offset

-

Posts

1,325 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by offset

-

-

3 hours ago, offset said:

I have an online biz with Kbank and I do not have a business

I have been told by head office to go to a Krungsri branch and change over to a online biz account with I will try to do soon

Just came back from my branch she did not have a clue what I wanted so she rang head office

Head office told me I have to do nothing till I get a notification online and telephone with the details of uploading to Krungsri online biz to be sent to me on the 1st of July

-

1

1

-

-

4 hours ago, mark5335 said:

...and if not, then you would need the usual gambit of documents from the Dept of Business Development to verify that you have a registered business.

I have an online biz with Kbank and I do not have a business

I have been told by head office to go to a Krungsri branch and change over to a online biz account with I will try to do soon

-

2

2

-

-

I have just spoken to Krungsri on the phone they are only closing Krungsri Online

They are not closing Krungsri Biz so if using Online you have to go to the bank to open Krungsri biz

It seems like the only way to use a Krungsri account

-

6 hours ago, KannikaP said:

Two months ago, my Mrs & I opened a Joint account at Bkk Bank, and when I tried WISE, the dosh was returned saying Incorrect Bank Data, because I had simply left MY name as the recipient. I now send it to my original single account, and transfer to Joint as soon as it arrives.

Some may ask why have a Joint account. So that when I pop my clogs, she can legally withdraw from it without waiting for probate.

I am not sure that you are correct about withdrawing money without probate you should check that

-

1

1

-

-

24 minutes ago, K2938 said:

You do. At best the Thai tax rate will be zero, they will not refund you anything.

Not quite true they will refund withheld tax from your savings in Thailand if you owe no tax here

-

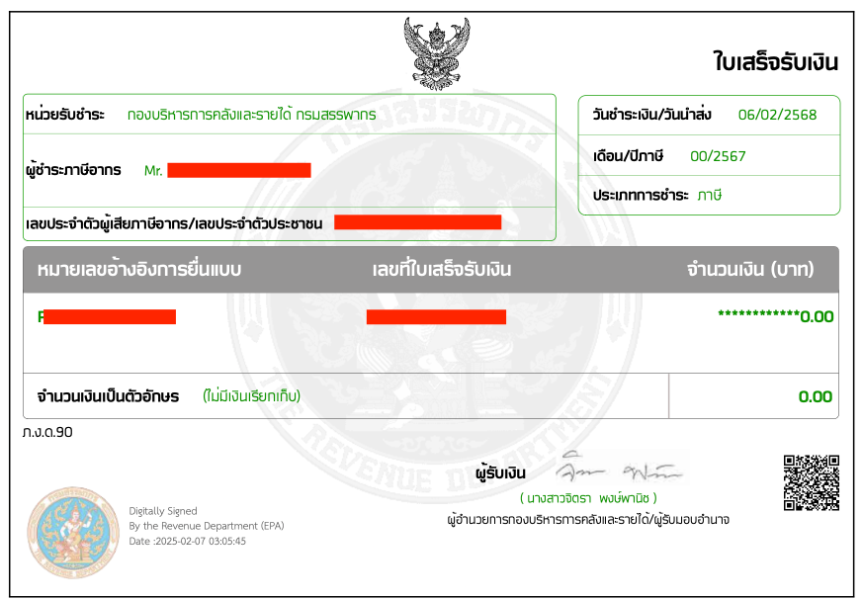

Just for info should be able to cash tax checks at any Thai bank as stated on the check

I have just cashed my checks in Krungsri bank (yellow bank)

-

Going a steep further is the tax free allowance in the UK assessable income in Thailand

-

Do you have to declare all of you accessible income for the year when bringing money over here or can you decide how much accessible income you bring over and say the rest of the money you bring over is from previous to 1st of 2024 savings

-

People must remember you are only taxed on accesable tax that is brought into Thailand not everything brought here

Also any money you bring in from savings held before the 1st of January 2024 is not taxable

-

1

1

-

-

56 minutes ago, NE1 said:

It's the bank account with 800,000 needed for the retirement extension that is my problem.

It has to be in my name alone , so I did a will at the amphur just for this account.

The other normal account is in joint names.

Some accounts in joint names maybe frozen on death

-

14 minutes ago, kwak250 said:

Get your friend to open a bank account and keep the book/card for now and when the time comes it will all be in his name

Becareful with that he can always get a new book anytime using his passport and a lost report from the police

-

Is the UK Tax free allowance (£12570) classed as accesable income in Thailand

-

I use both Internet banking and on the app

-

1

1

-

-

20 minutes ago, bbi1 said:

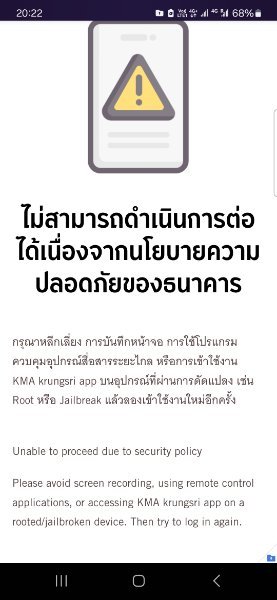

I'm on a Samsung Galaxy phone running Android. Krungsri App has always worked fine for me. Yesterday I had a forced "update your app via Google Play store to continue using the app". After updating it, and trying to start the app, I keep getting the following error pop up. Is anyone else also getting this error and how to fix this so my App will load up?

