-

Posts

3,155 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by TroubleandGrumpy

-

A change to the Tax Laws is being processed that basically changes everything back to the way they were before the badly thought out (idiotic) change that was made on January 1 2024. Foreign Earnings Taxed Under New Thai Rules - But With Exceptions - Page 2 - Thailand News - Thailand News, Travel & Forum - ASEAN NOW https://aseannow.com/topic/1361086-foreign-earnings-taxed-under-new-thai-rules-but-with-exceptions/ "The initiative aims to expedite the repatriation of foreign income, thereby potentially boosting domestic investment. The department acknowledges that the current taxation structure has somewhat deterred Thais from bringing foreign-earned capital back home." No sheite Einstein !! IMO this means all Expat's Pensions are not taxable if remitted in the same year or the next year. It also means that any 'income' earned (like interest etc) is not taxable if remitted in the same year or the next year. IMO this means that 99% of retired/married Expats who bring money into Thailand are AOK. Happy Days. When TRD implements the global taxation system, that all might change - so best to stay across things going forward. I feel sorry for all those that were 'conned' into paying to get a TIN and do a Tax Return by those with agendas or with 'issues'. No names No pack drill.

-

Another point - I saw an interview recently where the 'expert' said that TRD is seeking as part of its implementing of a global taxation system, a compulsory bank rule (by the Bank of Thailand) that all banks must report to them any accounts that have 2+ million baht remitted from overseas in any calendar year. That request will go (or has gone) to the Ministry of Finance who if they approve, will then be required to make a change to the Financial Institutions Businesses Act. There is a LOT going on and TRD is very busy - but until they are finished and have all the rules established for the new global taxation system - IMO Expats should carry on as they have for the last 20-30 years.

-

@No Forwarding Address That above - and also whether it is 'taxable income' under the Thailand tax laws. Dont ask me for any certainty - it is all very 'interpretive' as to what means what, here in Thailand. My position as stated many times is to wait until TRD moves to a global taxation system - they are currently working on it. Until then - perhaps not a good idea unless you have 'clear proof' that the source of the money is not income earned after 1 Jan 2024 - such as a Bank Account records showing the source and that the funds have been in that account since before 1 Jan 2024. Otherwise, you must have 'clear proof' that the money was not income as defined under Thai tax laws. "Clear Proof' is not defined - it is basically whatever the TRD Officers decides is acceptable. The only definite exemption is living in Thailand for less than 180 days in any calendar year - buy then and all is good - everything else is 'interpretive'.

-

Listen Closely - YOU COULD BE WRONG. I am bothering to write this is information to anyone interested - not just in reply to you (it is not all about you). What Thailand decides is a Mutual Fund is what Thailand decides is a 'mutual fund'. This is not the West where interpretation of Laws and the meaning of phrases/words in that Law, are based upon the legal system of Common Law. Common Law is based upon past Court Precedent (decisions) and higher Courts up to the Supreme/High Court rulings on those Precedents. But every single legal definition in Thailand is what the appropriate delegated Officer decides it is. And if you take it all the way to the Supreme Court - listen closely again - whatever that decision is ONLY APPLIES TO YOUR CASE !!! Thailand does not have a Common Law based legal system. The legal system here is that what one Govt Officer's interpretation of a Law and the meaning of any phrase or word in a particular situation - is valid - and is the decision. Everyone here has the right to get a Govt Officer ruling changed by Appeal (in Thai), but again - that change is only valid for that case. Everyone here has the right to then take the matter (in Thai) to Court to get the ruling changed, but again - that change is only valid for that case. What usually happens what that happens is that the Court decision is then advised to all the appropriate Officers for their future assessments of each case - but it is still their authority to make whatever decision they make - every case is different here. What often happens here in Thailand is that the Govt Dept (TRD in this case) will take the matter to Court and get them to make a decision. Unless you can provide a link to a Tax related Court case where the definition of what is a mutual fund has been decided, AND the directive subsequently issued by the TRD stating this definition is appropriate in most situations, then YOU COULD BE WRONG. I could be wrong too - but my statement is based upon what research I have done (a lot) and there aint no definition of a mutual fund and TRD directive that I have found, plus my understanding of the legal system here - minimal, but obviously much more than yours. The Thai legal system (including tax laws and rules) is extremely difficult and complex. Unfortunately Thailand was never fully colonised and given a legal system based upon the western system from UK/USA/France. This is an example of what is a Mutal Fund in Thailand - "Notification of the Office of the Securities and Exchange Commission - No. Sor Nor. 88/2558' (which has not relation to or impact upon TRD). https://publish.sec.or.th/nrs/7209se.pdf This is what Google AI states - which I tend to also agree with in this case: In Thailand, a mutual fund is an investment vehicle where multiple investors pool their money, and that pooled money is then invested in a diverse range of securities (like stocks, bonds, etc.) by professional fund managers. These funds are managed by asset management companies according to their stated investment policies, aiming to generate returns for the investors. Retirement Mutual Funds (RMFs) are a specific type of mutual fund designed for long-term savings and retirement planning, and they do offer tax benefits. Go Fish (that is for you).

