K2938

Advanced Member-

Posts

569 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by K2938

-

1) The problem with relying on capital gains is also that at least once every few years markets fall. And so your gains might not really exist in a year of relevance. 2) The dividend yield on Western equities is generally in the area of 1.5%-2%, in the U.S. currently even lower. So for 80k USD income without capital gains you would need an equity portfolio value of at least 4-6 MM USD. Not sure if disclosing such big amounts necessarily increases your safety in Thailand. 3) Maybe think of the Thai Elite/Privilege visa instead if you feel uncomfortable with the disclosure requirements and have the money.

-

1) So your chance to write an accompanying note explaining everything in a very easy to understand way. 2) Do however not get your hopes up too high about capital gains. If they are significant, the BOI does not very much like them regardless of what is written on their website. But you can try and see what happens.

-

Legal Strategies to Reduce Thai Tax

K2938 replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

All the scenario tables by the various international accountancy firms I have seen solely focus on whether the income was accrued while you are a tax resident in Thailand or not and do not at all focus on if at the time of remittance you are a Thai tax resident or not (see for example https://www.mazars.co.th/insights/doing-business-in-thailand/tax/revenue-department-s-guidance-on-foreign-income, same e.g. EY). So why should the latter be relevant? Do you have any reputable source saying this? -

Legal Strategies to Reduce Thai Tax

K2938 replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

Well, these funds presumably continue to yield income after Jan 1, 2024 and then the interesting - and so far unanswered question - is how to delineate what is old and new if both old and new funds are in the same account/investment/etc. -

So what about if the person could pay the hospital bill and used his $100k USD deposit for this? Depending on how the BOI looks at this in the future, they might well say you failed the requirements as you did not maintain the $100k USD throughout the visa period, throughout the last two years before the 5 year check-up etc. So in the worst case, this $100k USD might well be untouchable.

-

Air Pollution Spurs Lung Cancer Spike in Northern Thailand

K2938 replied to webfact's topic in Thailand News

Was also very bad last year. Did anything change then?🤣😱🤣 -

As has been previously discussed in this thread at least in the past the BOI was not very excited about any significant amount of capital gains, especially when these were generated based on your decision vs. the decision of some external trustee. Please therefore kindly update us if you make any progress with this. Thank you.

-

Siam Legal appears to claim that investing in a foreign (non-Thai) investment fund or depositary receipt is tax-free even for Thai tax residents who bring the income back into Thailand: “However, there is an exemption from being subject to income tax in Thailand by meeting one of the following conditions: The individual must not reside in Thailand for 180 days or more in a particular tax calendar year. Invest on a foreign investment fund or Depositary Receipt. Does not bring an income from overseas into Thailand.“ (https://www.siam-legal.com/thailand-law/thailand-new-tax-on-foreign-income-an-overview/ ) This seems very strange and contrary to everything else written on this at least as far as I have seen. Any thoughts?

-

Chiang Mai Air Quality and Pollution

K2938 replied to Cheesekraft's topic in Air Pollution in Thailand

As you will die much earlier because of the air pollution, you have much more money in each of the years still left. Simple mathematics 🤣 -

