noobexpat

Advanced Member-

Posts

1,036 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by noobexpat

-

Bit of a low self-esteem question IMO.

-

Being successful is all about state of mind.

noobexpat replied to Elvis Presley's topic in ASEAN NOW Community Pub

Now in bangkok, it was great for me to get away from pattaya. Definitely a big positive tick in the state-of-mind column. Was never into drinking/girls etc ...but living amongst those types became a challenge. -

Fortunate? ...thats a big assumption though. You have to visually see the person behind the words and the whole picture before that conclusion. You are never going to get that. This guy is a snapshot of my worst nightmare lol. But i have friends back in UK who are similar. Kid turns 18 and needs £100k gbp for a house deposit.

-

The eternal battle: how much does it cost to live in Thailand.

noobexpat replied to NorthernRyland's topic in General Topics

I bill at £100/hour approximately. So did about 3.5 in the condo and another in a restaurant whilst eating dinner. Wealth management stuff - deliberately vague, of course. Been running my own business for 10 years. Tax free as well. People don't believe that you can make decent money but also spend very little. Earned 17,000 baht today and spent 228b in a restaurant. Tomorrow i'll go to my local coffee shop and do an hour. 60b for a mocha frappe. Same problem again, albeit a nice one! Also, I don't actually spend any earned income or remit it to thailand. It stays in UK. -

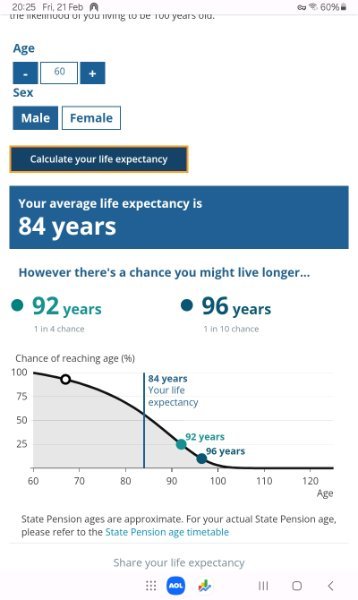

Ok ...so if we go worst case ie. Its decreased, what factors in thailand have caused my decrease? Arguably, life saving care time could be slower here. I can't think of anything else thats different from my 50 years in UK compared with 2.5 in thailand. Therefore i will still refer to UK stats until i materially change something. Agree or disagree?

-

Hotel/condo safes and small laptop/tablet

noobexpat replied to InlandSea's topic in IT and Computers

I have a stick-on Kensington lock on the front cover of my laptop. 14 inch ones don't seem to have the slot. Had to buy it from shoppee i think. Works great. -

The eternal battle: how much does it cost to live in Thailand.

noobexpat replied to NorthernRyland's topic in General Topics

I have a tiny breakfast and only have one proper meal per day. My typical day - mess about until noon. Work until 4pm. Head to iron pan restaurant and with a coke zero its about 160b. I'll do another hour and by then i will have invoiced £400x42.5=17,000 baht equivalent. Don’t have the time to spend it. Last friday ...??...i think! -

Went to buy some cinnamon fireball at a posh wine/spirit place in emsphere, bkk. Cheaper to buy 5x 200ml bottles versus 1L. Not on sale either. Bit strange!

-

The eternal battle: how much does it cost to live in Thailand.

noobexpat replied to NorthernRyland's topic in General Topics

A nice quote. Deserved more than an anonymous like. -

The eternal battle: how much does it cost to live in Thailand.

noobexpat replied to NorthernRyland's topic in General Topics

I'm a low spender but pretty high income earner and super high capital. Just hit age 50, so not on retirement visa. Average bangkok rent. Midweek i spend next to nothing because of work, although its only about 3 or 4 hours. 100b for dinner is typical. Saturday night cocktails here don't come under 450b. My 'luxury' spending. My visa is the most i've spent here. I don’t need 800k in thai bank but keep far more anyway. No health insurance because of capital. Not interested in buying lots of stuff. 12 noon, better do some work!