-

Posts

28,163 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by Pib

-

-

14 minutes ago, ExpatOilWorker said:

Is it possible you add the sim number in the My AIS app to monitor the data usage, up- and downloads?

The reason I ask, it that there is some debate in Europe that China is collecting and commercializing data from EVs.

This could just be driver behavior, that is then sold to insurance companies, but it could also be both voice and video recordings in and around the car.

I doubt it regarding the BYD-provided SIM. Whether it's an AIS SIM or was just connecting to the AIS network I couldn't say. The BYD infotainment system will show the long IMEI number of its mobile communications circuit and the long ICCID of the SIM card but does not show the actual SIM phone number.

************

Unlike an IMEI number, which refers to the mobile device, an ICCID number refers to the SIM card itself. Since each SIM card has a unique ICCID, you may sometimes hear it called the SIM card number

-

2

2

-

-

Just use Manila SSA to change your DD info....use the Manila SSA website inquiry form. They have a specific inquiry heading/topic just for that purpose.

-

3 minutes ago, Bandersnatch said:

Not sure about my BYD but I do know that OTAs are not included in the monthly allowance.

Yea...any OTA that could be hundreds of megabytes in size do not count against the monthly BYD data allotment.

-

- Popular Post

- Popular Post

7 minutes ago, ExpatOilWorker said:Do you then have to have a separate mobile package for the car's sim card and can you freely choose the service provider?

What is the monthly data usage?

Will the car work if you decide to remove the sim card and go "dark"?

The SIM that comes with my BYD Atto is provided free by BYD...and it's free service for 2 years...or maybe it's 4. Then you can extended the service with BYD or switch to another SIM according to what the dealership told me. The BYD SIM 2GB monthly limit (connects to AIS) which is much, much more than needed for basic communication. Actually, when you want to make calls and stuff like that you would still be using your Smartphone's SIM via bluetooth/USD connection to the BYD infotainment system just like how it works on my 2009 Fortuner. Yes, the car will continue to work without a SIM.

-

3

3

-

14 hours ago, stat said:

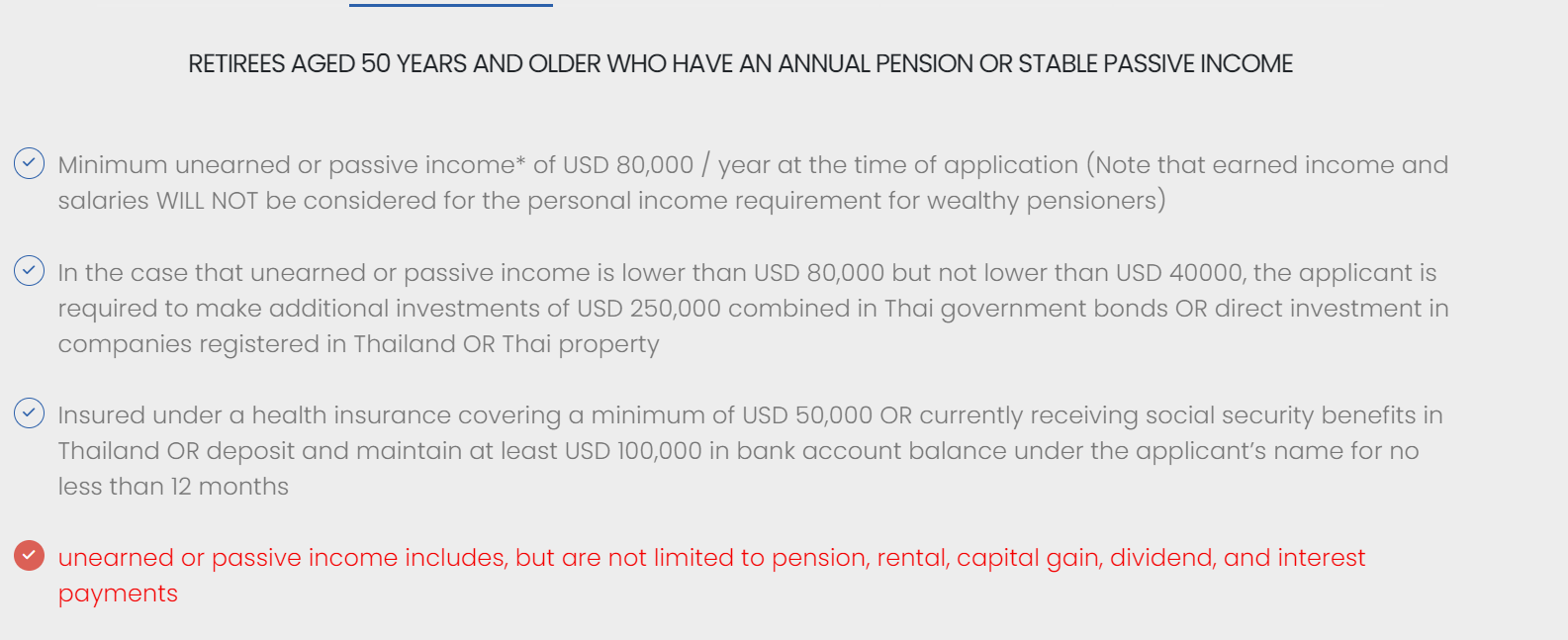

Thanks a lot! For me the biggest risk is that for some reasons one of the documents get rejected either when applying or when getting the 5 year extension. The 80K passive income per year is tricky while the goal is to not generate any passive income which is taxed in Europe/US etc. As for the bigger part I only have shares so I can "generate" income by selling shares whenever I want.

Are the 2 years rolling years or must they be calendar years?

Example:

2025 Jan-Dec 80K

2026 month Jan alone 80K

Can I apply for LTR in Feb 2026 as I already crossed the 80K Limit in Jan 2026?

Yes....but BOI may want proof that since you just went over the minimum income requirement that level of income is likely to continue. if it's primarily pension-based then that's easy enough to proof since it's unlikely a pension will decease...usually just increase from period cost of living increases. If not primarily pension-based the the stability of your income could come into question without income from previous years supporting your current income level.

14 hours ago, stat said:Does the BOI factor in losses in their calculation? Do I need 200K in positive income if I realized a loss of 120K beforehand in the same calendar year ? Example loss of 120K in Jan 2025 and feb to dec 80K plus.

As far as I know they expect you to meet the minimum income levels each year. Income based on pension/passive/fixed income should be fairly stable compared to income based on selling of stocks.

14 hours ago, stat said:I assume they accept a brokerage account like IB to show the 1M USD for the wealthy pensioner LTR and to prove the 80K income?

For the Pensioner LTR their is no requirement for $1M...that's a Wealthy Global Citizen LTR requirement. The LTR Pensioner income requirement is either $80K/yr "or" $40K/yr with $250K investment in Thailand.

-

1

1

-

1

1

-

-

- Popular Post

- Popular Post

8 minutes ago, ExpatOilWorker said:Technical question to our EV owners. How and how much are these new EVs connected to the Internet?

Do they have a sim card and always connected like a mobile phone or is it wifi only?

If using the home wifi, is it then always connected when within range or just connecting or just when charging or just when an software update requires connectivity?

BYD vehicle example: it connects to the internet via mobile/SIM and/or Wifi....just like your smartphone. It's always connected whether using SIM card or Wifi.....always connected where you have started/driving the car or not because when you turn off the EV it's really just going into standby mode where certain communications is still available.

And this type of connectivity is not really unique to EV....heck, ICEV can have the same capability.

-

1

1

-

2

2

-

24 minutes ago, Yellowtail said:

Anyone that remembers the big diesel fuel price hike in Thailand some years ago should have an idea how quickly people will adapt when it saves them a lot of money. In six months, I would guess half of the over the road trucks had been converted to LP/CNG.

Yeap, big trucks, taxis, and many people with private autos were tripping over themselves in trying to convert from petrol/diesel to LPG/CNG as fast as possible. I had several in-laws who converted their petrol cars to LPG because at that time it would cut their fuel cost approx in half due to the spike in petrol/diesel prices.

-

3 hours ago, Thailandbuckeye said:

Sorry forgot to mention that my bank book codes the deposits as BAHTNET.

