The Cyclist

Advanced Member-

Posts

2,245 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by The Cyclist

-

UK Labour Whip Resigns in Protest Against Starmer’s Welfare Reforms

The Cyclist replied to Social Media's topic in World News

Have they really ? Rwanda might have work on the deterrent factor, if Lawfare and Labour hadn't stopped it. Labours, Smash the Gangs, is an abject failure. How can a legal immigration system be working. When 1 million foreigners are paid £7.5 Billion a year in welfare benefits ? These figures do not include Illegal Immigrants. Neither legal migration Policy or the Welfare State Policy is worth the paper that they are written on. Not much in the UK at Government level is worth the paper it is written on, hence the reason the UK is clinging on at the S bend and in danger of flushing down it completely. -

UK Labour Whip Resigns in Protest Against Starmer’s Welfare Reforms

The Cyclist replied to Social Media's topic in World News

50,000 Dinghy Divers in the last year say otherwise. It might not be " Official Policy " but it is an open border nonetheless. -

UK Labour Whip Resigns in Protest Against Starmer’s Welfare Reforms

The Cyclist replied to Social Media's topic in World News

This says different the numbers reduced significantly in 2024 due to the Tories cutting family / spouse Visas. -

UK Aid Budget Strained as Asylum Hotel Costs Surge Amidst Overseas Cuts

The Cyclist replied to Social Media's topic in World News

Touchy touchy I never said you stated or suggested anything. I said you agree that they are illegal when they arrive in Europe, and re illegal when they arrive in the UK. There are plenty, from the UK Government, working downwards, , who refuse to accept that they are illegals. It will take time, but eventually we will get there, to start calling a spade a spade. -

UK Aid Budget Strained as Asylum Hotel Costs Surge Amidst Overseas Cuts

The Cyclist replied to Social Media's topic in World News

You agree then They arrive illegally in Europe, and are also illegal when they they land in the UK. Took a while, but we got there in the end. -

Starmer is neck deep in the cover up as head of the CPS and DPP https://www.bbc.com/news/uk-england-manchester-17853560 It took a man by the name of Nazir Afzal to tell Starmer that he was prosecuting, after the case was originally dropped by the CPS. Never landed on my desk is no excuse for the Head of the CPS and DPP. He is either a bungling idiot, who should be stripped of his tax free pension and KCB, or is complicit in the cover up and should be jailed, along side all the rest of them, that covered up, facilitated, or done nothing whilst in Public Office.

-

UK Wes Streeting’s NHS Gamble: Labour’s Make-or-Break Moment

The Cyclist replied to Social Media's topic in World News

@Red Forever mashing buttons is neither big nor clever. It is a sure fire indicator that a person is weak and somewhat intellectually bereft. Have a bash at trying to articulate which part, or parts, of my post that you disagree with. -

UK Wes Streeting’s NHS Gamble: Labour’s Make-or-Break Moment

The Cyclist replied to Social Media's topic in World News

Every Government Dept, The NHS, Police etc, should have a long term plan, reviewed and updated every year. It is the lack of long term planning that has enabled every Public Service to fall into the mess that they are currently in. I'll accept that there are other factors involved, which also fall under the no long term strategy umbrella. On the above, we can agree. 1 year in and Labour are finding out the difference between rabble rousing in opposition, and sitting in the big chair with the responsibilities that go with that. They went into the GE, claiming loudly that they had a plan ready to go from day 1. U- Turn after U-Turn, clearly shows that they not only did they not have a plan, they still don't have a plan. The current funding model and Modus Operandi ofthe NHS, dictates that it will never change, only tinkering at the edges will occur. -

And lets remind ourselves of what he had to say only months ago. In keeping with Starmers warcry of openness and transparency. I think it is only fair that Musk donates all the info stored on his servers to the Inquiry. And then jail every single person, involved in covering up, facilitating, or doing nothing.

