Guavaman

Member-

Posts

193 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Guavaman

-

For what it's worth, when I transfer funds from my Bangkok Bank US dollar account to my Thai Baht account, it shows as FTT = foreign transfer, which is actually a loophole in the 65k monthly income requirement of immigration. For example, one could transfer a lump sum into a dollar account here before Jan. 1st, and then simply transfer 65k each month from the dollar account to a Baht account to show immigration.

-

Taxation of Ex-Pats pensions etc.

Guavaman replied to LittleBear57's topic in Thai Visas, Residency, and Work Permits

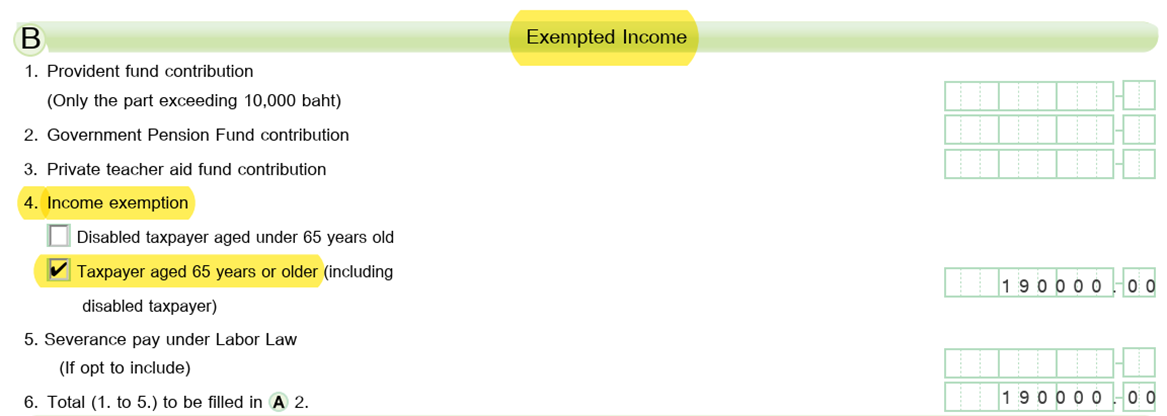

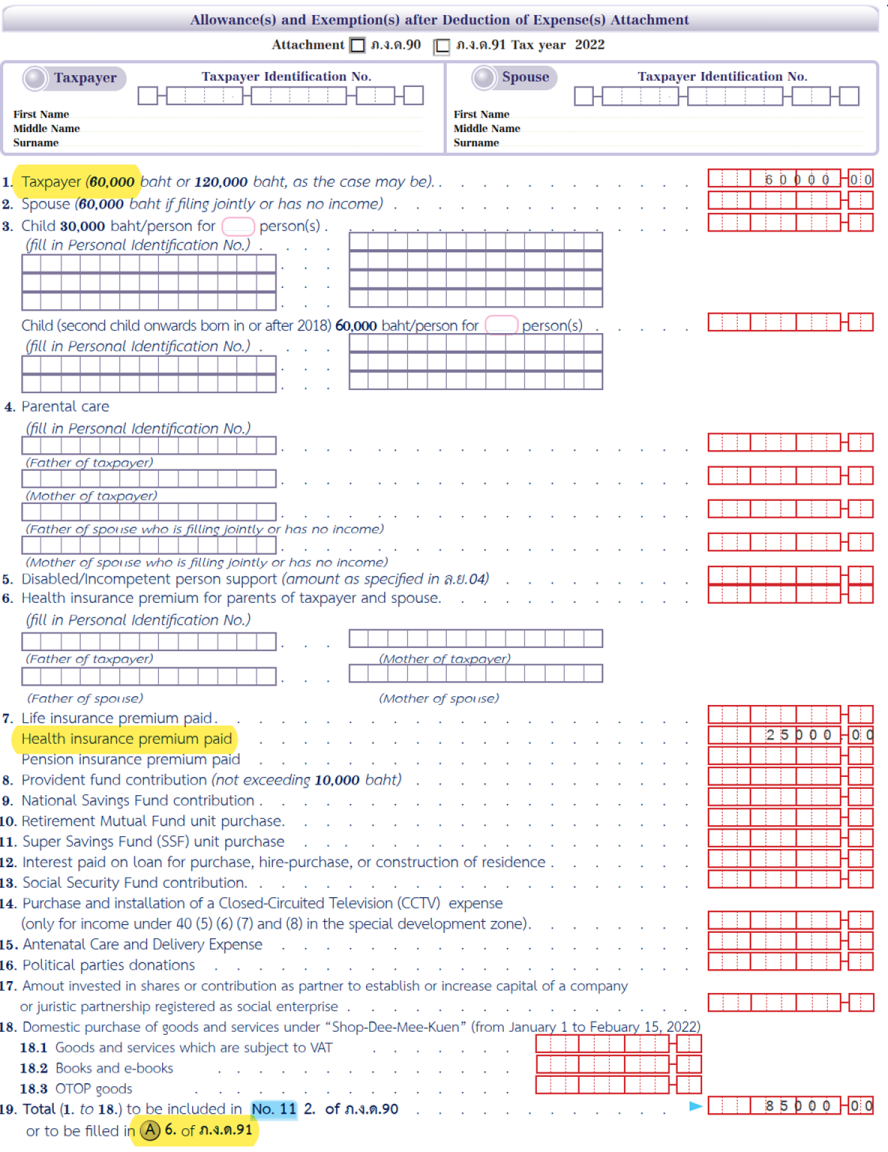

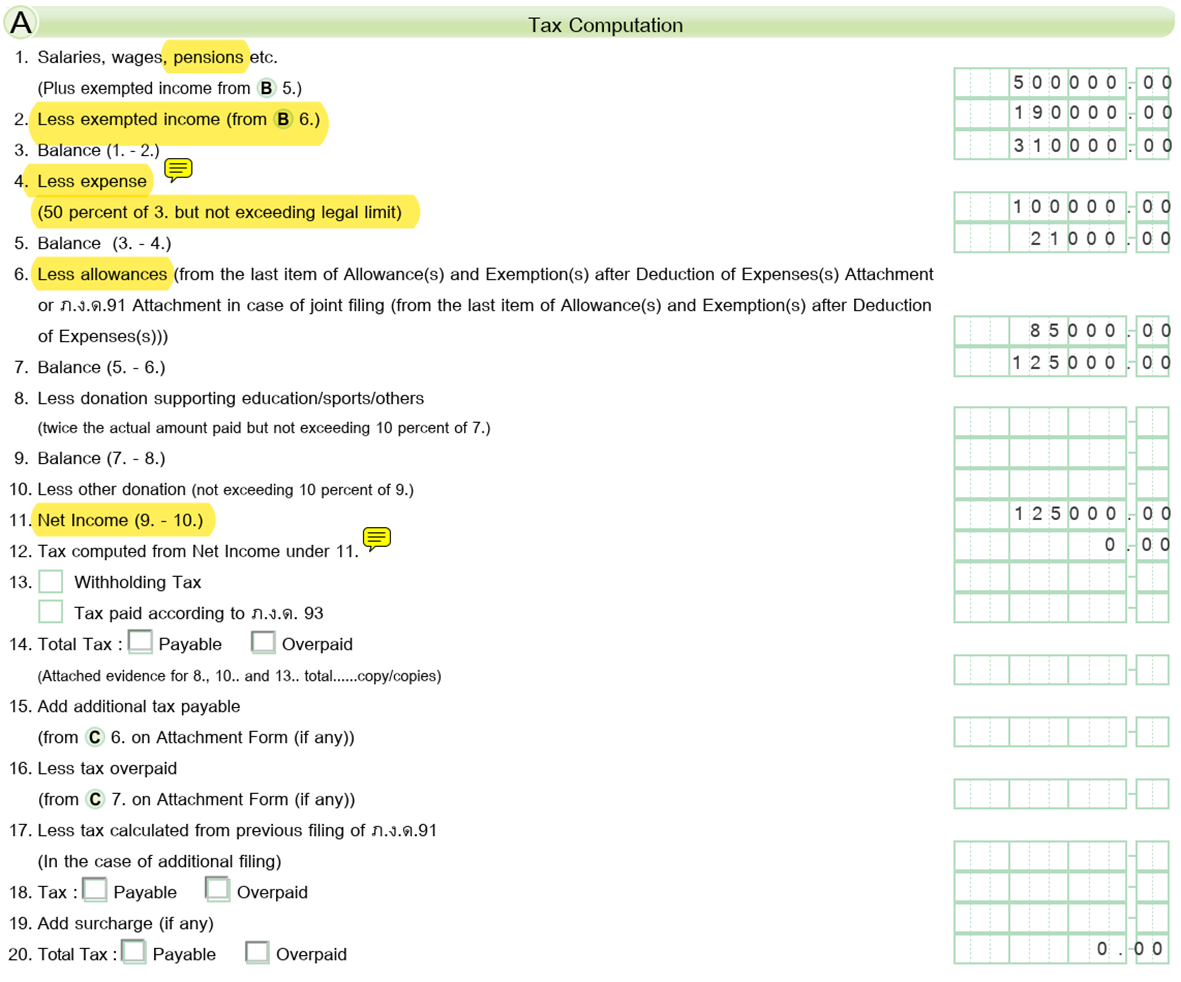

3. Personal Income Tax Return for taxpayer with only income from employment under Section 40 (1) of the Revenue Code Only (Tax Year 2022) As someone pointed out above, line 5 should be 210,000 rather than 21000; the form does not do any calculations for you. -

Taxation of Ex-Pats pensions etc.

Guavaman replied to LittleBear57's topic in Thai Visas, Residency, and Work Permits

