K2938

Member-

Posts

409 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Everything posted by K2938

-

Air Pollution Spurs Lung Cancer Spike in Northern Thailand

K2938 replied to webfact's topic in Thailand News

Was also very bad last year. Did anything change then?🤣😱🤣 -

As has been previously discussed in this thread at least in the past the BOI was not very excited about any significant amount of capital gains, especially when these were generated based on your decision vs. the decision of some external trustee. Please therefore kindly update us if you make any progress with this. Thank you.

-

Siam Legal appears to claim that investing in a foreign (non-Thai) investment fund or depositary receipt is tax-free even for Thai tax residents who bring the income back into Thailand: “However, there is an exemption from being subject to income tax in Thailand by meeting one of the following conditions: The individual must not reside in Thailand for 180 days or more in a particular tax calendar year. Invest on a foreign investment fund or Depositary Receipt. Does not bring an income from overseas into Thailand.“ (https://www.siam-legal.com/thailand-law/thailand-new-tax-on-foreign-income-an-overview/ ) This seems very strange and contrary to everything else written on this at least as far as I have seen. Any thoughts?

-

Chiang Mai Air Quality and Pollution

K2938 replied to Cheesekraft's topic in Air Pollution in Thailand

As you will die much earlier because of the air pollution, you have much more money in each of the years still left. Simple mathematics 🤣 -

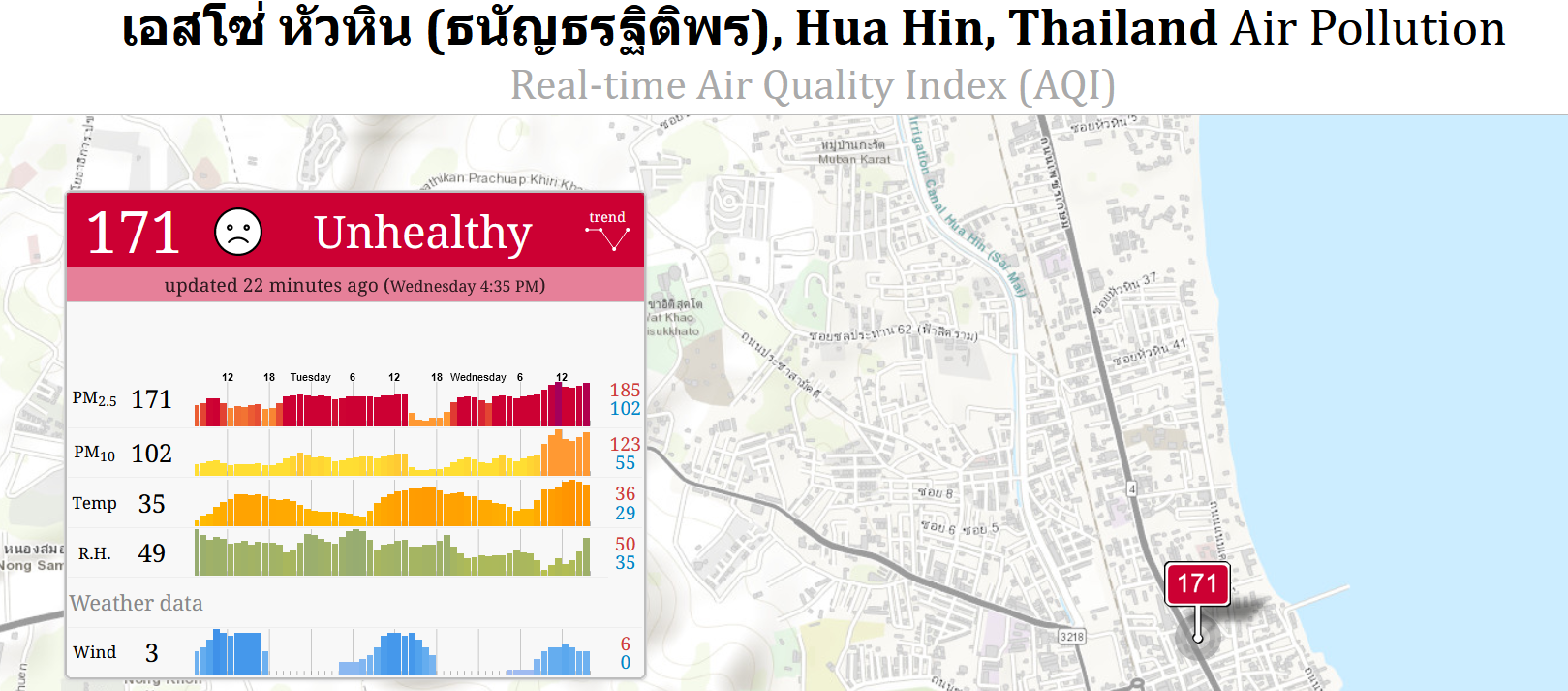

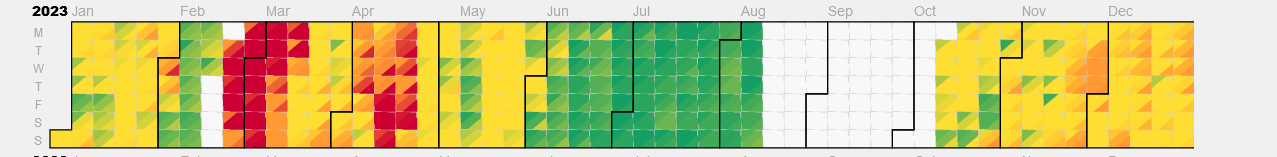

The key driver is not infrastructure projects, but fires. And these could largely be controlled if there were the political will to do this. But nobody cares unfortunately. The picture shows real-time data

