Guavaman

Member-

Posts

195 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Guavaman

-

Yes, that is a problem: we don't have the luxury of defining Thai tax law terms as we wish. The RD sets the rules and definitions. We can't just say: "My social security benefit payment is non-assessable income, so it doesn't count for the income threshold for filing a tax return", or "I already paid tax on my pension in my home country, so it is non-assessable income in Thailand". It is ALL assessable income when remitted, although some of it may be EXEMPTED from taxation by the RD.

-

Regarding "non-assessable" income: ASSESSABLE VS TAXABLE INCOME All personal income tax (PIT) in Thailand is collected upon the basis of ASSESSABLE INCOME. https://www.rd.go.th/english/37749.html Section 38 Income tax is an assessment tax. An assessment official shall make assessment on tax under this Chapter. This means that the taxpayer must compile their income-related information and use that information to prepare and submit a tax return to the RD summarizing the amount of their income that meets the characteristics as assessable income. The taxpayer, after calculating according to the characteristics, methods, conditions, rates set, and the burden of paying taxes, gives it to the tax assessor to determine the correctness of the taxable amount and the practice of duties of the taxpayer. http://www.smlaudit.com/%E0%B9%80%E0%B8%87%E0%B8%B4%E0%B8%99%E0%B9%84%E0%B8%94%E0%B9%89%E0%B8%9E%E0%B8%B6%E0%B8%87%E0%B8%9B%E0%B8%A3%E0%B8%B0%E0%B9%80%E0%B8%A1%E0%B8%B4%E0%B8%99 Section 39 In this Chapter, unless the context otherwise requires: Assessable income means income that is taxable under this Chapter. Such income also includes an asset [property] or any other benefit received which may be computed into a monetary value, any amount of tax paid by the payer of income or by any other person on behalf of a taxpayer and tax credit under Section 47 Bis. https://www.rd.go.th/english/37749.html So what is non-assessable income? This does not appear in the Thai tax code. One could imagine that it would be an asset [property] or any other benefit received which may NOT be computed into a monetary value; however, that would only be an imagination, because the concept of non-assessable income is absent from the tax code. A search of the The Thai Revenue Department website results in 0 results for “non-assessable”. The “non-assessable income” Straw Man does not exist. What does this mean for expat Thai tax residents? The RD defines 8 categories of assessable income. All of your “assessable income” falls within one of these 8 categories. ASSESSABLE INCOME EXEMPT FROM INCOME TAX CALCULATION Under Section 42, The assessable income of some categories are exempt for the purpose of income tax calculation; however, the tax code has no references to income derived under DTAs , although the content of DTAs specifically state that some categories of income are exempt from taxation in Thailand. Section 42 The assessable income of the following categories shall be exempt for the purpose of income tax calculation: (1) Per diem or transport expenses (2) Transport expenses and traveling per diem at the rates prescribed by the Government in the Royal Decree governing the rates of transport expenses and traveling per diem. (3) The part of traveling expenses paid by the employer to the employee which the employee spent wholly and necessarily in traveling … (4) Where a contract of employment which was bona fide entered into before the entry into force of the Royal Act on Income Tax B.E. 2475 … (5) Special post allowance, house rent allowance and rent free residence granted to an official of a Thai embassy or consulate abroad. (6) Income from a sale or discount received from purchase stamp duties or government postage stamps. (7) Board or committee meeting allowance and teaching and examination fees paid by the government or public educational institutions. (8) The following interest: (a) Interest from Government savings lotteries, or interest on demand deposit with the Government Savings Bank; (b) Interest on savings deposit with a cooperative; (c) Interest on savings deposit with a bank in Thailand which is repayable on demand; (9) Sale of a movable property acquired from inheritance … (10) Income derived from an inheritance.11 (11) Award for the purpose of education or technical research, government lottery and government savings prize, prize given by government authority in contest or competition to a person other than a professional contestant or competitor, or reward paid by government authority for the purpose of prevention of wrongdoing. (12) Special pension, special gratuity, inherited pension or inherited gratuity. (13) Compensation against wrongful acts, amount derived from insurance or from funeral assistance scheme. (15) Income of a farmer from sale of rice cultivated by the farmer and/or his family. (16) Income derived from an undivided estate liable to tax under Section 57 Bis. (17) Income prescribed for exemption by Ministerial Regulations.12 (18) Red Cross lottery prize, income from a sale or discount received from purchase of Red Cross lotteries. (19) Interest received under Section 4 Decem.13 (23) Income from sale of investment units in a mutual fund. (24) Income of a mutual fund. (25) Compensatory benefit received by the taxpayer from the social security fund under the law governing social security. (26) Income derived from the transfer of ownership or possessory right in an immovable property without any consideration to a legitimate child … (27) Income derived from maintenance and support or gifts from ascendants, descendants or spouse, but only for the portion not exceeding twenty million Baht throughout the tax year. (28) Income derived from maintenances and support under moral purposes or gifts received in a ceremony or on occasions in accordance with custom and tradition from persons who are not ascendants, descendants or spouse, but only for the portion not exceeding ten million baht throughout the tax year. (29) Income derived from gifts whereby a donor has expressed his or her intention or appeared to have an intention of using the gifts for religious, educational or public benefit activities in accordance with the rules and conditions as prescribed by a Ministerial Regulation. So there is assessable income that is taxable and assessable income that is exempt from tax, but "non-assessable" income is not a "thing". You can stop thinking and claiming that that some of your income is non-assessable.