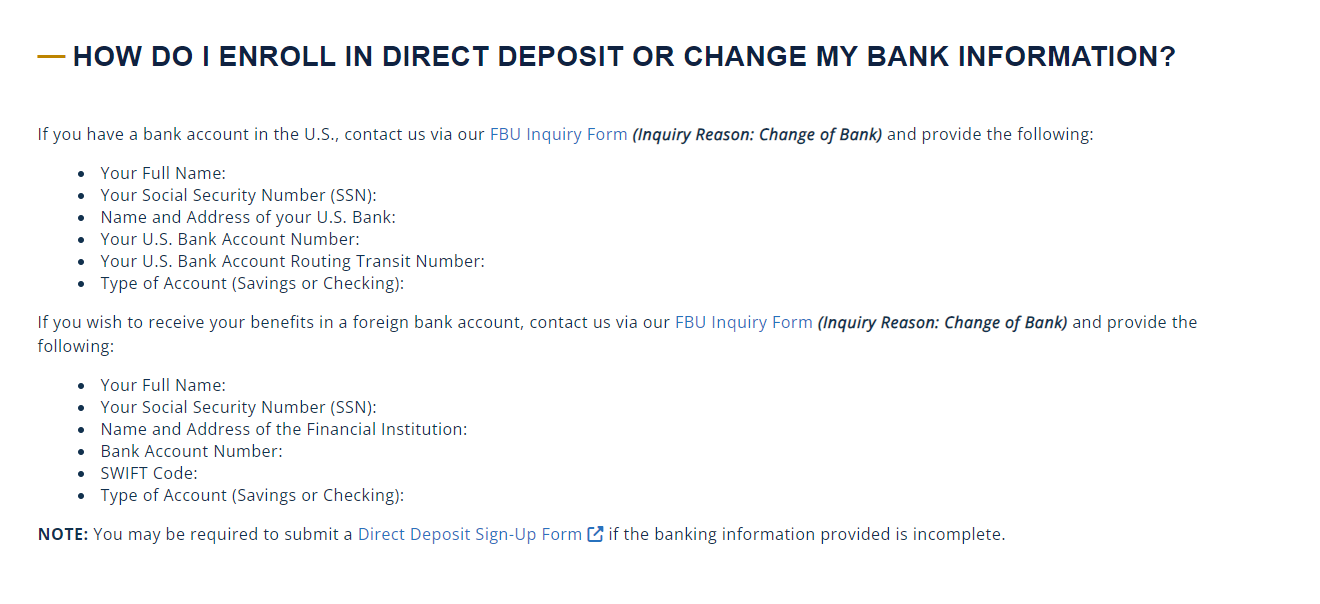

OK, that confirms your direct deposit is on the International Direct Deposit (IDD) funds transfer system that uses the SWIFT system and therefore using SWIFT codes to identify the bank....codes consisting of "letters" and maybe occasionally a number or two mixed it.. The U.S. Automated Clearing House (ACH) uses routing "numbers"...a nine digit number.

So, assuming you are using the SSA Automated Phone System to try to change your DD bank....the automated system expects your current US bank "routing number" that you are currently using for your DD (what loaded in your profile right now)....you will never get past that because you are "not" currently using an routing number...you are using a SWIFT code plus you are on the IDD system vs ACH system.

The SSA Automated Phone System is geared for changing from one U.S. bank to another US on the ACH system....it's routing number based. You are currently on the IDD system trying to change over to the ACH system....trying to mix apples and oranges. Seriously doubt the Automated System can accomplish the switch between IDD and ACH (or vice versa); instead you'll will have to talk to a "human" SSA representative who still may ask you to send in the ACH DD form since you are switching from IDD to ACH. Probably best to just do that thru the Manila SSA....they can enroll you in the ACH or IDD system.

https://ph.usembassy.gov/services/social-security/faq/

-

17 minutes ago, soisanuk said:

The BAHTNET system is for funds sent through the Bank of Thailand's Bahtnet system. Per Wise, their Swift code is BOTHTHBPTS1 (https://wise.com/us/swift-codes/BOTHTHBPTS1)

For IDD the BAHTNET system is only used as the last leg of the SWIFT transfer to the Thai receiving bank which for Thailandbuckeye is Bangkok Bank whose SWIFT code is BKKBTHBK. Plus the Wise SWIFT code above is for sending money to Bank of Thailand in those cases where someone would need to send funds to the Bank of Thailand (probably for companies and other central banks). Now "if" Thailandbuckeye is using the IDD system which means Citibank is handling the transfer as the US Treasury contractor bank for US govt payment to Thailand banks, then Citibank might be using the Bank of Thailand SWIFT as a "correspondent/intermediary bank" address on the way to its final destination at Bangkok.

