Guavaman

Member-

Posts

196 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Guavaman

-

In this post Por 161/2566 and Por 162/2566 era, it appears that the only way that current assessable income derived from a foreign source by a tax resident of Thailand -- Thai citizen or foreigner -- can become "savings" is to for that specific income to be remitted to Thailand and subjected to the assessment process -- self-assessment and/or assessment by the RD. If savings from current income that has been subjected to the tax process in another country is remitted 10 years from now, one will find it extremely challenging to obtain a tax credit or exemption for those particular funds. Thai tax residents need to segregate their offshore "savings" into separate accounts according to the source of funds to be able to prove the eligibility of those specific funds for exemption from calculation of tax in Thailand. The fungibility dilemma -- only solvable using digital funds with blockchain for tracking or some such system. On the other hand, if the RD moves to taxation of worldwide income irrespective of where it is derived, they could return to merely assessing reported income derived in a tax year by a Thai tax resident.

-

https://rd.go.th/fileadmin/download/nation/america_t.pdf

-

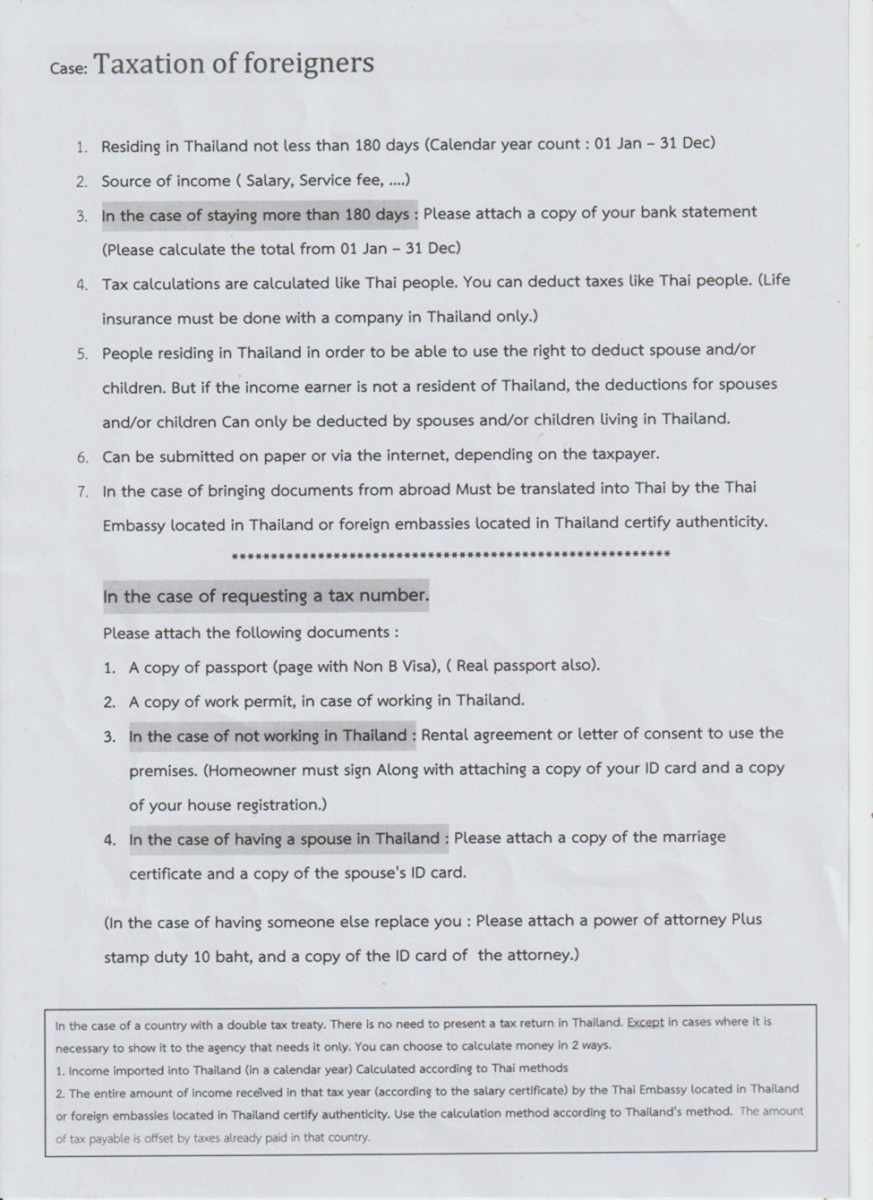

This is a significant issue in dealing with filing a tax return. Reports from members who have filed online have said that no financial supporting documentation is required. On the other hand, the RD handout being provided to foreign taxpayers in Item 3 instructs the taxpayer to "Please attach a copy of your bank statement." With this, the RD will see incoming remittances into your bank accounts in Thailand, including both assessable income and income that is exempt from calculation of income tax, such as government pensions, social security, inheritances, etc. If this is done in person, the tax officer could screen out exempted assessable income items that have no place to be reported on a tax return.

-

As we consider the application of the Tax Code and DTAs, it appears that a key challenge is understanding the meaning of documents in Thai language as translated unofficially into English, and the meaning of DTAs in English. Meanwhile, only the official Thai language versions of the Tax Code and DTAs are legal in Thailand. ROYAL DECREE (No. 18), B.E. 2505 (1962) Issued under the Revenue Code Regarding Revenue Tax Exemption states the following: Section 3 Taxes and duties under the Revenue Code shall be exempted for persons in accordance with the agreements on avoidance of double taxation which the government of Thailand has entered into or shall enter into with the governments of foreign countries. The Thai original also refers to exemptions of taxes for persons under the DTAs. Regarding the concept represented by AN posters using the terms "non-assessable" or "nonassessable" or "non assessable," searching in the TRD website on any of these 3 AN terms fails to show any search results in the English language unofficial translations. A reasonable