The Cyclist

Advanced Member-

Posts

2,132 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by The Cyclist

-

I would break them down as Some tall ones Some short ones Some fat ones Some thin ones Some light skinned ones Some dark skinned ones And all the rest somewhere in between. Job Jobbed.

- 25 replies

-

- 15

-

-

-

-

Scratches head 😀😀 I think I might have said a few times on this thread that income taxed in your home Country will probably not be subject to Thai tax ( especially Countries that have a DTA ) The tricky part ( for some ) will be proving that money has been taxed in Home Country before being remitted to Thailand.

-

I have no idea what the current UK rules are. I am still a resident of the UK, but I am non - dom for tax purposes. The benefit for me is that my overseas income ( O&G ) would not be taxable inthe UK, but income derived in the UK is still taxable in the UK. When I became non-dom the rules were 90 days or less a year in the UK, averaged over 5 years. There was slack in the system. About 2012 the rules changed to a straight 90 days a year or less. What the rules are today I do not know ( or care 😀😀 ) I officially retired in 2019 and no longer have overseas income. Only speculation on my part, but when the muddy waters are cleared, I think that income taxed in your home Country and then remitted to Thailand will not be subject to Thai taxation.

-

Is that not usually called a funeral 😁😁 Wouldn't fancy eating it tho, cows, sheep and pigs on the other hand

-

I usually have a choice of 3 other systems for drinking, Lotus, Makro or Big C 😂😂

-

Yes, they have closed a loophole that was being exploited. What is not clear. for ius farangs is if Thailand is going to tax foreign income, in our case, UK income, which has already been taxed by HMRC. So for the time being I will continue to have my Government Pension ( taxed in the UK and covered by a DTA ) remitted to Thailand. Until clarity is gained, I have stopped my Private Pension ( Taxed in the UK, not covered by a DTA ) from being remitted to Thailand. That is my bases covered until the powers that be clarify things and drain the muddy water.

-

Speculation on your part. I bring in via 2 x pensions between baht 115k - 200k a month. No idea how much tax I will have to pay ( if any ) until the powers that be clarify things. So I wont be upping that to baht 2.odd million, I will be reducing it before the 01 Jan ( paperwork already done ) until such times as clarity is gained. Not really rocket science, with the added bous of not having to trawl the internet hunting for cheap travel or fretting about making plans that are a waste of time and effort until clarity is gained.

-

Who got bored in Thailand and went back?

The Cyclist replied to georgegeorgia's topic in ASEAN NOW Community Pub

I think you will find it is pretty normal. I told you, in 15 years here, I have never had a bill less than 1000 Baht, except when I was offshore. Never use aircon during the day, an hour or so at night before hitting the sack in the hotter months. In the colder months none at all. The LHG's family home is the same, 4 hour drive, different Province, anywhere between 2500 - 3500 Baht a month, just the 2 oldies and no a/c whatsoever. -

Who got bored in Thailand and went back?