But that really neither here or there in Thailandbuckeye case and the issue he's having. Assuming Thailandbuckeye is currently on the IDD system then he will probably "not" be able to change from the IDD system that uses the International SWIFT system to the U.S. ACH system that uses routing numbers because the SSA "interactive computerized" system is geared for making direct deposit changes between U.S. banks...that is, changing from one routing number to another. Right now Thailandbuckeye if on the IDD system has a SWIFT code loaded as his bank identifier and does not have a U.S. bank routing number, therefore he could never pass the security question since the system is looking for a routing "number" (as is 0-9) vs a SWIFT code consisting of "letters."

-

12 hours ago, Thailandbuckeye said:

I originally signed up for direct deposit at my U.S. bank, I switched to Bangkok Bank for the 65000 for my visa. I nolonger need the deposit as I have a LTR visa. Since I am unhappy with the exchange rate into Thailand I am trying to change my direct deposit from Thailand back to my bank in the U.S.

In contacting Social Security one of their security questions is what is the routing number for Bangkok Bank. I gave them 026008691 and that does not match what they have on file. My original form show a Swift code on the form sent to FBU in the Philippines.

Since the banks are closed at the moment I was hopeful someone on here has possibly run into this problem and how was it solved. Any help would be greatly appreciated.

TB

Since you said your original DD form showed a "SWIFT" code that means you were signed up for DD via the International Direct Deposit (IDD) program which uses the SWIFT system (uses SWIFT codes to identify the bank); you were not signed up for the standard DD program that uses the Automated Clearing House (ACH) system which uses "routing numbers" to identify the bank. Direct deposit via IDD and ACH are two completely separate funds transfer systems....two different animals....it like riding in a taxi vs a bus...riding a train vs a plane....two different funds transfer systems.

The SWIFT code for Bangkok Bank is: BKKBTHBK "or" BKKBTHJBKXXX. Either one works fine....the XXX is just an extended version of the basic code...either one works fine. Most people probably just use the basic code without the XXX added on.

The ACH Routing Number for Bangkok Bank is: 026008681

-

6 minutes ago, JBChiangRai said:

I like the KISS methodology (Keep It Simple, Stupid).

Behind all the simple is the data that can reveal many more details versus relying totally on a news article.

-

10 minutes ago, Yellowtail said:

Is the only real difference between HEV and PHEV that you can "plug in" to charge the PHEV?

HEVs can vary from from Mild HEV to Full HEV with variations in-between depending on the manufacturer....from having no capability to power the vehicle only using the electric motor/traction battery (i.e., can only assist the combustion engine) to being able to totally power the vehicles for a short distance using the electric motor/traction battery. HEV capability can be all over the map in terms of electric motor/ capability to assisting the combustion engine, traction battery size, etc. More and more ICEV manufacturers are trying to get the HEV badge on their vehicle to give potential buyers at least a little bit of EV capability....but when the dust settles they are still driving a vehicles that is predominately a combustion power vehicle.

Now PHEV is a different story....they have a lot more electric capability, traction battery size, electric only range, etc., than a HEV. In quite a few cases the person could totally stay in electric mode (combustion engine never be used) depending on how far they are driving.

-

1

1

-

1

1

-

-

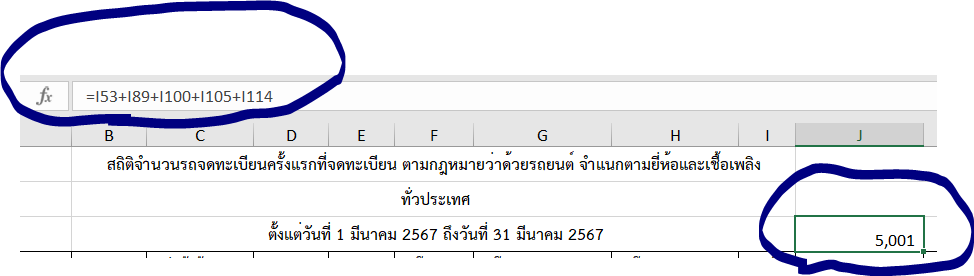

8 minutes ago, vinny41 said:

For RY1 figures are 4,722

For RY3 figures are 21

For RY6 figures are 247

For RY9 figures are 1

For RY10 figures are 13

Total 5,004

For my spreadsheet

RY1 is 4,720

RY3 is 20

RY6 is 247

RY9 is 1

RY 10 is 13

Total: 5,001

I expect due to the DLT website being setup to where you can down stats spreadsheets under different menus that the spreadsheets must vary slightly.

