The Cyclist

Advanced Member-

Posts

2,248 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by The Cyclist

-

I tried explaining this to another poster, using Einsteins definition of madness. Both Labour and Tories have presided over the shambles that the UK has become, over the last 30 or so years. Voting either in again, would meet Einsteins definition of madness. " Doing the same thing over and over again, expecting different results, is madness " Amazing, that people cannot, or will not, see what is before their eyes. Certain sections of society, can of course, be excused. Their indoctrination and cult like traits are simple to spot.

-

An indication of the desperation that is leaking out of Starmers pores https://www.theguardian.com/politics/2025/jun/28/keir-starmer-accuses-nigel-farage-of-taking-people-for-fools-in-wales Farage can say what he likes, He is from a Party that currently consists of about 5 MP's. If anyone is taking the Public for fools, it is you, you cretin, coupled with the rest of your Cabinet. You are a train wreck, clinging onto power. Perhaps you could explain why 2 male escorts, who caused criminal damage, have been refused bail, and their trial set for next year ? Nobody, but nobody, gets refused bail for criminal damage in the UK. What are you trying to hide and keep hushed up Starmer ?

-

UK Reform would be largest party if general election held today

The Cyclist replied to Social Media's topic in World News

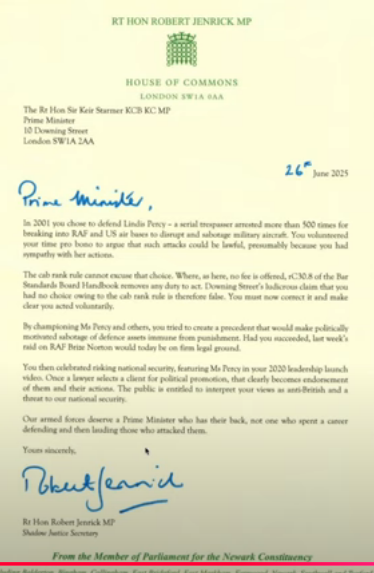

Then you best not read this I understand that some, not all, of our readers have genuine impediments to understanding written English. So this guy has provided commentary and broken it down into easily understandable English Lying, deceitful, sad excuse for a human being. Only just beaten into 2nd place by a certain T Blair. However as Chomper points out, there is still 4 years where he could potentially surpass T Blair and be so far in front, that he would be in a league of his own. Or perhaps the howls of " When are you going to resign PM " will start ringing out from the likes of the BBC, Sky News etc, from Monday morning. -

UK Reform would be largest party if general election held today

The Cyclist replied to Social Media's topic in World News

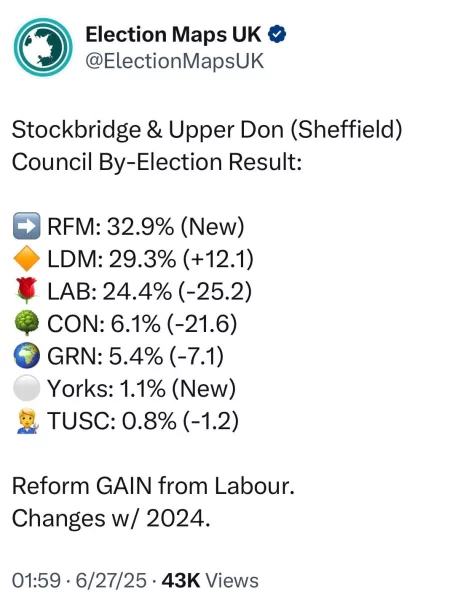

Correct. Just imagine how much of cluster Labour will be by then. By- Election wins for Reforms over the last few days, Labour dropping around 25% at each one, including Lyndsey Hoyles constituency. Reform have no need to implode They just need to sit back and watch Labour eating itself. Tories are gnawing on the bones of a not quite deceased carcass. Whatever way anyone tries to slice and dice it. For a Party that proclaimed loudly that they had a plan ready to from day . Somebody must have nicked that plan, they were lying like a big bag of lying things, or their plan consisted of driving the UK into the ground. U turn after U turn, meaning more tax rises in the Autumn Unemployment UP Welfare Bill UP Inflation UP Tax Rises UP Wealth creators fleeing the Country UP Different groups of people hating Labour UP Illegals almost 50% UP C'mon you 2. Give us the benefit of your mentalism by explaining how good the plan was, and how it is benefiting the Country ? People with inquiring minds, would like to at least try and understand the mentalism.- 66 replies

-

- 13

-

-

-

-

-

-

-

The 1st column after the dates are UK pedestrian fatalities Which are roughly about 100 a year less than Thailand. Does that make Thailands figures pretty good for a developing Nation Or does it make the UK's figures absolutely shocking for a so called developed Nation. Hope that clears up your confusion

-

The plebs are rebelling as well as members of the Labour Party At what point will both Labour and the Tories come to terms with being busted flushes and no longer represent the views or wishes of the majority of the electorate. Carry on. All you are doing is making the job of Farage easy. He does not have to do anything to become PM. You both, are doing it for him.

