-

Posts

29,139 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Pib

-

Based purely on above it seems the problem is not with the SSA but your identification (ID) credentials onfile with Bangkok Bank are outdated/incorrect. The SSA does not need to know your passport number to setup a pension payment via ACH or IDD; all the SSA needs to know is the bank account information. If using ACH (via Bangkok Bank NY branch) the SSA only needs to know the ACH routing number of the NY branch and you in-Thailand Bangkok Bank branch account number. If using IDD you need to have your Thailand address onfile with SSA (which I expect you do) and then the SWIFT code of the Thai bank (any Thai bank) and your acct number at that bank. The SSA could care less less about a passport number....a passport number is not part of ACH or IDD direct deposit forms/setup. So, once SSA has your ACH or IDD bank account info that is where they will send your payments. Also, U.S. SSA payments can go to non-U.S. citizens also when those folks paid into the U.S. SSA system for at least 10 years since many non-U.S. folks work part of their work career in the U.S. and pay U.S. taxes/social security while working. The SSA makes payments to U.S. and non-U.S. folks with non-U.S. folks not having a U.S. passport but a passport from another country. Passports are not an issue with the SSA. "BUT," when the Thai bank receives the SSA payment the bank can/will reject the payment if the information they have on file if your account is outdated/incorrect, especially if your passport is expired or there is some other issue/problem the bank has with your account which appears to be the source of your problems. Once the bank rejects a SSA payment then the SSA will suspend future payments until the problem is resolved which in your case requires "you" (not SSA), repeat, you (not the SSA)" to resolve the banking ID/visa problem you are having with your bank which is Bangkok Bank in your case. And whether you have a U.S. or other country passport should make zero issue with Bangkok Bank regarding incoming payments "as long as they have your current/valid passport on file. With outdated ID info on file with your Thai bank you are just begging for problems especially when it comes to money transfers. You can cuss, scream, etc., all day and night about Bangkok Bank rejecting your SSA payment(s) but the SSA can not fix the problem you have having with Bangkok Bank. You and Bangkok Bank need to resolve the problem and once resolve notify the SSA the problem is resolved which would probably require submission of a new direct deposit form "signed by/sent from the bank" to the SSA which signifies to the SSA the account information provide is correct and the bank will accept the payment. Probably best to send the new direct deposit form to the Manila FBU with a memo the bank account issue as been resolved with Bangkok Bank. If you haven't done so yet I recommend you call HQ Bangkok Bank in Bangkok and ask to be collected to the section which deals with U.S. govt pension payments such as SSA, military retirement, etc. Either one of the following phone numbers should get you into that section: 02- 230-2457 or 02-230-1323....and they will be able to look into their system to see why your payments are being rejected. In fact, this particular headquarters section may have first seen the invalid passport info and notified the Jontien branch to take action. You may or may not know this but incoming foreign payments like SSA payments first go thru HQ Bangkok Bank before being relayed to your particular branch anywhere in Thailand....it's possible the Headquarters Bangkok Bank is the one that started rejecting the payments and just notified your Jontien branch of the reason.....and you should have got a letter from Bangkok Bank explaining why your payments were rejected and how to fix the problem. Talk to Bangkok Bank again....tell them you don't think what your Jontiem branch told you about not being able to accept your EU-type passport & visa for U.S. SSA payments is correct. Or switch to another Thai bank and provide a new IDD direct deposit form to the SSA. Good luck.

-

Facial recognition required for some online services from Thai banks

Pib replied to snoop1130's topic in Thailand News

It's not till the end of June....the 27th I think...that the banks have to implement the BOT directive. -

