NoDisplayName

Advanced Member-

Posts

4,877 -

Joined

-

Last visited

-

Days Won

1

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by NoDisplayName

-

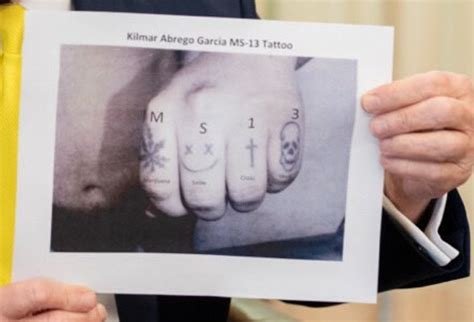

Trump can't understand photoshopped MS13

NoDisplayName replied to cdemundo's topic in Political Soapbox

Maryland man made it to the YouTubes. Police body camera video of alleged MS13 gangster trafficking humans. -

Obviously this was the Canuckian cartels introducing illicit cheap Chinese crapapples, sapping and impurifying their precious fermented fluids. You can be Shirley, when Trump annexes Canada as our 53rd state, after Panama State and Greenland State, they'll be permitted to utilize only the purest Monsanto/Dow/Dupont genetically-modified frankenapples. Or else. Winning!©

-

USDA publishes proposed rule to allow imports of apples from China. // August 15, 2014 https://www.goodfruit.com/usda-issues-rule-to-allow-imports-of-apples-from-china/ And who was president in 2014? Obama! There goes that commie Kenyan letting China send more poison into the United States! Apple seeds contain a compound called amygdalin, which can release cyanide when metabolized, but the risk of poisoning is very low. You would need to consume a large number of crushed seeds—around 150 to several thousand—to be at significant risk. Apples typically have between 5 to 10 seeds. Oh, no! This could be serious!! Many will die. China is the world’s largest producer and exporter of apples. ..... the USDA estimates that no more than 10,000 metric tons (half a million boxes) of apples would be exported from China to the United States annually, which would be about 5 percent of U.S. apple imports. Oh, my gosh! Let's do some math! Medium Apples: A box of medium-sized apples typically contains between 60 and 80 apples. This is a common size for many popular varieties. Lessee.......half a million boxes times 70 apples times 10 seeds. Holy snow white, that's 350 million seeds!!! 350 million divided by 150 , why that's enough to kill 2,333,333 infants. Call a press conference! Trump's 145% tariffs on Chinese apples has saved nearly two and a half million cuddly, precious babies! Winning!©

-

Transport Phuket Plans Boat Taxi Service to Ease Traffic Congestion

NoDisplayName replied to snoop1130's topic in Phuket News

....with a short stop halfway across to renegotiate the fares. -

Trump can't understand photoshopped MS13

NoDisplayName replied to cdemundo's topic in Political Soapbox

"And the next one is?" "I believe that's a '1'....I can't.....it's a little blurred out for me, sir, and then the last one's a '3' backwards, it looks like from here, sir." How's that, sir? Is that what you wanted me to see? Do I get the job? -

Trump can't understand photoshopped MS13

NoDisplayName replied to cdemundo's topic in Political Soapbox

-

Trump can't understand photoshopped MS13

NoDisplayName replied to cdemundo's topic in Political Soapbox

photoshop verb To digitally edit or alter a picture or photograph. Not exactly. It means the photograph has been altered. Was it altered? Yes, 'twas. Captions and letters were added. Digitally. Clearly, for the average human, but not for simply Trump. We have the transcript. We have the entire un-photoshopped video exchange. ************ Trump: "Wait a minute, wait a minute. He had MS13 on his knuckles." Trump: "No, no, Terry, no, no....no, no....He had M-S as clear as you can be, not interpreted. This is why people no longer believe....the news, because it's fake news. Trump: "It says M-S-1-3." ************** Sorry. You can't spin your way out of this. Trump is a simpleton. However, that doesn't mean Garcia isn't an MS-13 member. It doesn't mean he wasn't an illegal alien invader. It doesn't mean he isn't a wife-beater. It doesn't mean he wasn't picked up in a van owned by another deported MS-13 member, transporting additional illegal alien invaders. Garcia should have been arrested, should have been incarcerated, should have been deported. But Trump just has to make this about himself, about the lyin' press, about winning, about bullying anyone who disagrees with him,........about bigly dunning-krugering. He'll never covfefe. -

Ryanair Drops $33B Bombshell on Boeing Over Trump's Tariffs

NoDisplayName replied to BLMFem's topic in Political Soapbox

You missed one! Trump Shuttle, an airline owned by Donald Trump, went bankrupt after just three years of operation, ceasing in 1992 due to financial losses exceeding $100 million. At least it wasn't another casino. -

Donald Trump is still winning, one hundred days in

NoDisplayName replied to Social Media's topic in World News

And you know what they call a Quarter Pounder with Cheese in Omaha? They don't call it a Quarter Pounder with Cheese? No, they got the Trump tariffs there, they wouldn't be able to afford a Quarter Pounder. Then what do they call it? Winning. -

That was fast.