-

US- THAILAND CONVENTION The Treasury Department's 1996 Technical Explanation ("TE") to Article 20 explains, in relevant part: Paragraph 1 provides that private pensions and other similar remuneration paid in consideration of past employment are generally taxable only in the residence State of the recipient.

-

US- SWITZERLAND CONVENTION US-THAILAND CONVENTION The Treasury Department's 1997 Technical Explanation ("TE") to Article 18 explains, in relevant part: Paragraph 1 provides that private pensions and other similar remuneration derived and beneficially owned by a resident of a Contracting State in consideration of past employment are taxable only in the State of residence of the recipient. The Treasury Department's 1996 Technical Explanation ("TE") to Article 20 explains, in relevant part: Paragraph 1 provides that private pensions and other similar remuneration paid in consideration of past employment are generally taxable only in the residence State of the recipient.

-

Replace "Switzerland" with "Thailand" in this analysis by the IRS. U.S. tax law says that a U.S. citizen — no matter where he/she lives — will be taxable on worldwide income. But if you’re a U.S. citizen living in Switzerland you’re taxable as a resident there. Both country wants to tax you. Which country gets first crack at you when you take a distribution from your Individual Retirement Account? Survey says? Switzerland. Switzerland gets the right to tax the distribution from your IRA, and the United States will give you a tax credit for the Swiss income tax you pay. Just to be clear: if you’re a U.S. citizen living in Switzerland, you pay the Swiss income tax on the distribution. Then you also report the distribution on your Form 1040 that you have to file every year with the Internal Revenue Service because you’re a citizen. You claim the foreign tax credit on Form 1116. Since all of this is happening by way of the income tax treaty between the United States and Switzerland, you attach Form 8833 to your Form 1040, making the relevant elections to invoke the treaty provisions to protect you from the IRS. Here is a recent analysis of the law by the Internal Revenue Service. https://hodgen.com/ira-distribution-to-u-s-citizen-living-in-switzerland-which-country-taxes-it/

