- Popular Post

daejung

-

Posts

741 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by daejung

-

-

-

- Popular Post

- Popular Post

1 hour ago, Bim Smith said:A Thai man who runs a Sushi restaurant. Heard it all. He wouldn't have been so brave if his restaurant was in Bangkok.

Yes, not a democracy when senators are choosen by the army

-

18

18

-

10

10

-

4

4

-

When I created yesterday an account for notification online, the confirmation email I received stated :

Quote* To ensure reply and notification email from Thai Immigration System. Please add [email protected] and [email protected] to your contact list.

-

1

1

-

-

On 9/26/2023 at 10:07 AM, stat said:

Vietnam taxes your capital gains as regular income, you would likely be much better off in Thailand even under the new directive.

Not true for french citizens.

All this depends on bilateral tax treaties.

And if Thailand wants to tax everybody, they will have to renegotiate all tax treaties worldwide, with an impact on thai citizens too.

-

1

1

-

-

19 hours ago, DrJack54 said:

Correct.

Thanks Dr Jack

Not the same subject but a little bit related : I did a 90 days report in April 2023. It was my 1st report (after a new Non-O visa and extension) and couldn't do it online.I left Thailand at the end of April 2023 and will come back in November 2023.

Will my 90 days report, 90 days later, considered as my 2nd report, which can be done online, or will it be considered as the 1st one after my re-entry then to be done only in person at CW ?

Thanks

-

On 9/29/2023 at 6:13 AM, SunsetT said:

Do you mean I need to inform my bank of my new passport number?

yes, and your phone provider as well (AIS for me), and most probably any company that registered your passport number to identify you.

-

1

1

-

-

On 9/28/2023 at 5:22 PM, proton said:

No qualifications to teach and boasting about it on tik tok, how stupid can you get. Hopefully sacked and deported by now. Disgraceful and damaging kids education even more than normal.

Read this before reacting : https://www.sanook.com/news/9051322/

There is no issue at all. They are students

-

13 hours ago, DrJack54 said:

It's about continuity of your permission of stay

That does not mean physical presence in Thailand.

The reentry permit "protects" your permission of stay.

I didn't know that. I left Bangkok last april, my TM30 was made in November 2022.

In November 2023, I will go back to Bangkok with a re-entry permit and an extension of stay based on Non-O retirement and stay at the same place/condo.

So, when I'll make a new extension at CW in February 2024, I will show the TM30 made in November 2022 ?

-

17 hours ago, DrJack54 said:

Don't forget to update bank account information.

DTL not so important.

Also for phone provider, AIS in my case ????

-

On 9/24/2023 at 8:34 AM, AAArdvark said:

I use an Android app (90 days report)

Is it an official Android App ? Any link?

-

10 hours ago, webfact said:

A 100-kilogram cow

100 kilograms for a cow ?

must be a young calf

-

On 9/18/2023 at 1:44 AM, jacko45k said:

Twice as much as for fat! Need to pay for the bananas.

More weight but less volume than fat

-

1) Bangkok

2) Bangkok

3) Bangkok

4) Bangkok

5) Bangkok

-

1

1

-

1

1

-

1

1

-

-

1 hour ago, Startmeup said:

Not quite true. It depends on the rates in your home country and the rates in Thailand. If you pay rates in your home country equal to or greater than what the rates are in Thailand then you won't be taxed. If you pay less tax then Thai tax dept will take the difference so it meets Thai taxation rates. Maybe there will be exemption for taxations on government pensions, I dont know.

Not quite true. Depends upon each tax convention

-

1

1

-

-

7 hours ago, Isaan sailor said:

Thailand to tourists—please come.

Thailand to expats—please leave.

What about tourists transferring money to their bank account in Thailand ? They speak about tax residents so people that are not tax residents (generally staying more than 180 days) are not targeted.

As for tax residents themselves, Thailand would first have to renegotiate international tax convention signed with many countries.

-

1

1

-

-

- Popular Post

1 hour ago, liddelljohn said:hopefully the super obese will be alloted 2 seats , and the sweaty unwashed people made to shower

Or maybe they will pay double price ?