person might conclude that the absence of any of these terms in English on the TRD website could indicate that this concept does not exist in the Thai tax system. The only way to represent this concept in Thai language requires a description such as "income that doesn't need to be assessed," but nothing like that appears in results of searches in the Thai Tax Code. On the other hand, the Tax Code consistently refers to "assessable income ... exempt for the purpose of income tax calculation," for example: Section 42 The assessable income of the following categories shall be exempt for the purpose of income tax calculation. The Thai term is ยกเว้น yok wen, meaning yok = raise up + wen meaning exception; to provide an exception (to the rule). In other words, exempt assessable income = income that may be computed into a monetary value that is exempt for the purpose of income tax calculation. Tax Code Section 39 In this Chapter, unless the context otherwise requires: Assessable income means income that is taxable under this Chapter. Such income also includes a property or any other benefit received which may be computed into a monetary value, any amount of tax paid by the payer of income or by any other person on behalf of a taxpayer and tax credit under Section 47 Bis. In summary, "non-assessable" is not a concept that appears within the context of the Thai Tax Code; "exempt for the purpose of income tax calculation" is the concept applied in the RD context. One of the interesting features of Thai culture is the preferred tendency to maintain wiggle-room, facilitated by the use of ambiguity in communications to allow for flexibility of response as appropriate for diverse and unforseen situations.

-

It is highly unlikely that the RD intends to instruct foreign taxpayers from DTA countries that there is no need to file a tax return by a footnote in an unofficial handout with no logo or government agency identity. How about a third possible interpretation? Something like this: 3) There is no need to present a [copy of one's national] tax return in Thailand. Except in cases where it is necessary to show it to the agency that needs it only [such as offices of the Revenue Department for the process of calculation of tax on assessable income or for audits.] Note: Item 3 instructs the taxpayer to "Please attach a copy of your bank statement." With this, the RD will see incoming remittances into your bank accounts in Thailand, including both assessable income and income that is exempt from calculation of income tax, such as government pensions, social security, inheritances, etc. If this is done in person, the tax officer could screen out exempted assessable income items that have no place to be reported on a tax return. It remains to be seen how RD officers will interpret the "clarifications" provided in the unofficial handout. It is likely that we will read about this as more reports appear in these threads. It is to be expected that there will be diverse interpretations by the tax offices and officers, as we know well from experience with immigration offices.