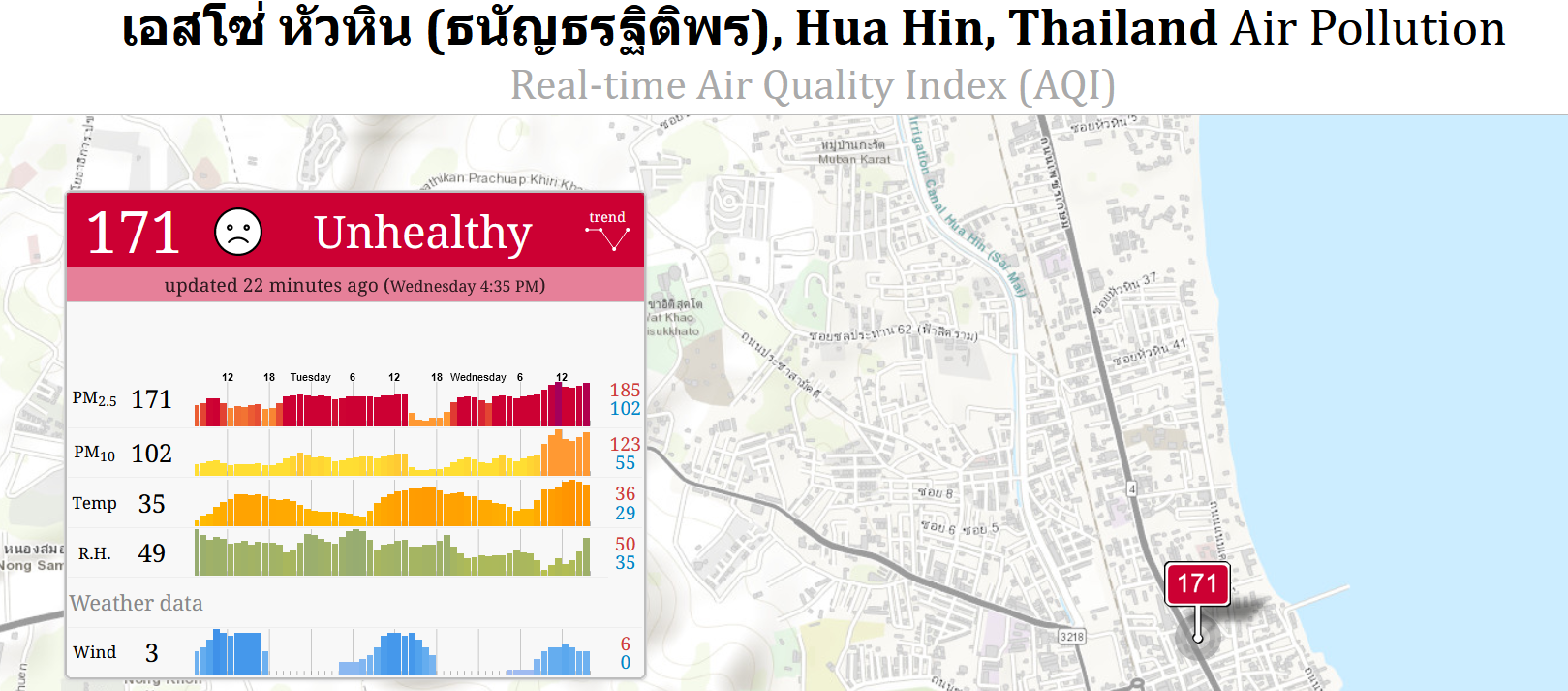

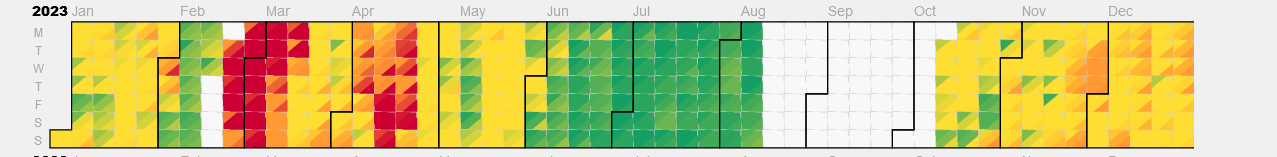

The key driver is not infrastructure projects, but fires. And these could largely be controlled if there were the political will to do this. But nobody cares unfortunately. The picture shows real-time data

-

Sadly, if you value your health, things have deteriorated so far in recent years that you now better also decamp to somewhere else Feb-Apr even if you live in Hua Hin / Cha-am

-

What is the source of your statement on DENV 4? I am not at all saying that it is not correct, but I have for example seen a Thai study from 2010 which says the opposite: "DENV-2 appears to be marginally associated with more severe dengue disease as evidenced by a significant association with DHF grade I when compared to DENV-1. In addition, we found non-significant trends with other grades of DHF. Restricting the analysis to secondary disease we found DENV-2 and -3 to be twice as likely to result in DHF as DEN-4." (https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2830471/ ) See also this from Brazil: https://bmcinfectdis.biomedcentral.com/articles/10.1186/s12879-016-1668-y ("The present study found that cases of DENV-2 had a higher proportion of severe dengue than among those of DENV-1 and DENV-4")

-

True, but even there the BOI appears to be kind of immune to economic logic. If you show them a brokerage account worth a zillion dollars, they will say this does not meet the self-health insurance criteria since it needs to be in cash even if you could easily sell the shares at any time or take out a margin loan against them hugely exceeding $100k USD. Also, they even reject if the $100k USD in cash is in a brokerage account in cash, insisting it needs to be a bank account as far as I know. So they just love to tick boxes and if the situation does not fully meet this they will reject things even if they are economically vastly superior.

-

I would recommend you to talk to them again about this. They should accept an annuity. Regarding their answer whoever wrote this just did not get that since this is already your money, you of course will not pay tax on the capital part being returned to you. Point this out to the BOI - politely - and see what they say. Best to visit in person if that is possible for you. If you need an additional argument, tell them that they also accept Roth IRAs in the U.S. as far as I know and they are also tax-free. P.S.: The only problem with annuities is that they tend to be awful investments. But that is a different topic.