-

Posts

124 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by HuaHinNew

-

On my return to Thailand when my current 90-day report in situ becomes due for renewal .............even though I should theoretical start a new 90-day report from the time of reentry back into Thailand. As I mentioned the two databases are not synchronized, it requires an IO to update the 90-day reporting details from the Immigration database...........try it some time

-

IMHO, the reason for all these issues of 90 day reporting are due to the Immigration Database and the 90-days reporting Database are not real-time synchronized. I have incurred all the above issues as stated above, passport changes, leaving the country ...etc. All I do is let the 90-day online report autofill the form, and it works each and every time, even though the information is outdated. When I go to do my annual retirement renewal visa, I also get a 90-day manual report done, where the IO updates all my 90-daya report details that have changed since my last annual visa renewal. IO agrees with me, online 90-day reporting software not always good.

-

The Immigration Bureau on Monday, Jan 22, 2024 announced a major upgrade to its online system for 90-day reporting. Responding to the need for a more efficient and user-friendly system, the Bureau has revamped the online service. This upgrade is anticipated to encourage more foreigners to opt for online reporting, thereby reducing the physical footfall at the offices. According to your TM47 online landing page, the latest version is“ Version 2023.08.00 00-0223_223” please explain what technical upgrades / expansions you announced on Jan 22, 2024 as the last update to the solution is August 2023. Unless you understand the disparity between any real-time synchronization between the immigration database and the 90-day online reporting database, you still have significant, “efficient and user-friendly” issues with the validity of the 90-day online reporting system user input data fields. IMHO, you should implement an Enterprise Service Bus to connect the two systems in real-time. https://www.oracle.com/technical-resources/articles/middleware/soa-ind-soa-esb.html Additionally, for any rejected online TM47 submissions, you should have individual rejection codes for each category of rejection and display the submission field or fields in error along with the associated rejection code to allow users to correct the issue online with a resubmission, as indifferent to the current one line message for rejections," Go to your local immigration office". Until you implement more intuitive technical improvements to the current TM47 online 90-day reporting system, you will find it difficult to achieve your desired goals as stated on Jan 22, 2024 announcement.

-

How many millions of baht does one need to retire in Pattaya?

HuaHinNew replied to advancebooking's topic in Pattaya

Up to 35% more than budgeted from Jan 1 2024.............. -

Yep, first clinic was next May, next clinic was next July.....and so on.....hospitals were the worst.........6 months plus out. Apparently, from what was gathered on the telephone conversations, the Periodontists in Hua Hin area are visiting specialists, and only visit a couple of days each month.... PS. Hua Hin Nana Dental told me after my visit to them, I would find all the Periodontists they listed in Hua Hin quite busy, that was an understatement. 5555

-

Anyone assist in first had recommendation of a dental Periodontist in the Sukhumvit to Lat Phrao areas of Bangkok. Living in Hua Hin, but all booked out months ahead, one had first appointment in July.... Here are a few I found from AI search........ Bangkok International Dental Hospital โรงพยาบาลฟัน กรุงเทพ อินเตอร์เนชั่นแนล at 98 Soi Pha Suk, Khwaeng Khlong Toei, Khet Khlong Toei, Krung Thep Maha Nakhon 10110 Bangkok International Dental Center, ศูนย์ทันตกรรม BIDC จัดฟัน รากฟันเทียม วีเนียร์ at 157 159 Thanon Ratchadaphisek, Khwaeng Din Daeng, Khet Din Daeng, Krung Thep Maha Nakhon 10400 FunYimDentalCenter at 170 Soi 7, Khwaeng Huai Khwang, Khet Huai Khwang, Krung Thep Maha Nakhon 10310, BIDC Dental Clinic at 695 EmQuartier shopping center, room no. 4A11, Building A, Khlong Tan Nuea, Watthana, Bangkok 10110 Dentaland Bangkok Dental Clinic: Located at 4 Prasertmanukij 31, Ladprao, Bangkok, Bangkok, 10230, Bangkok Smile Dental Clinic: Located at 32/5-6 Asok Montri Rd., Bangkok, Bangkok, 10110 Thanks in advance ............

