Naam

-

Posts

36,715 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by Naam

-

-

- Popular Post

- Popular Post

14 minutes ago, Batty said:Take THB in cash with me and exchange in UK for GBP

worst idea!

-

3

3

-

3

3

-

i'm afraid that

QuoteWeihenstaphener

is not available anywhere. but you might get lucky finding Weihenstephaner.

-

1

1

-

-

- Popular Post

- Popular Post

3 hours ago, beautifulthailand99 said:Any other suggestions ?

Haggis

-

2

2

-

10

10

-

2 hours ago, SheungWan said:

Brexiteer Economics Text: Lose Money and Wave The Flag...

and blame the EU.

-

2

2

-

-

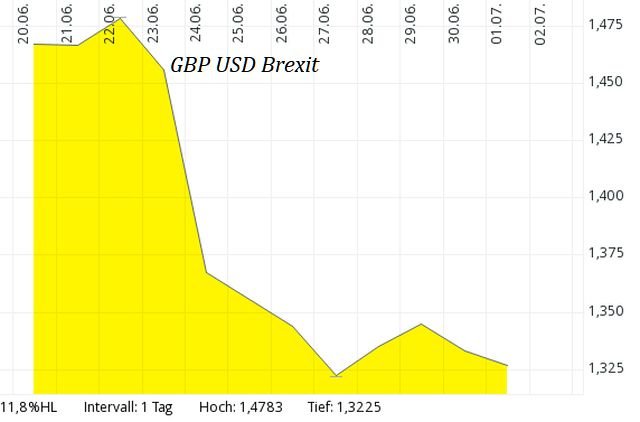

1 hour ago, CG1 Blue said:

The continued efforts of the remain establishment to frustrate the Brexit process is causing much more damage to the GBP rate than necessary. Currency markets react to uncertainty. The sooner the UK leaves the EU and starts to build from there, the sooner the currency will stabilise.

likely.

QuoteI would be a big buyer of GBP in the days leading up to a no deal Brexit. The currency markets will crush the pound over those few days making GBP very cheap. Then after we have left and the armageddon promised by project fear doesn't materialise, GBP will bounce back with a vengeance.

highy unlikely.

-

1

1

-

-

5 hours ago, sanemax said:10 hours ago, Naam said:

give us a break man, show some character and stop presenting ridiculous arguments. we all make mistakes. there's nothing wrong to admit when it happened.

Are you suggesting that the Pound fell by 25 % on the few days after the Brexit vote ?

what is it that you ingest and how do you do it? smoke? oral? intravenous? subcutane? intramuscular? inhale?

and is it legal?

-

10 hours ago, SS1 said:

Why are dishwashers so rare and unpopular here?

because a lot of people employ two-legged dishwashers. our 13 year old diswasher has never been used.

-

1

1

-

-

10 hours ago, Isaanbiker said:

When the "Germans decided" ( nobody was asking me though) that they wanted to have the Euro, the exchange rate to the dollar was around 1 Euro being $ two.

My family had sent me some cash a few years ago and I got around 56,000 baht for 1,000 Euros.

-EUR THB best rate was 53.54 for a couple of days july11-july13, 2008

-EUR USD all time high of 1.5973 was in April 2008 (for a few days).

-at EUR physical inception jan2001 one EUR bought 0.951, i.e. "1 Euro being $ two" = fairy tale.

-

2

2

-

-

10 hours ago, sanemax said:

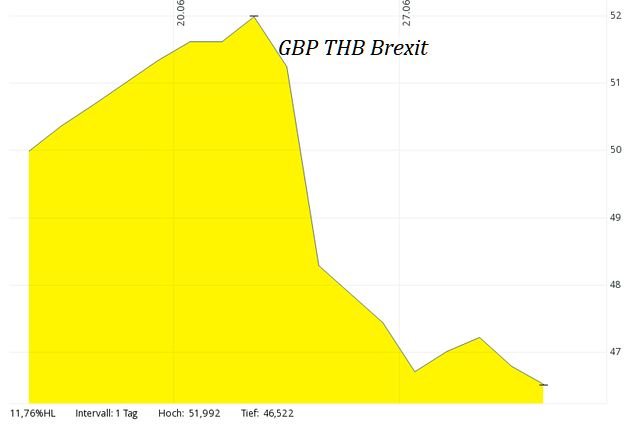

The Pound remained stable for a few months after the Brexit vote , After , AFTER , After the Brexit vote .

Stable AFTER the Brexit vote .

After, as in after the immediate fall

give us a break man, show some character and stop presenting ridiculous arguments. we all make mistakes. there's nothing wrong to admit when it happened.

-

2

2

-

-

- Popular Post

- Popular Post

-

7

7

-

11 hours ago, Perhaps2more said:

About 2.4 billion people (not a small market compare to the EU) - live in the Commonwealth's 53 countries. And most of them are under the age of 30.