-

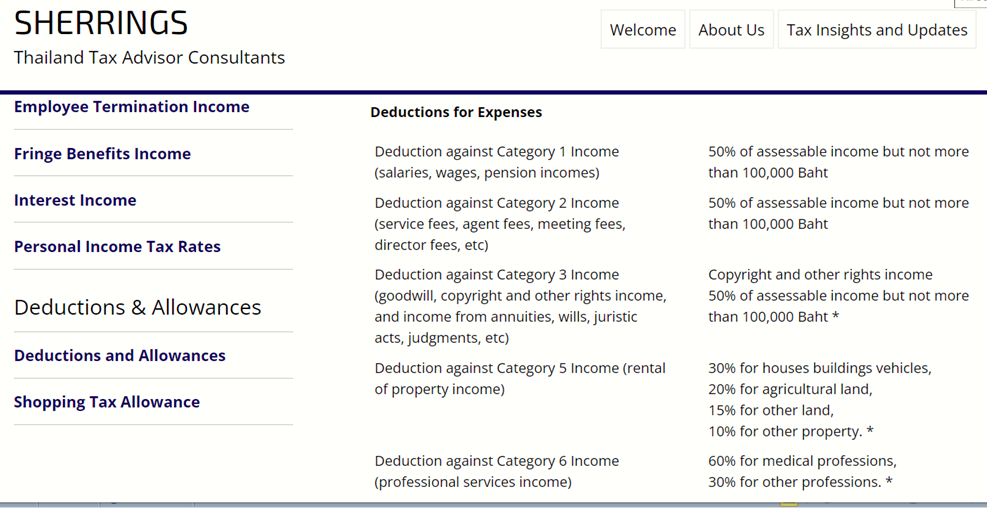

Interest and dividends come under Category 4 income in the Tax Code; no deductions are allowed. Note: Deduction against Category 4 income does not appear in this table. Section 40 Assessable income is income of the following categories including any amount of tax paid by the payer of income or by any other person on behalf of a taxpayer. (4) Income that is: (a) Interest on a bond, deposit, debenture, bill, loan whether with or without security, the part of interest on loan after deduction of withholding tax under the law governing petroleum income tax, or the difference between the redemption value and the selling price of a bill or a debt instrument issued by a company or juristic partnership or by any other juristic person and sold for the first time at a price below its redemption value. (b) Dividend, share of profits or any other gain derived from a company or juristic partnership, a mutual fund or a financial institution established under a specific law in Thailand for the purpose of providing a loan in order to promote agriculture, commerce or industry; the part of dividend or share of profits after deduction of withholding tax under the law governing petroleum income tax.

-

Another (tricky) income tax question

Guavaman replied to BenStark's topic in Jobs, Economy, Banking, Business, Investments

Every time that I transfer from my Bangkok Bank US$ FCD account to my Baht account, it shows the code FTT, which identifies it as a foreign transfer of funds. The good news is that your bank records provide evidence that you owned/received the funds in your FCD account prior to 1 January 2024; thus, even if it is deemed that you remit the funds when you withdraw from the FCD, the funds should be tax-exempt under new Order 162. Baker Mackenzie: https://insightplus.bakermckenzie.com/bm/tax/thailand-offshore-sourced-income-received-before-1-january-2024-can-be-brought-into-thailand-in-2024-or-later-without-being-subject-to-thai-personal-income-tax/ According to the Revenue Departmental Order No. Por. 162/2566 re: Income Taxation under section 41, paragraph two, of the Revenue Code, dated 20 November 2023 ("Order No. 162"), offshore-sourced income received by Thai tax resident individuals before 2024 can be brought into Thailand in any subsequent year without being subject to Thai personal income tax. -

According to the DTA, Thailand has priority in collecting tax from your IRA distributions. Since the Thai tax return must be filed by March 31st, the only way that one could have "already been taxed" is if one files early with the IRS prior to the April 15th deadline and prior to March 31st Thai tax filing deadline. Thai tax return due March 31st, US tax return due April 15th.

