeds in Germany make things for EVs worse than Thailand? These findings are in line with what I hear from an EV repair shop in Thailand. As tyre incidents are not picked up by EV repair shops, I hear them saying that after the 12V battery the AC onboard charger [or CCU in Kia/Hyundai] is the most frequent component that needs repair or replacement. Kia/Hyundai EV's and Neta V seem to be notorious. I That's why the Ioniq scores very badly in this German study. Besides the German EV's like VW IDx, Tesla model 3 score exceptionally very low incident numbers [0.n].

-

Sources: 1) Thaiexaminer.com: https://www.thaiexaminer.com/thai-news-foreigners/2025/04/19/bangkok-ev-car-self-ignites-while-charging-at-5-am-owner-is-done-as-insurance-costs-soar-over-premiums/ 2) EVinsider Thailand Facebook: https://www.facebook.com/share/p/1AFdZxLyxX/ Please reply with only facts, with what you can share and not any platitudes or anti EV opinion. EVinsider has more recent pictures with what seems like the fire is also coming from the bottom of the EV. We don't have more facts yet than these sources, but given the black plastic pattern below the headlights, I recognize it as a BYD Seal. For what I have found online sofar, this is the third case of a documented EV fire of a personal vehicle in Thailand. 1) 2024 Porsche Taycan. https://www.thaiexaminer.com/thai-news-foreigners/2024/05/25/luxury-porsche-ev-car-worth-10-million-self-ignites-and-is-destroyed-in-minutes-in-central-bangkok/ 2) 2023 BYD Atto 3. Cause was a short in the 12V cable https://www.nationthailand.com/special-edition/ev/40030792

-

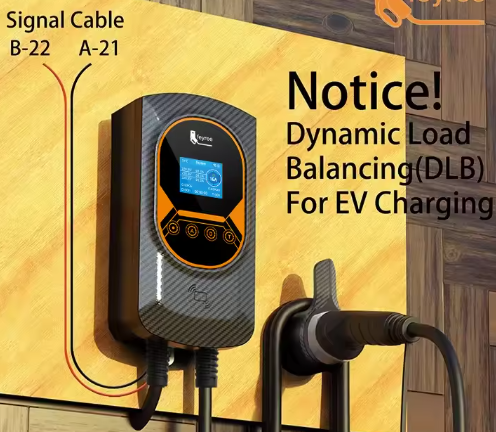

EV charger I want to install a single phase 32A home charger for an EV. Preferably one which the current can be varied, so the idea is I can charge for free during sunny hours from my grid-tied solar by lowering the current [ 8A-10A-13A-16A ]. Later I can automate the current [A] setting in Homekit to dynamically adapt to the actual solar production. I had this Feyree charger [ https://www.aliexpress.com/item/1005005875505790.html ] in mind. I am looking for one which is IEC 61851-1 compliant. It is not explicitly stated to be certified. It says: “Control box meet IEC 61851 control principle”. This one is also an option [ https://www.aliexpress.com/item/1005007741078236.html ]. It has no mention of IEC 61851, but it has RCD type B protection built in. Q1: Which one to take or do I need to look for another charger that is explicitly 61851-1 certified to be on the safe side? PEA meter and smart invoice I am selling my excess electricity to PEA, so they fitted a digital 30(100)A meter. This meter registers off peak consumption separately as seen on my PEA “smart invoice”. However the invoice clubs all consumption into a single rate of 3.2484 baht/kwh. Currently I have a consumption below 100 kwh per month. Also service charge is low at 24.62 baht. Q2: If I start to consume 140 kwh per month extra for my EV and charge it during off peak hours, what do I need to do to get from PEA a lower off peak tariff? Main consumer unit - integrated MCB/RCBO The main breaker is 63A, it will be sufficient for my additional 32A charger. However the MCB is an integrated unit with the RCBO, called CMT-2. See attached picture. Link: https://www.thaiwatsadu.com/en/product/เมนเบรกเกอร์-RCBO-CT-ELECTRIC-รุ่น-CTM2-63c-สีดำ-60264396 What is my gripe? At the EV charger side there will be a RCD type B breaker. All the connections in the main CU are connected to the integrated RCBO. I think this will not work well, having RCBO and RCD on the same EV charger circuit. So I want to route a separate EV breaker from the main MCB without the RCBO. Q3: is there a safe way possible with the existing CMT-2 to break open the bottom cover and route a cable from the MCB without RCBO. Or do I need to replace the CMT-2 unit or even the complete CU. The brand is Gsafe and the CU is 8 years old? Is there another simple route possible, as what I've read PEA does not allow a second line anymore for EV chargers? Solar DC cable interference The easiest way to route the new 15m 32A EV cable is to share a 1 meter conduit with my solar DC cables up to the attic floor. Peak capacity of DC is 4500Wp. Q4: Do I still need to avoid or minimize EMI interference from the dc cables, as Thailand requires onboard EV chargers to be EMC compliant? The home charger I have in mind does not mention any EMC compliance. If so, how to avoid/minimize? EV breaker box / MCB rating The standard configuration I read for the EV breaker box is a MCB for overcurrent protection of the AC cable. The recommended rating in Thai I read is 40A. Also recommended AC cable size is 10 mm2. I agree with oversizing the cable. I want to trip the MCB asap on the lowest overcurrent possible. Because of the bimetal the time that it will trip can take hours also depending on current and ambient temperature. Q5: Is MCB rating of 32A not better to spare the cable than the recommended 40A? EV breaker box / RCD type B Some EV chargers mention a built-in RCD type B with leak current protection of AC 30mA + DC 6mA. Thai papers I read also recommends a rating of 40A for the RCD. Q6: Is it from Thai regulation required to still have an external RCD breaker installed, if the home charger already has a rcd type b? If so, will the circuit work properly with 2 RCD breakers in series? Q7: If the MCB is rated 32A, do I need to match the rating of the RCD to 32A also?

