kiever

-

Posts

192 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by kiever

-

-

-

2 hours ago, topt said:

Have you had a look at any previous threads?

Many thanks I had missed that Thread.

-

On 3/23/2018 at 12:10 PM, ChouDoufu said:

**UPDATE v2.1**

SMS sent from tax office to notify refund approved march 20

check covered refund for tax paid on fixed account

bank interest and tax paid on dividends.

Did you fill pnd90 form or another form to get withheld tax ? I think it should be standard pnd90 form for using personal income tax return ? You have no other income and only filled pnd90 form to claim tax return ? I will do same for next year also. I Just want to be sure. Very difficult to explain myself in local tax office. I think it is the best way to fill pnd90 online and wait until you get your refund cheque or tax office want you to upload something extra.

and taxpayer id of the payer is tax number of your bank ?

-

Hello. Can you advise me a broker to do health insurance in samui ?

-

10 minutes ago, Peter Denis said:

Hi Kiever,

From the thai insurance companies it seems that PacificCross offers policies that are worthwhile.

But @Sheryl for sure will be able to give you good advice on the options.

As I am well-covered in my home-country, I make use of travel-insurance to cover the risk of any serious accidents/illnesses while staying in Thailand. Travel-insurance typically covers any accident/illness that needs immediate treatment, as well as re-patriation when required. That's a perfect solution for me, but of course the options are different depending on circumstances (nationality / residence / insurance options in home-country / etc.)

travel insurances covers up to 3 months in my home country therefore i want to buy a health insurance in thailand. what about axa ? i dont need it for my visa, i only want to have for my own safety.

-

I am also interest with this topic and look for a decent health insurance , not compulsory one for visa

-

On 12/26/2019 at 3:02 PM, Peter Denis said:

I presume you are referring to the physical examination screening for applicants to subscribe to an IO thai-approved health-insurance policy now required on extension of your Non Imm OA - retirement Visa.

A somewhat alternative point of view.

>> Lucky for you that the application was rejected by the insurance-company!

They actually denied you subscribing to the expensive and basically worthless bogus thai-approved health-insurance scam.

I will PM you a roadmap on how to convert from an OA - retirement Visa to an O - retirement Visa. Requirements and conditions for both Visa are identical, with the exception that the Non Imm O - retirement Visa does not require the bogus insurance.

The whole conversion process will cost you max 7.000 THB, and the money you saved by not subscribing to this insurance scam can then be spent on decent health-insurance (if you are not well-insured already).

Happy XMas!

Hello. Can you advice a good insurance company ? I also want to make a health insurance. Not for visa requirements. I want to make it for my safety.

-

Deleted

-

Btw , I’m from turkey. I checked Pacific cross standard extra and premier packages. About 20000 baht / year also not a big deal. Anyone use these packages and this company ?

-

Hello. I live in Thailand and I am 37 yo male. I want to get an insurance for affordable price. I heard there is accident insurance in Bangkok bank. Is it worth its price ? It is quite cheap, as far as I remember 4500 baht/ year. Is there other alternatives ? If I’m seriously sick I can fly back my country but what happens if I cannot fly back ? Therefore I want to have a insurance in Thailand for emergency.

-

On 3/3/2018 at 3:59 PM, ChouDoufu said:

***UPDATE***

after a couple weeks, the tax lady from lad phrao finally called us.

she consulted with her lawyer who said i did not have to pay income

tax on savings brought into thailand. good news.

more good news........okay to file for refund AND can file online.

http://www.rd.go.th/publish/300.0.html

went to the revenue department page, registered online using my new TIN.

filled out the form 90 with help from a native speaker. application was

accepted, and printed out a copy. should receive a check at my home address.

can check status online in 3 days.

there is a link to english hidden at the bottom of the page. this gets you to

downloadable forms and instructions in english:

http://www.rd.go.th/publish/56815.0.html

there was an option on the website for uploading a form OR using the

online thai system. we opted to fill out the thai form online after filling

out and referencing the english form.

interest and dividends go in no. 3, section 40(4). there are two lines

where you choose type of income for 40(4). the first one let us enter

dividends/interest for each payer along with the tax paid and payer tax id.

there is a "+" icon at the bottom to add more payers. the second 40(4)

option was for dividend payments directly from a thai corporation.

tried that one first, could not get it to work. after entering all interest

and dividends data, hit next and the system did all the calculations.

you must enter the taxpayer id of the payer. online system lets you add

entries for each payer. not sure you would handle that with the paper or

uploadable versions, as there is only one payer id space for all the possible

sources of income within no. 3.

only hiccup was the final check. form was not accepted unless filled out

lines for "company" and "website." those could not be left blank.

i used " เกษียณ " and "www.nowebsite.com"

Hello friend. When I read your post I smile because I had exactly same experience yesterday.