-

3 issues: Q1: Are IRA accounts deemed to be private retirement plans by the Department of the Treasury and the IRS? A1: Yes, IRA accounts are private retirement plans according to the DoT and IRS. Q2: Is taxation of IRA accounts encompassed by "the Convention"? (The Convention Between the Government of the United States of America and the Government of the Kingdom of Thailand for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income, signed at Bangkok on November 26, 1996) A2: Yes Q3: Should remittances of distributions from IRA accounts be tax-exempt per RD DI 162/2566? A3: For distribution of contributions prior to Jan. 1, 2024 = yes; for distributions of gains after Jan. 1, 2024 = no. Rationale: Q1: Are IRA accounts deemed to be private retirement plans by the Department of the Treasury and the IRS? (it's just an account defined as savings account by the IRS.) A1: Yes, IRA accounts are private retirement plans according to the DoT and IRS. https://www.irs.gov/retirement-plans/plan-sponsor/types-of-retirement-plans Types of Retirement Plans Individual Retirement Arrangements (IRAs), Roth IRAs, 401(k) Plans, SIMPLE 401(k) Plans, 403(b) Plans, SIMPLE IRA Plans (Savings Incentive Match Plans for Employees), SEP Plans (Simplified Employee Pension), SARSEP Plans (Salary Reduction Simplified Employee Pension), Payroll Deduction IRAs, Profit-Sharing Plans, Defined Benefit Plans, Money Purchase Plans, Employee Stock Ownership Plans (ESOPs), Governmental Plans, 457 Plans, Multiple Employer Plans https://www.irs.gov/retirement-plans/individual-retirement-arrangements-iras Individual Retirement Arrangements (IRAs) Types of IRAs A traditional IRA is a tax-advantaged personal savings plan where contributions may be tax deductible. A Roth IRA is a tax-advantaged personal savings plan where contributions are not deductible but qualified distributions may be tax free. A Payroll Deduction IRA plan is set up by an employer. Employees make contributions by payroll deduction to an IRA (Traditional or a Roth IRA) they establish with a financial institution. A SEP is a Simplified Employee Pension plan set up by an employer. Contributions are made by the employer directly to an IRA set up for each employee. A SIMPLE IRA plan is a Savings Incentive Match Plan for Employees set up by an employer. Under a SIMPLE IRA plan, employees may choose to make salary reduction contributions, and the employer makes matching or nonelective contributions. A SARSEP - the Salary Reduction Simplified Employee Pension Plan - is a type of SEP set up by an employer before 1997 that includes a salary reduction arrangement. So a traditional IRA is an Individual Retirement Arrangement , that is a type of (private) Retirement Plan. IRA accounts are private retirement plans according to the DoT and IRS. Note: private means not government. Q2: Is taxation of IRA accounts covered by "the Convention"? (The Convention Between the Government of the United States of America and the Government of the Kingdom of Thailand for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income, signed at Bangkok on November 26, 1996) A2: Yes The Technical Explanation is an official guide to the Convention. It reflects the policies behind particular Convention provisions, as well as understandings reached with respect to the application and interpretation of the Convention. Paragraph 1 Paragraph 1 provides that private pensions and other similar remuneration paid in consideration of past employment are generally taxable only in the residence State of the recipient. The phrase “pensions and other similar remuneration” is intended to encompass payments made by private retirement plans and arrangements in consideration of past employment. In the United States, the plans encompassed by Paragraph 1 include: qualified plans under section 401(a), individual retirement plans (including individual retirement plans that are part of a simplified employee pension plan that satisfies section 408(k), individual retirement accounts and section 408(p) accounts), non-discriminatory section 457 plans, section 403(a) qualified annuity plans, and section 403(b) plans. Q3: Should remittances of distributions from IRA accounts be tax-exempt per RD DI 162/2566? A3: For distribution of contributions prior to Jan. 1, 2024 = yes; for distributions of gains after Jan. 1, 2024 = no. Just an opinion waiting to be confirmed by the RD. This is an important issue that you have raised. It highlights the challenges that will arise due to the RD DI 162/2566 exempting remittances of income realized pre-2024. This special grandfathering order will likely be the source of endless conflict between the RD and Thai tax residents forever. Thus, although IRA accounts are encompassed by “the Convention”, all deductible contributions to IRA accounts that can be proven to have been deposited in an IRA prior to Jan. 1, 2024, are deemed to be exempt from taxation upon subsequent remittance to Thailand forever according to Order 162. This is a special opportunity that remains open to access during the remaining days of 2023. According to advice of Baker MacKenzie, Thai tax residents are advised to convert offshore income to capital prior to Jan. 1, 2024. https://insightplus.bakermckenzie.com/bm/tax/thailand-offshore-sourced-income-received-before-1-january-2024-can-be-brought-into-thailand-in-2024-or-later-without-being-subject-to-thai-personal-income-tax/ What to do before 1 January 2024 For greater flexibility in bringing offshore-sourced income back to Thailand, Thai tax resident individuals may consider recognizing and receiving such income by 31 December 2023. For example, if the shareholders receive dividends paid from offshore investments or gains from the sale of offshore investments outside Thailand by 31 December 2023, they can bring these offshore dividends and gains to Thailand in or after 2024 without being subject to Thai personal income tax. Alternatively, they may consider using that offshore-sourced income to reinvest offshore. In this case, the nature of offshore-sourced income should be changed to capital or costs of investment, and only the gains recognized from the reinvestment will be subject to Thai personal income tax upon remittance to Thailand. Example: If funds in an IRA account are invested in stocks: sell all the stonks this week to realise all gains/profits and losses. Once the IRA account value is all cash, the amount of the principal/capital in the account is established in the final statement for 2023. This amount is thus documented as the starting capital for reinvestment in 2024. Thus, all contributions and gains realized in December 2023 become deemed as pre-2024 income that can be remitted to Thailand tax-exempt forever. Regarding the gains on the funds reinvested in the IRA account, they are subject to Thai income tax upon remittance. What documentation is required as evidence of remittance of capital vs gains and if FIFO will be accepted, are issues that remain to be clarified in the uncertain future. The important point is that one can take action this week to potentially shelter future remittances from Thai income tax by acting NOW to take profits and reclassify all IRA funds as pre-2024 income NOW.