-

- 1

-

-

Part 2 of my note on extra care needed for AC systems in an EV. I am still in the learning process as it is a complicated topic. My research is based on reading and watching video's online. Why EVs needs extra care vs ICEVs? ICEV uses a separate radiator to cool off the engine. If AC condenser loop breaks or deteriorates it does not affect the engine. Most EVs use a shared AC condenser and if components in the cooling loop breaks or deteriorates, it can effect the separate or combined cooling loop(s) of battery, power electronics and motor, with consequences e.g. battery overheating during DC charging/driving fast or even battery shut off while driving as a precautionary taken by the BMS. There are a few expensive EV models that do not use a shared condenser, like the Lucid Air. Reactive vs preventive maintenance We often do reactive maintenance of the AC system, if it's not cool enough in the cabin, because it's hard, costly and requires expertise to do AC maintenance. Many EV manufacturers also omit to advise scheduled AC maintenance. However there are a few sources that recommend preventive maintenance: https://voltaic.net.au/protect-your-evs-battery-the-critical-role-of-aircon-servicing/ https://keepincool.com.au/electric-vehicles-ac-system-how-does-it-work/ What are the components | how it can deteriorate | how to prevent issues? Cabin filter, cabin evaporator | dirt & dust | remedy: replace or clean. Cabin filter replacement is part of scheduled maintenance. Heat pump incl. compressor, or compressor only | compressor oil leak, refrigerant leak, compressor oil contaminated by humidity | remedy: check leaks or more noise in engine bay, corrective: replace o rings compressor, replace and refill oil and refrigerant Condenser | dirt, debris, corrosion, leaks | remedy: clean Heat exchanger or liquid to liquid evaporator to other coolant loops of battery, power electronics or motor | corrosion, leak | remedy: use glycol coolant, clean Condenser air inlet | insects sticking to condenser | remedy: add aftermarket insect mesh to prevent bugs enter air inlet. Can be found at Aliexpress for a Chinese EV. Documented maintenance online Note that above maintenance applies to most EVs. However I only found a handful documented AC maintenance on EVs online. I've collected around 20 Youtube video's. This topic is also hardly discussed on reddit. Cleaning condenser: Tesla USA/Australia/Thailand, BYD Atto 3 & MG4 in Thailand Fixing leaks of compression oil & refrigerant: BYD Atto 3 Thailand. When the user goes to the repair shop complaining about not cool enough AC, in 7 out of 10 Atto 3's leaks are found. Fixing battery shut off while driving: MG EP Thailand. Older MG EPs uses compression oil type [PAG] that is not recommended for EVs. When contaminated by humidity due to hot climate, it lowers the electrical insulation of the compressor HV cable, leading to BMS shutting off the battery to prevent further damage and danger. This issue occurs to taxi driven EVs in Bangkok: MG EP, AION ES and MG ZS EV. Average km driven per year by taxi Bangkok is 83k km, and repair shop gives warranty for 6 months after a fix. Links: AC preventive maintenance tips: Tip: cleaning condenser Tesla annually Fix MG EP battery shut off: Add insect mesh to BYD Seal air inlet:

-

Many agree that EVs need less maintenance than ICEVs. However you don't hear so often that some EV models need extra care of the AC system, more than with ICEVs especially in a hot climate as Thailand. Because these models use the same cooling system to cool the cabin as to cool the battery. I would like to hear and learn from EV owners, who have driven more than 50,000 km, whether they had to clean their EV AC condenser or add refrigerant after driven a certain amount of km. Because their AC made more noise or the car's electricity consumption went up. Please watch as a context these video's. Unfortunately in Thai, but turning subtitles on will help:

