- Popular Post

-

Posts

4,682 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by redwood1

-

-

- Popular Post

- Popular Post

Hey I thought it was KhunHeinekens job to bring up the possible future link between taxes and visas......He never stopped bringing this up countless times no matter how many people told him shut up repeatedly.....but like a broken record he never stopped......Page after page after page...

For all you who have a unhealthy fascination with the subject.....Let me remind you Thailands expats come from many dozens of countries besides Caucasian expats of European origin...

And no way ever will they get all the expats onboard with the tax thing....Not ever and I mean absolutely NEVER.....So you can just forget about the tax visa fantasy....

-

2

2

-

1

1

-

1

1

-

3 hours ago, Merrill said:

I am moving to Thailand this year lock stock and barrel do I need to pay tax on the money I have for the purchase of a House in my son's name he is a Thai citizen. second do I pay tax on my UK pension? Cheers for any advice

Here is some advice for you.....Go ahead and do what ever you want.....

And remember......Loose lips sink ships.......

In other words dont volunteer any info EVER.....And avoid any tax office like the plague......

Every ones financials are individual including yours....But this should move things in the right direction...

-

1

1

-

-

9 hours ago, ronster said:

Always amazes me the amount of money people have to buy multiple tickets . There are ones with 20 tickets of the same number you can buy that are around 2500 a time to buy. I think I have even seen books with 30 of same number, must be a serious gambling addict to buy them or rich.

Amazing is not quite the right word....

A mostly stinking fixed lottery I think is closer to how it is....

Most ALL the time the top winners have bought 10 -15- 20 tickets on a single number..

Ok fair enough if it happend 1-2-3 times.....But not almost every bloody big draw...No Way........This smells very bad.....This has been going on for as long as I have noticed.......At least 15 years....

-

Is pulling random numbers out of thin air, Thailand's national sport?

-

- Popular Post

I am very disappointed in this thread.....Only 7 pages long.......

In the old days like 9 months ago we could rack up 30 pages in short order....

Must be a lot of cynical ,curmudgeon people out there who thrown in the towel and who have filed this subject in the bin.....

-

1

1

-

1

1

-

1

1

-

3

3

-

I would consider any legitimate E-mail from the revenue department a Scam....lol

-

1

1

-

-

- Popular Post

- Popular Post

I suggest for you to take up heavy drinking......Then the experts will not bother you so much...

-

1

1

-

8

8

-

1 hour ago, Jingthing said:

We're talking about different things and I'm finding your line of posting tedious.

Wait and see how TRD treats such withdrawals.

If they include them, then the question will be about the specific source of the withdrawals (accessable or not).

Thailand will definitely be able to see those transactions.

No, they won't know whether the source is accessable or not.

Pretty much the same as wire transfers.

It's up to the tax resident to report accessable remittances.

Have you filed?.....I very seriously doubt you have, or you have any plans to file....Maybe you should wait till you file before you start telling people what they can or can not do which you seem to be doing pretty often these day.....It gets real tiring after a while....

-

2

2

-

-

9 minutes ago, khunPer said:

At the beginning of the change of the savings-taxation and demand for foreigners' taxation, we were told that details would come later.