Queen Elizabeth II is the Head of the Commonwealth. UK news sometimes tell about some of the royal family visit and exchange visit between ministers, some precontracts were signed. That wouldn't be printed in the German newspapers, I think.

don't underestimate German newspapers where freelance journalists are writing sarcastic articles. i can vividly imagine their comments on Harry and Meghan selling British banking services to some youngsters in Bangla Desh or William and Catherine promoting British products in Nigeria.

-

7 minutes ago, ThaiBunny said:

Gold quality (in common with all gemstones including diamonds) is measured in carats. Gold is usually sold as 16 or 24 carat. I understand (although I could be wrong) that gold sold in Thailand is more often 8 carat (ie. inferior quality)

gemstones are measured in carat (weight), gold is measured in karat (gold content).

-

4 minutes ago, ThaiBunny said:

I understand (although I could be wrong) that gold sold in Thailand is more often 8 carat (ie. inferior quality)

you are indeed wrong.

-

3 minutes ago, davidst01 said:

Can you please educate me. what is the difference between 24k and thai gold. Are you talking about 24k diamonds? I dont understand

thanks

Thai Gold is 96.5% = ~23 karat, bullion gold is 99.99% = 24 karat.

-

-your total filtration volume is 24.5m3 plus 4.5 m3 of the balance tank.

-chlorinating the water by "salt" does not reduce the CL content of the pool water (no matter what fairy tales you might have heard and read).

-UVsanitation on it's own is either not sufficient or too expensive (been there, done that).

-prices of pump and filter indicate that both are 24k gold plated with embedded small diamonds.

hint: compare a "normal" 1HP pump for 3,000 Baht with a "pool" 1HP pump for 25,000 Baht.

-

2

2

-

-

18 hours ago, DrTuner said:

Check the title of the OP. "Rich Indians". And then the reality on the ground is one coke and four straws. People are tired of the BS from TAT.

one coke and four straws is the usual thaivisa BS presented by the wanna-be Sahibs who are moving to Cambodia because they are lacking the THB 800k pot to piss in.

-

1

1

-

-

51 minutes ago, Perhaps2more said:

You can buy Chinese products globally because their government help them with the postage.

goodness gracious!

-

1

1

-

-

2 hours ago, onera1961 said:

All my plans are based on 25USD/BHT in 2023. That will translate to 30GBP and 14AUD per BHT.

14 AUD per THB...

-

- Popular Post

- Popular Post

10 hours ago, Mikisteel said:Stay strong my fellow farang, face the negatives head on and take the positive from this barrage of uncertainty, keep bouncing over every hurdle they put in your way, be the expat warrior you need to be in this modern day take on farang life in Thailand.

what negatives?

-

7

7

-

1

1

-

1

1

-

14 hours ago, DPKANKAN said:

Correct. I read that before. And I also understand, tax laws here are only on money earned or made here! Until that is changed!!

little do you know

read and weep:

QuoteTaxpayers are classified into “resident” and “non-resident”. “Resident” means any person residing in Thailand for a period or periods aggregating more than 180 days in any tax (calendar) year. A resident of Thailand is liable to pay tax on income from sources in Thailand as well as on the portion of income from foreign sources that is brought into Thailand.

-

2

2

-

-

4 minutes ago, LivinLOS said:

Maybe they will not come for it, maybe they will continue to allow farangs to not pay taxes that the statute says they can claim, I just wouldnt bet on it myself. The risk is there.

the risk is there without any doubt. however, the big profiteers how the tax situation is handled are not Farangs but the Thai big shots. that should minimise the danger of a change.

-

1

1

-

1

1

-

-

1 hour ago, Farang99 said:1 hour ago, Farang99 said:

Your pension should already have tax deducted in the country of origin which probably has a no double taxation agreement with Thailand.

I have been living here on UK pensions for 20 years and never had a tax demand as the pensions are taxed at source

a number of Farangs use the THB 65k/month derived from other sources than pensions.

-

1

1

-

-

21 hours ago, Thaidream said:22 hours ago, LivinLOS said:

Said this as soon as people started depositing pensions directly each month.. The 800k savings route is safe but those reporting directly bringing pensions in are literally signing a tax liability.

I mean, why would Thailand just ignore that free revenueThe money is not earned in Thailand or originated in Thailand as any form of income.

The Immigration person is blowing smoke- they don't like the income method- too much work and using the *))K also allows agents into the system.

whether earned or not or origininated in Thailand as income is irrelevant. relevant is

QuoteTaxpayers are classified into “resident” and “non-resident”. “Resident” means any person residing in Thailand for a period or periods aggregating more than 180 days in any tax (calendar) year. A resident of Thailand is liable to pay tax on income from sources in Thailand as well as on the portion of income from foreign sources that is brought into Thailand.

-

2

2

-

-

3 hours ago, Nong Khai Man said:

He Must've been Dreaming when He Posted that......Over the 43 Years I've been Coming Here the Very LOWEST I've seen was when they DEVALUED The THB Overnight by 50% & It went from 38 One Day DOWN To 19 The Next Day.....

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)

Where can I buy German beer in Pattaya?

in Pattaya

Posted

Staphylococcus aureus or albus?