-

At the Motor Show BYD knew they had to lower the price of the Dolphin [ 499k / 599k ]. Otherwise the fight with the AION UT [ 49xk / 64xk ] would not have been so close. The base model of the AION UT has more value [space, performance ] than the Dolphin base model at the same price. The top model of the Dolphin is 50k cheaper and has more torque than UT top model, so this evens out the volume gains of the UT base model. Source: https://autolifethailand.tv/booking-byd-dolphin-gac-aion-ut-motor-show-2025/

-

This is not correct. According to the Dutch DTA, the old age pension [AOW] is not explicitly excluded to be taxable only in the Netherlands. I think that US citizens are lucky where social security has been explicitly excluded. However this does not mean that your local tax office know how to interpret each tax agreement. From online stories I read, some offices apply the rule that old age pensions from the Netherlands are treated similarly to the old age pension/allowance in Thailand [ Revenue code section 42, clause 25], which is exempt from Thai tax. The term in Thai is referred to as prakan sangkhom.

-

As I have booked the AION UT, I did some research on GAC AION, as on internet GAC is less known than BYD or MG. GAC is a state owned company with EV global brands AION and Hyptec and joint-ventures with Toyota and Honda, primarily for the Chinese market. GAC Toyota has just launched the bZ3X EV [ https://carnewschina.com/2025/02/01/gac-toyota-bz3x-ev-with-620-km-range-will-launch-on-march-3rd-in-china/ ]. They have 2 type of customers, the ride hailing [e.g. AION S and ES], which is declining, and the end consumer [AION V, Y Plus, Hyptec]. Although they produce AION V in Thailand, they decided to import the AION UT, likely due to unknown demand and excess factory capacity in China. AION UT is not selling as well as the Geely Star Wish. One of the reasons is that GAC decided to produce more of the UT 400 model instead of the cheaper UT 300 [not available in Thailand]. GAC makes their own batteries, the Magazine Battery 2.0 [ https://autonews.gasgoo.com/m/70030001.html ]. The latest in the AION V has 400V 3C fast charging, 4,000 cycles, is module repairable and can suppress thermal runaway if punctured or twisted. For what it's worth, GAC is planning solid state batteries in 2026 [ https://cnevpost.com/2024/04/12/gac-to-equip-hyper-evs-with-all-solid-state-batteries-in-2026/ ]. Chinese users of the AION V are satisfied with the driving capabilities and suspension, even though the rear has a torsion beam, which is characteristic to all AION models [S, V, Y Plus and UT]. Also the ADAS lane keeping is more precise than peers, maybe because GAC is investing heavily in Robotaxi's [ https://www.metal.com/en/newscontent/103085517 ]. On the downside, GAC still have too little dealerships and expertise in Thailand. They say they will extend with 80 this year, but no concrete plans yet where [ https://kyodonewsprwire.jp/release/202503256247 ]. On facebook I can gauge not enough expertise on AC maintenance. Testdrive AION UT by German car reporter: Magazine Battery 2.0:

-

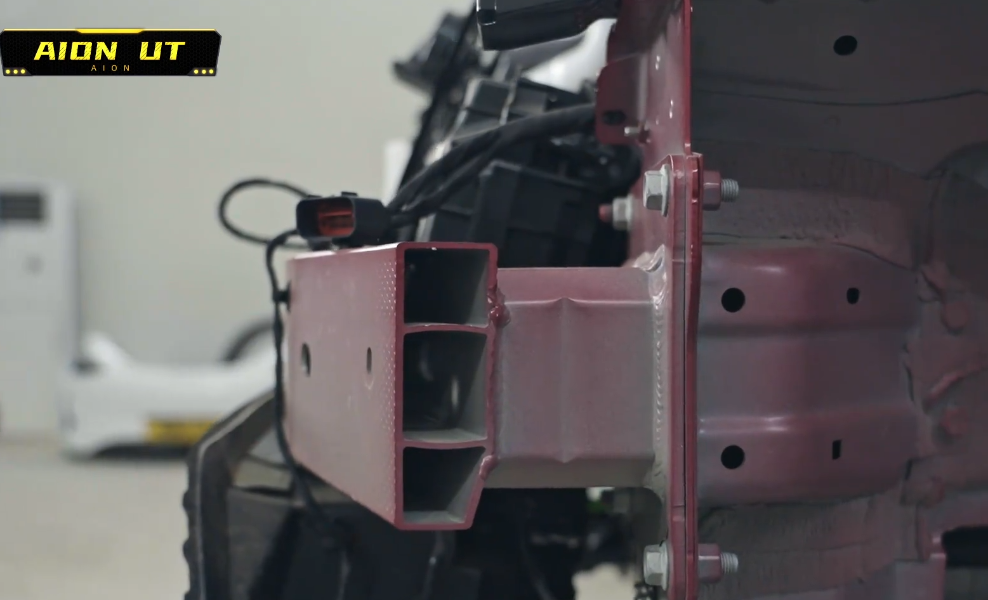

Yes very interesting car indeed. It even has a frunk in front. But a typical city car. I would not want to drive this car with speeds higher than 60 km/h. Have you seen the crash bar? See picture below. They skimp on the amount of steel to keep the price low And about the price. I think it would be hard for Geely to keep the price under 400k. The cheapest model in China is 68.8k yuan [322k baht]. Geely did not sign the EV3.x MOU, so its cars do not get any EV subsidy, between 25-50k in 2026. If I calculate with the markup that they ask for a currently discounted EX5 model, then the price would be at least 440k for a 300km cltc range car. [Source: https://www.dongchedi.com/video/7481483073671004699 ]

-

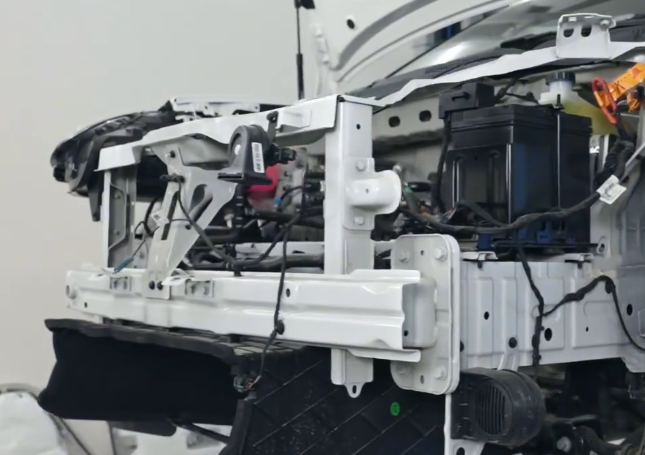

Yesterday came back from a chaotic Bangkok. Had to flee Central Westgate around 1.30pm. We were lucky to have left the parking garage within half an hour. The day before at the Motor Show has been a crowded affair at the booths of Deepal [S05], GAC AION [UT] and MG [IM6, S5]. Not so at Geely and Neta. My top list of prospective cars I had in mind was Deepal S05 and MG S5. I ended up with a booking for my wife with the AION UT as a second car. We'll keep the 10 year old ICEV for long journeys. Why the AION UT ? [ https://www.aionauto.com/th-th/aion-ut ] Most importantly the car has a light interior [beige], instead of orange, black or gray. Really impressed with the space [at the rear bigger than our Mazda 3], the comfort of the seats [we like it on the firmer side] and the quality of the materials given the price of 510k up. Just slam the door tight and listen to the sound. Options wise the standard model has all ADAS features and even front parking sensors [ https://resource-www-sg.aionauto.com/static/TH/tenant/cms/common/202503/AION_UT_Brochure.pdf ]. But I have to admit the brochure did not match the pre-production RHD international top model [ no rear center armrest ] and the chinese LHD standard model [ no front parking sensors ]. I hope the brochure is finally correct. Yes there are areas where cheaper or less materials are used [single pane glass, glove box, wheel skirts]. I even think the front fascia is made of plastic. And no freebies like a charger. After watching some videos I am more confident that the passive/hidden security features are also sound: 1) radar and acceleration sensors for timely airbag deployment even at rollover 2) automatic emergency braking for obstacle in reverse 2) a robust steel frame structure Links: https://www.dongchedi.com/video/7481483073671004699 [ The first disassembly of Aion UT on the entire network, electric cars under 100,000 yuan can actually be built like this! ]

-

Nightmare at the Prachuap tax office

4myr replied to thesetat's topic in Jobs, Economy, Banking, Business, Investments

Had similar experience with this office last year. Went there twice. Even spoke with the lawyers office on the 3rd floor. Things they don't understand or recognize, even after reading out loud the Thai version of my country's DTA: they said they never allowed DTA exemptions in their history of cases, only tax credits. Even for cases not mentioned in the DTA they allow tax credits, this according to my first visit with the tax officer lady. Hua Hin is a smaller branch. But you can go to the regional office where Prachuap is part of [ https://www.rd.go.th/english/40118.html ]. It is Office 6, but located in Bangkok. Here's the address https://www.rd.go.th/region/06/19.html -

My Thai Tax Office Tax Filing Experience...