-

In Malaysia the Govt has recently reiterated that they will not tax the money of Retired Expats brought into their countries in most situations. One of those is that they will not impose any taxation obligations on money that has been subjected to the taxation system of the country of origin, if that country has a DTA with their country. https://officialmm2h.com/foreign-sourced-income-tax-exemption/ Other countries in the Region have similar exemptions and allowances on the foreign money of retired/married Expats living in their country - usually implemented as part of their processes in moving to a global taxation system (which Thailand has not yet done). May I suggest that literal interpretations of the current TRD Tax Laws and related DTAs are at best 'uncertain' at this time. That is because they have not be 'tested' in Thai Tax Court since the rule change in 2024, and the DTAs and TRD Laws/Rules were not written for Expats who are retired/married and who are not working or earning money in Thailand. The only change to the tax situation on Jan1 2024 was that money earned overseas by a Thai tax resident is no longer tax exempt if it is brought into Thailand after 12 months. The change was not targeted at Expat's pensions and other retirement funds or situations, and TRD clearly did not realise the sh**storm the change would create. I will also point out that since that change was made, and the incomplete unsatisfactory TRD answers provided under the previous TRD Management, that the Thai Govt changed - from the PM down including the Minister responsible for the TRD. Since then they have not said a word about 'the problem', and I remind you of the normal behaviour of Thais when they might 'lose face'. What they have said since the change of Govt, is that they are 'very busy' developing a global taxation system and that will involve extremely difficult and convoluted changes to Thai Taxation Laws and Rules, and then is when they will provide full details and clarity to both Thais and Expats. If you have been in Thailand a long time, then you know even the simple easy things take a long time to change here and they involve a lot of work. I am of the opinion that the reason TRD has not clarified in detail all the issues raised by Expats and Lawyers and Others due the the rule change, is because that would take a lot of work and changes to the Laws/Rules that are not worth the trouble - especially given they are moving towards a global based taxation system. IMO until the changes are made to the Thai taxation system for the implementation of global taxation, retired/married Expats not earning money in Thailand are not who the TRD wants to go into the local Provincial Offices - and the local Provinces dont want them too. I will also point out that there is a Taxation Law in Thailand that clearly states that any Expat who is a Tax Resident and who is leaving Thailand must present a Tax Certificate before leaving. That is not enforced - but when the non-enforcement decision was made, it was clearly too much trouble to change the Laws. Unlike in the West where all determinations and decisions are ratified in the applicable Laws and Rules, in Thailand they dont go through the nightmare that such a change requires (including approval by the King). I state that because there are Laws in Thailand, and then there is whether Thailand Authorities enforce those Laws or not, and how they both interpret and enforce them at the Provincial levels. PIT is a Provincial issue.

-

I hear you BUT I will say that the USA/West definition of what a mutual fund is, does not automatically mean that in Thailand they are the same. I am no expert but I would check the Thai definition in the Tax Laws (now and when a global system is introduced). In the USA/West what a 'mutual fund' definition is probably based upon (taxation and legal issues) does not automatically translate to Thailand. Plus there is the Tax Court's interpretation that may or may not have already taken place. Unlike in USA/West where the Tax Office decides what exactly one of their rules and laws means (which can be challenged in Court), in Thailand there are a lot of situations where a matter is referred to the Taxation Court for interpretation and decision - including by the TRD itself.