-

UK Aid Budget Strained as Asylum Hotel Costs Surge Amidst Overseas Cuts

The Cyclist replied to Social Media's topic in World News

They are all breaking the law by crossing the Channel illegally and breaking the law by landing on UK shores without having leave to do so. That makes them not only Illegal but also criminals. Another 900 landed on Friday. Another approx £ 45 million spunked up a wall. -

Behind the facade of the Rightwing Moral Crusade

The Cyclist replied to Chomper Higgot's topic in Political Soapbox

You struggling ? This beyond your comprehension skills ? I could explain it further. What I cannot do is make you understand that explanation. -

Behind the facade of the Rightwing Moral Crusade

The Cyclist replied to Chomper Higgot's topic in Political Soapbox

Well reading the comments, he seems to have been in both parties. Which puts you, and your OP in a bit of a quandary. And perhaps reinforces, that perverts and their perversions are nothing to do with Politics or Political Parties. Try not to struggle getting your head around that, I wouldn't like to see you suffering from an aneurism. -

Behind the facade of the Rightwing Moral Crusade

The Cyclist replied to Chomper Higgot's topic in Political Soapbox

Then I am afraid you are going to go through your asseannow life, extremely disappointed. Mentalists really do walk amongst us. -

UK UK economy shrinks by the most since 2023

The Cyclist replied to Social Media's topic in World News

I'll stick with the BDS, for those that wish to shoehorn Brexit into an unrelated topic. It's a serious condition, and many are afflicted by it. -

UK UK economy shrinks by the most since 2023

The Cyclist replied to Social Media's topic in World News

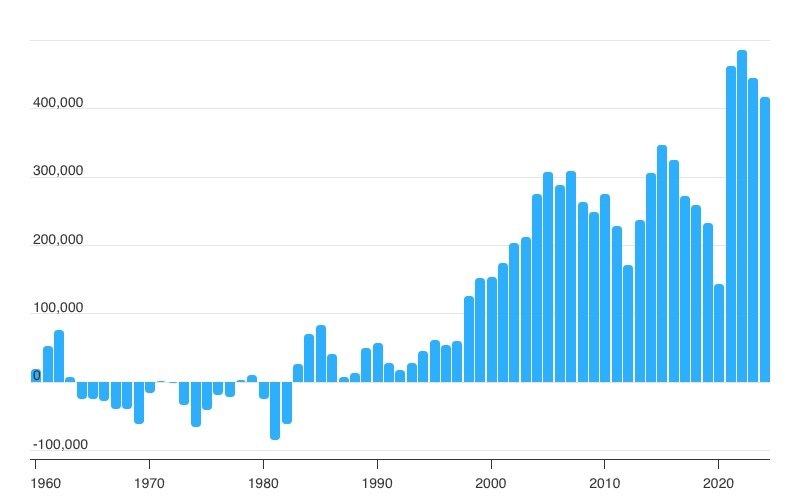

I will try to break this to you gently ( Even though it has nothing to do with the topic ) UK GDP grew every year ( Covid aside 2020 ) since Brexit I'm not convinced that there will by any growth in 2025. The normal good start to the year ( Q1 ) 0.7%, has in the month of April been reduced by 0.3%. Tariffs or no tariffs, I'm not seeing anything that is pointing to additional growth, only further decline. -

UK UK economy shrinks by the most since 2023

The Cyclist replied to Social Media's topic in World News

I'm saying that Brexit is nothing to do with the thread, which is To bring up brexit, is a nasty case of BDS. Unlucky. -

UK UK economy shrinks by the most since 2023

The Cyclist replied to Social Media's topic in World News

That is a bad case of BDS ( Brexit Deranged Syndrome ) Sadly for you, there is no known cure. -

UK UK economy shrinks by the most since 2023

The Cyclist replied to Social Media's topic in World News

You poor deluded child The " Growth " required to pay for that investment ( All £2.2 Trillion of it ) is heading South. Just a reminder, from that well known Right Wing Political mouthpiece 😀😀 https://www.politico.eu/article/uk-labour-party-project-growth-rachel-reeves-economy-public-services/ The fat lady has sung, and is now in her death spiral -

UK UK economy shrinks by the most since 2023

The Cyclist replied to Social Media's topic in World News

https://www.thetimes.com/uk/politics/article/britain-labour-tax-non-dom-policy-exodus-loophole-x5cqjqxgc Growth down Unemployment up People fleeing the UK up Under Labour, the only way is down. -

UK UK economy shrinks by the most since 2023

The Cyclist replied to Social Media's topic in World News

The OP doesn't mention the £500 million fall in april exports to the EU. Was that a result of Trumps Trade policies as well 😀😀😀😀 Keep banging that lonely drum. -

UK UK economy shrinks by the most since 2023

The Cyclist replied to Social Media's topic in World News

The only 2 facts in my post were 1 Growth fell by 0.3% in April 2. Payrolls reduced by 109,000 in April. Non of them counter factual or nonsense. So it must be you that is spouting counter factual nonsense, yet again, yet again, yet again, yet again. See the trend yet ?- 34 replies

-

- 12

-

-

-

-

-

-