-

First, insurance payments are exempt from Thai income tax. Section 42 The assessable income of the following categories shall be exempt for the purpose of income tax calculation: (13) Compensation against wrongful acts, amount derived from insurance or from funeral assistance scheme. Secondly, Under the new RD Order 162, income received prior to 2024 may be remitted tax-exempt forever. Tax flash news: Further guidance from the Revenue Department on Foreign Sourced Income https://www.mazars.co.th/Home/Insights/Doing-Business-in-Thailand/Tax/Further-guidance-on-Foreign-Sourced-Income Further guidance on Foreign Sourced Income On 20 November 2023, the Revenue Department issued Departmental Instruction no. Paw.162 ("DI Paw. 162"), which provides further guidance that the interpretation under the Departmental Instruction Paw.161/2566 ("DI Paw.161") shall not apply to any foreign-sourced income earned by Thai tax residents before 1 January 2024. By virtue of this DI Paw. 162, Thai tax residents will not be required to include their foreign-sourced income earned before 1 January 2024 in their personal income tax returns, even if such income will be brought into Thailand from 1 January 2024 onwards. The challenge is in documenting the source of funds and the history of transfers and remittances.

-

Baker MacKenzie: https://insightplus.bakermckenzie.com/bm/tax/thailand-offshore-sourced-income-received-before-1-january-2024-can-be-brought-into-thailand-in-2024-or-later-without-being-subject-to-thai-personal-income-tax/ What to do before 1 January 2024 For greater flexibility in bringing offshore-sourced income back to Thailand, Thai tax resident individuals may consider recognizing and receiving such income by 31 December 2023. For example, if the shareholders receive dividends paid from offshore investments or gains from the sale of offshore investments outside Thailand by 31 December 2023, they can bring these offshore dividends and gains to Thailand in or after 2024 without being subject to Thai personal income tax. Alternatively, they may consider using that offshore-sourced income to reinvest offshore. In this case, the nature of offshore-sourced income should be changed to capital or costs of investment, and only the gains recognized from the reinvestment will be subject to Thai personal income tax upon remittance to Thailand. Regarding US IRA accounts, Order 162 may offer an opportunity to exempt all funds in an IRA account from future Thai taxes upon remittance, if one realises gains by converting to cash before Dec. 31st and subsequently reinvests funds in 2024. This would provide a documented amount of pre-2024 tax exempt funds as capital that can be remitted at any time in the future as per Order 162. Future gains starting in 2024 will be taxable upon remittance, while clarification is still lacking regarding documentation required, FIFO, etc.

-

Department of the Treasury Technical Explanation of the Convention between the United States and Thailand which was signed on November 26, 1996. https://www.irs.gov/pub/irs-trty/thaitech.pdf Article 20 (Pensions and Social Security Payments) Article 20 deals with the taxation of private (i.e., non-government) pensions, annuities, social security, and similar benefits. Paragraph 1 Paragraph 1 provides that private pensions and other similar remuneration paid in consideration of past employment are generally taxable only in the residence State of the recipient. The phrase “pensions and other similar remuneration” is intended to encompass payments made by private retirement plans and arrangements in consideration of past employment. In the United States, the plans encompassed by Paragraph 1 include: qualified plans under section 401(a), individual retirement plans (including individual retirement plans that are part of a simplified employee pension plan that satisfies section 408(k), individual retirement accounts and section 408(p) accounts), non-discriminatory section 457 plans, section 403(a) qualified annuity plans, and section 403(b) plans.

