kiever

-

Posts

192 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by kiever

-

-

Thank you so much ☺️

-

Everybody can have bank account in Thailand even if upon visa exemption. Just go tiktok services in Pattaya. They charge 4500 baht to open bank account for you That is all.

-

I need ENT specialist in phangan. My ear is blocked because of ear wax and sea water. I called phangan western hospital and Bangkok phangan hospital but they don’t have ENT physician. They both told me they have eye doctor and general practitioner that they can clean my ear. If I insist on ENT, I need to go Samui , they told. I look for recommendations for cleaning my ear by a specialist in phangan. Do you have any experience on phangan ? Which clinic or hospital I need to go ? Walk in clinics can do it ?

-

-

Anyone use online tm6 form ? I downloaded app but never used it. any users ?

-

6 hours ago, emptypockets said:

Blood fully loaded? say what?

He means drugs

-

I live in Koh phangan , not Phang nga.

Surat Thani immigration is very good I think.

I sent tm30 by registered sasa mail before 1 monthts to Samui immigration but still nothing to come back.

I registered online tm30 system without house book , owner id and lease contract but accepted very quickly. I just uploaded my passport , tm6 and my visa and that is all.

-

If i move to another house in phangan , I can again register online tm30 with different address ?

-

-

thank you. i used section38 app and it was very easy to register and submit address.

-

Because of my weight problem I quit my work in my home country and come Thailand. Here I eat only seafood vegetables and fruits. Oats, Skimmed milk and yogurt and everyday swimming minimum 30 minutes. I have meniscus on my both knee therefore running and jogging is prohibited. I was 130 before 2 months. Now I am 120. Just in 2 months I lost 10 kgs without heavy exercise and diet.

I just stopped eating red meat beef pork lamb , even I don’t eat chicken.

And forget about carbohydrates such as bread pizza and sugary food.

For me hardest thing is find food without msg.

I take b vitamins as supplement.

That is all.

-

1

1

-

-

-

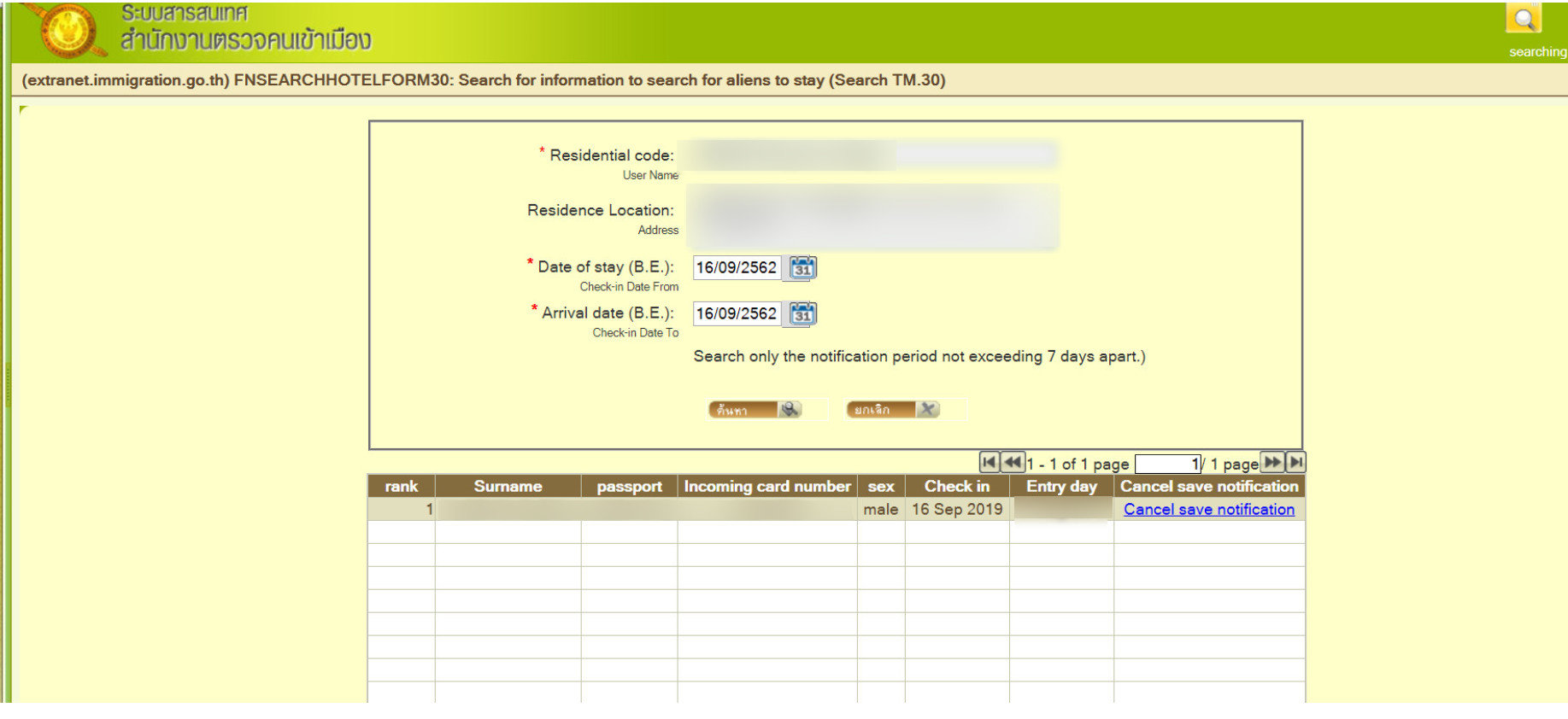

Any idea ? Just print this screenshot is ok ?