4myr replied to WingNut's topic in Jobs, Economy, Banking, Business, Investments

For what it's worth. Had a free consultation call with Thomas Carden's office. Tax resident in 2024, remitted savings prior 2024 above threshold for married couple. Do I need to file? Answer: NO, but strongly advised to file. Why? Because all Thai banks will report to TRD all remittances per bank account. How to file? Put 1 baht interest income and attach evidence 1) total remitted income 2) 2023 balance statements of foreign bank savings. -

My Thai Tax Office Tax Filing Experience...

4myr replied to WingNut's topic in Jobs, Economy, Banking, Business, Investments

Why many are talking about the 60/120k thresholds. According to the 2023 TRD guide, these are the thresholds: https://www.rd.go.th/fileadmin/download/english_form/2023/GUIDE_91_66_Complete.pdf -

A few articles on Thai and China EV insurance markets give insight into why at the moment EV insurance costs are higher than ICE equivalents. The EV (insurance) market is more mature in China. The trend of increasing insurance premiums for EVs is not unique to China and Thailand; similar patterns have been observed in markets like Australia, US and the UK. "Thailand's EV insurance struggles with high costs, rapid depreciation" https://www.reccessary.com/en/news/th-market/ev-insurance-loss-rate-hit-over-90-percentage-attery-is-main-challenge-thai-insurers-commented The article highlights a complex landscape for EV insurance in Thailand, characterized by high loss ratios driven by battery costs and competition among insurers. While there are significant challenges, including stricter lending practices and complicated insurance requirements, government incentives and advancements in local manufacturing present opportunities for growth. The future of the EV market will depend on how insurers adapt to these changes and address the specific needs of EV owners. Overview of EV Insurance Challenges High Loss Ratios: The Thai General Insurance Association (TGIA) reports that the loss ratio for EV insurance has surged to over 90%. This means that for every 100 baht insured, insurers are incurring losses of 90 baht or more. This high loss ratio is attributed to several factors, including the rapid depreciation of EVs and increased maintenance costs, which are 50-60% higher than those for internal combustion engine (ICE) vehicles. Battery Costs and Risks: Batteries represent about 70% of an EV's price and pose significant risks, such as fire hazards and high replacement costs. The rapid pace of technological advancements can also render parts obsolete quickly, complicating long-term insurability. Impact of Competition: The intense competition in the insurance market has led some companies to modify their premium structures. For example, Tokio Marine Insurance's Thai branch has adjusted its premium calculation method, particularly affecting new customers or those transferring policies. Factors Affecting the EV Market Cybersecurity Risks: The increasing connectivity of EVs raises cybersecurity concerns, further complicating risk assessments for insurers. Government Policies: Despite these challenges, there is optimism about the growth of the EV insurance market due to government incentives aimed at promoting EV adoption. These incentives are part of a broader push for sustainability and environmental awareness among consumers. Local Supply Chain Development: The establishment of production facilities by various manufacturers in Thailand is enhancing the local EV supply chain. This increased capacity is expected to drive down production and maintenance costs, making EVs more affordable. Recommendations for Insurers Separate Policies for Key Components: Industry experts suggest that insurers consider offering separate policies specifically for batteries and electric motors, potentially with higher premiums for these high-value components. This could help address the unique risks associated with EVs while providing clearer coverage options for consumers. "High Insurance Premiums Are the Latest Thing Weighing on China’s EV Market" https://www.insurancejournal.com/news/international/2024/04/05/768245.htm The article highlights the growing challenges faced by electric vehicle owners in China regarding insurance costs and availability. As the EV market evolves, insurers are grappling with issues related to pricing accuracy, claims history, and repair costs. These factors contribute to rising premiums that may deter potential buyers and complicate the transition from traditional vehicles to electric ones. The situation underscores the need for improved data collection and risk assessment methodologies as the market continues to develop. Overview of Rising EV Insurance Costs in China Increased Premiums: Many electric vehicle owners in China are experiencing significant increases in their insurance premiums. Reports indicate that some drivers are paying up to 8,000 yuan (approximately $1,100) annually for EV insurance, which is about 2,000 yuan more than what they would pay for a comparable fuel-powered vehicle. Some drivers have noted that their renewal premiums increased despite having no accidents. Rejection of Applications: Insurers are reportedly rejecting applications from EV owners who have high mileage or long commutes, viewing them as elevated risk factors. This trend has led to dissatisfaction among consumers, who have taken to social media to express their frustrations. Factors Contributing to Higher Premiums Repair and Maintenance Costs: The higher premiums for EVs can be attributed to their increased repair and servicing costs. EV parts are generally more expensive and harder to source, which raises the overall cost of insurance. Lack of Claims History: The insurance industry faces challenges in accurately pricing and assessing risks due to the relatively short claims history associated with electric vehicles. This lack of data complicates risk assessments for insurers. Shortage of Qualified Technicians: There is a limited number of qualified technicians capable of servicing EVs, which further contributes to the higher costs associated with insuring these vehicles. And finally, one of those China and EV bashing youtube channels funded by Falung Gong, and critical of the CCP, has this time a surprisingly balanced report on this topic. Just ignore the click baiting title and watch:

-

Some cars like Tesla and Xpeng have charger on route planners standard. And if your EV does not have it, just download the app abetterrouteplanner.com [ABRP] and connect it to your OBD scanner to read realtime data like your SoC battery charge. And plan your charging stops along your route. There is however no equivalent planner for your gas fuel stations.