It's now saying:

UNABLE TO PROCEED DUE TO SECURITY POLICY. PLEASE AVOID SCREEN RECORDING, USING REMOTE CONTROL APPLICATIONS, OR ACCESSING KMA KRUNGSRI APP ON A ROOTED/JAILBROKEN DEVICE.

But my decide is not rooted or jailbroken, I'm not using screen recording or remove control applications. So why am I getting this message pop up in a web browser when trying to start the app?

Do you use any anti virus i

-

1 hour ago, JB300 said:

Large Swift transfers usually end up being more cost effective than Wise due to the charges involved (+ you usually get a better exchange rate on larger transfers).

No idea where the “swing” point is but would guess that somebody doing a one off transfer of 780K (using the suggested amount for retirees) for their annual living costs would find it more cost effective to do it via Swift.

Edit: Just did a test on Wise & the fees for sending £17,500 are £103.98… Swift is typically £9.99

But normally the exchange rate with Kbank is 0.4% less with swift

-

1

1

-

-

1 hour ago, BrianStar said:

Yes, it's Jomtien. And I ball parked the amount of money I had brought in as 400k and that's when she told me 5k. She seemed to mention if it was a different amount, it would change. But when I asked for the formula, she couldn't explain and just started showing me the individual tax tables. It definitely seemed like BS and my gf was no help because she's a very passive person and takes what anyone says as the truth so I was left with the decision to pay 5k so I'd have the TIN for next year and can do it online.

They do post that you need bank statements to pay the tax but I didn't bring mine, expecting to file online but she still filed for me based on the random amount I told her. I should have low-balled the estimate but didn't expect she'd tell me there's any tax due to begin with.

Is this 5000baht fee only being asked for in Pattaya

-

6 minutes ago, motdaeng said:

after my tax return was reviewed by the tax office and declared correct and complete ... !

(i have also received and already redeemed the withholding tax check ...

)

)

you can download this "tax confirmation" for this tax year via the online portal ...

Can I ask how long did it take them to review you case

-

1 hour ago, motdaeng said:

When did you get the form telling you that no tax is to be paid

-

4 minutes ago, redwood1 said:

So we only need to pay 0.1% of our yearly rent to cover our income tax for the entire year.....Smashing baby......Where do I sign up....I will be first in line....

At least I had the pleasure that I ended up that they owe me money

-

2

2

-

-

- Popular Post

Today I filed for tax at the tax office to prove my address i showed her my rental agreement. She said this has not got a stamp on it and will cost 0.1% of the yearly cost.I did not argue because it was not a lot of money but as anybody had the same happen to them

-

6

6

-

15 minutes ago, ukrules said:

Describing it as a loop hole is not correct. The previous system where no tax was due on prior years earnings was very deliberately introduced with a 'memo' issued way back in the 1980s.

Suddenly out of nowhere a new memo was issued some 40 years later which reversed the 1980s memo.

Which brings us to where we are now.So it was never a 'loop hole' - which is an unintentional consequence of something which wasn't thought through properly - it was a very deliberate and meticulous act when introduced and a very deliberate act when removed.

Call it what you want but it was a way of avoiding tax (which is legal) and most probably used by many rich Thais that have overseas connections

-

1

1

-

-

7 minutes ago, Yumthai said:

In absolute more Thais are eligible to pay taxes than foreigners.

True because there are many more of them than us

But most Thais will do online and not need to go to the tax office

The other thing most Thais would need to earn more than 20000 baht a month not many of the population will earn that much

-

1

1

-

-

4 minutes ago, Yumthai said:

Yes Thais don't worry about taxes, it's a farang hobby.

Not many Thais have to pay tax

-

16 hours ago, redwood1 said:

Well I certainty hope you also filed for all the back years when you did not file because those years could also come back to bite you......And you do want to stay on the up and up...

The current tax requirements have been on books for a long time....Many years....

Just filed my tax in the tax office no mention of previous tax years even though i was claiming back with holding tax for 2 years back year's

Many falangs in the office

-

1

1

-

Current UK banking arrangements for British in Thailand

in Jobs, Economy, Banking, Business, Investments

Posted

I have a Nationwide account with my Thai address had no problems with them