Guavaman

Member-

Posts

195 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Guavaman

-

The TRD terms define how and where to enter the numbers into the tax form. For example, the 190,000 income exemption is subtracted from pension income before the calculation of the amount of expenses deducted @50% up to 100,000. If we use our own terms, it becomes a cause of confusion in communications, as we have seen in these threads.

-

These are standard deduction amounts with no need to provide details. Guide to Personal Income Tax Return 2023 (ภ.ง.ด.90) For taxpayers who received incomes not only from employment No. 1 item 5. Enter allowable expense equal to 50% of the amount stated in item 4. but not exceeding 100,000 baht. If you and your spouse both have income and you are filing jointly, you and your spouse can each deduct expense as stated above. Thus, the maximum allowable expense is 200,000 baht in this case. See https://sherrings.com/personal-tax-deductions-allowances-thailand.html

-

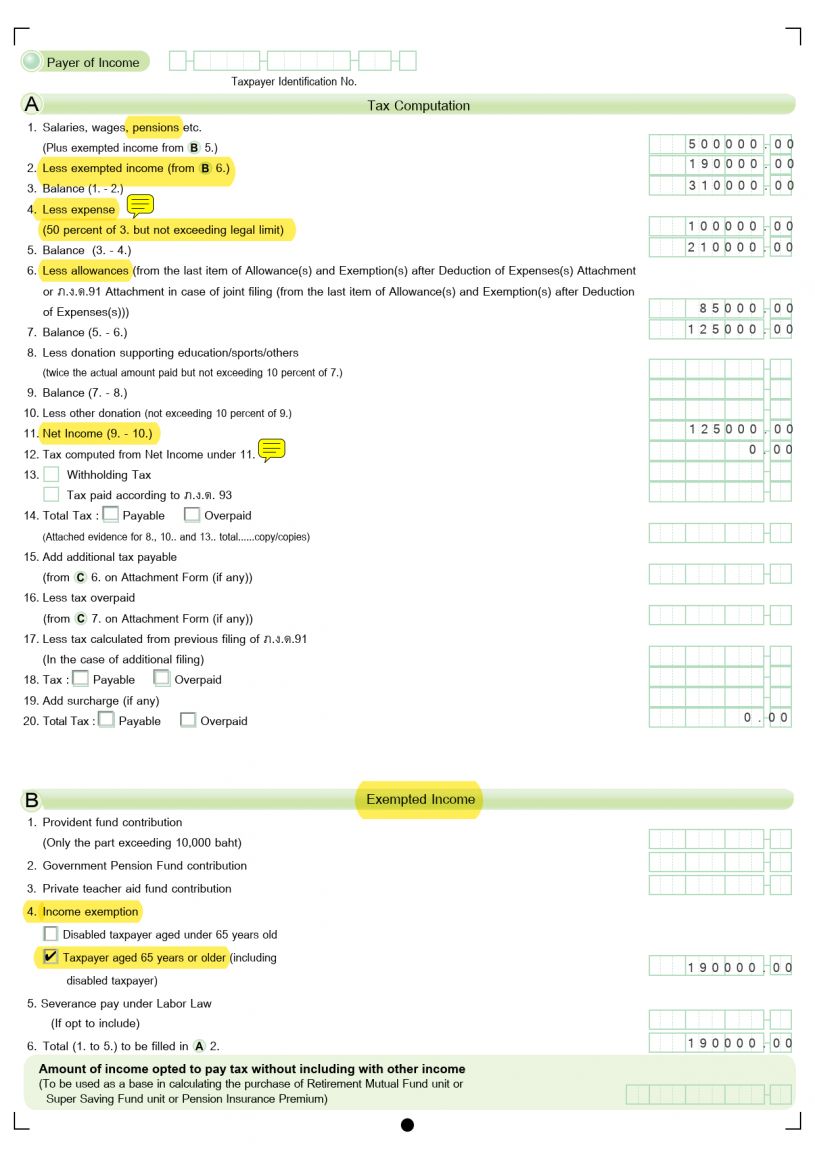

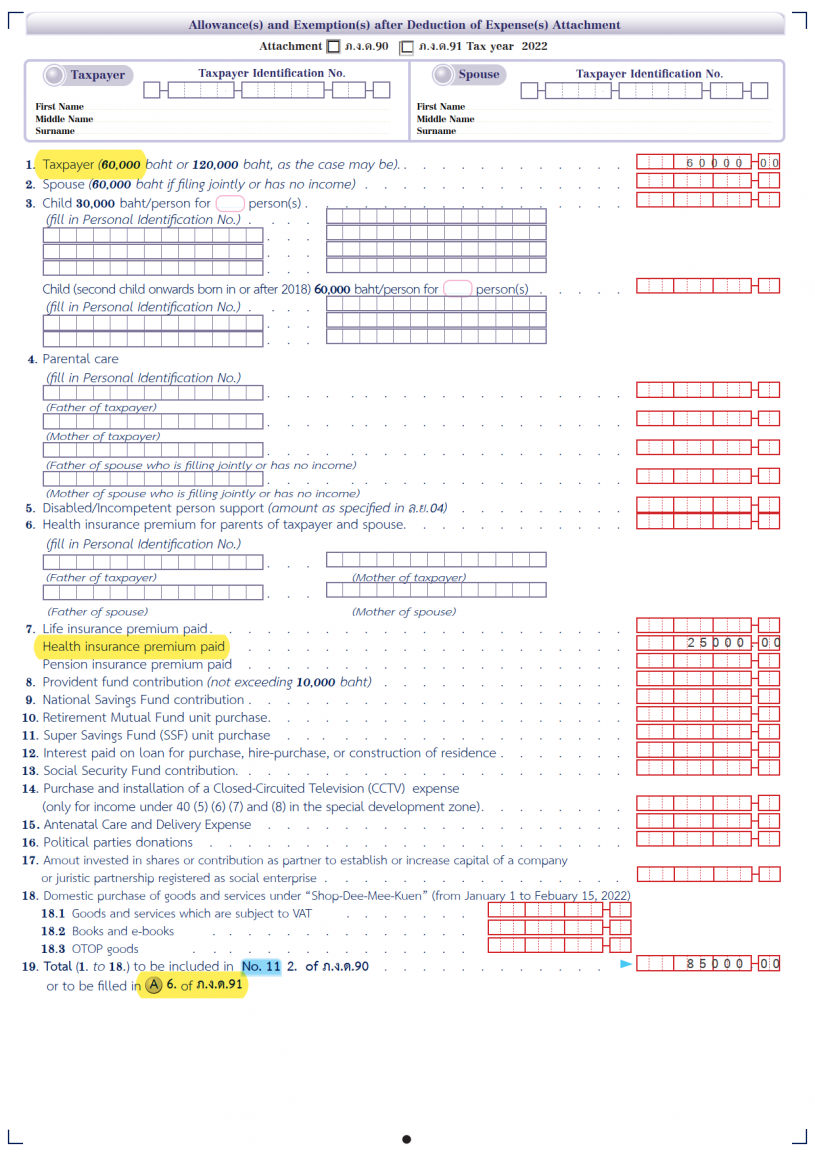