-

9

9

-

- Popular Post

- Popular Post

17 hours ago, steven100 said:why wouldn't it make sense to get rid of them ... the war would cease tomorrow imo.

A nuclear war would start

-

2

2

-

1

1

-

18 hours ago, SuperSaiyan said:

It's a terrorist attack because they are "civil leaders", not military leaders, the same way Zelensky is still alive today.

Russians tried to kill him

-

Oops, I should have found out myself

Thanks

-

On 8/8/2023 at 9:27 AM, Photoguy21 said:

Perhaps due to a lack of effective policing

The worst are already in France

-

1

1

-

-

Hello,

I just discovered this :

Customs Procedure for arriving passengers at the Nothing to Declare or Green Channel :

QuotePersonal belongings in reasonable quantity, which are worth no more than 20,000 baht in total and are not prohibited or restricted goods or food

20,000 baht is quite low. My luggage was never checked and my personal belongings are always much over this limit and most probably the same for all tourists

This is very strange! -

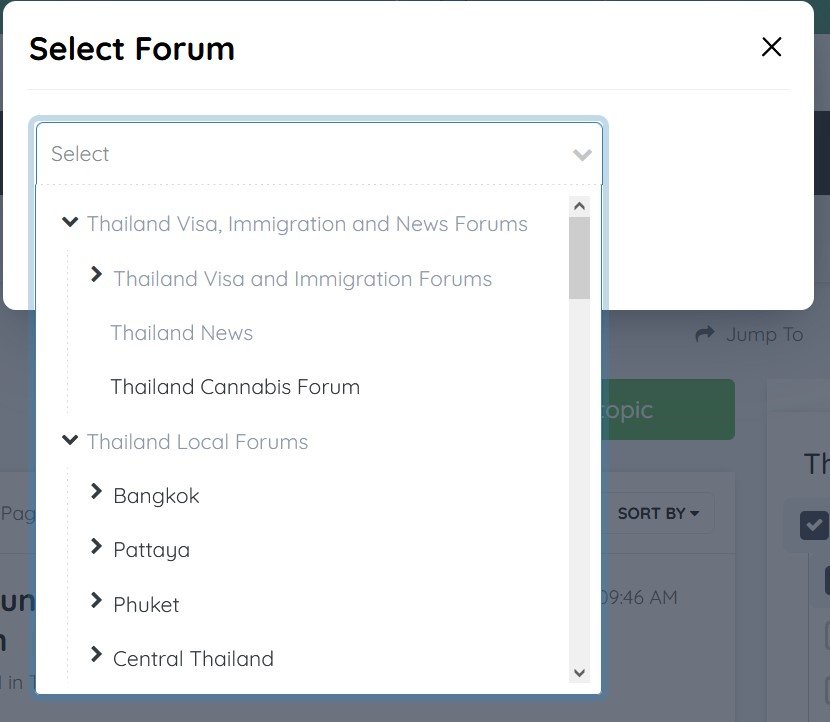

Hello,

When I want to create a new topic in "Thai Visas, Residency, and Work Permits", I can't select that forum. This choice is shaded in the list.

How do I do ?

Thanks

-

7 hours ago, Caldera said:

That depends. At some immigration offices, you won't get past the document check without a TM30 receipt. So even when it's in the system, you still need to add a screenshot of your record to your documents.

Yes, at Chaengwattana, they asked for a TM30 receipt when I made the 90 days report on april.

-

On 9/8/2023 at 2:37 AM, steven100 said:

OP ..... as mentioned by others, it's no different from the owner/landlord having a key, usually a master key that can open every room.

It's common practice ..... what if there's an electrical fault in your room and a fire breaks out and your not home, he needs access, or a water pipe bursts ... he needs access.

It's no big deal, just hide valuables or lock them in a bag, also put a camera on the door if your that concerned.

For me, not a problem if the landlords has the code. A bigger problem if he does not change the code when the tenant changes.

-

1

1

-

1

1

-

More details on Thai taxation of overseas income

in Thailand News

Posted

True. Tax agreement says where each type of revenue is taxed.