-

Sadly, if you value your health, things have deteriorated so far in recent years that you now better also decamp to somewhere else Feb-Apr even if you live in Hua Hin / Cha-am

-

What is the source of your statement on DENV 4? I am not at all saying that it is not correct, but I have for example seen a Thai study from 2010 which says the opposite: "DENV-2 appears to be marginally associated with more severe dengue disease as evidenced by a significant association with DHF grade I when compared to DENV-1. In addition, we found non-significant trends with other grades of DHF. Restricting the analysis to secondary disease we found DENV-2 and -3 to be twice as likely to result in DHF as DEN-4." (https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2830471/ ) See also this from Brazil: https://bmcinfectdis.biomedcentral.com/articles/10.1186/s12879-016-1668-y ("The present study found that cases of DENV-2 had a higher proportion of severe dengue than among those of DENV-1 and DENV-4")

-

True, but even there the BOI appears to be kind of immune to economic logic. If you show them a brokerage account worth a zillion dollars, they will say this does not meet the self-health insurance criteria since it needs to be in cash even if you could easily sell the shares at any time or take out a margin loan against them hugely exceeding $100k USD. Also, they even reject if the $100k USD in cash is in a brokerage account in cash, insisting it needs to be a bank account as far as I know. So they just love to tick boxes and if the situation does not fully meet this they will reject things even if they are economically vastly superior.

-

I would recommend you to talk to them again about this. They should accept an annuity. Regarding their answer whoever wrote this just did not get that since this is already your money, you of course will not pay tax on the capital part being returned to you. Point this out to the BOI - politely - and see what they say. Best to visit in person if that is possible for you. If you need an additional argument, tell them that they also accept Roth IRAs in the U.S. as far as I know and they are also tax-free. P.S.: The only problem with annuities is that they tend to be awful investments. But that is a different topic.

-

Thank you for posting the Sherrings note which is very useful. In there the following is also quoted from the Q&A from the Thai Revenue department: "Question: If, yearly, I invest abroad and I bring part of it back into Thailand, is the part I bring back into Thailand determined as investment capital or as assessable income? Answer: For monies that are brought into Thailand, taxpayers have a duty to self- determine based on facts and evidence that the monies brought into Thailand are capital or assessable income." Does anybody have any idea what this means in practice? The answer is really not answering the question as they do not say what methods are supposed to be used for the separation of funds.

-

Where does it say this in the Sherrings note, please? If the respective double taxation agreement does not prohibit Thailand from taxing the overseas pension, then the only thing which can be done is to credit any foreign taxes to any Thai taxes due, but if the Thai taxes are higher, then an additional payment is due.

-

The links cited by connda indeed concern Dengvaxia, but a sufficient number of eminent scientists having reviewed the Qdenga data has concluded that there is really insufficient data to decide if Qdenga does not cause the same problem for dengue-naïve people that one should be careful IF one has never had dengue yet. This is for example discussed in the Nature article I quoted above, this is also the concern of the Germans, this is the concern of Mahidol and I have also seen an article of some renowned Swedish scientists (from Karolinska if I remember correctly) pointing out the same. Now of course there are also other opinions, but I personally prefer to be on the careful side as a dengue-naïve person. Moreover, the first time you get dengue the likelihood of it killing you is very very small, so the risk is quite small, and the vaccine is more effective if you already had dengue as well.

-

The manufacturer did a study, but again if you look at the data closely things do not look as great as they might appear: https://www.nature.com/articles/d41586-022-03546-2

-

There is actually not enough data to decide at this point of time if it is really advisable to get Qdenga if you have not had dengue previously. For this reason, respected Western health authorities such the German ones do not generally recommend Qdenga for people who have not had dengue yet at this point of time. Also, the application of Qdenga for the U.S. was withdrawn for lack of sufficient data (which applicants generally do to prevent a rejection). So this all seems to support a cautious approach which also falls in line with Mahidol University as quoted by the OP ( https://www.thaitravelclinic.com/blog/vaccineinfo/dengue-vaccine-for-foreigners-travelers-in-thailand-should-i-get-it-update-2023.html ). Mahidol was actually also involved in the original development of Qdenga so what they say should have a lot of weight. This is not just some random "travel clinic". P.S.: I was actually planning to get Qdenga, but in view of all this I decided to better wait.

-

It is just PR. If you run the numbers, then the daily death rate during these new year days was only marginally above the average death rate over the entire year using last year's data (42.7 vs. 40.4 deaths per day). So these horrible year end days do not really exist at all. This is just the rate people die in Thailand in traffic accidents every day and nobody cares.

-

Based on our discussion I have today contacted some Indonesian firm providing immigration and tax advice. They confirmed that if a retired person is in Indonesia more than 183 days, he or she is taxable on global income. Without any caveats, without any exceptions. Sorry. So if you find some more evidence supporting what you say, then please let me know. But - unfortunately - I do not think it is true.