The Cyclist

Advanced Member-

Posts

2,130 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by The Cyclist

-

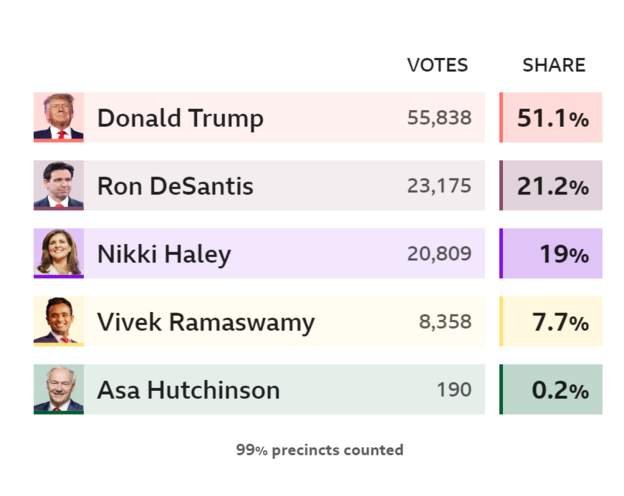

Trump wins Iowa caucuses, cementing frontrunner status in 2024 race

The Cyclist replied to webfact's topic in World News

And you do not seem to understand humour. I really could not give toss who wins, I just know enough to understand that Trump doing well will have heads exploding. Yours included. -

Trump wins Iowa caucuses, cementing frontrunner status in 2024 race

The Cyclist replied to webfact's topic in World News

-

Trump wins Iowa caucuses, cementing frontrunner status in 2024 race

The Cyclist replied to webfact's topic in World News

I couldnt care less who won the 2016 election I asked you what happened in the evolutionary cycle that made this happen Its only 8 years, I thought you might be able to put your finger on it. -

Trump wins Iowa caucuses, cementing frontrunner status in 2024 race

The Cyclist replied to webfact's topic in World News

Not following you Is the evolution of Trumps support different from the evolution of Bidens support ? How did this happen ? What evolutionary change happened between last night and 2016 ? -

Trump wins Iowa caucuses, cementing frontrunner status in 2024 race

The Cyclist replied to webfact's topic in World News

OK, if you say so. I would have thought that this part was very relevant. What would I know, I'm not American. -

Trump wins Iowa caucuses, cementing frontrunner status in 2024 race

The Cyclist replied to webfact's topic in World News

If that is all you managed to read in the article, it probably says plenty about you. -

Trump wins Iowa caucuses, cementing frontrunner status in 2024 race

The Cyclist replied to webfact's topic in World News

Interesting take from the BBC https://www.bbc.com/news/world-us-canada-67989443 It wont make comfortable reading for some. -

The only part that we know is that something has changed from the 01 Jan 2024 with regards to foreign transfers into Thailand. Is there really any point in trying to paint a picture based on speculation for the RD to throw a bucket of black paint over it when they finally extract their finger and issue further instructions ? As I said yesterday, the code attached to my Government Pension remittance probably identifies exactly what it is to both the bank and the RD. Will the RD require me to file a tax return on income that they cannot touch ? Logic would tell me no, but then I have no idea what the OECD best practice in tax avoidance / evasion is. And unless someone has waded through the forests of OECD paperwork on CRS is, then they will not have a clue how Thailand will move forward until the RD make an announcement.

-

We are in agreement that RD Code, as has been copied & pasted numerous times is for Thais and foreigners who are / have been employed in Thailand. I believe that the wording is something like ' Anyone who has assessable income must file an annual tax return ' Whicn by implication means that if you do not have assessable income there is no need to file a tax return. Ditto exempt income. If it is exempt it is not assessable for tax, and therefore no tax filing necessary. That would be the norm up until 01 Jan 2024, and will probably continue to be the norm for Thailands Internal taxation Policy. A further edict is required from the RD before anything can be declared as ' confirmed ' pertaining to the readers / posters on this, and related threads.

-

Trump has a sizeable lead ...

The Cyclist replied to Crossy's topic in US & Canada Topics and Events

And not just in the Republican Party https://www.nytimes.com/2023/11/05/us/politics/biden-trump-2024-poll.html It is all about to get rather interesting, ramp up the popcorn production -

Does the Revenue code not deal primarily with Thailands Internal Taxation Policy ? The above sounds very much like it applies to employment / past employment in Thailand. I would expect to see an additional section added to the Revenue code to compliment the additional section being added to the tax filing form. Therefore it is a bit premature to be announcing that anything is actually confirmed. Neither does it address the issue of whether something is ' assessable ' or ' non-assessable '

-

It has already been printed by Mazers and others that ' Thailand will respect existing DTA's ' Exactly, and that is not going to happen until between Jan - Mar 2025. Or the RD come out with a detailed plan before then. Until the RD come out with a detailed announcement, every thread is going to turn into a buggers muddle. If it helps you. My private pension ( taxed in the UK ) is now being paid to my UK account, until I get clarity from the RD. My Government pension ( taxed in the UK and covered by a DTA ) continues to be remitted direct to Thailand. At this moment in time, I can do no more to limit my potential exposure to the Thai taxman.

-

As I have said before, the major part of the problem is the term ' Assessable income ' Is a source of funds, only taxable in Country X, Y or Z due to a DTA really ' assessable income ' in Thailand ? I would not be surprised to see wording changed to ' International remittences ' must be..... Otherwise it becomes a total dogs dinner.

-

Unless someone on this thread has access to the EOCD's Rules, Regulations and Reporting criteria regarding Tax avoidance / evasion in compliance to CRS theneverything is wait and see. Up to date anecdotal evidence Changed passprt number at 3 banks last Monday, not one mentioned anything to do with tax. On Thursday, Apple told me my bank card had expired and could not process my 99 Baht purchase Back to bank on Friday to renew bank card and got ( my first ever ) 12 month printout. Having now seen ( for the first time ever ) the code that delivers my Government Pension, the bank and the RD will have no problem identifying that code and working out that it is a UK Government Pension, and subsequently covered by a DTA. Which might be why the bank has not mentioned anything to me about tax.

-

@rs11 To back up Sigma said. Way back in 2011, I was pulled and told to get a proper visa. I had about 18 months of working 6 on 6 off, and was about 8 months into working 4 on 4 off. Every visit to Thailand during that 6 on 6 off period, was roughly 2 weeks in Thailand, 10 - 14 days somewhere else, and the last 2 weeks back in Thailand. What the actual ruling is, I do not know, but it is not something that has just started.

-

Never cycled the whole route, though plenty of cycling in the park. This might help you, although its from North to South https://www.routeyou.com/en-th/route/view/2609432/cycle-route/khao-yai-national-park-bicycle-track-5