-

MG ES5 expected to launch on March Bangkok Motor show Two Thai sources confirmed this, referring to announcements by managing director MG Sales at MG Dealer conference 2025 held in Bangkok: https://autostation.com/cars/mg-es5-electric-crossover-expected-to-launch-in-thailand-this-march/ https://www.car250.com/mg-es5-ev-2025-th-03.html What's special: Similar size as Atto 3, Geely EX5, Omoda C5, Neta X, etc. Drives as rear wheel drive better than its FWD peers. See reviews below Will probably get lifetime battery warranty as MG4. Charging speed better than average among peers. VtoL higher than peers. Has more conventional stuff than peers like normal door handles and more hardware buttons. What's below average than it's peers: Although infotainment system is upgraded and OTA's will be supported, Chinese reviewers still complain about lack of features. Like not many 3rd party apps, no dashcam, no sentry mode. Sofar domestic China sales were mediocre [below 10,000], while Deepal S05 and Geely EX5 exceeded 90,000 during similar launch time. They changed the marketing manager, but his [Zhou Jinkai] first appearance seen as a re-launch event has been ridiculed on dongchedi.com. Reviews Interior, driving and comparison with European peers Features, interior, exterior, driving Driving dynamics ES5 vs Atto 3 [start at 8:49]

-

Latest Michael Dunne's newsletter, as copied by youtubers like Electric Viking: BYD: So Damn Good – But Not Invincible. What Warren Buffett Might Be Thinking https://newsletter.dunneinsights.com/p/byd-so-damn-good-but-not-invincible Not the main conclusion of Dunne's newsletter, he refers to the hidden debt of BYD, which to him is manageable. However GMT Research's study sees it as an addiction. At the end of the day, BYD like CATL and Huawei are showcase entities for the CCP which will be regarded as too big to fail. Links: https://wallstreetpit.com/122698-behind-the-numbers-is-byds-supply-chain-masking-debt/ https://www.mk.co.kr/en/world/11222381 https://www.gmtresearch.com/en/research/byd-addicted-to-supply-chain/ [ study by GMT research ] https://www.bloomberg.com/news/articles/2025-01-19/byd-s-supply-chain-financing-masks-ballooning-debt-gmt-says