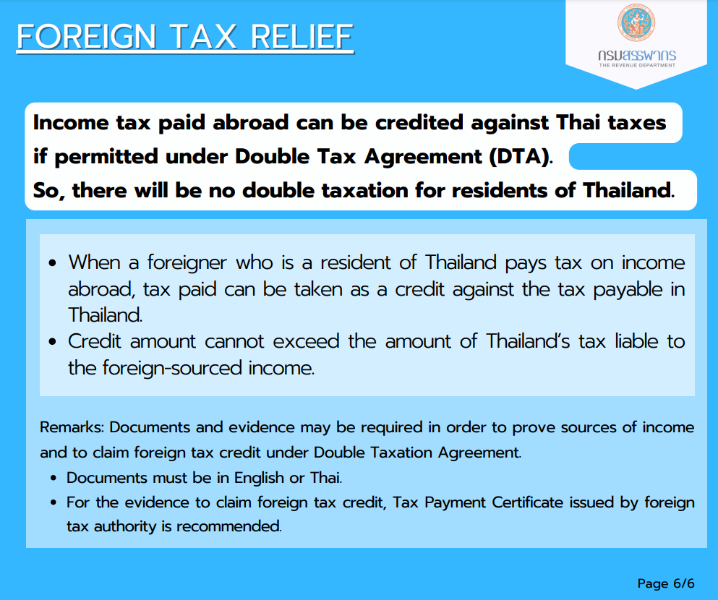

Deadline is 31st March for 2024-tax year. Due to the official postings, tax-resident foreigners need to declare taxable income – i.e., anything earned after 1st January 2024 and transferred into Thailand, including ATM withdrawals on foreign cards – but can be credited already paid foreign income tax for those amounts that has already been taxed abroad and is covered by a DTA (Double Taxation Agreement). Bear in mind that DTAs are slightly different from country to country, so you need to check you own home country's DTA.

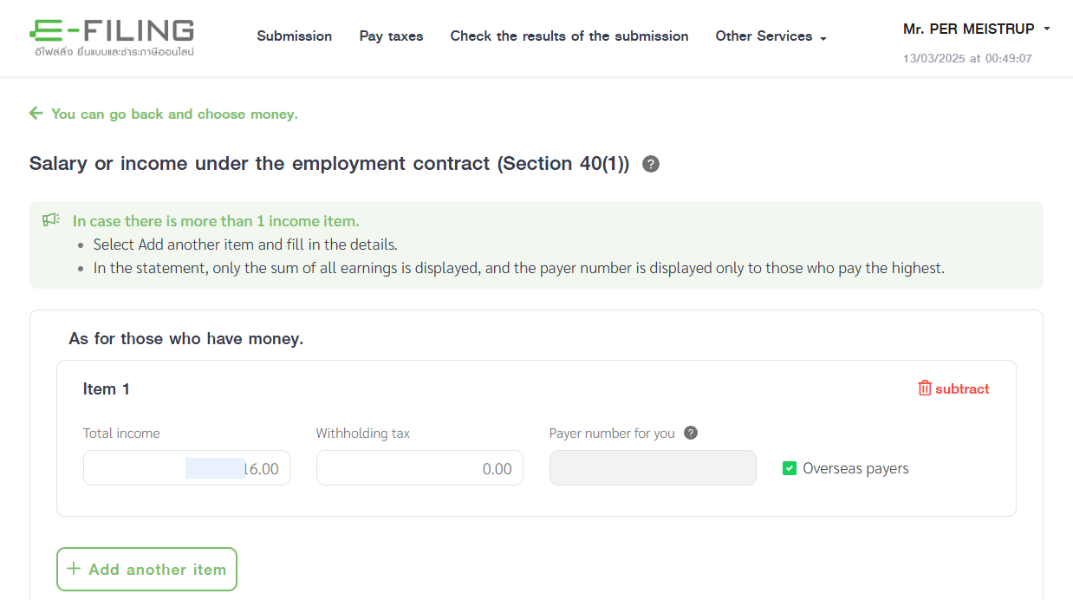

A had a meeting – actually two, see more below – with the local revenue office director, who insisted that foreign already taxed income – for example retirement pension – shall be registered in the tax return form. However, income tax covered by a DTA shall be credited. Easy to be done online with E-filing...

However, there seems to be a system-error. You can only mark "Overseas payers" if "Withholding tax" is 0.00. And if you place any amount in the "Withholding tax"-field, a Thai "Payer number for you" is needed. I've set my browser to translate the Thai characters in E-filling to English, which is why you see English in my screen dump.

A second meeting with Big Boss in revenue department unveiled that it was impossible to credit foreign paid tax. The staff tried with access to my E-filling profile, and even a call to "someone important" up in Bangkok didn't solve the problem. If you need to deduct foreign withheld tax in accordance with a DTA, you need to fill in a paper P.N.D.90 tax return form – which has to be the one in Thai language and you name and address in with Thai characters; perhaps your local tax department in the Aphor-office might do it for you. You need to attach proof of paid tax in English or preferably Thai language.

Now, your deductions are:60,000 baht personal deduction

100,000 baht maximum deduction, taken as 50% of your income

190,000 baht if you are a 60 years or elder retiree

150,000 baht untaxed base

-----------

600,000 baht total; but can be little more if you are married and spouse no income, and have minor children with your spouse.

The below screen dump shows the deductions in my E-filing-attempt...

If you are 65 year or elder, and total taxable foreign transferred income is not more than around 600,000 baht, just fill in the tax return on E-filing and avoid any problems.