I'll say it again, the Direct Express card is EXPENSIVE to use outside the U.S. and is a card probably best suited for an "unbanked" person. While opening a bank account in Thailand can be challenging at some banks and for some people, the opening of a Thai bank account is still quite doable for the great majority of folks. And by EXPENSIVE I mean if you use it in a Thai ATM there will be a Direct Express card fee of $3 "plus" 3% of amount withdrawn and then you also have the Thai bank ATM fee of Bt220. This means if a person used the card to withdraw Bt30,000 then another approx Bt1,222 in fees would be applied---OUCH!!!!! But if the person had their SSA pension direct deposited to their Thai bank acct (assuming they want the pension paid to their Thai bank acct) a Bt30,000 withdrawal would cost zero in extra fees. Sure, if you do an in-depth/in the grass cost analysis to include the ACH and IDD transfer fees into your Thai bank acct there are some fees there also, but those fees are far less than what a person will incur using the Direct Express card. I'm sure the Direct Express card will work fine in Thailand....but it's laden with heavy fees when used outside of the U.S. Up to the individual whether they want to have pension payments deposited to a U.S. bank acct, Thai bank acct, some money service like Wise acct, etc....each one will have its costs, pros, and cons.....but a major con of the Direct Express card is high fees when used outside the U.S. https://www.usdirectexpress.com/faq.html