Fellow expat tax residents in Thailand, One source of confusion in our communications regarding Thai income tax issues is the lack of consistent use of technical terms in English. The Revenue Department webpage https://www.rd.go.th/english/38306.html states the following: Advisory Notice Please note that the English version is for translation purposes only. For official use, please refer to the Thai language. The absence of “official” translations of Thai language tax-related documents results in variations in terms used by sources of information accessible online, including articles in English language newspapers. On the other hand, use of terms on web-based articles by international law and tax consultant firms are usually quite consistent, with minor variations. The diverse collection of participants in this forum from different countries and including non-native English speakers naturally gives rise to many different idiosyncratic uses of important legal and taxation terms, resulting in confusion. If we could all get clear on the use terms these terms in English, it would facilitate clarity in our continued discussions going forward. For example, Exemptions, Deductions of Expenses, and Allowances are not synonyms – they are not inter-changeable; rather, each term has a specific meaning and a different root word in Thai. These are the terms used in the PND 91 tax filing form in English from the downloadable forms on the RD webpage: https://www.rd.go.th/english/63902.html Personal Income Tax Return for taxpayer with only income from employment under Section 40 (1) of the Revenue Code Only (Tax Year 2022). It is hoped that this example may help to visualize the structure of the tax filing form for those who report “only income from employment” category using the PND 91 form. Taxpayers who report other categories of income must use the other form PND 90 “for taxpayer with income not only from employment” to include income from other categories as well, such as interest, dividends, rental income, etc. If one accepts payment of 15% withholding tax on interest on Thai bank accounts, one can use the PND 91 form; otherwise, one must use the PND 90 form to claim refund of the 15% withholding tax on interest. Exemptions, deductions of expenses, allowances: not same = different. Good luck in your Thai tax adventures -

Taxation of Ex-Pats pensions etc.