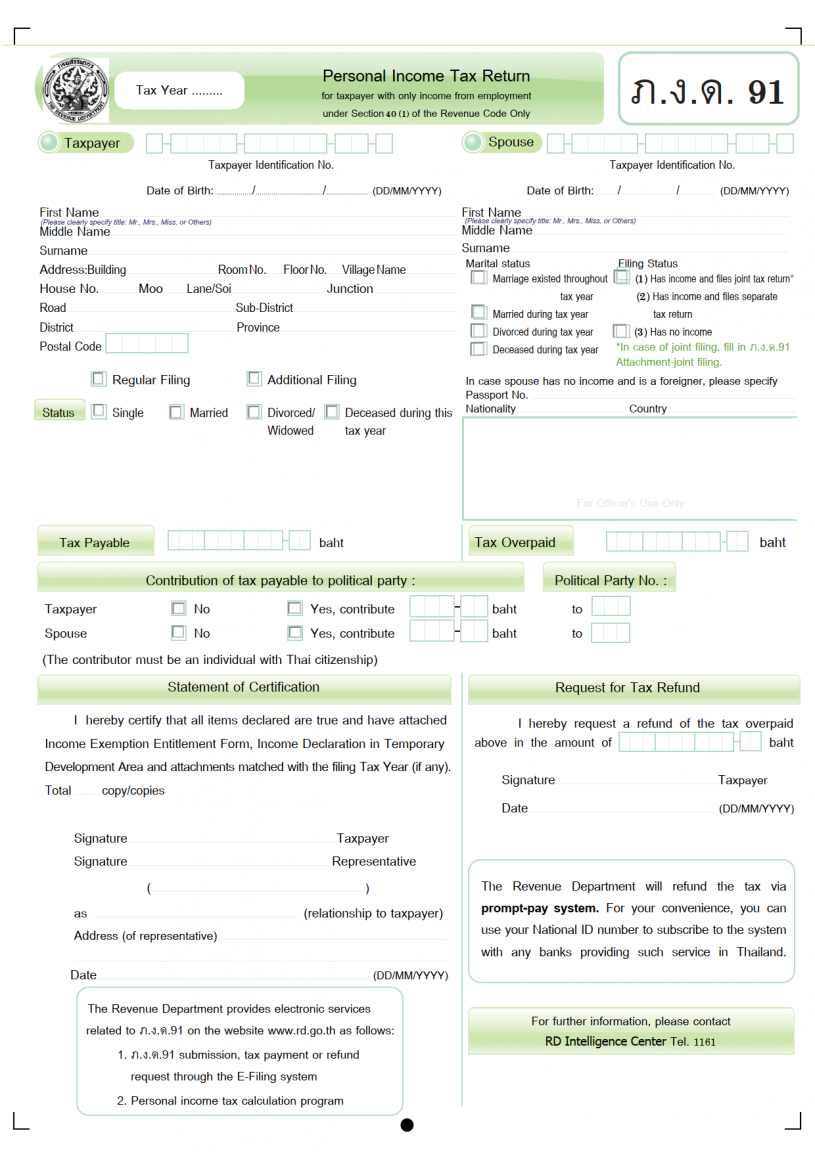

Dear jwest10: It is imperative to obtain an understanding of the basic concepts of the Thai Tax Code and its' implementation in filing a tax return. You are loosely using terms related to exemptions, deductions, and allowances, that are specific technical terms in the Thai Tax Code. I suggest that you re-read the Guide: TAX EXEMPTIONS DEDUCTIONS & ALLOWANCES (TEDA) 76) The Thai tax system contains a series of Tax Exemptions, Deductions and Allowances (TEDA) that will help you reduce your tax bill and they are very generous. It is easily possible for the average expat foreign retiree to reduce their taxable income by 500,000 baht or more each year. For example, a retiree aged 65 years of age, married and living here full time, supporting a Thai wife and receiving only pension income, is allowed the following TEDA, identified by the corresponding RD code: a) Personal Allowance for self (PA1) - 60,000 b) Personal Allowance for wife (PA2) - 60,000 c) Over age 65 years exemption (OAE) - 190,000 d) 50% of pension income received, up to 100k (PD) - 100,000 e) In addition, the first 150,000 of assessable income is zero rated and free of tax (ZR) 77) Additional deductions and allowances exist for health or life insurance premiums paid in Thailand, along with a range of other things. A complete list of deductions, allowances and exemptions can be found in the links below: https://www.rd.go.th/english/6045.html or from Sherrings below. https://sherrings.com/personal-tax-deductions-allowances-thailand.html Here is an example of a tax filing for 500,000 remitted assessable income for a single filer over age 65 with a wife and claiming the maximum allowance of 25,000 Baht for health insurance. premium with a Thai company. I hope that this example might be helpful. You really need to get clear on the basic concepts/terms in the Thai Tax Code before you try to communicate with TRD officials to overcome the confusion in your own mind and in their minds. Exemptions, deductions, and allowances are like apples, mangos, and durians -- they are all fruits, but very different.