-

It appears that the RD has finally issued clarification in the form of a handout for foreign taxpayers to be provided by local tax offices. This has been reported twice now, with the most recent case in Chiang Mai. In the box on the bottom, it states: You can choose to calculate money in 2 ways. 1. Income imported into Thailand (in a calendar year) Calculated according to Thai methods So that’s it: simply calculate your income tax according to Thai methods.

-

This is the second report of a tax office providing the document titled: Case: Taxation of Foreigners; this time from Chiang Mai, while the first report did not mention the province. This might indicate that this document with these instructions are the RD's handout provided to the local tax offices for distribution to foreign tax payers. Could this be the long-awaited (by some) additional details provided by the RD?

-

The TRD approach to assessable income that is exempt for the purpose of income tax calculation under Section 42 is demonstrated in the following examples --- there are no provisions on the tax forms to declare & exempt these types of assessable income for income tax calculation: (10) Income derived from an inheritance. (15) Income of a farmer from sale of rice cultivated by the farmer and/or his family. (23) Income from sale of investment units in a mutual fund. (27) Income derived from maintenance and support or gifts from ascendants, descendants or spouse, but only for the portion not exceeding twenty million Baht throughout the tax year. Even though Royal Decree No. 18 on DTAs was promulgated in 1962, the TRD has not included any provisions for claiming exemptions or foreign tax credits in the forms for filing personal income tax returns for 64 years; this demonstrates the TRD approach.

-

Regarding the reference to Ministerial Regulations in the Revenue Code, there are only two that are specified in a footnote to category (17) that appear in the English translation on the RD website; however, on the Thai website, the following additional Ministerial Regulations are also listed in the footnote to category (17): Google Translate 230 BE 2544 Give as much money as was paid for the purchase of the building. Building with land Apartments or land along with the construction of a building on the land within a period of 1 year are exempt income. 241 BE 2546 Concerning the exemption of revenue, add (62) of Section 2 of Ministerial Regulation No. 126 (B.E. 2509), granting income from the sale of real estate. Real estate including land and apartments are exempt income. Amendment No. 126 252 BE 2548 Specifies that the assessable income of those damaged by a geological disaster is income that is exempt from being included in the calculation of income tax. 254 BE 2548 Tax exemption Tax benefits for civil servants who left government service according to government measures in 2004 and civil servants who left government service according to government measures in 2005. 385 BE 2565 Issued in accordance with the Revenue Code. Exemption from income tax for community enterprises only that are general partnerships or groups of persons that are not juristic persons. Additional amendments (No. 126) 386 BE 2565 Issued in accordance with the Revenue Code. Regarding tax exemption Measures to shop well and have returns in 2023. (Announcement from the Director-General of the Revenue Department About income tax (No. 431) etc.) 387 BE 2565 Regarding tax exemption Tax measures to support the filming of foreign films in Thailand 388 BE 2565 Regarding tax exemption Personal income tax exemption measures for compensation support or any other benefits received from the government in tax year 2022 https://www.rd.go.th/6160.html

-

Regarding the reference to Ministerial Regulations in the Revenue Code, there are only two that are specified in a footnote to category (17): Section 42 The assessable income of the following categories shall be exempt for the purpose of income tax calculation: (17) Income prescribed for exemption by Ministerial Regulations.12 12M.R. No. 126, No. 201 B.E. 2539 Ministerial Regulation No. 126, (B.E. 2509) Issued under the Revenue Code Regarding Revenue Tax Exemption Clause 2 The following incomes shall be prescribed as incomes under (17) of Section 42 of the Revenue Code as amended by the Revenue Code Amendment Act (No. 10), B.E. 2496 : 95 types of exempted income are listed with descriptions; the English translation appears on the RD website here: https://www.rd.go.th/fileadmin/user_upload/kormor/eng/MR_126.pdf The only other Ministerial Regulation referred to in Section 42 (17) is M.R. No. 201 (B.E. 2539) covering exemption from personal income tax on compensation from transfer of ownership in real estate in the Pa Sak Basin Development Project.