-

Yes they have and that is why IMO they are working hard to get as much sorted out as they can, given the extremely 3rd world legal system they operate under, before they ever proactively pursue income taxes on Expats who are not earning income in Thailand. IMO (and of many others) they will not be proactively pursuing retired/married Expats PIT until they have as much sorted as possible, and they have implemented a global taxation system. Thailand is moving to a global taxation model and IMO it is only when that is implemented that retired/married Expats will know where they stand with regards to PIT in Thailand. Anything being done or stated now that a TIN must be done and a PIT lodged by a retired/married Expat who does not earn income in Thailand, is IMO scaremongering and/or ridiculous - because TRD has no idea themselves and are too busy sorting things out to provide all the answers to the thousands of questions. Walk into any Provincial TRD Office and they will not have a clue - how could any Provincial TRD Official possibly know the details of 61 DTAs and all the associated complications.

-

Take a look in your DTA and the TRD Tax Laws for the wording associated with 'mutual retirement provident fund'. My understanding is that mutual funds for retirement are also not taxed in Thailand and IRA/401s are a mutual fund ? The Revenue Department (rd.go.th) https://www.rd.go.th/65497.html I beliueve that there are a lot of PIT exemptions and allowances in the TRD rules that are applicable to Thais and which have never really been looked into in detail for Expats before because we were not proactively taxed in the past.

-

I read an article on Pattaya Mail recently - they interviewed a lot of Expats and asked them what they were doing about 'the income tax issue'. The responses they got were - Never heard of it - Not on your life - Doesn’t apply to me - The Tax office said “Go Away”. Some Expats admitted using a tax consultant because they felt threatened, and some said they already have a work permit and pay taxes now. The vast majority are not getting a TIN and are not lodging anything, because they view that they are getting non-taxable money (Pensions) - and/or the money they bring in has already been taxed and is largely savings made from years of working - and/or with all the allowances and deductions available they do not have to pay any income taxes. I recently saw a youtube interview that included a senior tax official, and she said that she believes that Thailand will follow the lead of all their neighbours and exempt Govt Pensions from being taxable (which she thinks are exempt anyway). She also indicated that as with Malaysia. Indonesia and The Philippines, they will probably also exempt any money already subjected to the taxation system of the Expat's home/source country. I very much liked her opinions and views, not only because she was saying 'good' things, but also because she knew what a DTA was and knew the details. She said to the interviewer in response to a question about taxing Pensions (paraphrase) - 'No that will probably not be taxed - because under all DTAs all foreign tax residents in Thailand are entitled to the same rights and privileges under Thai tax laws as afforded to Thais, and Thai citizens do not pay income taxes on any Govt Pension or payment. Therefore under International Tax Laws and DTAs, Thailand cannot tax Govt Pensions or any Govt payment'. In summary it was agreed that if any Expat (tax resident) is earning income that is taxable in Thailand, then they should get a TIN and lodge a tax return. But it was clear to me that if an Expat reasonably believes they are not bringing any taxable income into Thailand, then they do not have to lodge a tax return. That situation will change if they are earning income overseas but do not bring it into Thailand, if/when Thailand goes to a global taxation model (as do most other countries do). The suggestion by the interviewer that it might be safer to lodge a return just in case, was agreed to by the Expat tax consultant (of course), but it was not actually agreed to by the Official - she said nothing. Instead she gave a commitment that over time TRD will provide a lot more clarity about what is taxable and what is not taxable. Plus she noted that there was not a place in the 2025 tax return to advise the amount of any Govt Pension received, because Thais dont pay income taxes on Pensions. The Expat tax consultant (IMO to drum up fear/business) said that it could be done in a separate letter attached to the tax return - the Thai official said nothing and just looked away (and we know what that means). As for a long time now - I am waiting and watching before doing anything. I know Government enough to know that if you file a document once, they will wonder why you have not done it again the next time around. If as the Thai Tax Official indicated (both verbally and non-verbally), I am not required to file a tax return in the future, then it would be wise not to file one now. Plus I have written advice from a tax company that I do not have to file a tax return because I do not have to pay income taxes based on the money I remitted and my allowances, deductions and exemptions - their caveat being 'under the current tax filing directives from TRD'. Given somewhere about 20-30 million Thais dont lodge a tax return on the same basis - I accept that advice.