-

clear. dont need to open us dollar account then. i was planning a trip to philippines and didnt want to change baht to dollars. i thought just will be easier to open us dollar account and transfer dollars directly. transferwise works like a charm. i can send baht and exchange them to us dollars in thailand. cheaper, easier.

-

On 1/2/2020 at 11:25 AM, Caldera said:

Can you elaborate on that, please? Is that an agent that assisted you with opening an account? Did you need anything besides your passport?

http://tiktokservicesthailand.com/

they set up bank account for me when i came LOS with 30 days tourist visa (30 days visa exemption). i didnt have even tourist visa when i came .

dont need any paperworks other than your passport and dont need to buy silly insurance from bank.

i also get my thai driver license with them in 3 hours only.we went land of transport mornin 07:00 and i was keeping my driver license at 10:00 am

they are just great.

bad thing : they provide their services only in pattaya-

1

1

-

-

TransferWise rocks !

-

Minimum deposit is 1000 usd and minimum balance is 250 usd. So when I open my account I should deposit at least 1000 usd ? If I keep zero dollars still I need to pay 10 usd monthly ?

-

4 hours ago, LivinLOS said:

The other option I would guess is to have a savings account, taxed at source, and file a return on that 'income' which will usually be refunded as the deductions are far under the tax threshold.

If I do as you said , which kind of tax return I will file ? Now I did pnd90 tax return. To claim withholding tax , I will still file pnd90 or another form for tax return ?

-

I will set up US dollar account in Bangkok-bank. Nobody told me this also.

-

If there is zero tax , you cannot use online tax file system. You need to go tax office and officers will help you. Today I experienced it.

-

- Popular Post

- Popular Post

You are right. There was a communication problem. I also agree with you thai people doesn’t like Muslim people but it was not valid for tax officers I visited. They are extremely friendly and helpful. The taxman yesterday I talked had no enough information. I did it today with other officer. I already go with my Thai gf and today I talked with another officer. I explained myself by help of my Thai gf. I signed a statement that I have no income in 2019 and I live with My savings from previously years. I paid zero tax and make tax return. And then they take my passport to calculate how many days I stay in Thailand and they told me after 3 days my residency certificate is ready. That is all. Pay zero tax and be tax resident in Thailand. I love this country.

-

2

2

-

1

1

-

34 minutes ago, userabcd said:

In your home country they withheld tax on what (dividends, interest, capital gains?) If so what are the rules in your home country about taxing your income where it is generated?

If you are trying to get a tax residence certificate in Thailand you need to pay tax and submit tax returns. RD on their website list the requirements for what is needed for getting a tax residence certificate. Just living in Thailand does not suffice.

What does your home country say about residence, just living in a other country does not automatically confer non residence for tax purposes and also depends on your ties back to your home country. All this depends on your home country tax rules.

Maybe your home country tax office want you to show them that you have paid tax on what you are trying to reclaim from them (double taxation and applicable under the treaty) and then they will reimburse the tax provided you show them you have already paid tax on that income where you currently live.

My home country (turkey) wants me to provide certificate of tax residency. That is all. Other users at Previously posts in this topic says they can Submit tax return with zero tax and get certificate of tax residency.

-

1 hour ago, JimGant said:

You never said what country you're from..... Are you wanting a certificate of tax residency (whatever that is) to avoid taxes in your home country? Using Norway as an example, you need to show a Thai tax return for the Norwegian pensions declared and taxed in Thailand. Then, you get a pass from the Norwegian tax authorities. Don't pay any taxes in Thailand (your situation), no pass. Not exactly sure what you're trying to do? As you state, you have no income taxable in Thailand -- but is it taxable in home country, and you're trying to avoid paying taxes there, as well as in Thailand? Good luck, as the OECD countries are cracking down on "no taxation anywhere" thru badly written tax treaty language.