-

Confusion is caused by the diversity of the readers and the application of tax concepts and practiced in their home countries. Thai tax residents must accept RD working definitions for assessable income in tax law. Thailand: Assessable income under Section 40 includes income under Section 42 that “shall be exempt for the purpose of income tax calculation.” Australia: A taxpayer's "assessable income" is broadly their ordinary income and their statutory income but excludes their exempt income. USA IRS: Taxable income: Generally, an amount included in your income is taxable unless it is specifically exempted by law. Income that is taxable must be reported on your return and is subject to tax. Income that is nontaxable may have to be shown on your tax return but is not taxable. UK: Assessable income: the portion of one's income that is subject to tax. The Revenue Department will confirm that: This is Thailand!

-

After all of these posts, it appears that there is still confusion on three basic issues. Too much noise masking the signal. Some of this confusion can be resolved by due diligence in studying the Thai tax code = taxpayer homework! On the other hand, some of the confusion is due to translation issues, and some is due to the lack of explicit documentation clarifying exemptions and procedures regarding application of DTAs by the RD. 1. Q: Is the filing threshold based upon assessable income or total income? A: Assessable Income 2. Q: What are the assessable income filing thresholds for income not only from employment (single/married) vs. income from employment only (single/married)? A: PND.90 = 60,000/120,000; PND.91 = 120,000/220,000 3. Q: What is assessable income? A: Income under Section 40(1) to (8); however, under Section 42: The assessable income of 29 categories shall be exempt for the purpose of income tax calculation. ASSESSABLE INCOME FILING THRESHOLDS FOR PND.90/91 It is most unfortunate that non-Thai readers cannot rely upon the English language” unofficial translations” posted on the Revenue Department website, such as the Guide to Personal Income Tax Return 2021 (PND.90/ภ.ง.ด.90) For taxpayers who received incomes not only from employment and the Guide to Personal Income Tax Return 2021 (PND.90/ภ.ง.ด.91) For taxpayers who received income from employment only. This means that non-Thai readers, who may be misled by weak translation issues, are forced to rely upon more accurate “unofficial translations” by private law and tax consultancy firms with offices in Thailand, either through their websites or paid services, such as: REFERENCE: https://www.rsm.global/thailand/insights/rsm-focus/filing-pnd90-and-pnd91 PND.90 return is the personal income tax return to report the assessable income under Section 40(1) to (8) [for all 8 categories of income] PND.91 return is the personal income tax return to report the assessable income under Section 40(1) obtained from employment [category 1 only] [(40(1) Income derived from employment, whether in the form of salary, wage, per diem, bonus, bounty, gratuity, pension, house rent allowance, monetary value of rent-free residence provided by an employer, payment of debt liability of an employee made by an employer, or any money, property or benefit derived from employment.] Who is liable to pay personal income tax? Filing of PND.90/91 returns are summarized below: PND.90 return [income under Section 40(1) to (8)] PND.91 return [income under Section 40(1) derived from employment only] Single status and assessable income exceeding 60,000 baht. Single status and assessable income exceeding 120,000 baht. Marriage status and assessable income together exceeding 120,000 baht Marriage status and assessable income together exceeding 220,000 baht Additional Reference for PND.91: https://www.mazars.co.th/content/download/1176493/59841085/version//file/Personal-income-tax-return-PND-91-A-closer-look-November-2023.pdf Who must file Form PND 91? A person must file a PND 91 if they have income as set out in Section 40(1) of the Revenue Code and meet one of the following conditions: 1. Single Person Assessable income exceeding 120,000 baht in the tax year. 2. Married Person Assessable income, combined with that of your spouse, exceeding 220,000 baht in the tax year. When filing Form PND 91, there are 3 options to choose from regarding your filing status: 1. Spouse has income, and you are filing a joint tax return 2. Spouse has income, and spouse will file a separate tax return 3. Spouse has no income 3. Q: What is assessable income? Reference: https://www.rd.go.th/english/37749.html Section 39 In this Chapter, unless the context otherwise requires: Assessable income means income that is taxable under this Chapter. Section 40 Assessable income is income of the following categories including any amount of tax paid by the payer of income or by any other person on behalf of a taxpayer. A: Income under Section 40(1) to (8); however, under Section 42: The assessable income of the following categories shall be exempt for the purpose of income tax calculation: Reference: https://www.rd.go.th/english/37749.html (1 – 29) including e.g.,: (10) Income derived from an inheritance. (12) Special pension, special gratuity, inherited pension or inherited gratuity. (13) Compensation against wrongful acts, amount derived from insurance [life insurance annuity] or from funeral assistance scheme. (25) Compensatory benefit received by the taxpayer from the social security fund under the law governing social security. (27) Income derived from maintenance and support or gifts from ascendants, descendants or spouse, but only for the portion not exceeding twenty million Baht throughout the tax year. (28) Income derived from maintenances and support under moral purposes or gifts received in a ceremony or on occasions in accordance with custom and tradition from persons who are not ascendants, descendants or spouse, but only for the portion not exceeding ten million baht throughout the tax year. SUMMARY: Assessable income under Section 40 includes income under Section 42 that “shall be exempt for the purpose of income tax calculation.” Currently, the RD tax code under Section 42 does not specify that any category of income is exempt from taxation under DTAs. Disclaimer: Guavaman is not a lawyer, CPA, or tax advisor – just another passenger on the Thai-Taxic, seeking to construct a lifeboat to survive the sinking of the tax haven.