-

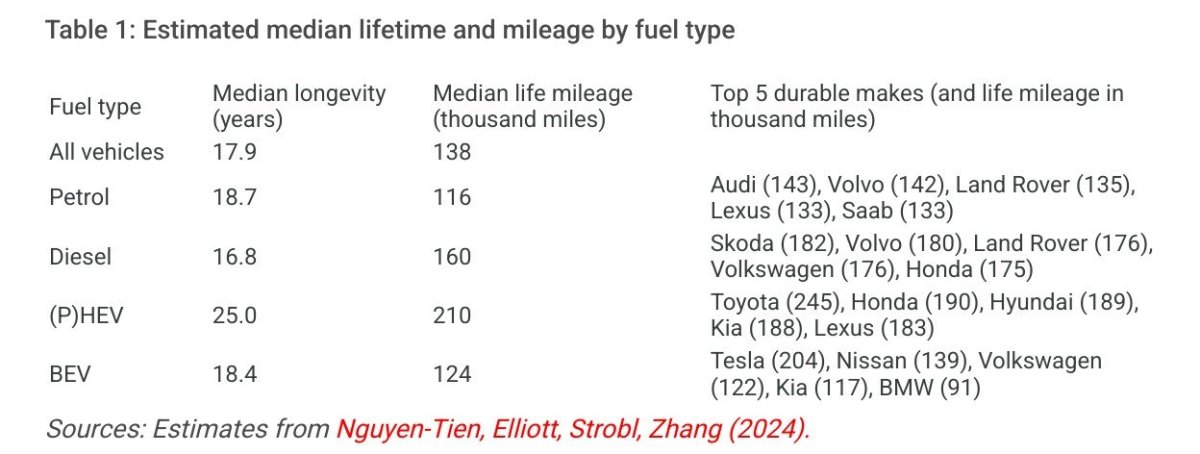

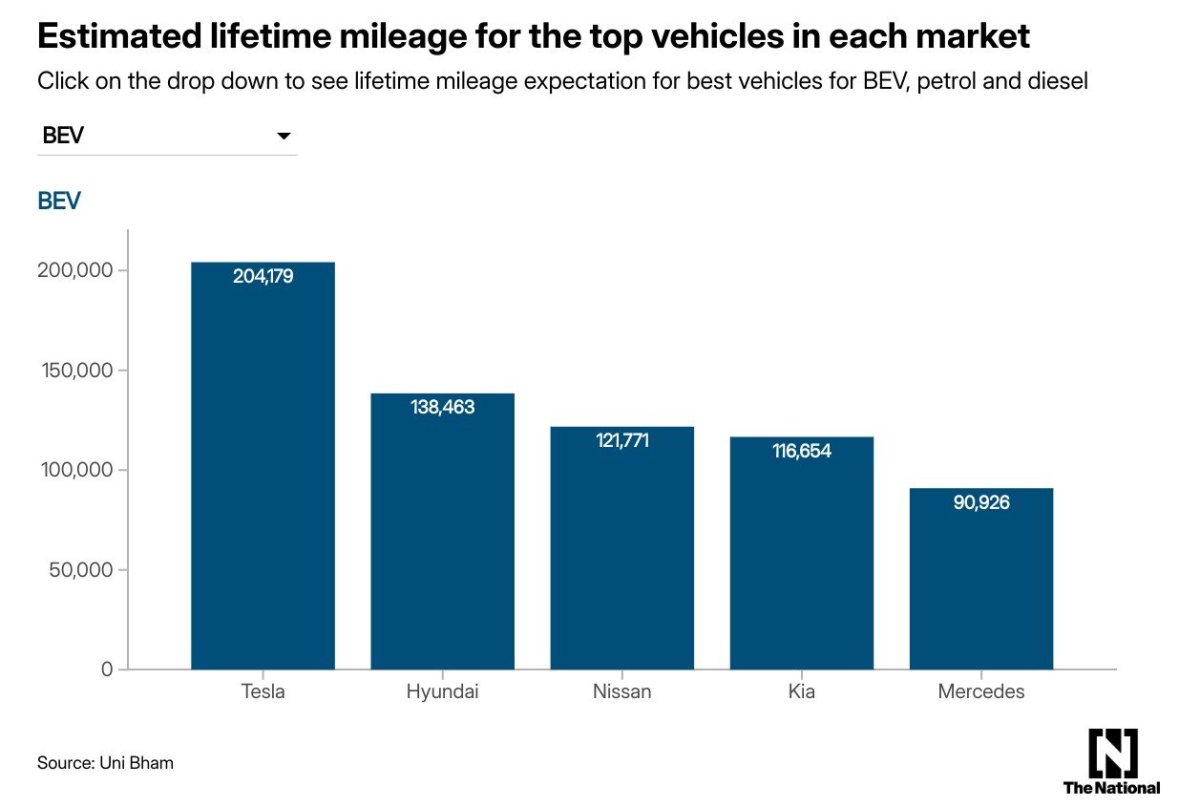

A big data study based on UK Ministry of Transport roadworthiness tests gave some insight in the longevity and reliability improvements of BEVs vs ICE. Key Findings Lifespan Comparison: The study found that newer BEVs have an average lifespan of 18.4 years, which is comparable to traditional petrol vehicles. Notably, BEVs can travel up to 124,000 miles over their lifetime, surpassing the mileage of petrol cars Reliability Improvements: Newer BEVs show a 12% lower hazard rate (likelihood of failure) for each successive year of production, indicating significant advancements in reliability. In contrast, petrol and diesel vehicles exhibit lower improvements in reliability at 6.7% and 1.9%, respectively Technological Advancements: The research highlights that while early models of BEVs were less reliable than internal combustion engine vehicles, rapid technological advancements have led to improved performance and longevity in newer models. This trend suggests that BEVs are becoming a more viable option for consumers seeking sustainable transportation solutions Links: https://www.nature.com/articles/s41560-024-01698-1.pdf [detailed study] https://www.thenationalnews.com/news/uk/2025/01/24/electric-vehicles-now-last-as-long-as-petrol-and-diesel-rivals/ [best readable synopsis] https://blogs.lse.ac.uk/politicsandpolicy/a-novel-way-to-estimate-car-longevity-shows-that-electric-vehicles-life-mileage-is-increasing-fast/ [earlier findings from the authors on same subject]