-

ISSUE: Online source of tax information contradicts US-Thailand DTA and US Department of the Treasury Technical Explanation https://home.treasury.gov/system/files/131/Treaty-Thailand-TE-11-26-1996.pdf This quoted statement from an online legal source is misleading – it is only partially correct; that is: - Government pensions, social security benefits, alimony & child support benefits are taxable only in the state where they arise. (US) – Paragraphs 2, 4 & 5 of Article 20, and Paragraph 2 of Article 21 (Government Service) - Private pensions and annuities are taxable only in the residence State of the recipient (Thailand for tax residents) – Paragraphs 1 & 3 of Article 20 The lesson here is that one cannot simply accept a single source of tax information from non-Revenue Department sources. ARTICLE 20 Pensions and Social Security Payments 1. Subject to the provisions of paragraph 2 of Article 21 (Government Service), pensions and other similar remuneration paid to a resident of a Contracting State in consideration of past employment shall be taxable only in that State. TECHNICAL EXPLANATION: Paragraph 1 Paragraph 1 provides that private pensions and other similar remuneration paid in consideration of past employment are generally taxable only in the residence State of the recipient. 2. Notwithstanding the provisions of paragraph 1, social security benefits and other similar public pensions paid by a Contracting State to a resident of the other Contracting State or a citizen of the United States shall be taxable only in the first-mentioned State. TECHNICAL EXPLANATION: Paragraph 2 The treatment of social security benefits is dealt with in paragraph 2. This paragraph provides that, notwithstanding the provision of paragraph 1 under which private pensions are taxable exclusively in the State of residence of the beneficial owner, payments made by one of the Contracting States as a social security benefit or similar public pension to a resident of the other Contracting State or to a citizen of the United States will be taxable only in the Contracting State making the payment. 3. Annuities derived and beneficially owned by a resident of a Contracting State shall be taxable only in that State. TECHNICAL EXPLANATION: Paragraph 3 Under paragraph 3, annuities that are derived and beneficially owned by a resident of a Contracting State are taxable only in that State. 4. Alimony paid to a resident of a Contracting State shall be taxable only in that State. 5. Periodic payments, not dealt with in paragraph 4, for the support of a child made pursuant to a written separation agreement or a decree of divorce, separate maintenance, or compulsory support, paid by a resident of a Contracting State to a resident of the other Contracting State, shall be taxable only in the first-mentioned State. TECHNICAL EXPLANATION: Paragraphs 4 and 5 Paragraphs 4 and 5 deal with alimony and child support payments. Both alimony, under paragraph 4, and child support payments, under paragraph 5, are defined as periodic payments made pursuant to a written separation agreement or a decree of divorce, separate maintenance, or compulsory support. Paragraph 4, however, deals only with payments of that type that are taxable to the payee. Under that paragraph, alimony paid by a resident of a Contracting State to a resident of the other Contracting State is taxable under the Convention only in the State of residence of the recipient. Paragraph 5 deals with those periodic payments that are for the support of a child and that are not covered by paragraph 4 (i.e., those payments that are not taxable to the payee). These types of payments by a resident of a Contracting State to a resident of the other Contracting State are taxable only in the first-mentioned Contracting State. ARTICLE 21 Government Service 2. a) Any pension paid by, or out of funds created by, a Contracting State or political subdivision or a local authority thereof to an individual in respect of services rendered to that State or subdivision or authority shall be taxable only in that State. TECHNICAL EXPLANATION: Paragraph 2 Paragraph 2 deals with the taxation of a pension paid by, or out of funds created by, one of the States or a political subdivision or a local authority thereof to an individual in respect of services rendered to that State or subdivision or authority. Pensions paid to retired civilian and military employees of a Government of either State are intended to be covered under paragraph 2.