-

This one ? https://www.housingtoday.co.uk/green-light-for-460-home-mixed-use-marina-scheme-in-southampton/5134805.article You will find that this is endemic throughout the UK. Affordable housing included to gain planning permission. affordable housing dropped once project begins as being non viable. There have also been a number of high profile Court Cases, where the Council took the developer to Court for dropping the affordable housing. Hobsons choice for the Court. Rule in favour of the Council and the project does not go ahead. Invariably, the decision goes in favour of the developers.

-

UK Asylum Appeals Surge Leaves Thousands of Migrants in Hotels for Years

The Cyclist replied to Social Media's topic in World News

You are beginning to stutter. You might want to take a deep breath and step away from your keyboard. And accept that someone with over 2 decades of experience - It might be fair to say that my big toe has forgotten more than you will ever learn from google. -

UK Asylum Appeals Surge Leaves Thousands of Migrants in Hotels for Years

The Cyclist replied to Social Media's topic in World News

Just a mentalist then. -

UK Asylum Appeals Surge Leaves Thousands of Migrants in Hotels for Years

The Cyclist replied to Social Media's topic in World News

Right here Are you bi-polar ? -

UK Asylum Appeals Surge Leaves Thousands of Migrants in Hotels for Years

The Cyclist replied to Social Media's topic in World News

I never retired with a big fat, gold plated, index linked Government pension, because I worked in the DWP or similar. There is a world of difference between a legal challenge and a Judicial Review. A Judicial review will always side with the Government when it comes to matters of National Security. How is that for speculation ? -

UK Asylum Appeals Surge Leaves Thousands of Migrants in Hotels for Years

The Cyclist replied to Social Media's topic in World News

Are you struggling ? You intimated that I suggested setting up camps on the South Coast You invented an issue that did not exist. Just like you invent excuses as to why something cannot, or will not work. No, it's not a hypothetical, its a very simple solution, by invoking the National Security Act and drafting in the Military under Military Aid to the ( failing ) Civil Authorities. Because you are not familiar with what can be done, does not make it untrue. -

UK Asylum Appeals Surge Leaves Thousands of Migrants in Hotels for Years

The Cyclist replied to Social Media's topic in World News

Check it out for yourself then. You know, sometimes people actually know what they are talking about. Amazing eh -

UK Asylum Appeals Surge Leaves Thousands of Migrants in Hotels for Years

The Cyclist replied to Social Media's topic in World News

I see your issue. I never mentioned the South Coast. I specifically said set up camps on military Training Areas. There is 1000's of acres to choose from. I don't answer questions on your hypothetheticals. I asked you to answer a factual question. -

UK Asylum Appeals Surge Leaves Thousands of Migrants in Hotels for Years

The Cyclist replied to Social Media's topic in World News

Nope It may be subjected to a Judicial Review, which would most likely side with the Government. No vexatious lawfare allowed. -

UK Asylum Appeals Surge Leaves Thousands of Migrants in Hotels for Years

The Cyclist replied to Social Media's topic in World News

Then do not try and criticize what is a simple solution, and whining that it is unworkable. How about answering why arrivals are up 50% since Starmer killed the Rwanda Act, which became British Law on the 25 April 2024 ? -

UK Asylum Appeals Surge Leaves Thousands of Migrants in Hotels for Years

The Cyclist replied to Social Media's topic in World News

You can point out flaws in my solution, when you have read and understood the UK's National Security Act. You might also want read into Military Aid to the Civil Authorities and when it can be invoked If someone had a spine and a set of hairy swingers, the solution is easy. Which is an abject failure Need a bit more reading, you missed this Arguably, all 3 are under attack. Except if your name is Starmer and those like him. -

Take your BB card to a BB Branch ATM Go into settings and set up online payments or whatever it is called by BB

-

UK Asylum Appeals Surge Leaves Thousands of Migrants in Hotels for Years

The Cyclist replied to Social Media's topic in World News

Right, so instead of looking in a mirror, try answering the question. Try explaining why what I have suggested, will ot act as a deterrent? Do I really ? For someone who just admitted that you have no answers. You certainly have a lot to say for yourself. I gave you one. Which involved invoking the National Security Act. You try explaining why it would not work. Instead of getting bombastic and offering nothing -

UK Asylum Appeals Surge Leaves Thousands of Migrants in Hotels for Years

The Cyclist replied to Social Media's topic in World News

He will also need to repeal the UK's HRA. And I'm afraid that the chances of getting both of these through the HoC and the HoL, are slim to non existent. A good example, of knowing how to box and knowing how to box clever. And the clever boxer will put them at priority No1 & No2 on their election manifesto. The clever boxer, right now, would also be calling for both to be suspended under the UK's National Security Act, until the boats are halted, the backlog cleared and those with no right to be in the UK, removed. -

Which will make you a racist, all sorts of " Isms " with a large dash of other " Ists " Don't visit the UK anytime soon 😀😀