NoDisplayName replied to NoDisplayName's topic in Thai Visas, Residency, and Work Permits

Sure, mine has the name of an immigration sergeant major (ด.ต.) printed, not signed. Is a sergeant major actually signing off on all these 90-day reports? More like the presidential autopen. I would guess that's programmed into the national system according to the office where registered, and then the provincial offices are notified of approved submissions with an end of day batch report. -

Trump can't understand photoshopped MS13

NoDisplayName replied to cdemundo's topic in Political Soapbox

Of course not. Unless the position had to be filled, and the only other viable candidate was a moronic DEI hire. Best of the worst. Would you prefer stage 4 cancer or ebola hemorrhagic fever? You must pick one. -

China Accuses U.S. of COVID-19 Origins in Escalating War of Words

NoDisplayName replied to Social Media's topic in World News

No surprise the "renewed" claims coincide with Trump's maximum pressure campaign. The CIA now believes the virus responsible for the COVID-19 pandemic most likely originated from a laboratory, according to an assessment that points the finger at China even while acknowledging that the spy agency has “low confidence” in its own conclusion. January 26, 2025 https://apnews.com/article/covid-cia-trump-china-pandemic-lab-leak-9ab7e84c626fed68ca13c8d2e453dde1 And just what is this "low confidence" in regards to intelligence reporting? Low confidence generally means questionable or implausible information was used, the information is too fragmented or poorly corroborated to make solid analytic inferences, or significant concerns or problems with sources existed. In other words.............fake news. Here's another example from the CIA: "Tenet reassured the president that "it's a slam dunk case" that Saddam had weapons of mass destruction." -

It helps them feel even more stunning and brave in the women's restrooms.

-

Trump can't understand photoshopped MS13

NoDisplayName replied to cdemundo's topic in Political Soapbox

Watch the interview again. That's Trump being Trump - clueless and arrogant. President Dunning-Kruger. He's not a good actor. He's not faking it. He really is that stupid. -

That was fast.

NoDisplayName replied to NoDisplayName's topic in Thai Visas, Residency, and Work Permits

Korat. But this is the nationwide online system. Is it not centralized? -

Three different categories. There are those that illegally enter and are detained, and there are those that illegally enter and are NOT detained. The White House credited these numbers to aggressive border policies and celebrated a 99.99% drop in “gotaways,” a term used for individuals who enter the country illegally and evade apprehension. There is a third category, a subset of those that illegally enter and are detained, who are later released in the country rather than being deported/denied entry. He emphasized that each of the nine releases under Trump had exceptional circumstances. The 9 released are not part of the "gotaways" category.

-

That was fast.

NoDisplayName replied to NoDisplayName's topic in Thai Visas, Residency, and Work Permits

Hotmail timestamps all one hour ahead. Was still set to Beijing time. Or Thailand must be the land of tomorrow. -

90-day report is due on the 17th. Received an email from immigration this morning at 3:30 informing me of the upcoming due date. Logged onto the TM-47 site at 10:00, submitted at 10:05, received acknowledgement at 10:08. Approval email with receipt received at 11:30.

-

U.S. Customs and Border Protection, the federal agency tasked with patrolling the U.S. border and areas that function like a border, claims a territorial reach much larger than you might imagine. A federal law says that, without a warrant, CBP can board vehicles and vessels and search for people without immigration documentation “within a reasonable distance from any external boundary of the United States.” These “external boundaries” include international land borders but also the entire U.S. coastline. https://www.aclu.org/know-your-rights/border-zone#are-immigration-officials-allowed-to-stop-people-in-places-wholly-inside-the-u-s The federal government defines a “reasonable distance” as 100 air miles from any external boundary of the U.S. I can confirm this. I lived in southwest Texas 'bout 15 miles (air distance) from the southern border. Border Patrol traffic checkpoints are common.

-

The Immigration and Nationality Act of 1952 gives immigration extra powers within a 100-mile distance to any external border. According to 8 U.S. Code § 1357, employees of the United States Citizenship and Immigration Services (USCIS), Immigration and Customs Enforcement (ICE), and Customs and Border Patrol are granted certain "powers without warrant" within this area, such as the authority to "board and search for aliens" on any "railway car, aircraft, conveyance, or vehicle." This law also gives border patrol agents the authority to "access private lands, but not dwellings, for the purpose of patrolling the border to prevent the illegal entry of aliens into the United States." However, the law states that border patrol agents only have the authority to "access private lands" within 25 miles of the border, not 100 miles. Two --thirds of the US population, about 200 million people, live within that zone.........which includes the entire eastern seaboard and most of California. Dang it, Truman! You and all those fascist democrats controlling both houses of the 82nd congress!