-

Posts

498 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by ChasingTheSun

-

Minibus not worth the hassles/time unless you are on the verge of bankruptcy.

-

Thailand’s Destination Visa loophole that could cost you

ChasingTheSun replied to snoop1130's topic in Thailand News

Tax man cometh for thy destination visa peeps. -

Indian passengers turn Thai AirAsia plane into party zone - video

ChasingTheSun replied to snoop1130's topic in Thailand News

They’re eating the dogs, they’re eating the cats!- 184 replies

-

- 20

-

-

-

Pattaya bar girl scams 10 million baht from South Korean man

ChasingTheSun replied to webfact's topic in Pattaya News

I need to see a clear full body picture of the gf before i can make a judgement. -

Boy 7 killed by Thai mother rocks quiet Welsh town

ChasingTheSun replied to webfact's topic in Thailand News

Make the electric chair great again! -

And so the exodus of quality expats begins. This time it's personal

ChasingTheSun replied to Galong's topic in Phuket

As long as they dont start to include worldwide taxes on those visas you would be safe. -

And so the exodus of quality expats begins. This time it's personal

ChasingTheSun replied to Galong's topic in Phuket

i doubt that there will be a “changing of the guard.” Low income expat pensioners cannot replace an exodus of wealthier expats. -

And so the exodus of quality expats begins. This time it's personal

ChasingTheSun replied to Galong's topic in Phuket

If the tax laws change to include a new taxation of an expats non-Thai/worldwide income, regardless of if/when it is remitted, you will indeed begin to see a very serious “mass exodus of quality expats” from all over Thailand. -

Destination Thailand Visa (DTV) Success Faces an Uncertain Future

ChasingTheSun replied to webfact's topic in Thailand News

35% is “fair”? what do you get for your 35% donation to Thailands coffers?- 72 replies

-

- 17

-

-

-

-

Destination Thailand Visa (DTV) Success Faces an Uncertain Future

ChasingTheSun replied to webfact's topic in Thailand News

Are these guys gonna report their worldwide income in Thailand and then pay Thailand taxes on it if they stay longer than 6months in a calendar year? -

And so the exodus of quality expats begins. This time it's personal

ChasingTheSun replied to Galong's topic in Phuket

The problem is that for every one that leaves, two more are coming! -

And so the exodus of quality expats begins. This time it's personal

ChasingTheSun replied to Galong's topic in Phuket

Yes it is a big island and offers something for everyone. East coast property is much cheaper and far less visited for many reasons. Enjoy the east coast if thats your thing, but most people understandably prefer the great beaches and amazing sunsets on the west coast. -

Can you name somewhere that got better over the last 40 years?

-

And so the exodus of quality expats begins. This time it's personal

ChasingTheSun replied to Galong's topic in Phuket

what are the significant changes which you feel happened since 2009? -

And so the exodus of quality expats begins. This time it's personal

ChasingTheSun replied to Galong's topic in Phuket

Have lived in Phuket since 2009. Haven't seen any significant changes since then. - a few new condos and malls. - more Russians/Ukranians than before the SMO - chinese tour groups came, then disappeared, then came back - a few more indians/north africans/GCC tourists - traffic a little worse Prices to buy/rent villas and condos have generally increased, and that has probably driven-out many lower income long-term expats who just cant afford it. Still waiting for someone to tell us where it is better overall in SE Asia?? . -

Thai visa agencies offer hassle-free DTV applications

ChasingTheSun replied to webfact's topic in Thailand News

The DTV visa agencies will also register Tax Identification Numbers for all the new folks who will need to start paying tax on their worldwide income as tax residents of Thailand? Asking for a friend. . -