Guavaman replied to LittleBear57's topic in Thai Visas, Residency, and Work Permits

The Thai tax system does not have a single “standard deduction”. Rather, each of 8 categories of assessable income has a standard deduction of expenses as a % of that type of assessable income, within a specified limit. The taxpayer can choose whether to claim the standard % or to claim actual and proven expenses for some categories and sub-categories, as shown by asterisks below. Exemptions and allowances are detailed on this webpage. https://sherrings.com/personal-tax-deductions-allowances-thailand.html -

Taxation of Ex-Pats pensions etc.

Guavaman replied to LittleBear57's topic in Thai Visas, Residency, and Work Permits

Sorry, it was only meant to indicate that retired Thais take the standard deduction on their pensions. -

Taxation of Ex-Pats pensions etc.

Guavaman replied to LittleBear57's topic in Thai Visas, Residency, and Work Permits

It is a standard deduction. The Revenue Code on the RD website has not been updated on this in English; however, a translation of the amended Act of 2017 appears in the Revenue Department Annual Report 2560 (2017) on page 73 https://www.rd.go.th/fileadmin/download/annual_report/annual_report60.pdf 1. Tax measures to increase the competitiveness of the country. 1.1. Restructuring personal income tax. (1) Increased standard deductions. 1. Any person, who has the assessable income under Section 40 (1) and (2) of the Revenue Code such as salary, wage, or commission, shall be allowed to use a standard deduction as expense of 50 percent of the income but shall not exceed 100,000 Baht according to Section 42 Bis of the Revenue Code amended by Section 3 of the Act amending the Revenue Code (No. 44) B.E. 2560. Note: The original deduction was 40 percent of income but shall not exceed 60,000 Baht. Section 40 Assessable income is income of the following categories including any amount of tax paid by the payer of income or by any other person on behalf of a taxpayer. (1) Income derived from employment, whether in the form of salary, wage, per diem, bonus, bounty, gratuity, pension, house rent allowance, monetary value of rent-free residence provided by an employer, payment of debt liability of an employee made by an employer, or any money, property or benefit derived from employment. Thailand: Individual - Deductions Last reviewed - 12 July 2023 Employment expenses A standard deduction of 50%, with a limit of THB 100,000, is permitted in respect of income from employment. Here is an example from the Defence Finance Department of a General receiving a pension and taking the standard deduction.. Google Translate: Defence Finance Department Example of calculation of withholding tax, type 3, age 65 years General. A receives a monthly pension of 74,320 baht, amounting to 12 month 891,840.00. Exemption age 65 years 190,000.00 Deduct expenses 50%, not more than 100,000 baht 100,000.00 Balance 601,840.00 Allowances 1. People with income 60,000.00 2. Husband or wife who has an income 60,000.00 3. Educational child 1 person 30,000.00 4. Biya Prakanatcheewit (not exceeding 100,000 baht) 100,000.00 5. Fund units in stock mutual funds (not exceeding 15% of income, not exceeding 500,000 baht) 133,776.00 6. Interest on loans for hire purchase or construction of residential buildings. Not more than 100,000 baht 100,000.00 483,776.00 Balance Net Income 118,064.00 7. Donation 10% net income (not exceeding 100,000 baht) 11,806.40 Net income for tax calculation 106,257.60 Income tax structure Ordinary people start tax year 2017 All of the retired Thai civil servants and military are eligible for the standard deduction on their pension incomes. -

In the UK, calculating the tax on your income involves two primary methods: the arising basis and the remittance basis. The arising basis is straightforward. You pay UK tax on your worldwide income and gains for the tax year (April 6th to the following April 6th). However, the remittance basis is more complex and requires deeper understanding. What is the remittance basis of taxation? Under the remittance basis of taxation, you will pay tax on UK sources of income and gains, plus any foreign incomes and gains that you remit to (bring into) the UK. In effect, you can exclude foreign incomes and gains from UK taxation – providing that those incomes and gains are kept offshore. Qualifying for the remittance basis of taxation requires fulfilling three conditions. In order to claim the remittance basis of taxation and keep your foreign unremitted income tax-free in the UK, you must: Be a resident of the UK for tax purposes Classify as non-domiciled Have foreign income or gains1 Here is an article about this: https://brighttax.com/blog/uk-remittance-basis/#:~:text=Under%20the%20remittance%20basis%20of,and%20gains%20are%20kept%20offshore.