-

1 minute ago, JBChiangRai said:

I think HEV figures are largely irrelevant but I do think PHEV is relevant.

Yea...I agree as more and more ICEV turn themselves into an HEV by even installing a small 48V motor/generator married to a very small traction battery of just a few KWH. That 48V electric system is typically referred to a "mild" HEV because that electric motor can "not" power the HEV by itself....can not drive only on electric power...the HEV can completely recharge its small traction battery without the need to plug-in. All the 48V system can do is "assist" the combustion engine, replace the noisy the starter, maybe run an electric A/C.

Yea....more and more vehicles now days have the HEV badge on them and whether the installed electric system/traction battery can power the car under its own, maybe power the car for just a few kilometers, maybe power the car for 20 kilometers, etc., is a wildcard until looking at the car specs.

ICEV manufacturers are slowing adding "some electric traction" capability to many of their cars, sticking on the HEV badge, but the vehicles are still predominately a combustion engine powered vehicles with some electric motor assistance. Preaching to the choir I know.

-

1

1

-

1

1

-

-

7 hours ago, vinny41 said:

Thanks for the detailed explanation

DLT updated their website late yesterday with a new spreadsheet named Fuel_NewCar_Mar67

using the RY1 ,RY3, RY6, RY9, and RY10 categories. the total number of BEV registered in March was 5,004

DLT also make corrections to Fuel_NewCar_2023 where autolifethailand showed 76,314 BEV

and using the RY1 ,RY3, RY6, RY9, and RY10 categories. DLT is showing an extra 39 BEV vehicles

2023 shows little interest in PHEV

Diesel PHEV 208 registered in 2023

Petrol PHEV 11,495 registered in 2023

HEV are the 3rd most popular fuel choice after petrol and diesel with 84,229 registrations in 2023

That's the spreadsheet I was using. I just downloaded it again at 9:45am/today/5Apr and still get 5,001. See the cells I have Excel totalling up which represent above mentioned RY categories.

-

1

1

-

-

- Popular Post

- Popular Post

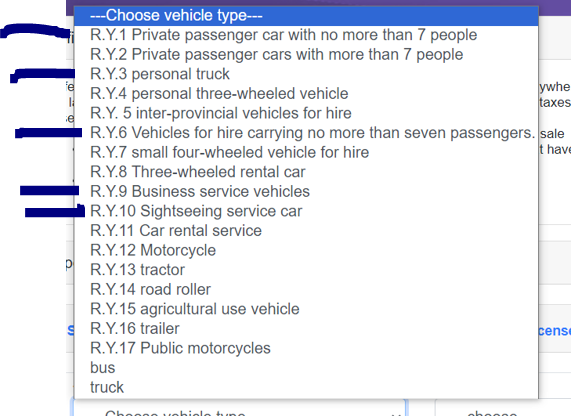

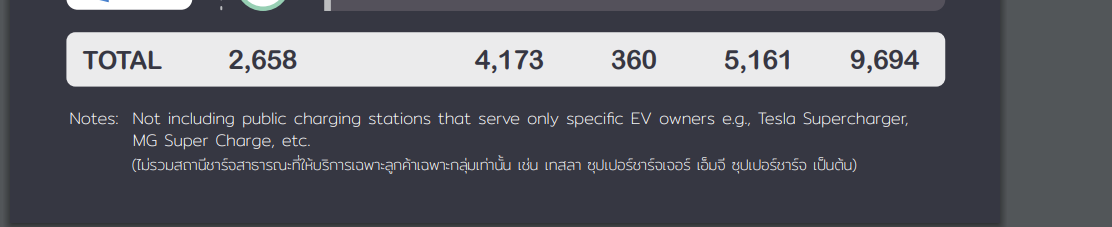

11 hours ago, vinny41 said:This website https://web.dlt.go.th/statistics/

is the DLT which is the same source that autolifethailand is using except for their figures that are taking

R.Y.1 Private passenger car with no more than 7 people plus R.Y.6 Vehicles for hire carrying no more than 7 passengers plus an unknown vehicle class or classes as there is 11 vehicles missing

Someone asked me once do I believe everything that journalist writes it does help when you understand how they are producing figures

By using the DLT stats I can get the 5001 EV registered for March 2024 to match the autolifethailand article by adding the RY1 ,RY3, RY6, RY9, and RY10 categories. Definition of the categories below.