-

I don't have an EV yet, but I imagine it can be simple as this. You stop as your bladder commands you and you use ABRP [A Better Route Planner app] to compute and route you to the charging stops you need to make, based on realtime battery SoC data ABRP gets from your EV through the OBD connection or the cloud if your EV is connected. And you can sync bladder time and charging stops by setting in ABRP whether you want to have short and many charging stops or few and longer ones. No need to think/calculate, what is my speed, my efficiency and range I can drive before my next charging stop. Links: https://abetterrouteplanner.com/

-

Nope, lead acid. It is 60Vx20Ah battery I believe. Around 200-300 charge cycles. Even if I replace the lead acid by LFP batteries, the charge cycles will increase to maybe 1000. But the problem is these batteries do not have cooling or a sophisticated BMS like in a car. So expect it to replace it after 2-3 years. It's range is 25km with a speed of 20-25km/h. Charging to full takes 6-8 hours. I've installed a solar panel on top with a dc-to-dc booster to charge while on the road. I keep the battery temp in check not to increase over 50C.

-

Surprise surprise. Honda will also launch the e:N1 EV as an import model this March that you can buy. Till now it was only available with a lease. The e:N1 import model is similar to the Chinese e:NS1, made by Dongfeng Honda. The car is based on the HRV platform. A few things why this Honda will not resonate with some buyers: it uses a NMC instead of LFP battery. And it's charging speed is not on par with peers - 78 kw. I expect the price to be between 1 - 1.1 M baht, based on the Chinese top model and with an uptick of 50% of an import model. Maybe they will ask more, because it is a Honda and not a Chinese brand. Turn on English subs: Links: https://autolifethailand.tv/spec-option-unofficial-price-honda-en1-ev-mar-2025/ https://www.dongchedi.com/auto/params-carIds-x-5387 [ Chinese model specs ]

-

According to car250.com Mazda will launch an EV in Thailand, the Mazda 6e. In China this car is known as the EZ6, however with a smaller standard range battery [68kwh]. The car is based on a previous iteration of the Changan Deepal L07. It is a sedan the size of a BYD Seal. On the looks it is a very lovely car and has a bigger boot space than the Seal. But I'm afraid the price will not be competitive to the Seal with discount. Based on the Chinese EZ6 topmodel standard range [68kwh battery] and an uptick of 50% of an import model, I expect the Thai price to be around 1.3 M baht. This is the price of the Thai Deepal L07. A Seal Dynamic with discount is now 1 M baht. Links: https://www.car250.com/mazda-6e-th.html https://www.changan.co.th/en/deepal/l07-en/specification/ https://www.dongchedi.com/auto/series/10137 [ Chinese EZ6 specs ]

-

It depends where you live. I live in a rural area. I've got a similar one and use it for trips with the dogs and to buy large amounts of groceries at Makro. As long as you don't drive on provincial roads it is tolerated. I've even seen a mobile coffee shop on these tricycles. My problem with these tricycles like with e-bikes is the longevity of the battery. But I saw a video lately where they put a BYD blade battery on an e-bike. I hope they have some cooling installed to get the same longevity as in a car

-

I'm still in the woods whether I need to file, even though I have remitted income that Thai RD on paper confirmed that it is not seen as taxable - savings and income prior 2024. https://www.rd.go.th/fileadmin/user_upload/lorkhor/newspr/2024/FOREIGNERS_PAY_TAX2024.pdf Expat Tax Thailand is most clear on this topic [ I do not need to file ], in this video: https://www.expattaxthailand.com/do-you-need-to-file/. However their latest interview with 2 RD tax experts made it less clear. Siam Legal did not answer, nor Benjamin Hart. Some in this forum has chosen a route by filing a nil return. At least you can show evidence even though the rules whether to file are not clear to me. Some is very vocal in saying you have to file, because any remitted income is assessable. I am not buying this argument, as the current 2024 Thai forms only allow a listed Revenue code TEDA exemptions and allowances, that has not been changed between 2023/2024. When I last visited the RD local office, the lady showed a tax calculation that cannot be represented in the form, so is to me not transparent and not usable for future audits, as it will only available in the records of RD. So for now my attitude is to wait and see for a few weeks if there is more news and then make up my mind.

-

I tend to agree on your last speculation - no rushing to tax foreigners as earning/cost ratio for foreigner tax residents is lower than for Thai residents. Here is my logic: 1) the rule changes apply to both Thai as foreigner tax residents. CRS is in place and TRD know more on foreign assets of Thai residents than they do on foreign assets of foreigner residents. 2) Thai residents are not covered by DTA's as foreigners and taxable income of foreigners are alleviated by possibly already taxed income in source country [check Chiang mai TRD 2 way tax calculations notice] 3) I read the google translated Thai guide on PND90 [ https://www.rd.go.th/fileadmin/tax_pdf/pit/2567/Ins90_101067.pdf ]. I have not read any new specific guidance with regards to foreigners or foreign sourced income.