-

Assessable Income in Thailand Source: Tilleke & Gibbins Thailand Tax Guide: 2. Taxable Base The taxable base is determined by deducting certain allowances from the total assessable income. The total assessable income is determined by aggregating the amounts under the different categories of income after deducting certain permitted expenses from assessable income of each category. In general, all types of income are assessable unless expressly exempt by law. https://www.tilleke.com/wp-content/uploads/2011/05/Thailand-Tax-Guide.pdf Source: MoneyMgmnt Assessable & taxable income All types of income are generally assessable unless expressly exempt by law (see the exemptions below). You can read the Revenue Code (Section 40) for more details about each type. While assessable income represents a total of income that counts towards your tax liability, taxable income/base is the actual amount on which you pay tax. You can calculate it by subtracting deductions & allowances from your assessable income: Taxable income = Assessable income (excl. exempt income) - Deductions - Allowance Tax-exempt income Currently, there are 29 income categories exempt from personal income tax. Below is a summary of some of those most likely to apply to foreigners living in Thailand (courtesy of the Revenue Code): You can find the full list in the Revenue Code (Section 42). https://www.moneymgmnt.com/tax/personal-income-tax-thailand/

-

Revenue Department Contact Reports

Guavaman replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

Source: Tilleke & Gibbins Thailand Tax Guide: 2. Taxable Base The taxable base is determined by deducting certain allowances from the total assessable income. The total assessable income is determined by aggregating the amounts under the different categories of income after deducting certain permitted expenses from assessable income of each category. In general, all types of income are assessable unless expressly exempt by law. https://www.tilleke.com/wp-content/uploads/2011/05/Thailand-Tax-Guide.pdf Source: MoneyMgmnt Assessable & taxable income All types of income are generally assessable unless expressly exempt by law (see the exemptions below). You can read the Revenue Code (Section 40) for more details about each type. While assessable income represents a total of income that counts towards your tax liability, taxable income/base is the actual amount on which you pay tax. You can calculate it by subtracting deductions & allowances from your assessable income: Taxable income = Assessable income (excl. exempt income) - Deductions - Allowance Tax-exempt income Currently, there are 29 income categories exempt from personal income tax. Below is a summary of some of those most likely to apply to foreigners living in Thailand (courtesy of the Revenue Code): You can find the full list in the Revenue Code (Section 42). https://www.moneymgmnt.com/tax/personal-income-tax-thailand/ -

Under the Revenue Code, income from a pension is assessable income. https://www.rd.go.th/english/37749.html Revenue Code Chapter 3 Income Tax Section 40 Assessable income is income of the following categories including any amount of tax paid by the payer of income or by any other person on behalf of a taxpayer. (1) Income derived from employment, whether in the form of salary, wage, per diem, bonus, bounty, gratuity, pension, house rent allowance, monetary value of rent-free residence provided by an employer, payment of debt liability of an employee made by an employer, or any money, property or benefit derived from employment. Section 56 Every taxpayer except a minor or a person adjudged incompetent or quasi-incompetent shall, on or before the last day of March every year, file to the official appointed by the Minister a tax return reporting the assessable income received in the preceding tax year in the form prescribed by the Director-General, if such person - (1) has no spouse and has the assessable income of the preceding tax year exceeds 60,000 baht, (2) has no spouse and has the assessable income of the preceding tax year under only Section 40 (1) exceeds 120,000 baht, (3) has a spouse and the assessable income of the preceding tax year exceeds 120,000 baht, or (4) has a spouse and the assessable income of the preceding tax year under only Section 40 (1) exceeds 220,000 baht. Thai Tax 2022/23 Booklet - PricewaterhouseCoopers Legal & Tax Consultants Limited https://www.pwc.com/th/en/tax/assets/thai-tax/thai-tax-2022-23-booklet.pdf Tax administration Thailand applies a self-assessment system in collecting taxes. Taxpayers are required to declare their tax liabilities in the prescribed tax returns and pay the tax due at the time of filing. The following individuals are required to file income tax returns for income earned in the preceding tax year irrespective of whether there is any tax due: • A person who has no spouse and earns income of more than Baht 60,000 • A person who has no spouse and earns income under category (1) (salaries and wages) of more than Baht 120,000 • A person who has a spouse and earns income of more than Baht 120,000 • A person who has a spouse and earns income under category (1) (salaries and wages) of more than Baht 220,000.