And before someone says the RY9 business category must have many vehicles, well, no it don't as there was only a total of 10 ICEV/EV in this category for March with 1 of the 10 registrations being an EV registration.....that 1 was an Aion model.

And yea, I don't think the journalist is identifying all the various RY categories being counted and the categories being counted has probably expanded over the last year as more EV manufacturers and models come to the Thai market.

-

2

2

-

2

2

-

7 minutes ago, JBChiangRai said:

I can’t see the MG charger network thereThe chart/snapshot above didn't include the Notes area which explains why the MG charger network not being shown.

-

1

1

-

-

20 minutes ago, pablo el sueco said:

In an email yesterday, I asked the LTR visa unit what documentation will be required to confirm compliance with the self-insurance provision at the 5-year point. Would they require 5 years of bank statements? They responded as follows:

That's good to hear. Hopefully the 5 year renewal process will basically mirror the initial application process in that they will only ask for 1 or 2 years worth of various docs (I sure hope so) but we won't know for sure until mid 2027 when the first batch of issued LTR visas would be within approx 3 months of 5 year renewal. And since people "learned how to ride the LTR application bicycle" during the initial application then having/gathering the paperwork for the 5 year renewal will be easier. Unless BOI publishes some guidance on the LTR 5 year renewal process which would provide public notice to applicants I would guess the renewal process will mirror the initial application.

However, keep in mind that BOI/Immigration (especially Immigration) could ask for additional documentation to prove if a person has maintained the visa requirements throughout the past 5 year period...they can do that for any type of visa. But I would expect (guess) they would only do this if they had suspicion a person was not maintaining the requirements and/or at the renewal time some event/policy change motivates BOI/Immigration to check to see if an applicant possibly failed to comply in maintaining visa requirements like maybe not maintaining an insurance policy or $100K self insure for several years after initially getting the visa approval but then getting a policy/topping-up their bank balance to $100K twelve months before the renewal.

A person who fails to maintain all visa requirements throughout the visa/permitted to stay period is gambling (hoping) it will not be spotted/checked. Preaching to the choir I'm sure.

-

6 minutes ago, Lost Nomad said:

Thanks for the feedback.

Yes, that was a photoshop version of the pdf form. I thought I needed to submit it as part of the online application. I was hoping to make things as easy as possible for the BOI and I've been told that the BOI reps like the 1040 as supporting documentation. I'll be applying using my 4/1/23-3/31/24 income so my 1040 numbers won't match. I want to give them enough info to make the decision without oversharing info they don't need. I'll group all of my income documents into one file, all medical insurance info into another file, etc.

The application form is totally online; that paper-based application is really just FYI so people can see what the application looks like without registering for a BOI LTR online acct in order to apply for an LTR.

Yes, your 1040 numbers which are 1 Jan-31 Dec amount will not match another timeframe like 1 Apr 2023 to 31 Mar 2024. Use your most current income numbers and income documents to report your total income and then the 1040s will serve as secondary documentation. Include a short one page memo to expand any income you think needs clarify like maybe you have some income that is totally non-taxable/non reportable on a 1040 form or associated tax document when can make your income look lower than it actually is. Just for example anyone who receives a VA pension/benefit none of that money appears anywhere on the tax return and the govt does not provide any tax doc like a 1099 saying your got paid X-amount of VA pension/benefit because by law a VA pension/benefit is non taxable so the govt don't even provide a VA 1099.

-

1

1

-

-

1 hour ago, Bandersnatch said:

From looking at the full article/numbers and comparing that to the DLT data/spreadsheet appears autolifethailand is now also counting some 100% electric vehicles outside of only the RY1 category of private vehicle not exceeding 7 passengers like the RY6 category of passenger vehicle for hire not exceeding 7 passengers.

https://autolifethailand.tv/ev-register-march-2024-thailand/

-

2

2

-

-

59 minutes ago, Middle Aged Grouch said:

Can one have a LTR retiree visa and use it only for a few months each year and thus not be subject to the new tax rules ?