-

Well as expected, happy new year expats from the Thailand RD, "we're coming for your money", but like most anything Thailand endeavors to implement it will be a Cluster F. Just thank your lucky stars they don't have dual taxation percentages for expats, like their dual pricing in national parks, hospitals, golf courses....etc......555

- 454 replies

-

- 17

-

-

-

-

-

-

PM Prioritizes Higher Education and Innovation

HuaHinNew replied to webfact's topic in Thailand News

If you put lipstick on a pig, it's still a pig! It's just like the driving attitude here by many Thais; absolutely clueless. The education system will never change here as, like driving, getting from point A to point B via the fastest method is the only criteria. The education system is the same, get in.....get out, again clueless in many cases. The Thai education motto is, "leave no one behind", everyone passes the education system here, either through, money, manipulation or makeup exams and in universities plagiarism. First-hand knowledge....... -

Five Phuket Boat Drivers Test Positive for Illegal Drugs

HuaHinNew replied to webfact's topic in Phuket News

Did they all actually have licenses for operation tourist boats. -

Where there is a problem, there is always an opportunity. With all the cloud computing services available today and excellent software like WordPress and great plugins add-ons and many associated plugins being free. A smart hotel consortium group could establish a corporate company, employ a software development team that could run up a new global scalable site, e.g "Hotels Genuine" A low fixed price fee of a few % based on each hotel's annual revenue generating from bookings from the site could be leveraged against all participating hotels. Initial funding for the project could be leveraged by hotels buying shares and ownership in the company, single hotel shared ownership limited to a %. Hotel owned and hotel controlled. Force current hotel booking sites to drop their commissions to be competitive. PS. Plenty of opportunity out there. Booking Holdings: The global leader in online travel bookings, Booking Holdings had a total revenue of over 17 billion U.S. dollars in 2022. Expedia Group: Expedia Group, which owns brands like Expedia, Vrbo, and Hotels.com, reported worldwide revenue of under 12 billion U.S. dollars in 2022 Airbnb: While not strictly a hotel booking site, Airbnb's vacation rental platform has seen explosive growth in recent years. Their gross booking value worldwide peaked at around 63 billion U.S. dollars in 2022,

-

Phuket officials to target ‘bad foreigners’ to enhance tourism

HuaHinNew replied to webfact's topic in Phuket News

Don't forget the old Jet ski scams......and you know the officialism involved with them that I don't need to name here! -

Phuket Immigration Investigates Alleged Russian Working at Tour Booth

HuaHinNew replied to webfact's topic in Phuket News

Why are Thais so paranoid about a little competition in business by foreigners. Could it be because they feel threatened due to their inferior business abilities. -

Thailand’s digital wallet project: Green light to make cash splash

HuaHinNew replied to webfact's topic in Thailand News

From taxation of Thais and Foreigners on Jan 1 2024 from OS money transfers into Thailand. -