-

That file - https://www.rd.go.th/english/23520.html - was last updated: 01.09.2014. The most recent set of Q&A issued to clarify the Order by the RD includes mention of only the credit method , not the exemption method. 10. Question: If assessable income imported into Thailand is income that was already taxed abroad, if the money is brought back in, the income must be taxed in Thailand again? Is it a double tax collection or not? Answer: There is no double taxation. In the case of being a tax resident in Thailand (remained in Thailand for more than 180 days) can take tax paid abroad as a credit against required tax in Thailand in the tax year in which the assessable income is brought into Thailand according to the provisions of the Double Tax Convention that Thailand is a contracting party with that country.

-

The real estate (land & property) business in Thailand is subject to a specific business tax. Google translate: Royal Decree Issued in accordance with the Revenue Code Concerning the sale of immovable property for commerce or profit (No. 342) 1998 Section 4 specifies that the sale of immovable property specifically requires registration of rights and legal acts as follows: It is the sale of immovable property in a commercial or profitable manner that is subject to specific businesses tax according to Section 91/2 (6) of the Revenue Code. https://www.rd.go.th/english/37753.html#section912 Section 91 Specific business tax is an assessment tax. Section 91/2 Subject to section 91/4, the following businesses carried on in Thailand shall be subject to specific business tax under the provisions of this Chapter: (6) sale of an immovable property in a commercial or profitable manner, irrespective of the manner in which such property is acquired, only in accordance with the rules, procedures and conditions prescribed by a royal decree;

-

The working definition of "property" in Royal Decree No. 743 needs to be clearly defined by RD. Assets vs. Property seems to be a difficult issue, both in Thai & English. Part of the confusion is due to different usages by lawyers and accountants = different systems. I can tell you this: the only places that the word “property” (ทรัพย์สิน) appears on the PND 90 income tax filing form, it is related to immovable property – rent or sale. You can see in the attached filing forms in Thai & English highlighted in yellow. So for these purposes, i.e. exemption of income tax, if the RD tax officer applies the definition as “immovable property”, then all other types of assets are not included – not exempted. That depends upon RD. 220366PIT90.pdf 271265PIT90 THAI.pdf