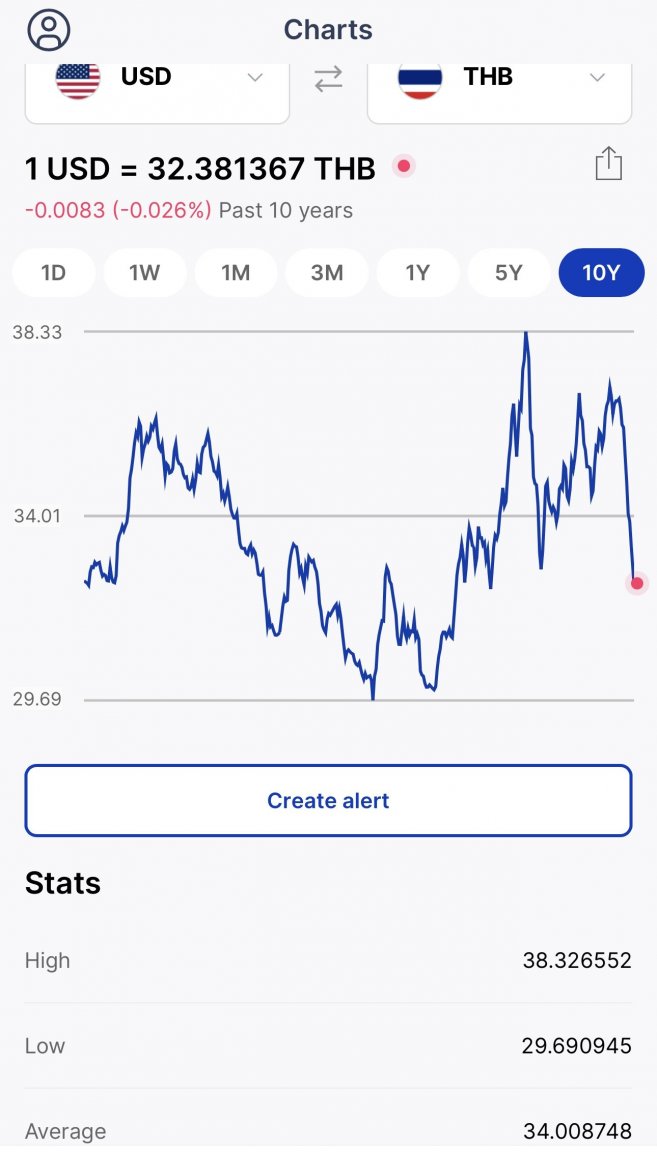

Rising Baht Sparks Fears of Another 'Tom Yam Kung' Crisis

ChasingTheSun replied to webfact's topic in Thailand News

Nothing to see here folks. Typical exporters cribbing when the baht is strong, but silent as they gorge on a weak baht. The baht is just slightly stronger vs USD on a ten year average. -

Destination Thailand Visa Sparks Interest, Faces Future Hurdles

ChasingTheSun replied to webfact's topic in Thailand News

And how will those who stay longer than 183 days in a calendar year be taxed in Thailand on their worldwide income? -

Thai tax riddle: Elite Visa holders off the hook?

ChasingTheSun replied to webfact's topic in Thailand News

Lots of countries don't tax personal worldwide income/cap gains. Singapore and HK are two prominent ones in Asia. Thailand would be in good company if they just keep the system as is. Otherwise, they will lose most of their wealthy retired expats, killing the real estate industry and a big part of the consumption they represent. -

Baht's Biggest Surge Since 1998 Poses Risk to Tourism And Exports

ChasingTheSun replied to webfact's topic in Thailand News

The baht is still 10% weaker vs USD from 2021. just about the average fx rate vs USD over the last ten years. its a sign that the Thai economy is relatively resilient compared to some weaker neighbors.- 161 replies

-

- 15

-

-

-

-

The thing is, there are many thousands of foreigners residing in Thailand who have far higher incomes than 95% of Thais. As such, foreigners can supply a HUGE easy new tax revenue source per capita vs Thais. It’s easy to force every foreigner to get a Thai tax ID in order to maintain their visas. Foreigners tax situation will be vetted at every 90day immigration report, or at minimal once per calendar year. Now foreigners will need to pay tax in Thailand, and they will get nothing for it. 😢

-

You underestimate the revenue incentive and ability of the TRD when it comes to sharing information with foreign governments. Its easier than you think. If you are mostly relying on a foreign pension to survive, and are already taxed on it overseas, then you can probably sleep well. Everyone else with foreign income and cap gains will be in for a shock when the Thai tax man cometh for them.