Hi, I have been through the same experience with National Australia Bank for 6 months, eventually I just gave up as I am of the opinion their technical networking personal are a bunch of wasted space. They kept telling me no problem here in NAB via their CS support, must be your phone. I have received OTP codes for years in Thailand, from NAB on the same True Thai mobile number and phone up until May 31 this year 2023, it all just stopped dead in its tracks. I still, as of today, receive other SMS OTP codes from other institutions in Australia and all over the world, plus my friends back home in AUS send me SMS msgs regularly. After great expense on international calls to and wasted time with NAB CS support for months and the fact I proved to them, it fails on both my DTAC and TRUE services on different model iPhones and Androids, I called it a day!!!! Both True and DTAC told me the two numbers NAB send OTP codes on were not blocked, as for CAT Thailand, I am not sure about them as they are the primary infrastructure provider for Mobile carriers here. The SMS international gateway networking system is quite complex, with often many intervening SMS servers that cater for variations in the different protocol conversions used in the various countries The dummies in NAB networking operations are clueless to understand how the SMS end-to-end process works for international msg transfers, Some servers do a function called store and forward, where the NAB originating gateway server provider gets a response that their SMS OTP has been delivered, where if fact it could be blocked further down the networking services due to security concerns of all the spam floating around the international networks. The other issues is; SMS is a connectionless network transmission. This means that there is no established connection between the sender and receiver before the message is sent. The message is simply sent out into the network and is routed to the recipient's mobile phone. All those knuckleheads at NAB Networks Operations have to do is contact their technical SMS outgoing gateway provider in Australia and have them engage their counterparts in Thailand CAT, True or DTAC and run an SMS network trace between NAB AUS and TRUE or DTAC Thailand SMS servers. Would find the issue in a flash............but they are neither not interested or lack the skills to do so. So in summary I had to divert my OTP mobile code to my son's phone in Australia, I's a real PITA, but it gets me over NAB's incompetence. Sorry for the detail discussion, but it was so frustrating dealing with such poor technical support in NAB AUS. BTW, I am definitely not an expert in this SMS international delivery area, but just use a common sense approach to understand the problem.

-

Immigration e-mails classed as junk

HuaHinNew replied to foreverlomsak's topic in Thai Visas, Residency, and Work Permits

Lots of good information, Just right click on Outlook IMM email and say not junk. Additionally, set up a separate IMM folder and create a filter rule for IMM emails All emails from IMM will be filtered into your IMM folder. There are a raft of things that can cause diversion of IMM emails in Spam or Junk folders Not sure but I think in the case of Outllok.com (Outlook Live) Microsoft have their own email servers Microsoft applies algorithms to determine if their outgoing email to a recipient is valid or possible false, scam, or junk. These algorithms are based on a variety of factors, including: The sender's email address and domain reputation. The content of the email, including the subject line, body text, and any attachments. The recipient's email address and domain reputation. The sender's and recipient's past interactions. https://www.mailersend.com/blog/dns-records ..... very technical stuff on email records. I think many people on this forum know you can use free tools like MXToolBox or DNS Checker and Others to validate email DNS records. -

Prevention of swimmer's ear (external ear infection)?