-

Here is the translation of Royal Decree No. 743 from the BOI site: https://ltr.boi.go.th/documents/Royal-Decree-743.pdf (For translation purpose only) Royal Decree Issued under the Revenue Code Governing Reduction of Tax Rates and Exemption of Taxes (No. 743) B.E. 2565 (2022) ------------------------ His Majesty King Maha Vajiralongkorn Phra Vajiraklaochaoyuhua Given on 21st May B.E. 2565 (2022); Being 7th Year of the Present Reign. His Majesty King Maha Vajiralongkorn Phra Vajiraklaochaoyuhua is graciously pleased to proclaim that: Whereas it is expedient to reduce tax rates and exempt personal income taxes in certain cases; By virtue of section 175 of the Constitution of the Kingdom of Thailand and section 3 (1) of the Revenue Code as amended by the Revenue Code Amendment Act (No. 10), B.E. 2496 (1953), a Royal Decree is hereby enacted as follows: Section 1 This Royal Decree is called the “Royal Decree issued under the Revenue Code governing reduction of tax rates and exemption of taxes (No. 743) B.E. 2565 (2022).” Section 2 This Royal Decree shall come into force as from the day following the date of its publication in the Royal Gazette. Section 3 A withholding income tax rate shall be reduced and charged at 17 percent of income for assessable income that a foreigner categorised as High-Skilled Professional who is granted a Long-Term Resident Visa under immigration law, receives from an employment of a company or juristic partnership carrying on targeted industries under national competitiveness enhancement for targeted industries law, investment promotion law, or eastern special development zone law in accordance with rules, procedures, and conditions prescribed by the Director-General of the Revenue Department, which, when computed in accordance with section 50 (1) of the Revenue Code, is subject to withholding income tax at the rate specified in - 2 - the Schedule of Income Tax Rates annexed to Chapter 3 in Title 2 of the Revenue Code of more than 17 percent of income. In cases where the assessable income in paragraph one, when computed in accordance with section 50 (1) of the Revenue Code, is subject to withholding income tax at the rate lower than 17 percent of income, the foreigner who receives the income shall be exempted from having to include such income in computation of income tax in accordance with section 4 if such foreigner allows the payer of the income to withhold income tax at the rate of 17 percent of such income. Section 4 A foreigner whose income is withheld for income tax at the rate of 17 percent of assessable income under section 3 shall, when a tax return is due for filing, be exempted from having to include such income in computation of income tax, provided that such foreigner does not claim a refund or credit for the tax withheld, whether in whole or in part. In cases where a foreigner has assessable income under section 40 (4) and (8) of the Revenue Code of which income tax is withheld under section 50 of the Revenue Code and is entitled to choose to pay tax under section 48 (3) and (4) of the Revenue Code, such foreigner shall be entitled to exemption in paragraph one if such foreigner does not include such assessable income under section 40 (4) and (8) of the Revenue Code and the assessable income of which income tax is withheld under section 3 in computation of income tax when filing a tax return, and does not claim a refund or credit for the tax withheld, whether in whole or in part. In order to be granted exemption under paragraph one and two, the foreigner shall file a tax return reporting assessable income which is exempted from having to be included in computation of income tax. Section 5 Income tax under Part 2 of Chapter 3 in Title 2 of the Revenue Code shall be exempted for a foreigner categorised as Wealthy Global Citizen, Wealthy Pensioner, or Work- from-Thailand Professional who is granted a Long-Term Resident Visa under immigration law for assessable income under section 40 of the Revenue Code derived in the previous tax year from an employment, or from business carried on abroad, or from a property situated abroad, and brought into Thailand. Section 6 A foreigner who is entitled to benefits under Section 3, Section 4, and Section 5 must meet qualifications and comply with rules, procedures, and conditions as prescribed by the Director-General of the Revenue Department. - 3 - Section 7 In the case that a foreigner has applied tax reduction or exemption under this Royal Decree, and later does not comply with rules prescribed in Section 3, Section 4, Section 5, and Section 6 in any tax year, benefits will be suspended in that tax year. Section 8 The Minister of Finance shall have charge and control over the execution of this Royal Decree. Countersigned by General Prayut Chan-o-cha Prime Minister -------------------- Another translation issue: BOI TRANSLATION: Section 5 Income tax under Part 2 of Chapter 3 in Title 2 of the Revenue Code shall be exempted for a foreigner categorised as Wealthy Global Citizen, Wealthy Pensioner, or Work- from-Thailand Professional who is granted a Long-Term Resident Visa under immigration law for assessable income under section 40 of the Revenue Code derived in the previous tax year from an employment, or from business carried on abroad, or from a property situated abroad, and brought into Thailand. The Thai original reads: "... for assessable income under section 40 of the Revenue Code derived in the previous tax year from an employment, or from business carried on abroad, or from a property situated abroad, and brought that assessable income into Thailand". [และได้นาเงินได้พึงประเมินนั้นเข้ามาในประเทศไทย]