-

Department of the Treasury Technical Explanation of the Convention between the United States and Thailand which was signed on November 26, 1996. https://www.irs.gov/pub/irs-trty/thaitech.pdf Article 20 (Pensions and Social Security Payments) Article 20 deals with the taxation of private (i.e., non-government) pensions, annuities, social security, and similar benefits. Paragraph 1 Paragraph 1 provides that private pensions and other similar remuneration paid in consideration of past employment are generally taxable only in the residence State of the recipient. Note regarding life insurance annuities in Thailand: Section 42 The assessable income of the following categories shall be exempt for the purpose of income tax calculation: (13) Compensation against wrongful acts, amount derived from insurance or from funeral assistance scheme. Thai life insurance annuity payments are exempt from income tax. I cannot find any reference to offshore life insurance annuities. Annuity Insurance If you have purchased annuity life insurance before retirement, by the time it comes to receive a retirement pension, this amount will also be tax-exempt. Returns are tax-free and insurance premiums are tax-deductible. (Microsoft translator) https://www.batcbkk.com/%E0%B9%80%E0%B8%81%E0%B8%A9%E0%B8%B5%E0%B8%A2%E0%B8%93%E0%B8%AA%E0%B8%B3%E0%B8%A3%E0%B8%B2%E0%B8%8D-%E0%B8%A3%E0%B8%B2%E0%B8%A2%E0%B9%84%E0%B8%94%E0%B9%89%E0%B8%AB%E0%B8%A5%E0%B8%B1%E0%B8%87/

-

Deductible contributions to a traditional (not Roth) IRA are pre-tax income, as well as any capital gains, dividends, and interest derived from those contributions that accrue with the IRA. So all funds in an IRA are untaxed in the US until they are withdrawn, at which point all of it becomes taxable income, taxed at the ordinary income rate. Regarding remittance of traditional IRA withdrawals under the DTA, the Department of the Treasury Technical Explanation clarifies that remuneration (withdrawals) from traditional IRAs are are "generally taxable only in the residence State of the recipient." DEPARTMENT OF THE TREASURY TECHNICAL EXPLANATION OF THE CONVENTION BETWEEN THE GOVERNMENT OF THE UNITED STATES OF AMERICA AND THE GOVERNMENT OF THE KINGDOM OF THAILAND FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH RESPECT TO TAXES ON INCOME https://www.irs.gov/pub/irs-trty/thaitech.pdf Article 20 (Pensions and Social Security Payments) Article 20 deals with the taxation of private (i.e., non-government) pensions, annuities, social security, and similar benefits. Paragraph 1 Paragraph 1 provides that private pensions and other similar remuneration paid in consideration of past employment are generally taxable only in the residence State of the recipient. The phrase “pensions and other similar remuneration” is intended to encompass payments made by private retirement plans and arrangements in consideration of past employment. In the United States, the plans encompassed by Paragraph 1 include: qualified plans under section 401(a), individual retirement plans (including individual retirement plans that are part of a simplified employee pension plan that satisfies section 408(k), individual retirement accounts and section 408(p) accounts), non-discriminatory section 457 plans, section 403(a) qualified annuity plans, and section 403(b) plans. The payer must submit a 1099-R with the IRS, so the taxpayer must report this income in a tax filing with the IRS. Theoretically, a tax credit will be available from the RD in Thailand for taxes paid on IRA withdrawals in the US.