HuaHinNew replied to Lorry's topic in Health and Medicine

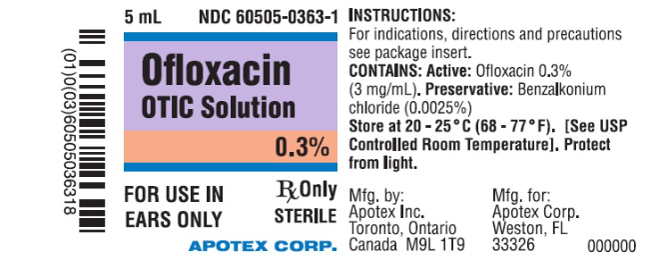

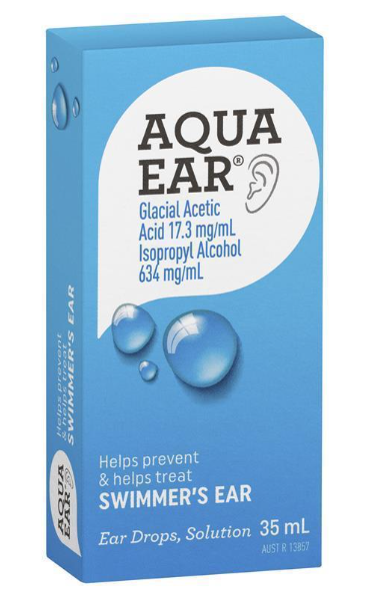

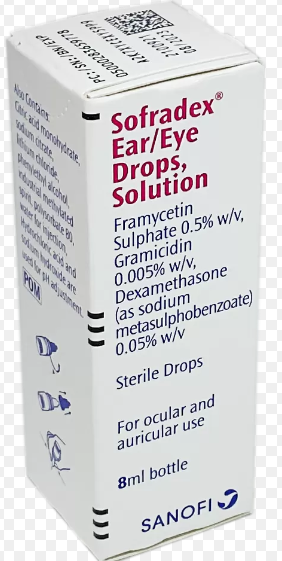

Hi, as an ex surfer for 50 years, ear infections were a regular occurrence. Here is how we minimized infections but also treatment for infections. Wear cord connected earplugs, quality ones, worked excellent even in big surf. 3.0 Pro Ear Plugs for Surfing Swimming Diving Showering - Waterproof Ear Plugs with Lanyard - Universal Fit for Swimmer & Surfer After exiting the water, use a product like AQUAEAR to dry out water in the ears that contain Glacial Acetic Acid 17.3 mg/mL & Isopropyl Alcohol 634 mg/mL If you get infection, use an ear drops that contains Ofloxacin OTIC Solution 0.3% We used Sofradex which we found very effective. -

Thanks for the reference, much appreciated. Re: Lawan Saengsanit, the Director-General of the Revenue Department, promises hearings and focus groups to clarify rules and listen to concerns. However, such afterthoughts indicate a lack of preparation and foresight, which only adds to the skepticism surrounding the initiative. Though the Revenue Department aims for clarity in the long run, the absence of it in the initial stages could be costly. But, I recall reading these folks have been working on this plan for nearly 10 years, why does it lack clarity after 10 years of tossing it around. Don't have much faith that in the capabilities of anyone in Thai government to get any policy near being effective or clear and concise.

-

Well, I read about this before it was posted and have a document (see my attachment) that has endeavored to translate and summarize the Thai version of the proposal. I don't have time to read every post, but my outlook is every retire here over 180 days in total residency is going to get whacked. I suspect the next step will be the Dept of Revenue will instruct every Thai bank from Jan 1 2024 to place a withholding tax on all OS inbound transfers. It will be then up to each individual to deal with the taxation issues to justify and recover their bank transfer withholding tax, if possible! "Clause 1 : Persons who are residing in Thailand according to Section 41 , paragraph three, of the Revenue Code. who have assessable income due to work duties or activities conducted abroad or because of assets located abroad according to Section 41 , paragraph two of the Revenue Code In the said tax year and has brought that assessable income into Thailand in any tax year That person has a duty to include that assessable income in calculating income tax according to Section 48 of the Revenue Code. In the tax year in which the assessable income was brought into Thailand" Knowing how most government departments in Thailand are a circus, dealing with these people will be like pulling teeth. This is going to justify the government hiring a mass of new employees to deal with all this new taxation BS. Plus, tax accountants will have a windfall, dealing with all the Farangs trying to navigate the mess created. We will all most likely need a tax ID to comply with the proposed legislation. If those that have 401K or like retirement accounts or savings accounts where tax was already paid in years gone by in their home country, they will be victims. Unless, your country has a tax treaty with Thailand maybe, and a big maybe, you might have a chance to be exempt, but if not, you're screwed IMHO For those from a country with a tax treaty, they will want official documentation from your home country's taxation department that all your OS funds being transferred to Thailand have been fully taxed in your home country. I fully support them going after money laundering or funds that have been hidden overseas for tax avoidance by individuals or corporations. But, honest Farangs that have retired here are going to be caught up in the net, It can only be interpreted as a money grab and extortion by the Thai government against retirees and other honest foreign residents of Thailand. Tax Concern.pdf

-

Just wait a few months before using it if you can, until they sort out the bugs they encounter by users. You absolutely know from all the comments on this forum topic that, as usual, they always fail to do. Comprehensive end-user testing in the real world before releasing it. It does not mean they will find all the bugs in the first few months, but hopefully the all new dancing and singing TM30 web software will be in a better useable and stable state.