-

As I have pointed out before, it is unfortunate that the RD website unofficial English translations contain inaccuracies and outdated information. The Guide to tax return form PND 91 is an example: Where the guide states "total income", the Revenue Code states "assessable income", which is an accurate translation of เงินได้พึงประเมิน: ngoen dai (income) + pheung (must) + pramoen (assess). I suggest replacing the reference document to the RD Revenue Code as follows: https://www.rd.go.th/english/37749.html Revenue Code - Chapter 3 Income Tax Section 56 Every taxpayer except a minor or a person adjudged incompetent or quasi-incompetent shall, on or before the last day of March every year, file to the official appointed by the Minister a tax return reporting the assessable income received in the preceding tax year in the form prescribed by the Director-General, if such person - (1) has no spouse and has the assessable income of the preceding tax year exceeds 60,000 baht, (2) has no spouse and has the assessable income of the preceding tax year under only Section 40 (1) exceeds 120,000 baht, (3) has a spouse and the assessable income of the preceding tax year exceeds 120,000 baht, or (4) has a spouse and the assessable income of the preceding tax year under only Section 40 (1) exceeds 220,000 baht. Note these requirements apply to "Every taxpayer". Regarding offshore income, the issue of earned vs. remitted, or received vs. brought into Thailand, here is a summary by Baker McKenzie: https://insightplus.bakermckenzie.com/bm/tax/thailand-offshore-sourced-income-received-before-1-january-2024-can-be-brought-into-thailand-in-2024-or-later-without-being-subject-to-thai-personal-income-tax/ Order No. 161 and Order No. 162 collectively reveal the Revenue Department's position on Thai personal income taxation on offshore-sourced income, summarized as follows: Offshore-sourced income Applicable interpretation Thai personal income tax consideration Offshore-sourced income received by Thai tax resident individuals before 1 January 2024 Not subject to the new interpretation under Order No. 161 Offshore-sourced income that is brought into Thailand after the calendar year of receipt is not subject to Thai personal income tax. Offshore-sourced income received before 1 January 2024 can be brought into Thailand on or after 1 January 2024 without being subject to Thai personal income tax. Offshore-sourced income received by Thai tax resident individuals from 1 January 2024 Subject to the new interpretation under Order No. 161 Offshore-sourced income that is brought into Thailand from 1 January 2024 onward is subject to Thai personal income tax. Offshore-sourced income received from 1 January 2024 and brought into Thailand on or after 1 January 2024 will be subject to Thai personal income tax.

-

It should read: "assessable income over 120k". https://www.mazars.co.th/content/download/1176493/59841085/version//file/Personal-income-tax-return-PND-91-A-closer-look-November-2023.pdf Who must file Form PND 91? A person must file a PND 91 if they have income as set out in Section 40(1) of the Revenue Code and meet one of the following conditions: 1. Single Person Assessable income exceeding 120,000 baht in the tax year. 2. Married Person Assessable income, combined with that of your spouse, exceeding 220,000 baht in the tax year.

-

NOTE: I did not mean to imply that US Social Security benefit payments are taxable by the RD. Again, the issue is about assessable income. We understand that US Social Security benefit payments should be EXEMPT from taxation by the RD, even though that income is ASSESSABLE, since it "may be computed into a monetary value". . Section 39 In this Chapter, unless the context otherwise requires: Assessable income means income that is taxable under this Chapter. Such income also includes a property or any other benefit received which may be computed into a monetary value.

-

According to the Thai Tax Code: Section 39 In this Chapter, unless the context otherwise requires: Assessable income means income that is taxable under this Chapter. Such income also includes a property or any other benefit received which may be computed into a monetary value. Since the Thai Tax Code regarding foreign source income is based upon remittance into Thailand, such remittances of assessable income are subject to personal income tax in Thailand.