Thai income tax begins with 5% of the first taxable 150,000 baht, so even if you taxable income is a little more than the tax free base, it might be worth just paying a few baht instead of making a P.N.D.90-paper tax return form; especially if you need paid help from an accountant of tax service agent.

And remember that savings from before 1st January can be transferred free of tax. It might be a good idea to keep a home country tax office-statement of your savings by 31st December 2023.

Yawn.....Boring

-

1

1

-

1

1

-

-

- Popular Post

11 minutes ago, jojothai said:There seems to be a lot of opinion that nothing will happen.

But the banks are now starting to ask for tax ID to satisfy CRS.

ITs taken two years.

Slow, yes. In uk it took about one year.

One step at a time.

For those who think the TRD will not get their act together, then things may prove to be a but quicker than some expect.

There was a seminar in hua hin recently to discuss the tax issues with the TRD. See attached FYI.

some points to note , but still questions yet to be answered.

From the reports we see, its clear that many jurisdictions do not Understand what is started, however it may slowly become more consistent.

Many people will hope it does not happen too quickly.

Added comment. Sorry if the text is not very clear. I wil look at improving if i can later on my notebook.

Who gives a rats azz what happens in Hua Hin....

They are all a bunch of banjo playing, red neck hicks in Hua Hin any ways...

-

1

1

-

4

4

-

- Popular Post

12 minutes ago, DULEROY said:It's not time yet

The Thai Revenue Department is amending the tax law to tax worldwide income, not imported income.Not any more ......

Trump gave the OECD the middle finger......And the worldwide OECD tax is all but dead now.....

Thailand will not have a world tax until long after Trump is out of office.

-

1

1

-

2

2

-

- Popular Post

19 minutes ago, kuzmabruk said:Why listen to idiots ???

The RD (revenue department) of Thailand posts the tax rules for Thais and foreigners.

https://www.rd.go.th/fileadmin/user_upload/lorkhor/newspr/2024/FOREIGNERS_PAY_TAX2024.pdf

Ok I will not listen to you then.

-

1

1

-

1

1

-

3

3

-

- Popular Post

1 minute ago, lordgrinz said:Me too, but I am still holding out as long as possible on remitting anything to Thailand. I want to see the first guinea pigs that go through the tax process, and especially what happens to those who ignore the remittance rules, or play ignorant of them. If I can make it until Jan 1st before needing to remit anything, I should have a clearer picture of things.

I honestly think the only people who have invested more than 5 minutes of their life looking into this rotting corpse of a so called tax... Are tiny number of posters in the endless and pointless and strictly for entertainment tax threads here....

Everyone else like the Chinese,Russians, Indians etc.....Have not given this tax rubbish 2 thoughts....

-

6

6

-

1

1

-

2

2

-

- Popular Post

17 minutes ago, lordgrinz said:They aren't going to clarify anything, and they don't care about fair treatment, especially as it applies to Expats.

I agree I think we have had all the clarifying we will ever get........A big half baked half azz mess suites me just fine....Perfect for me....

The writer of this article is very wrong .....Nothing needs to change.....Not now not ever....

-

11

11

-

Beavis and Butthead have the perfect response to Songkrans is going to bring in 100 zillion baht and save the day for the countless time..

-

1 hour ago, oldcpu said:

There is a LOT of consensus on many details ... and no consensus on some others.

Some examples of consensus:

1. For example the Canadian-Thai DTA states Canadian pensions and similar remunerations are only taxable in Canada (and not in Thailand). This has been agreed with all tax advisors, who have gone a step further and also agreed such Canadian pension (and similar remunerations) are not to be included in a tax form. This is also consistent with Royal Decree-18.

2. Also, per por.161/162, there is agreement (tax advisors and Thai RD) that pre-1-Jan-2024 money in foreign bank accounts, if remitted to Thailand, is exempt Thai taxation, and not to be included in a Thai tax form.

3. Also per Royal Decree 743 and RD Ministerial Instruction 427 those on an LTR-WP and LTR-WGC have their remitted foreign income tax exempt. A forum member in a call to the Thai RD tax help line confirmed such income is not to be included in a Thai tax form.

Any who dispute the above, are going against both the Thai RD and against different Tax advisors.

I suspect there is also agreement in other country sourced income as well ...