As far as the joker in the Thai tax office, there's no way you have to report your deposits in Thai bank accounts. Eventually, maybe, Thai tax authorities will be able to see direct deposits from overseas pensions, and per tax treaty, conclude they are taxable first by Thailand. But the prudent individual will filter these through a home country account, so as to not show them as same year deposits into Thailand (but, I suspect that "same year" rule is being closely looked at, as a major source of lost revenue).

Anyway, I'm kinda lost in all of this -- but were you also denied a Tax ID? And, if so, why? (No filed tax return, perhaps?)

I have tax id. I don’t make anything illegal. I live in Thailand and in 2019 I spent here in Thailand 9 months. Therefore I have right to get certificate of tax residency. There is not anything wrong here.

i have withholding tax in my home country and I want to get it back. If I have certificate of residency I will get withholding tax back. That is same thing other punters write in this topic.

I just didn’t understand why thai tax office told me I should pay tax for the money I transferred to Thailand in 2019, doesn’t matter which year I earned this money. Rules are changed ? -

But in this case all expats needs to pay tax in Thailand. If they don’t declare and don’t pay , this is also illegal.

According to tax man , this is not true

“We only need to pay tax if only We transfer money same calendar year We earned to Thailand but if I transfer money from previously years I earned , this is not taxable “. Tax man told me this is not true.

-

Today I visited revenue department to file tax return and get certificate of tax residency. Taxman asked me how much money I transferred to Thailand in 2019 and told me I need to pay tax for this money in 2019 year. I don’t work in Thailand and I have no income in 2019. I only transferred money to Thailand from my savings that I made in previously years , not from 2019 income. Taxman told me doesn’t matter which year I get my income and he insists that , I must pay tax for portion of money I transfer to Thailand in 2019 and he demand statement of my bank account in Thailand. According to him , I should pay tax for 500000 baht that I transferred in 2019 to Thailand based on my bank account statement. This means roughly I should pay 27500 baht tax. How you guys make pnd90 tax return with zero tax and get certificate of tax residency?

-

1

1

-

-

I used tik tok services in Pattaya to open bank account with online banking

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)

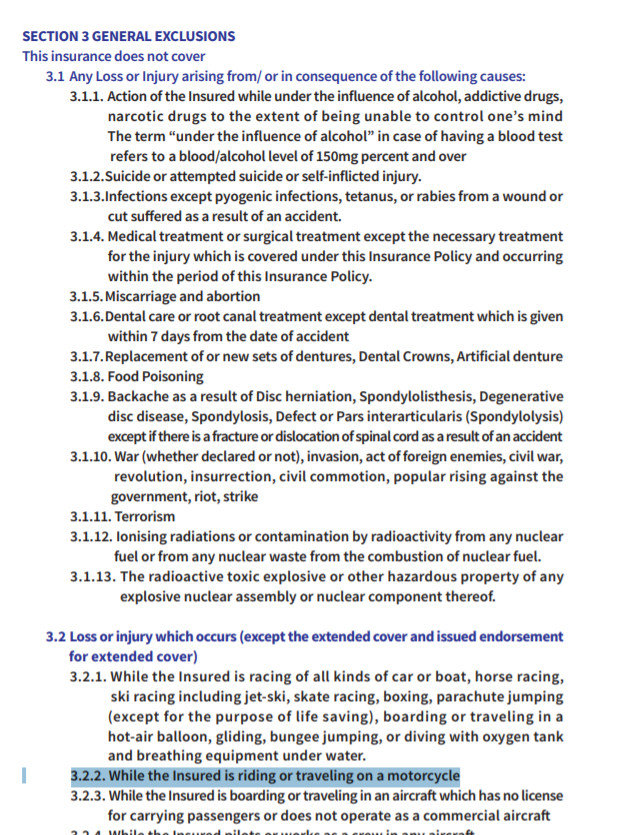

O-A Visa health insurance

in Insurance in Thailand

Posted

pm sent