The Cyclist

Advanced Member-

Posts

2,136 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by The Cyclist

-

One of the twisted firestarters Both of them advertise in the UK as male Models / Escorts. Perhaps that is why Starmer is big on a " Youth Mobility Scheme " 😀😀

-

No, The Cyclist 26 May 2025. I have a couple of bridges for sale, if you think it is not going to be newly minted Germans that take advantage of any of these madcap schemes.

-

Report Foreign Earnings Taxed Under New Thai Rules - But With Exceptions

The Cyclist replied to snoop1130's topic in Thailand News

I'm not worrying. Yes, I could do that. But the idea of splitting my time between both Countries is beginning to grow on me. SRRV is only $10,000, with a pension of $800 a month and $300 to renew annually, what's not to like. -

Report Foreign Earnings Taxed Under New Thai Rules - But With Exceptions

The Cyclist replied to snoop1130's topic in Thailand News

As all my income is taxed in the UK, I cannot possibly be evading tax. But by setting up with a philippines address, it means that when I claim my State Pension ( If it's not means tested by then ) I will get the annual uplifts. You really are being rather stupid. -

Report Foreign Earnings Taxed Under New Thai Rules - But With Exceptions

The Cyclist replied to snoop1130's topic in Thailand News

Well done trigger. It would be absolutely beyond you to think 175 days in each Country. -

Report Foreign Earnings Taxed Under New Thai Rules - But With Exceptions

The Cyclist replied to snoop1130's topic in Thailand News

Exactly. Which is why I have just spent 3 months in the Phillipines, getting my head around the SRRV and a feel for the place. Plan B planning, in case global taxation in Thailand takes off. -

Report Foreign Earnings Taxed Under New Thai Rules - But With Exceptions

The Cyclist replied to snoop1130's topic in Thailand News

Sure, that is why I said Those same people might look into the OECD instead of bumping their gums continuously, and understand that until Thailand withdraws from joining the OECD, the OECD will be steering Thailand in a direction that is acceptable to the OECD. Which in some instances, will not be to the benefit of Thailand ( as we currently know Thailand ) -

Report Foreign Earnings Taxed Under New Thai Rules - But With Exceptions

The Cyclist replied to snoop1130's topic in Thailand News

That B 600 a month is not a pension, it is a means tested allowance. Probably great swathes of Thai people who do not qualify for a pension and exist on the B600 a month allowance. Unsurprisingly, the OECD are all over it. Any guesses as to why that might be ? https://www.oecd.org/en/publications/pensions-at-a-glance-asia-pacific-2024_d4146d12-en/full-report/thailand_eaeb7aea.html -

Report Foreign Earnings Taxed Under New Thai Rules - But With Exceptions

The Cyclist replied to snoop1130's topic in Thailand News

As I posted yesterday, Thailand wishing to join the OECD is past tense. The Accession process has already begun. https://www.oecd.org/en/about/news/press-releases/2024/10/oecd-kicks-off-accession-process-with-thailand.html The next thing will be a welfare state, a National Pension Scheme and all manner of other expensive gambits. Guess what is needed to fund these ? So unless Thailand halts the accession process, the direction of travel is only one way. Benjamin Hart had a very ranty video on this very subject, it he did not appear to understand / know that the process was already underway. -

Yes, It easy to be confused Now try thinking of newly minted Germans getting moved on, in great schemes like " Youth mobility Schemes " and it all becomes clear.

-

Report Foreign Earnings Taxed Under New Thai Rules - But With Exceptions

The Cyclist replied to snoop1130's topic in Thailand News

You told me, did you ? Have a read of this. https://www.oecd.org/en/about/news/press-releases/2024/10/oecd-kicks-off-accession-process-with-thailand.html Take note of these in particular. That means taking rules from the OECD. Has the magnitude of the above sunk in ? -

Report Foreign Earnings Taxed Under New Thai Rules - But With Exceptions

The Cyclist replied to snoop1130's topic in Thailand News

Yet, here you are. On a thread about a proposal, that may or may not happen. I think you might miss the irony. -

Report Foreign Earnings Taxed Under New Thai Rules - But With Exceptions

The Cyclist replied to snoop1130's topic in Thailand News

Yes , it can. What does not change is Governments desperation to raise even more revenues. Not forgetting https://www.oecd.org/en/about/news/press-releases/2024/10/oecd-kicks-off-accession-process-with-thailand.html When that formal accession process is halted, by Thailand, then I think things will return to normal regarding taxation, until then, you know what these organisations are like. The EU is a good recent example. -

Report Foreign Earnings Taxed Under New Thai Rules - But With Exceptions

The Cyclist replied to snoop1130's topic in Thailand News

It hasn't you know. Don't be shocked or surprised if Thailand implements global taxation for tax year 2027. -

Report Foreign Earnings Taxed Under New Thai Rules - But With Exceptions

The Cyclist replied to snoop1130's topic in Thailand News

Trump is the President of Thailand ? Who knew ? Trump is the head of the OECD ? Who knew ? There is something really ironic about Americans being upset about Thailand possibly implementing global taxation. -

Report Foreign Earnings Taxed Under New Thai Rules - But With Exceptions

The Cyclist replied to snoop1130's topic in Thailand News

https://www.rsm.global/thailand/news/proposed-taxation-worldwide-income-thailand People ( mainly Thais ) have been given a tax free window to repatriate their money to Thailand, before Global Taxation takes off. The Thai Government ( and most other Governments ) need additional revenues, I would be very surprised if Global Taxation is not implemented in time for 2027 tax year. -

Trump Urges Starmer to Abandon Wind Power in Favor of North Sea Oil

The Cyclist replied to Social Media's topic in World News

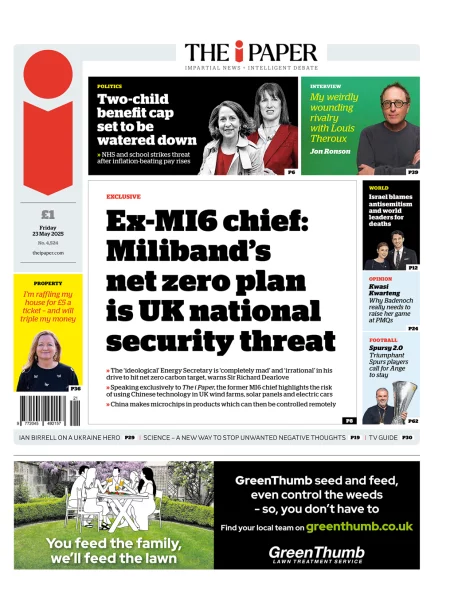

I'll just leave this for the zealots, that cannot see past " All bow and worship to the Sainted Greta " -

Trump Urges Starmer to Abandon Wind Power in Favor of North Sea Oil

The Cyclist replied to Social Media's topic in World News

6 Glacial and Inter-Glacial periods over Millennia, shows how how deluded and foolish they are. -

Trump Urges Starmer to Abandon Wind Power in Favor of North Sea Oil

The Cyclist replied to Social Media's topic in World News

You are probably correct. What he does know is that the UK's Nut Zero is mentalism at its finest. China / Russia / The US / India / Japan 5 reasons out of many, as to why it is mentalism. Even if the UK reached Nut Zero, it would be as effective as a fart in space.