The Cyclist replied to georgegeorgia's topic in ASEAN NOW Community Pub

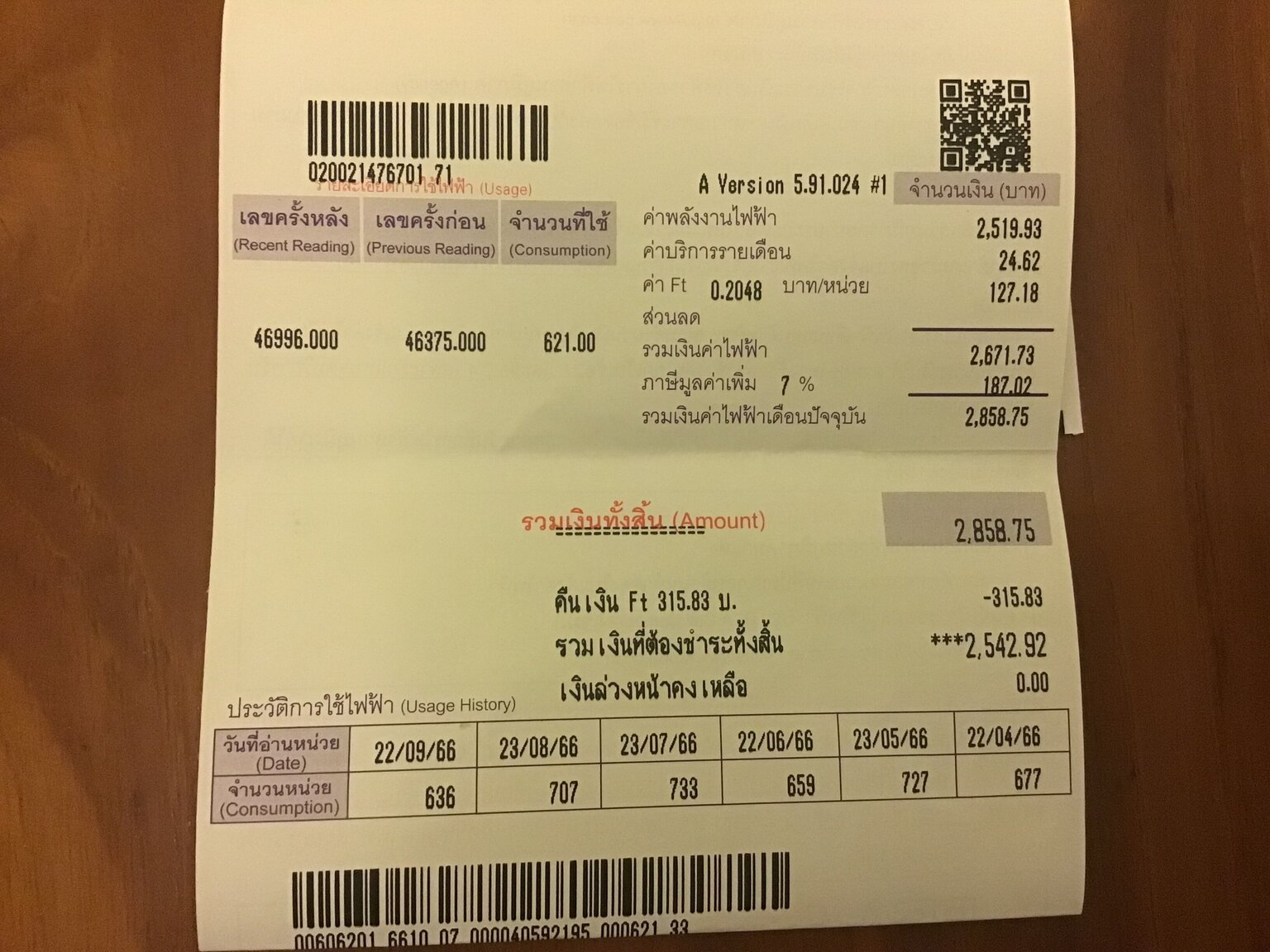

No idea. And the condo block may have had its own tariff. I dont remember as it was about 15 years ago. Latest bill No real change to monthly usage. The spikes into the 700 units was due to visitors. I suspect anyone who is in a house with a 500 baht monthly leccy bill might just be getting skelped with a rather large bill at some stage. -

Between pump to house I also installed a whole house RO filter. Wasn't cheap tho. Probably went overboard and still wouldn't drink the tap water.

-

Who got bored in Thailand and went back?

The Cyclist replied to georgegeorgia's topic in ASEAN NOW Community Pub

An empty condo does not need a/c and leccy was still around 800 baht a month. Fridge freezer left plugged in and probably left the balcony light on. You not have a fridge/freezer, washing machine, kettle / coffee machine / electric showers / fans, other electrical items ? Fair play to you if you built a tree-house and are happy. -

Who got bored in Thailand and went back?

The Cyclist replied to georgegeorgia's topic in ASEAN NOW Community Pub

No idea, I thiought you would be able to tell me 😂😂 I have never had a leccy bill in the region of yours Except the months I was offshore and the condo was empty.