-

Thailand’s 2025 Census: What You Need to Know

TroubleandGrumpy replied to Georgealbert's topic in General Topics

Wife has a couple of family members who work in the public service in Bangkok - they dont have a clue how many Expats (like us) are living in Thailand. They estimate about 2-3 Million Foreigners - but that includes all workers (both seniors like Toyota, and building site workers, and those working for a living, and those retired or married - all foreigners). They literally have no idea how many Expats (Western and Japanese and Korean, etc etc) live in Thailand long term as either retired or married persons. To find that out would mean adding up the number registered in each Province in one year and then categorising them all into various groups, and the adding that up across every Province in the whole country - that has never happened and probably never will. And that only gives totals for that one year - they have no idea how many have lived here 1, 2 or 5 or 10+ years. The best chance for a true picture of Expats living in Thailand is if this Census reports that there are lots of Expats living in Thailand full time and who have been living here for many year - is if Expats do the Census. One question is how long have you lived there - and like I said the Census does not ask for ID or for proof or for any personal info other than name, address (it accepts minimal address details) and the month of birth (for age). It is a Census and the information is not specific to individuals - it is for obtaining totals of people living in all the locations across the country (you know - for future hospitals, roads, etc etc). Over time it gives demographical information, and shows the changes from Census to Census - eg. last time 200K lived in XYX province, and now 350K live there. Thais should do it too - but the majority dont and as always there is no enforcement - so they use averages. The more Expats that complete it the better - that is all am I saying. -

Thailand’s 2025 Census: What You Need to Know

TroubleandGrumpy replied to Georgealbert's topic in General Topics

Yeh - not impressed myself either. -

Thailand’s 2025 Census: What You Need to Know

TroubleandGrumpy replied to Georgealbert's topic in General Topics

What is wrong with so many Expats - why are they so negative? Why not just complete the census online - easy peasy. Something to hide?? Technically it is a requirement - but that is not why to do it. When there is a media statement in a 2-3 years saying the Thai Govt does not believe that there are many Expats living in Thailand, the lack of information provided in the Census of 2025 will be basis upon which they do it. Immigration does not share the detailed numbers of Expats from those doing 90 days and extensions - unless asked for by PM or a Court - and even then it is their 'best guess'. They dont even share their data between the Provinces - there is SFA totalling going on - that would be work and they (Thai Govt workers) just dont care. They dont know the death toll in that building collapse because they dont have the records of the Expat workers - let alone the illegals (and in this case mostly Myanmar people I would say). But as the bar girl said to the Priest - complete it or not - it is up to you. -