Or does the fact plainly to have a LTR pensionner visa mean that the tax lads will be after you even if you don't stay more then the 180 days ?

Is it 180 days for the fiscal year that is from jan to december or how is it counted ?

Thank you.

Having a LTR visa does not mean you are automatically classified as a year round resident....no more so than if you have an Non OA, Non O, etc., and only visited Thailand a couple weeks or months each year. Heck, after getting your LTR visa you don't need to stay in Thailand....you might just visit Thailand occasionally....maybe a few days each year or ever few years, maybe 9 months a year, maybe XYZ.

A LTR visa makes your "foreign" income tax exempt if you do stay in Thailand more than 180 per calendar year; but does not exempt any income "you make in Thailand" in case you plan to get a work permit with your LTR visa and work in Thailand.

The Thai tax year is calendar year based 1 Jan to 31 Dec; not some other period like how many governments use a fiscal year of 1 Oct XX thru 30 Sep XX.

-

1

1

-

-

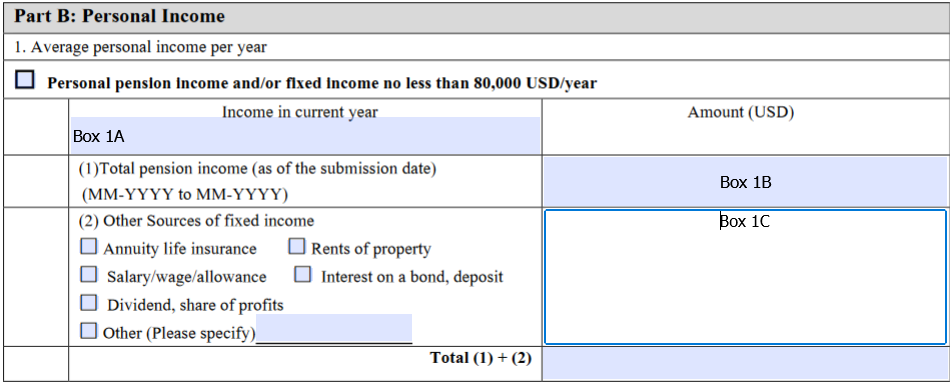

4 minutes ago, Lost Nomad said:

I've completed my 2023 taxes and am now ready to submit my LTR Pensioner application. I thought I could use my 1040 form since Pension + Dividends > 80K. I'm unsure on how to make this the easiest for BOI to approve since Box 1A wants current year. I can show 1/1-3/31 statement for pension and pull the 1Q24 dividend amount from online account. I'm not sure if my 1Q24 income is $20K since the dividends seem to be weighted to pay more in December. Recommendations?

2nd question: Is it better to consolidate all forms/passport photo/etc into one document when uploading to the BOI? I think I've read that once uploaded there is no means to delete documents from my BOI account. True?

Is above a snapshot of the online form within your online BOI LTR account or just the example paper-based form you have photoshopped? You can't submitted a paper-based application; you have to use the online application from within your BOI LTR acct.

Unless something has changed (and maybe it has) when filling out the online pensioner application form "within your BOI LTR online acct" for area (1) you enter the beginning and ending dates of the 12 month period your are reporting income on.....like 1 Apr 2023 thru 31 Mar 2024 assuming you were going to submit the application in early Apr 2024. Then there is a block to enter that income amount......the 31 Mar 2024 is within the current year and then there is a block to enter that total pension amount. There is no Box 1A like you have probably photoshopped in above.....just blocks for the MM-YYYY to MM-YYYY and then a block of the total pension income.

Then there is an area (2) to enter other sources of income.....then the a block for the total of areas 1 +2.

Unless something has changed from late 2022 when I applied the online form looks a little different than the example paper-based form anyone can download.

DO NOT consolidate all the various forms/docs into one BIG document "because" the online application has specific areas for specific forms. Income area for income docs, passport area for passport, health coverage area, etc. You can consolidate all your income docs into one big income doc to be uploaded to the income area, but don't include anything unrelated like your passport, health coverage docs, etc. Do mix apples and oranges. And even when uploading income docs think what makes it easiest for BOI to review...if this means uploading "several" separate docs in one area then go that route. Like upload your pension docs/certificates in one doc but your tax return(s) as a separate doc.