-

Assessable income is declared according to the category of income 40(1)-(8), pension or dividends that is remitted. If you withdraw those funds by ATM, CC, etc., that assessable income is reported as either pension or dividends according to the source of those funds remitted. Ideally, one would have separate accounts for pension and dividends; however, if those funds are comingled in one account, one cannot document the source of the funds for each transaction. The deduction for 50% of expenses up to 100K for employment/pension income category 40 (1) in 1 (1) does not apply to assessable income from dividends, so including dividend income there confounds the calculation of the deductible expenses in 1(5).

-

Department of the Treasury Technical Explanation of the Convention between the United States and Thailand which was signed on November 26, 1996. https://www.irs.gov/pub/irs-trty/thaitech.pdf Article 20 (Pensions and Social Security Payments) Article 20 deals with the taxation of private (i.e., non-government) pensions, annuities, social security, and similar benefits. Paragraph 1 Paragraph 1 provides that private pensions and other similar remuneration paid in consideration of past employment are generally taxable only in the residence State of the recipient. The phrase “pensions and other similar remuneration” is intended to encompass payments made by private retirement plans and arrangements in consideration of past employment. In the United States, the plans encompassed by Paragraph 1 include: qualified plans under section 401(a), individual retirement plans (including individual retirement plans that are part of a simplified employee pension plan that satisfies section 408(k), individual retirement accounts and section 408(p) accounts), non-discriminatory section 457 plans, section 403(a) qualified annuity plans, and section 403(b) plans.

-

Section 41 A taxpayer who in the previous tax year derived assessable income under Section 40 from an employment, or from business carried on in Thailand, or from business of an employer residing in Thailand, or from a property situated in Thailand shall pay tax in accordance with the provisions of this Part, whether such income is paid within or outside Thailand. A resident of Thailand who in the previous tax year derived assessable income under Section 40 from an employment or from business carried on abroad or from a property situated abroad shall, upon bringing such assessable income into Thailand, pay tax in accordance with the provisions of this Part. https://www.rd.go.th/english/37749.html

-

Exemptions under DTAs are covered in ROYAL DECREE No. 18 Issued under the Revenue Code Regarding Revenue Tax Exemption in B.E. 2505 (1962). Section 3 Taxes and duties under the Revenue Code shall be exempted for persons in accordance with the agreements on avoidance of double taxation which the government of Thailand has entered into or shall enter into with the governments of foreign countries. Remarks :- The reason for the promulgation of this Royal Decree is that the government of Thailand has executed the agreements with the governments of foreign countries for the avoidance of double taxation for persons who are residents of one country but earn incomes or have properties in another country. Without such agreements, those persons may be obliged to pay taxes to both countries at the full rates which causes onerous burden to them. Hence, it is deemed expedient to alleviate burden of those persons in order to promote international investment and economic relations. https://www.rd.go.th/fileadmin/user_upload/kormor/eng/RD_18.pdf

-

The concept of assessable income exempt from tax calculation appears in the Revenue Code in the following translation from the RD webpage: https://www.rd.go.th/english/37749.html Section 42 The assessable income of the following categories shall be exempt for the purpose of income tax calculation: The Tax Code lists 29 types of assessable income that shall be exempt, including -- (10) Income derived from an inheritance (13) Compensation against wrongful acts, amount derived from insurance or from funeral assistance scheme (27) Income derived from maintenance and support or gifts from ascendants, descendants or spouse, but only for the portion not exceeding twenty million Baht throughout the tax year. (28) Income derived from maintenances and support under moral purposes or gifts received in a ceremony or on occasions in accordance with custom and tradition from persons who are not ascendants, descendants or spouse, but only for the portion not exceeding ten million baht throughout the tax year.

-

US Tax Filing Status MFS/MFJ

Guavaman replied to NoDisplayName's topic in Jobs, Economy, Banking, Business, Investments

Here is an example of a potential issue: Claiming the foreign earned income exclusion for a U.S. citizen working abroad due to physical presence or bona fide residence in Thailand might be negated if the U.S. citizen is treated as a U.S. resident due to election of treating one's Thai wife as a resident alien, since that election results in both husband and wife being deemed as U.S. tax residents. -

US Tax Filing Status MFS/MFJ

Guavaman replied to NoDisplayName's topic in Jobs, Economy, Banking, Business, Investments