Unlike previous GOP POTUS', such as Reagan and Bush, the majority of Trumps supporters are not in the 50-60+ age category - they are in the 18-29 age group. When Reagan retired as POTUS after doing such a great job for 8 years (best ever?) he was replaced by a Bush who screwed it all up, and the People went to Clinton, a young good looking smooth-talking personality who resonated a lot with women and the younger generations. That the young people of today (and white women) so strongly support Trump, bodes very well for future GOP POTUS candidates. I can see GOP Presidents until 2040 and maybe longer. Trump 4, Vance 8, 1st Female POTUS 4 to 8. Not predicting that - the reality is that each election is very different, and in politics a day can be a very long time. It has taken a while, including 4 years after a 'stolen election', but Trump will finally get to lay the foundation for a long GOP reign in the POTUS role. IMO in 2030 the US People will see the results, ignore the MSM lies, and vote Vance in for another term/s to keep doing what Trump has started. After that, the gods of politics will decide. https://www.newsweek.com/young-people-most-optimisitc-about-donald-trump-presidency-cbs-poll-2017544 The most optimistic people about the next four years are young Americans, according to a new poll. The survey, taken by CBS and YouGov, found that 60 percent of all Americans are optimistic about a second Trump term, and that number is even higher among Americans aged 18-29, where 67 percent of them said they are feeling good about the incoming president. And with that, after being very active in politics under many names on social media and forums, this old man is bowing out of politics. I have been active in politics for a long time, and I became very active since I retired in 2013 (sometimes too much). Now that Trump has been inaugurated, I am going to leave 'the field'. It has been a great time, and a bad time, and the best and worst of times, at times. But through it all I knew what was right and what was wrong, and I stayed true to my convictions and to the truth. It is not because he is a Republican that Trump was re-elected as POTUS in a landslide victory in an almost Reagan-like manner. He was re-elected because he is the right person to lead the American People away from all the woke liberal progressive insanity and institutionalised corruption that has been damaging their lives for decades. I leave the game and walk off the field, not to any applause or admiration or condemnation, but with knowing that I did my bit. But, I leave the field with one more post about what IMO is real and what is fake, and the real difference between those things in the world of politics. Many years ago an Irish Statesman named Edmund Burke said: “The only thing necessary for the triumph of evil is for good men to do nothing.” However, that is wrong. Edmund Bourke never sad that. JFK said that. In a Presidential speech in 1961 JFK attributed the words to Edmund Bourke - but they were his own. What Bourke wrote in 1770 was: “When bad men combine, the good must associate; else they will fall, one by one, an unpitied sacrifice in a contemptible struggle.” JFK 'modernised' those words and gave them meaning within the context of the 1960s. The attribution is fake - but the meaning is true - and truer words have never been spoken by a politician since JFK spoke them in 1961. Trump got as close as any, when he said: 'You are all Fake News".

-

GO TRUMP GO - Saving the World from the Woke

TroubleandGrumpy replied to TroubleandGrumpy's topic in Political Soapbox

And with that I am out of here - away from all the lunatic woke insufferables that dominate here. I would like to say a few kind words, but my Mother told me never to tell a blatant lie. Trump won and the World is a better place for it. Not a perfect man, but a man perfect to remove the lunacy of the woke liberals from western societies who are happy to have boys in girl's bathrooms, to permanently mutilate confused children, to let in terrorists who hate our culture, and to fund never ending wars. So it is goodbye from me and goodbye from him.- 71 replies

-

- 13

-

-

-

-

-

-

GO TRUMP GO - Saving the World from the Woke

TroubleandGrumpy replied to TroubleandGrumpy's topic in Political Soapbox

No mate - they never will understand - brainwashed deranged haters. -

GO TRUMP GO - Saving the World from the Woke

TroubleandGrumpy replied to TroubleandGrumpy's topic in Political Soapbox

The upholding of laws and moral values is something you lefties dont agree with??? -

@earlinclaifornia Cheers mate - I am pleased to know you have integrity and honour, and that you have changed your avatar having lost our bet. There is only one thing that an Aussie likes more than a man who admits he was wrong, and that is one that makes good on a bet he has lost. Credit where credit is due mate. And with that in mind, I have changed my avatar to that of Trump winning trophy, and I will only hold you to using that avatar of Trump/Vance only until the end of the week. Cheers mate - or as we Aussies say - Here's to you Champ.

-

Yep - the left thinks that anyone that tries to "enhance people's economic security, real wages, personal security and the prospects of their kids" is far right. They are truly delusional and hopefully they will soon be removed in every western democracy.

-

Revenge is a meal best eaten cold - and how it is going to be 😁 Trump tried to mend the divide last time, they used that against him. IMO this time he is going to do what the Democrats always do, but never say they will, Trump is going to destroy all things woke liberal. From Education to the Border and everything in between - if it is woke - it is OUT. Just like IN Argentina, Trump is going to tear them all down - sack all of them. Meanwhile Musk will be gutting what is left of the public service like a big fish. Any left wing nutter NGO reliant on Federal funding or tax breaks, is 'out of here'. Long answer - and could say a lot more - but Trump will lead for all 'real' Americans and destroy the woke liberals and their institutions and their rules/regulations that have been tearing down the American values. Peanut will be avenged !!