-

Sorry, no -- your delayed response jumped over my retraction/correction. The BOI unofficial translation got one word wrong, and the implications are in the gazillions of Baht, potentially. Unless one is bilingual or hires a bilingual legal firm, the devil is in the detailed nuances of translation of legal language. I made the lazy mistake of reading the unofficial English translation of the Royal Decree without checking it with the original official Thai document . If I had just read the Thai, I would not have been misled by the erroneous translation of "assets" as "property" in Royal Decree 743, and then applying the English term "property" as it appears in Section 40. Unless (and even if) one is fluent in Thai, miscommunication and misunderstandings will arise and will unfortunately play out in ways that result in suffering amongst the various humans involved. Please do not accept my sharing of info as anything else. Caveat emptor.

-

Apologies, this is a good example of the legal minefield in which we are treading. The unofficial translation of the Royal Decree No. 743 is the source of confusion. This shows why we need opinions from bilingual lawyers -- and remember that Thai language is full of assumed nuanced "understoods". The BOI translation uses the word "property". Here is the source of confusion: Royal Decree Issued under the Revenue Code Governing Reduction of Tax Rates and Exemption of Taxes (No. 743) B.E. 2565 (2022) Section 5 Income tax under Part 2 of Chapter 3 in Title 2 of the Revenue Code shall be exempted for a foreigner categorised as Wealthy Global Citizen, Wealthy Pensioner, or Work from-Thailand Professional who is granted a Long-Term Resident Visa under immigration law for assessable income under section 40 of the Revenue Code derived in the previous tax year from an employment, or from business carried on abroad, or from a property situated abroad, and brought into Thailand. The Thai word: ทรัพย์สิน (sapsin) = assets when used in a legal sense. However, the unofficial translation on the BOI website used the English word: "property", which back translates as สินทรัพย์ (sinsap). On the other hand, "Assets" (sapsin) include tangible assets, financial assets, and intangible assets. So the accurate translation expands the types of income from offshore that are exempt under Royal Decree No. 743 to include income from assets (sapsin) situated abroad, rather than property (sinsap) situated abroad. Lesson learned: tread carefully and seek professional help.

-

First, read the Royal Decree here: https://www.rd.go.th/fileadmin/user_upload/kormor/newlaw/Eng_IBC_Royal_Decree.pdf Then read Section 40 here: https://www.rd.go.th/english/37749.html Then you can see which types of income are included in the Royal Decree = exempted. The other types of income under Section 40 are not mentioned in the Royal Decree = not exempted.

-

As usual, the devil is in the details. Some types of income are not exempted for LTR visa holders. Royal Decree Issued under the Revenue Code Governing Reduction of Tax Rates and Exemption of Taxes (No. 743) B.E. 2565 (2022) Section 5 Income tax under Part 2 of Chapter 3 in Title 2 of the Revenue Code shall be exempted for a foreigner categorised as Wealthy Global Citizen, Wealthy Pensioner, or Work from-Thailand Professional who is granted a Long-Term Resident Visa under immigration law for assessable income under section 40 of the Revenue Code derived in the previous tax year from an employment, or from business carried on abroad, or from a property situated abroad, and brought into Thailand. -------------------------------- EXEMPTED UNDER ROYAL DECREE 743 Section 40 Assessable income is income of the following categories including any amount of tax paid by the payer of income or by any other person on behalf of a taxpayer. (1) Income derived from employment, whether in the form of salary, wage, per diem, bonus, bounty, gratuity, pension, house rent allowance, monetary value of rent-free residence provided by an employer, payment of debt liability of an employee made by an employer, or any money, property or benefit derived from employment.4 (5) Money or any other gain derived from: (a) rent of property, (8) Income from business, commerce, agriculture, industry, transport or any other activity not specified in (1) - (7). NOT EXEMPTED UNDER ROYAL DECREE 743 (4) Income that is: (a) Interest on a bond, deposit, debenture, bill, loan whether with or without security, the part of interest on loan after deduction of withholding tax under the law governing petroleum income tax, or the difference between the redemption value and the selling price of a bill or a debt instrument issued by a company or juristic partnership or by any other juristic person and sold for the first time at a price below its redemption value. Such income also includes income assimilated to interest, benefit or other consideration derived from the provision of a loan or from a debt-claim of every kind whether with or without security. (b) Dividend, share of profits or any other gain derived from a company or juristic partnership, a mutual fund or a financial institution established under a specific law in Thailand for the purpose of providing a loan in order to promote agriculture, commerce or industry; the part of dividend or share of profits after deduction of withholding tax under the law governing petroleum income tax. (g) Gains derived from transfer of partnership holdings or shares, debentures, bonds, or bills or debt instruments issued by a company or juristic partnership or by any other juristic person.