-

1

1

-

-

i live in koh phangan. which immigration office i should go to get residency certificate , samui or suratthani ? i was planning to go samui immigration but i registered for tm30 online and today i received password by email from surat thani immigration, not samui. so i should visit suratthani for residency certificate and 90 days report ?

-

hi

i live in phangan in a rent house. not condo. and before 2 weeks i hopelessly registered tm30 by using section 38 application on my phone.i dont have rental contact and landlord id , also no power of attorney.i registered as tenant and today i received username and password from surattahni immigration. i quickly made notification of residence and it was successful. when i check from application and from my pc, i can see that my notification is successful. but where i can print receipt of notification ? i couldnt see it on application or website of tm30. i have this screen on tm30 website

-

Thank you so much. You answered all questions in my mind

-

14 hours ago, Rod the Sod said:

For the year ending 2019 you go in March 2020 and complete a Tax Return. They will help you and you simply tell them you have no earned income and you are doing this to get a refund of WT. They will be quite happy with that and you will not get a tax demand. Income from previous years appears to be treated as savings and is not subject to Thai tax.

The Tax Man thought it was hilarious that I wanted to complete a zero tax return and pay a late fee of TB200 for 2017, until I explained how much I would get back from Switzerland in refunded WT. Then he got it, so no problems doing that. No need for an Accountant if you follow my guide.

Glad I could help.

Cheers

Rod

MAny thanks for your help and answer.

I have lots of wt tax in my home country , but I have no wt in Thailand because I have no deposit account in thailand.

This is a problem ? Tax man will want to see a proof of wt in Thai bank ? Or it will be enough to declare I will get back wt from my home country and I have no wt in Thailand ?

-

3 hours ago, Patanawet said:

Do holders of ELITE cards have to comply with TM30?

this is easiest question in the forum about tm30.

- yes --

1

1

-

-

I have no wp

-

On 3/6/2019 at 10:59 AM, Rod the Sod said:

Oznomad, first go to your local Tax Office and register for tax (take passport, Blue Book etc.) and they give you a number. The tax year runs Jan 1 - Dec 31 and so before end March go and ask to complete a tax return taking your Tax Number with you. If you are late they charge you TB200 penalty. They will probably complete it for you. If you are reclaiming withholding tax on Bank deposit interest you need a certificate from your Bank beforehand (just ask them for it). After two weeks you receive your tax refund. So that is your tax registration and return completed. Now armed with a copy of your tax return (duly stamped and signed by the Tax Office to show it is legit) and usual ID/Blue Book papers you go to the Department that issues Tax Residency Letters. I asked the first tax officer and he gave me the details for my area (if you are in Wattana BKK I can let you know these). The only other thing you need do is photocopy your passport pages and highlight the entry and exit stamps. You need to show that you have been in Thailand for 181 days (I think or thereabouts), so I created a table in "Word" that showed them the dates and I cross referenced to the photocopy stamp pages. They were happy that I had taken away the hard work for them and was told to return 2 weeks later. I claimed Tax Residency letters for 2017 and 2018 and on the due date, there they were. Without these you cannot claim tax back under double taxation laws so well worth the small amount of effort involved. Good luck. Let me know if you need to know anything else. RtS

Hello. First of all thank you for your post. I was trying to exactly same thing. I spent more than 180 days in Thailand until today in 2019. I have some questions:

I need tax residency letter for 2019. For that :

- I need to wait until first three months of 2020 to apply 2019 tax residency certificate ? Because I can only complete pnd90 for 2019 in first three months of 2020 and until end of March ?

- I don’t want to pay any taxes in Thailand. Because I have no income in Thailand also I didn’t bring any money from overseas same year I Earned. I transferred money to Thailand that I earned previously years. In this case I will pay no tax in Thailand ?

- in tax office , they will help me to fill tax return ? and again ,I should complete pnd 90 until end of March of 2020 ? Not before ?

- is it ok to pay zero tax and complete pnd90 tax return with zero income - zero tax ?

- and do you think I should get help from accountants?

- I quoted for tax residency letter from law offices between 4500 baht -30000 baht. Your post is great. Almost for one year I was trying to find answers for this. Many thanks again.

-

I have been told immigration will not issue residency certificate unless I did 90 days report. This is correct ? I’m here for 1 month and didn’t do 90 days report yet. In this case I must visit my embassy in Bangkok to get residency certificate?

-

I can also buy 2018. Not strictly 2019.

And I have residency certificate from my embassy but issued before 5 months when I lived in Pattaya and shows that my address in Pattaya. I wonder if this certificate will be accepted by land transport office ?

-

Thank you. I stay in Lamai. I can go and check everywhere in Samui. I try to find

2019 models

honda Forza

honda psx

yamaha xmax

Yamaha nmax

-

I want to buy second hand motobike in Samui. Do you know a reputable shop ? I couldn’t find anything online. Thanks.

Ear nose throat physician in phangan

in Health and Medicine

Posted

They didn’t have ent doctor.