-

Correction: Contributions to IRAs and life insurance annuities are not conjugal/community property. So gifts of income from these sources can be made to a spouse as a gift of personal property to a spouse. Income from life insurance annuities are exempt from Thai income tax, while IRA withdrawals are taxable under the DTA between Thailand and the US.

-

The issue of a gift of "non-conjugal property" is an important issue for aliens who are married to Thais in this country which is a "community property" state, which is a legal fact, of which, many foreigner are not aware. The community property concept refers to assets that are owned jointly after accumulation after marriage. So assets accumulated by an expat prior to marriage, are deemed to be his assets. If a foreigner has accumulated financial assets prior to marriage, he retains his ownership of his personal assets such as his contributions to pensions, annuities, social security, etc. It is only the assets that have been accumulated after marriage, that result in joint ownership with the spouse. Important exceptions to this for Americans are the following; contributions to IRAs and life insurance annuities, whereby the sole ownership of these instruments lies with the owner of the contract for the IRA or the annuity. This means that foreign income from IRAs and life insurance annuities are exempt from Thai income tax. Distributions of income from these instruments are NOT construed to be "conjugal property".

-

Section 40 Assessable income is income of the following categories including any amount of tax paid by the payer of income or by any other person on behalf of a taxpayer. (1) Income derived from employment, whether in the form of salary, wage, per diem, bonus, bounty, gratuity, pension, house rent allowance, monetary value of rent-free residence provided by an employer, payment of debt liability of an employee made by an employer, or any money, property or benefit derived from employment.4 You need to seriously study the Thai RD tax laws -- pension income is included under the category of "employment." This is the first thing that you need to understand + a lot more to deal with the new reality for foreign tax residents.

-

Regarding the tax exempt status of gifts of income from abroad: According to the Q&A that the Revenue Department published on its website (translated by Mazars), income from abroad will not be subject to tax, if such income is eligible for tax exemption under the general rules. https://www.mazars.co.th/Home/Insights/Doing-Business-in-Thailand/Tax/Q-A-published-on-foreign-sourced-income Following the issuance of the Revenue Departmental instruction number Paw. 161/2566 ("DI. Paw. 161") in September 2023, the Revenue Department published on its website this month a Q&A concerning the concept, conditions and clarification of tax treatments on foreign-sourced income under the Revenue Code. Q1: What kind of income shall be taxed upon bringing into Thailand, according to Section 41 and DI. Paw. 161? A: Foreign-sourced income subject to Thai personal income tax upon bringing into Thailand is an assessable income under Section 40(1) to (8) of the Thai Revenue Code. Assessable income under Section 40 of the Revenue Code: 1. Employment 2. Independent personal services 3. Goodwill, copyright and other (intangible) rights 4. Interest income, dividends and capital gains 5. Rental from property 6. Professional services 7. Hire of work (i.e., services contracts) 8. Business, commerce, agriculture, industry, transport, etc. However, if the income is eligible for tax exemption under the general rules, such income from abroad will not be subject to tax under DI. Paw. 161. For example, income regarded as a gift from parents, descendants, or spouses in an amount not over Baht 20 million per annum is exempt from personal income tax.

-

There is still a physical transfer of Baht funds into the receiving account on the date shown in the bank book and statement with the FTT code. However, for RD the remittance would show up twice: once in the dollar account and then again in the Baht account. That could complicate things for RD, which might want to see both account statements and double count the remittance for income tax assessment purposes.