Regarding house sale for married filing jointly and U.S. income tax: If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a joint return with your spouse. Publication 523, Selling Your Home provides rules and worksheets. Topic no. 409 covers general capital gain and loss information. Qualifying for the exclusion In general, to qualify for the Section 121 exclusion, you must meet both the ownership test and the use test. You're eligible for the exclusion if you have owned and used your home as your main home for a period aggregating at least two years out of the five years prior to its date of sale. You can meet the ownership and use tests during different 2-year periods. However, you must meet both tests during the 5-year period ending on the date of the sale. Generally, you're not eligible for the exclusion if you excluded the gain from the sale of another home during the two-year period prior to the sale of your home. Refer to Publication 523 for the complete eligibility requirements, limitations on the exclusion amount, and exceptions to the two-year rule. https://www.irs.gov/taxtopics/tc701 In this case (house sale), MFJ has a big upside = up to $500,000 tax-free gain under U.S. tax law; however, it appears that she would not be able to claim foreign tax credit for the Thai transfer tax paid to the Land Department due to her election to be treated as a U.S. resident alien, which negates relief under the DTA, similar to the example provided by the IRS regarding interest income. Note: I have enjoyed the upside of 30 years of reduced U.S. income taxes due to electing to treat my non-resident Thai wife as a resident alien and I expect to enjoy tax-free sale of our house in the future; however, I have never considered the implications of this with regard to the DTA until recently. In practice, this appears to be a gray area that the average junior IRS worker would not be able to deal with involving the DTA and issues of non-resident aliens treated as resident aliens. Other issues with upside/downside may be identified if one conducted deep research into the implications of this election, including the fact that not only one's Thai wife but the U.S. citizen husband is also treated as a U.S. resident while also being a Thai tax resident and how that impacts upon relief provided to U.S. citizens under the DTA. -

US Tax Filing Status MFS/MFJ

Guavaman replied to NoDisplayName's topic in Jobs, Economy, Banking, Business, Investments

If you choose Married Filing Jointly with a nonresident alien spouse, you must elect to treat your spouse as a U.S. resident alien for tax purposes. You’ll need to include all of your spouse's income, which might only be the interest income from her savings accounts in Thailand. There are some issues related to the DTA and election of this treatment under 26 CFR § 1.6013-6. 26 CFR § 1.6013-6 - Election to treat nonresident alien individual as resident of the United States. § 1.6013-6 Election to treat nonresident alien individual as resident of the United States. (a) Election for special treatment—(1) In general. Two individuals who are husband and wife at the close of a taxable year ending on or after December 31, 1975, may make an election under this section for that taxable year if, at the close of that year, one spouse is a citizen or resident of the United States and the other spouse is a nonresident alien. The effect of the election is that each spouse is treated as a resident of the United States for purposes of chapters 1, 5, and 24 and sections 6012, 6013, 6072, and 6091 of the Code for the entire taxable year. (2) Particular rules. (v) An individual who makes an election under this section may not, for United States income tax purposes, claim under any United States income tax treaty not to be a U.S. resident. The relationship of U.S. income tax treaties and the election under this section is illustrated by the following example. Example. H, a U.S. citizen, is married to W, a nonresident alien of the United States and a domiciliary of country X. H and W maintain their only permanent home in country X. W receives both U.S. source and country X source interest during the taxable year. The interest is not effectively connected with a permanent establishment or a fixed base in any country. H and W make the section 6013 (g) election. Under article ii (1) of the United States—country X Income Tax Convention interest derived and beneficially owned by a resident of one contracting state is exempt from tax in the other contracting state. Article 4 (1) of the treaty provides that an individual is a resident of a contracting state if subject to tax in that country by reason of the individual's domicile, residence, or citizenship. Under article 4 (1) of the treaty, W is a resident of country X by virtue of her domicile in country X and also of the United States by virtue of the section 6013 (g) election. Article 4 (2) of the treaty provides that if an individual is a resident of both the United States and country X by reason of article 4 (1), the individual shall be deemed to be a resident of the contracting state in which he or she has a permanent home available. Because W's sole permanent home is in country X, under article 4 (2) of the treaty W is treated as a resident of country X for purposes of the treaty. Because W has elected under section 6013(g) to be treated as a U.S. resident (and thus to be taxed on worldwide income), W may not, for U.S. income tax purposes, claim under the treaty not to be a U.S. resident. W, therefore, is subject to U.S. income tax on the interest. For purposes of country X income tax, W is considered a resident of country X under the treaty. https://www.law.cornell.edu/cfr/text/26/1.6013-6 One can imagine some of the other implications of the relationship of DTA and the election under this section; for example: If your non-resident alien wife (treated as a U.S. tax resident alien) owns land and sells the land resulting in capital gains, that income would be subject to interpretation of the DTA and election under section 6013(g) to determine how to apply U.S. tax laws. -