-

14 minutes ago, stat said:

Is ist still Ok to show a brokerage account (Interactive Brokers) that shows cash over 100K USD for 12 month ? Much obliged!

BOI no longer accepts that type of acct to self-insure.

-

1

1

-

-

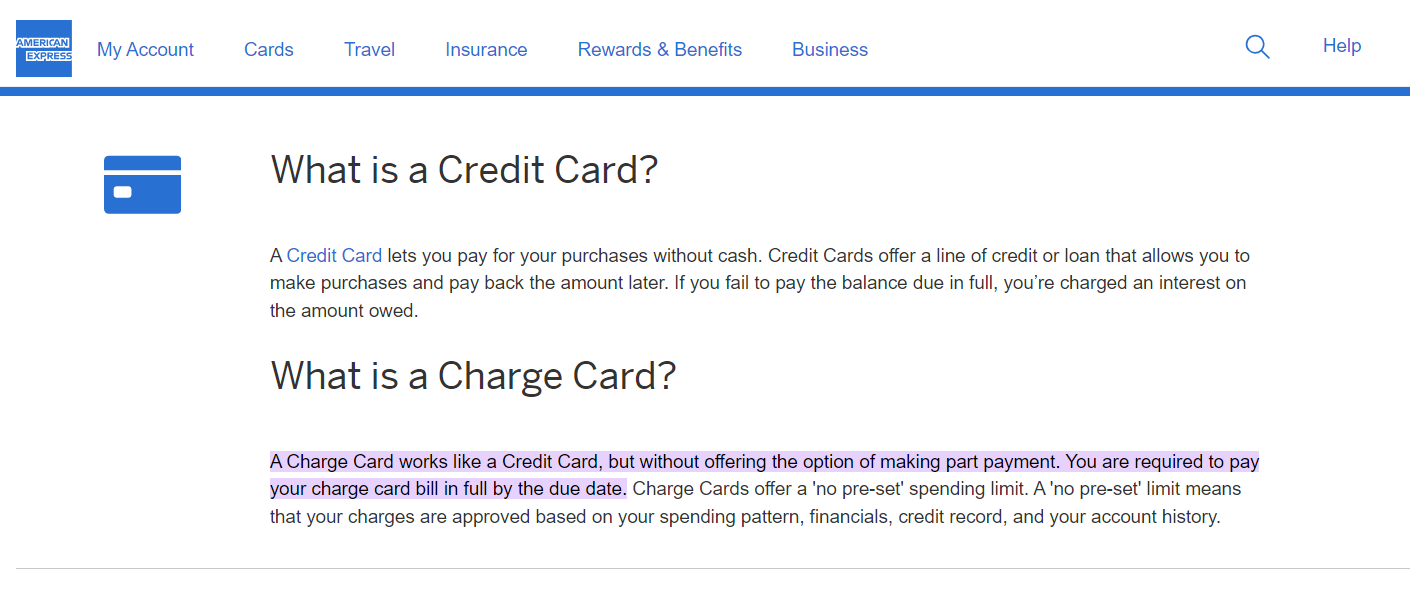

16 minutes ago, CharlesHolzhauer said:

I specifically stated an American Express Gold Charge Card, which is not a credit card! Readily available cash is necessary to utilize a card like the AMEX CHARGE gold card.

Understand....but it still relies on you being able to pay the monthly card bill. If you can't pay the monthly charge I expect AmEx would cancel/freeze the card. Plus, card companies can cancel/freeze cards on a whim preventing its use but freezing a bank acct with $100K is not likely to happen. Bottomline it still relies on you having the "cash" to pay the card bill.

Contact BOI and ask....and I recommend you point out the difference between an AmEx Credit and Charge Card card which below AmEx webpage should do.

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)

LTR Visa is Now available for Long Term Residency

in Thai Visas, Residency, and Work Permits

Posted · Edited by Pib

Full info (like the screenshot) at the BOI LTR website: https://ltr.boi.go.th/

The LTR visa stamp that goes into your passport is just a plain jane stamp....for visa category it just has "LTR" preprinted followed by a handwritten code like "P" for pensioner.

And Cap Gains is passive income since it was not earned from employment/wages.