-

GO TRUMP GO - Saving the World from the Woke

TroubleandGrumpy replied to TroubleandGrumpy's topic in Political Soapbox

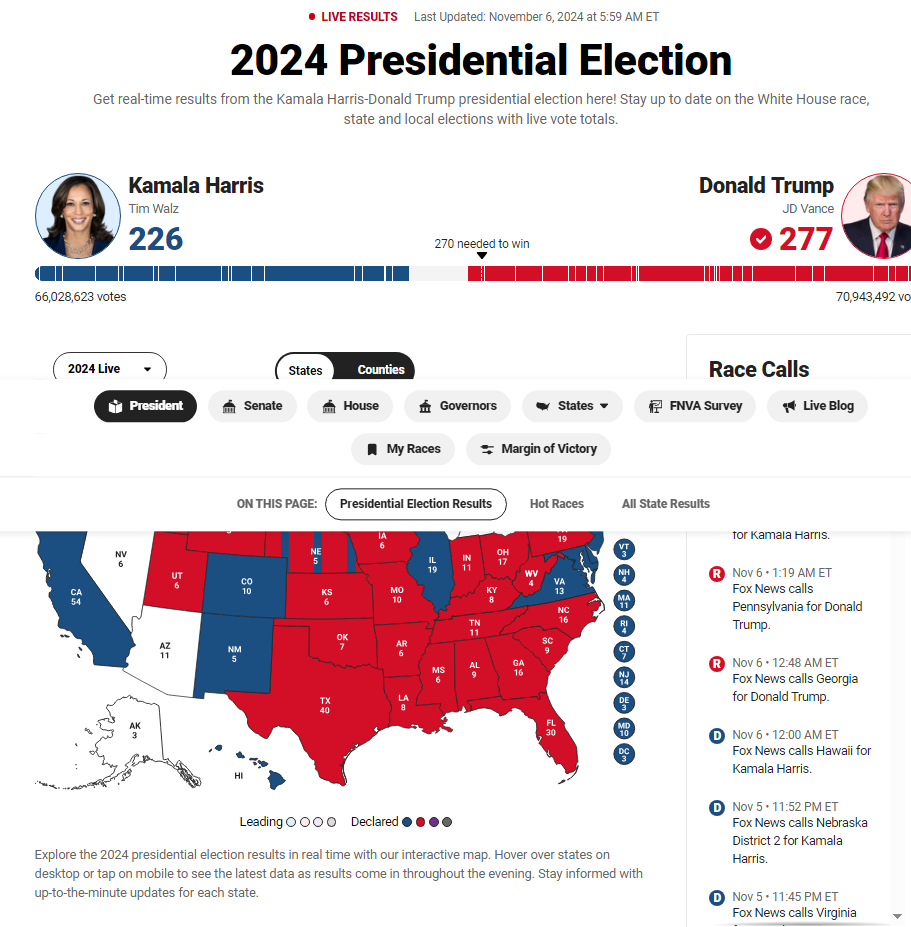

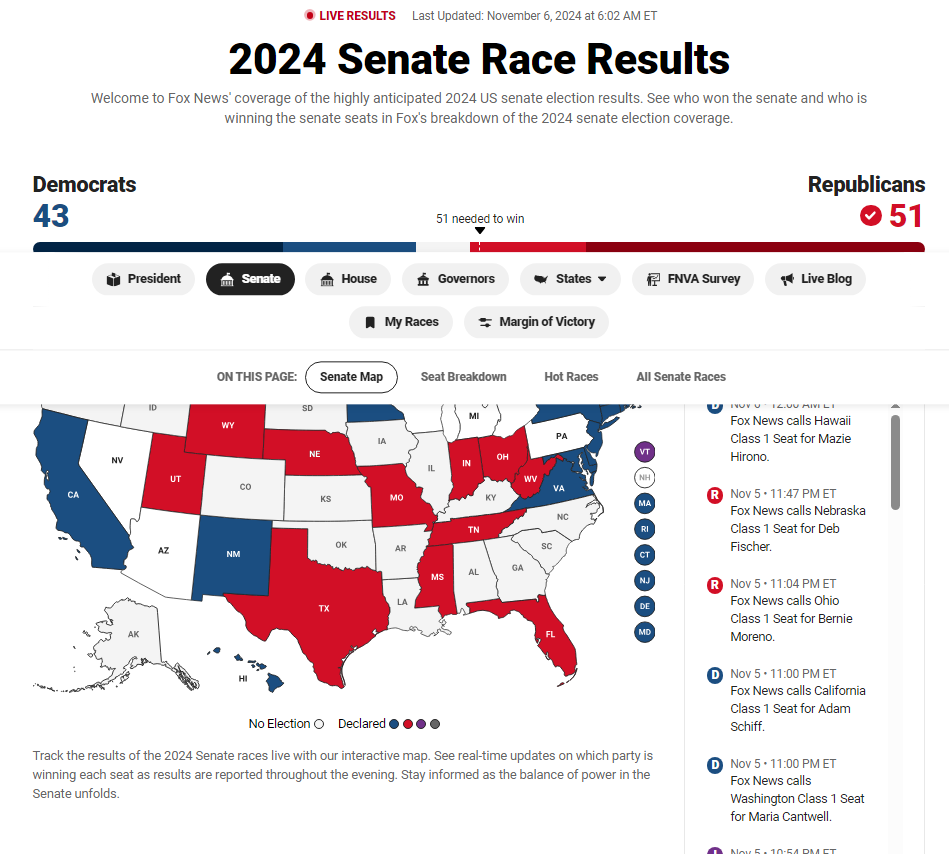

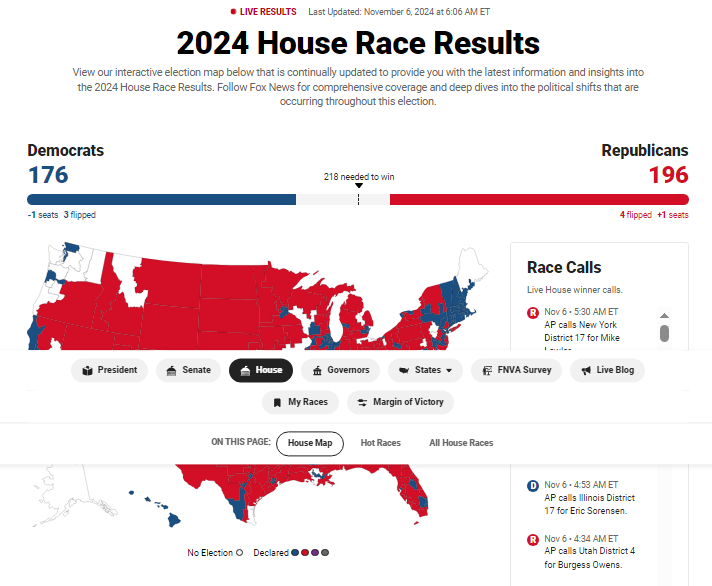

Clean Sweep for GOP - POTUS, Senate and House - All Over Red Rover 😁 Latest Election 2024 News and Updates | Fox News Elections Center PRESIDENT SENATE HOUSE -

GO TRUMP GO - Saving the World from the Woke

TroubleandGrumpy replied to TroubleandGrumpy's topic in Political Soapbox

There are many things and reasons why Harris and the Democrats got resoundingly rejected by the American People. One of them that shows the divide between the Dems and the People, is that Trump supporters chanted 'USA USA USA', and Democrat supporters chanted 'Kamala, Kamala, Kamala'. The Dems are all about feelings and emotions and this results in boys being in girl's bathroom, but the GOP and Trump are about economic strength and wealth generation and morals and laws . The Democrats have lost POTUS, House and Senate - all will be controlled by the GOP. Trump will push forward massive changes, and most of that will be a total destruction of all things woke and liberal. Any GOP Member or Senator that does not support Trump should be expelled and banned from the Party. Like him or not, Trump has been given a massive mandate by the People and the House/Senate must support him achieving that. Unlike in 2016 when the People really did not know what Trump is going to do - this time around they know exactly what he stands for and will do - and they voted for him to do just that.- 71 replies

-

- 15

-

-

-

-

-

-

-

Thanks - that worked.

-

November 2036 - maybe. The People will not forget 2020 and its dubious results, nor the years 2021-24 for a long time. And I am sure they will be reminded by GOP 🙂

-

Now blocked? Video could not play (removed??)