-

It appears that you have accessed this (outdated) regarding information about Personal Income Tax (PIT) here: https://www.rd.go.th/english/6045.html All of the amounts in all of the tables are OUTDATED. The first & most important point to learn about the Thai tax system is this: NEVER trust any information in an unofficial translation on the Revenue Department website. For example, the webpage referenced = Last updated: 23.11.2020 A seeker will find other outdated references and amounts stated on the RD webpages. This is Thailand: What you see is only the tip of an enormous iceberg. Suggestion: Find 3 "reliable sources" (not including the Revenue Department) that all match, then you might be getting close to what the experts in Bangkok agree upon. Regarding what Somchai in the local district Revenue Office understands --- Welcome to Wonderland!

-

We -- the inhabitants of this forum/thread -- have still not understood the most fundamental term/meaning upon which the entire Thai income taxation system is based: Assessable Income. Section 39 In this Chapter, unless the context otherwise requires: Assessable income means income that is taxable under this Chapter. Such income also includes a property or any other benefit received which may be computed into a monetary value. "Assessable" income that is taxable may be computed into a monetary value. * The unstated implication is that income that may NOT be computed into a monetary value is NOT assessable. The Thai Tax Code does not address the concept of non-assessable income. How the RD deals with US Social Security under the DTA as policy implemented at local levels remains to be seen.

-

If true, this is a very important assertion, for which clarification is lacking to date. I have been studying the Thai Tax Code for 3 months, but I have not yet come across this concept: filing a nil return, with no tax payable, meaning (in Thailand): Taxable income = assessable income minus: exemptions, deductions, allowances = 0 Baht. Please provide a reference link to a Revenue Department webpage or a legal/tax firm webpage that provides advice that Thai tax residents are not required to file tax returns if the taxpayer self-determines that they "owe no tax". TIT caveat: This is Thailand (TIT). As we have learned, a primary loveable aspect of Thai people is their radical empiricism -- responding to events in the most practical way for that particular person, muddling through in uncertainty, which underlies everything, everywhere, everytime.

-

Unfortunately, it is not that simple. The decision point is whether or not the tax resident has income from only category 1 (employment including pensions) or from category 1 plus any other of the 8 categories of assessable income. See NOTE regarding Thai bank withholding tax on interest below. REFERENCE: https://www.rsm.global/thailand/insights/rsm-focus/filing-pnd90-and-pnd91 PND.90 return is the personal income tax return to report the assessable income under Section 40(1) to (8) [Assessable income under Section 40 of the Revenue Code: 1. Employment (including pensions) 2. Independent personal services 3. Goodwill, copyright and other (intangible) rights 4. Interest income, dividends and capital gains 5. Rental from property 6. Professional services 7. Hire of work (i.e., services contracts) ] 8. Business, commerce, agriculture, industry, transport, etc.] PND.91 return is the personal income tax return to report the assessable income under Section 40(1) obtained from employment [category 1 only] [(40(1) Income derived from employment, whether in the form of salary, wage, per diem, bonus, bounty, gratuity, pension, house rent allowance, monetary value of rent-free residence provided by an employer, payment of debt liability of an employee made by an employer, or any money, property or benefit derived from employment.] Who is liable to pay personal income tax? Filing of PND.90/91 returns are summarized below: PND.90 return [income under Section 40(1) to (8)] PND.91 return [income under Section 40(1) derived from employment only] Single status and assessable income exceeding 60,000 baht. Single status and assessable income exceeding 120,000 baht. Marriage status and assessable income together exceeding 120,000 baht Marriage status and assessable income together exceeding 220,000 baht [Note Regarding Thai bank withholding tax on interest : If a taxpayer chooses to file PND. 91, it means that the taxpayer accepts the default 15% withholding tax on interest on deposits in Thai bank accounts. If the taxpayer chooses to claim any refund of that withholding tax, the taxpayer must file the more comprehensive PND. 90 filing form.]

-

Same problem -- nothing personal. Many posters have used the term "non-assessable" according to their personal idiosyncratic definition of the term. What is assessable is up to the RD tax code and the tax assessor, not up to the opinion of the taxpayer. The problem has arisen due to so many posters using the term according to their own individual definition of the term, most often confusing the concept of exemption to mean non-assessment. With so many pages of posts with misuse of the term, it has taken on its' own meaning in this thread as defined by the crowd, rather than by the RD.