-

As usual, the devil is in the details. Some types of income are not exempted for LTR visa holders. Royal Decree Issued under the Revenue Code Governing Reduction of Tax Rates and Exemption of Taxes (No. 743) B.E. 2565 (2022) Section 5 Income tax under Part 2 of Chapter 3 in Title 2 of the Revenue Code shall be exempted for a foreigner categorised as Wealthy Global Citizen, Wealthy Pensioner, or Work from-Thailand Professional who is granted a Long-Term Resident Visa under immigration law for assessable income under section 40 of the Revenue Code derived in the previous tax year from an employment, or from business carried on abroad, or from a property situated abroad, and brought into Thailand. -------------------------------- EXEMPTED UNDER ROYAL DECREE 743 Section 40 Assessable income is income of the following categories including any amount of tax paid by the payer of income or by any other person on behalf of a taxpayer. (1) Income derived from employment, whether in the form of salary, wage, per diem, bonus, bounty, gratuity, pension, house rent allowance, monetary value of rent-free residence provided by an employer, payment of debt liability of an employee made by an employer, or any money, property or benefit derived from employment.4 (5) Money or any other gain derived from: (a) rent of property, (8) Income from business, commerce, agriculture, industry, transport or any other activity not specified in (1) - (7). NOT EXEMPTED UNDER ROYAL DECREE 743 (4) Income that is: (a) Interest on a bond, deposit, debenture, bill, loan whether with or without security, the part of interest on loan after deduction of withholding tax under the law governing petroleum income tax, or the difference between the redemption value and the selling price of a bill or a debt instrument issued by a company or juristic partnership or by any other juristic person and sold for the first time at a price below its redemption value. Such income also includes income assimilated to interest, benefit or other consideration derived from the provision of a loan or from a debt-claim of every kind whether with or without security. (b) Dividend, share of profits or any other gain derived from a company or juristic partnership, a mutual fund or a financial institution established under a specific law in Thailand for the purpose of providing a loan in order to promote agriculture, commerce or industry; the part of dividend or share of profits after deduction of withholding tax under the law governing petroleum income tax. (g) Gains derived from transfer of partnership holdings or shares, debentures, bonds, or bills or debt instruments issued by a company or juristic partnership or by any other juristic person.

-

Just out of interest, where did you find this information? If Jeffrey is not bullsh!tting, and his wife is a lawyer working for the RD, everything that anyone writes on this thread is feeding into the RD. I suggest that we refrain from discussing strategies & tactics for avoiding income tax here because this thread has been compromised. Sleeping with the enemy.

-

Like it or not, this clearly refutes the poster and other wishful readers that: "the RD has not provided any guidance to district RD officials". The Order has already been officially been announced, thus requiring execution by the responsible officials at regional, provincial, and district levels. In the Thai bureaucracy, an order issued by a Director-General is similar to an order from a military officer to his subordinates. Failure to implement the order is subject to prosecution for malfeasance.

.png.3b3332cc2256ad0edbc2fe9404feeef0.png.8488ab72b8bb2e508209bfe3211b6e08.png)