There are of course, some areas where it is not so clear yet, but I believe with time there will be more clarification.

To think thou that there is "no consensus by anyone on tax matters" is not universally correct in regards to Thai taxation.

Ok I should have said SOME/ or MANY tax matters.....But I do stand by people need to interpret for them-self........And not eat up all the expensive $$$ nonsense from the shady tax adviser services..

-

On 3/12/2025 at 3:22 PM, Presnock said:

You can contact expattaxesthailand.com and since you just have a basic question, they advertise a 15-minute free consultation and also say that they have an online self check on assessability of incomes. Not sure if that will work, but it will only cost you a couple of minutes and no money.

Sir quit pumping/ pimping for these slimy, self serving, money grubbing, tax adviser services.......There must be at least be a dozen of these shady places around now...

-

6 hours ago, Jingthing said:

Again, not savings. Pensions.

We're on different planets on this.

I'm going with the at least current MAINSTREAM interpretation.

Your theory though you back it up, in my curent understanding, lacks mainstream Thai tax advisor agreement.

Again happy to be corrected.

I will be starting a dedicated thread about U.S. private pensions (IRAs and 401ks) based on a PCEC video but it won't be about your theory. It will be about further questions about the mainstream reading which I have been merely repeating.

You know, you may indeed be "right" but if TRD doesn't think you are, what difference does it make?

There is no consensus by anyone on any tax matters, that has been proven very very clear from day one.....Even after 1,000s of pages of endless boring bla bla bla

Just interpret the rules how ever you like and go with that...

-

1

1

-

-

The thing is yes people are living a bit longer than 50 years ago......But hardly anyone is living to 100 and even by 90 the heard starts getting pretty thin with plenty of people not making it through their 80s....

But the powers that be never tire of repeating that people are living a lot lot lot lot longer...

They want badly to push the retirement age up to 70 every where...And who knows how high after that...

They hate paying out retirement money...

-

1

1

-

1

1

-

-

- Popular Post

- Popular Post

6 hours ago, Hamus Yaigh said:+1 Makes no sense why anyone would go.

Like I have posted before some people are just desperate to pay taxes....Whether they owe taxes or not, does not matter to them.........And they will not take, No for an answer.......

Maybe even going so far as going to multiple tax offices to find one who will let the obsessed with paying farang pay..

-

2

2

-

1

1

-

1

1

-

2

2

-

2

2

-

22 minutes ago, jacko45k said:

It is also the things that go into the supermarket plastic bags..... the plastic containers fruit, bakery goods etc go into, and of course the plastic water, drink, sauce, oil etc bottles. We lost the will when Covid struck and Greta stopped yelling at us.

My favorite is Home Pro......They have been enforcing the no bag insanity for years now.....Almost every bloody thing they sell in covered in plastic....Or made out of plastic....The whole store is wall to wall plastic....

But no we cant give you a plastic bag.....We are saving the planet....lol

Hypocrites of the worst kind.

-

16 minutes ago, bamnutsak said:

Your mountain of posts would indicate otherwise.

KhunHeineken is cut from the same cloth as some other serial posters, that for some reason? No longer post.....And they were all desperately trying (nonstop) to get everyone to file same as Khun...

-

2

2

-

-

On 3/10/2025 at 9:40 PM, rough diamond said:

Why don't you stop telling people what to do.

As I said earlier people should only post facts, not instructions or guesswork.

Its Khuns hobby to pop into the tax threads even so often and sturr up trouble...He has been at it for a while now.....I seriously doubt he himself is filing but for some reason he wants others to file....

-

1

1

-

-

On 3/10/2025 at 7:31 PM, KhunHeineken said:

Exactly.

All these threads / posts challenging other people's strategies, just because they are different to theirs.

Everyone should just do what they want.

All I know is, I will have a document from the TRD that I am prepared to pay for, so I have no worries for the next 12 months. Simple as that.

Yea well you may have some kind of document......But I am hung like a horse,and thats what is really important here.....lol.......And I have no worries for way longer than 12 months.....In 12 more months you will need another document because you put yourself into the system...

-

1

1

-

.thumb.jpg.9bcb39176551b2c1639c71549f3782b4.jpg)

Thailand Bars Alcohol Sales on Trains and at Hua Lamphong

in Thailand News

Posted

I agree it was a mistake to not legalise weed and mushrooms at the same time...