Thailand to tax residents’ foreign income irrespective of remittance

Guavaman replied to snoop1130's topic in Thailand News

Sorry, it appears that one needs a MyTax Account to enter the system to reach this webpage. -

TRD form ค.10 is a request for refund of tax. On the (old) form provided, the data fields are as follows: 1. Name and TIN (below and not filled in); to the right is the Thai National ID No., filled in by hand starting with 0 99 ...... The English "TIN No." is misplaced over the field for the Thai ID No.

-

Posters on this thread and its' predecessor have stated that there is no mention of DTAs in the Thai Tax Code. Here is a TRD reference to the Royal Decree No. 18 on DTAs from 1962: ROYAL DECREE Issued under the Revenue Code Regarding Revenue Tax Exemption (No. 18), B.E. 2505 (1962) Section 3 Taxes and duties under the Revenue Code shall be exempted for persons in accordance with the agreements on avoidance of double taxation which the government of Thailand has entered into or shall enter into with the governments of foreign countries. Remarks :- The reason for the promulgation of this Royal Decree is that the government of Thailand has executed the agreements with the governments of foreign countries for the avoidance of double taxation for persons who are residents of one country but earn incomes or have properties in another country. Without such agreements, those persons may be obliged to pay taxes to both countries at the full rates which causes onerous burden to them. Hence, it is deemed expedient to alleviate burden of those persons in order to promote international investment and economic relations. (Government Gazette, Volume 78, Part 69, dated 31st July B.E. 2505 (1962)) Source: https://www.rd.go.th/fileadmin/user_upload/kormor/eng/RD_18.pdf

-

Living will in Thailand; suggestions requested

Guavaman replied to NewGuy's topic in Health and Medicine

Here are links to the 2 sample living will formats developed by the Thailand Office of the National Health Commission: English versions https://www.thailivingwill.in.th/sites/default/files/Living_Will_Samples_1_2_Final_1.pdf Thai versions matching the English versions https://www.nationalhealth.or.th/th/node/4004 ตัวอย่างหนังสือแสดงเจตนา แบบที่ 1 รูปแบบ DOC File ตัวอย่างหนังสือแสดงเจตนา แบบที่ 2 รูปแบบ DOC File -

Question about the two types of lower class consonants

Guavaman replied to transpose's topic in Thai Language

It is the vowels that are long or short. า in ยาก is long vowel, the o sound for the missing vowel in มด is a short vowel. For example: look at มาก and ยก. -

Actually, on the Income Exemption Entitlement Form to be used with ภ.ง.ด.90, the form is set up so that “… the taxpayer can elect to apply the exemption to any categories of income from 40 (1) – (8), but the aggregated exempted amount cannot exceed 190,000 baht. If the exemption applies, fill in the information in ภ.ง.ด.90.” Note the double asterisks ** No. 2-9 Assessable Income Exempted Income* Income after deduction** of exemption to be filled in ภ.ง.ด.90

-

This only comes into play when a taxpayer receives gifts exceeding 10m or 20m during the tax year. Revenue Code Chapter 3 Income Tax (26) Income derived from the transfer of ownership or possessory right in an immovable property, … but only for the portion not exceeding twenty million baht per a legitimate child throughout the tax year (27) Income derived from maintenance and support or gifts from ascendants, descendants or spouse, but only for the portion not exceeding twenty million Baht throughout the tax year. (28) Income derived from maintenances and support under moral purposes or gifts received … but only for the portion not exceeding ten million baht throughout the tax year. The tax on this is reported further down on Form PND 90: 17. Plus additional tax payable (from No. 9 (if any))