-

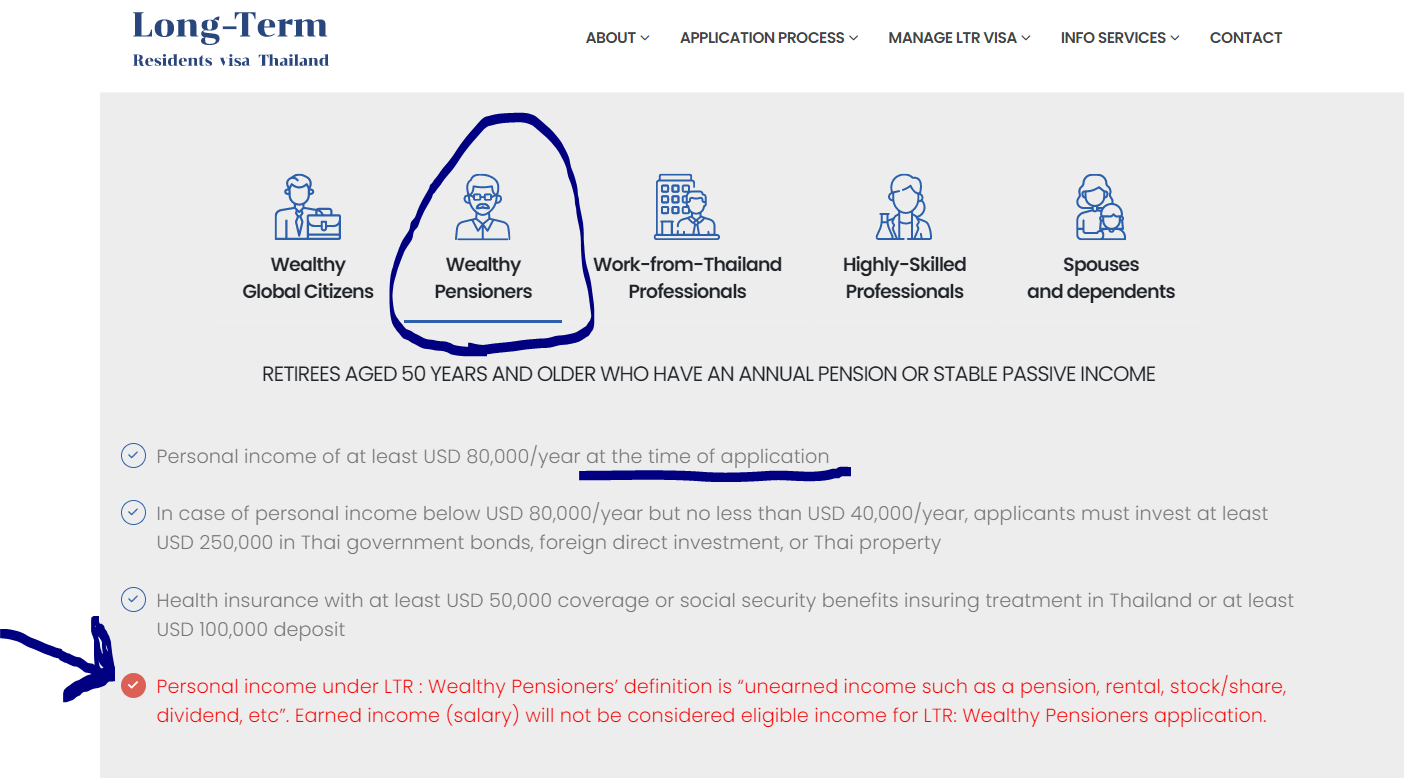

The info in below 31 Dec 2022 post and a BoI LTR weblink may answer your question. Additionally, for a LTR Pensioner application you only need to meet the income requirements "as of the LTR application date" which means you don't need to have 12 months worth of pension/annuity statements under your belt to apply/to be approved for a pensioner visa. However, the BoI will still want to see your latest income tax return which may or may not reflect any pension/annuity you started receiving after your last tax return. Also, BoI understands some pensions/annuities may be partially or completely tax free which means they would only partially or not appear at all on a tax return. And this means the pensions/annuity amounts shown on your tax return may not match-up with pension/annuity periodic statements which show the taxable and/or non-taxable amounts....higher amounts than might be shown on your tax return. Example: people who draw Veteran Administration (VA) pensions receive those pensions totally tax free....no 1099R are issued....VA pensions are not taxable/reportable on income tax returns. Heck, even a Social Security pension is only partially taxable. In cases like this your pension/annuity statements provide the primary and accurate income proof versus your tax return. . https://ltr.boi.go.th/index.html#what

-

No need to go to BoI immigration and have a multi-entry stamp entered since your evisa states multi-entry. Misty entered on an LTR evisa like you just did and visited with BoI on the question you are asking. See Misty's 19 Dec 2022 post at the bottom and a partial quote from her post regarding your question. Misty's 19 Dec 2022 post below.

-

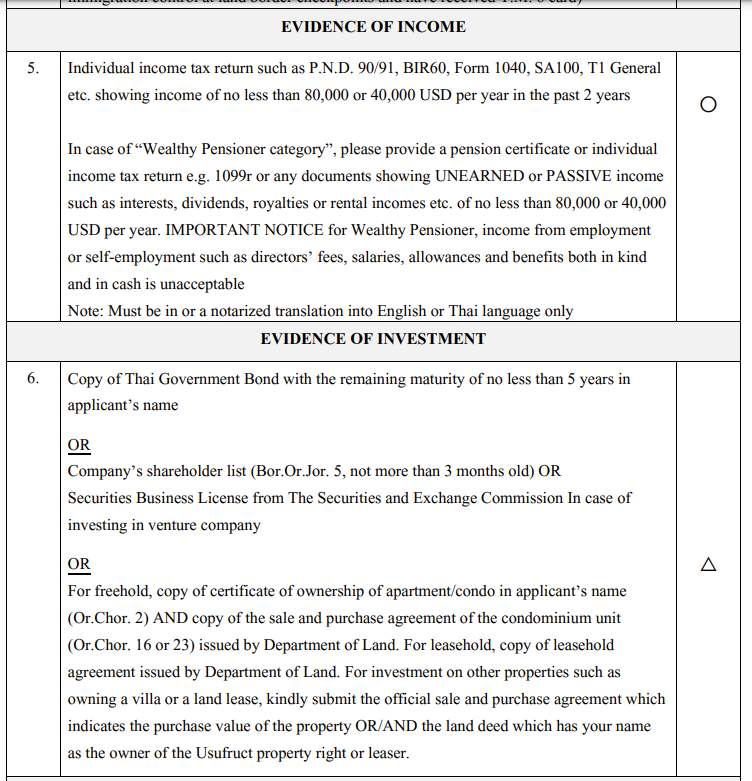

What BoI will require is documents from the entity that pays the annuity/pension income and associated tax docs that entity will issue each year. Example: your annuity paying entity is going to issue some statement/benefit letter once a month/quarter/semi-annually/yearly where they state how much they are paying you "AND" each year they will issue a tax document (like a form 1099R Distribution from Pensions/Annuities) unless the payment is totally tax free where no tax doc might be issued. Below is weblink is to the BoI "required docs" for a LTR Wealthy Pensioner application and snapshot from that weblink regards Evidence of Income. In the first statement they are talking tax returns from various countries like PND 90/91 which is a Thailand tax return, Form 1040 which is a U.S. tax return, SA100 that is a UK tax return, etc. In the second statement they start talking statement/benefit letters, specific tax form like the U.S. 1099R. Take a thorough look at the BoI LTR website especially under the Application Process pull down menu....lots of detailed info there like the info in below weblink/snapshot. In closing in my particular case when I initially submitted my LTR Pensioner application is just submitted pension statements showing my monthly pensions payments from several U.S. agencies....these statements gave very detailed info, but about a month after submitting my application BoI asked for my latest U.S. tax return in an Additional Document Request. I provided my last tax return and shortly after doing so the BoI approved my LTR Pensioner visa. https://ltr.boi.go.th/documents/Required-Documents-for-Qualification-Endorsement-for-Wealthy-pensioner-16-03-66.pdf

-

Immigration offices look for Bt65K/month "international" transfer for a retirement extension....Bt40K for a marriage extension....that is proven by the coding on your statement/passbook like "FTT" (Foreign Telegraphic Transfer) which Bangkok Bank uses. Immigration offices know Bangkok Bank FTT coding means it was an international transfer. And if necessary a person can obtain a Credit Advice from Bangkok Bank for each transfer.....a Credit Advice is just a document which shows in detail where the money came from like starting it's trek in the U.S. (or whatever country) and coming over to Thailand. Now if using the IDD method which results in BAHTNET coding (typically BNT) since BAHTNET can be used to transfer funds domestically/intra-Thailand "AND" BAHTNET can also interface with the SWIFT system for incoming international transfers, a person's particular immigration office may ask for proof a person's monthly transfers coded as BAHTNET did indeed originate from outside Thailand....like from the SSA in the U.S. versus the transfer just being an intra-Thailand domestic transfer where you might be sending money to yourself via BAHTNET, a friend in Pattaya is just sending you money in Bangkok via BAHTNET, etc. Getting a Credit Advice for a BAHTNET transfer is most likely going to be problematic because your receiving bank just sees the incoming BAHTNET transfer as a domestic transfer and they will not/can not issue you a Credit Advice but will tell you that you need to contact the Thai bank that handled the leg of the international transfer where it was input into the BAHTNET system for the final leg to your receiving bank. That particular Thai bank that input the last leg into the BAHTNET system might be the Bank of Thailand, Citibank, etc....which is bank a person would have to contact to get a Credit Advice because that bank is the one that received it thru the international SWIFT system just before handling it off to the BAHTNET system. It would depend on a person's immigration office as to what will satisfy them the funds originated from outside Thailand....some will accept separate documentation like you showing them SSA docs that they pay you X-amount per month along with your Thai bank statement/passbook showing that amount in baht arriving each month........other immigration offices will simply be hardcore and require "Thai bank documentation" the transfer was international. Then there are those money transfer company transfer slike Wise (Transferwise) which use a peer-to-peer transfer system (not SWIFT, not ACH, etc) where they have partner banks/companies in Thailand (like Bangkok Bank, K-Bank, DeeMoney) who relay funds to a person's Thai bank acct (any Thai bank) which might receive international coding or might now....depends on which Thai partner bank Wise used for a transfer, reason for transfers, and if it's going to a partner bank or non-partner bank. Like if you are using Wise to send to your Bangkok Bank acct and you have your Wise transfers to use Bangkok Bank as the partner bank for the transfer then you will receive FTT/international transfer coding; but if another Wise partner bank handles that particular transfer you will not get international coding...it will just appear as a plain ol' domestic transfer. Once again it would depend on a person's immigration office as to what will satisfy them the funds originated from outside Thailand....some will accept separate documentation like you showing them SSA docs that they pay you X-amount per month or Wise PDF Receipt showing you transferred the funds from your home country; other immigration offices will simply be hardcore and require "Thai bank documentation" the transfer was international. Summary: receiving FTT/international transfer type Thai bank coding or being able to easily get a Credit Advice provides the proof "any" immigration office will accept that the transfer originated from outside Thailand....some offices will accept alternate/non-Thai bank documentation as proof of international transfers....some offices simply only accept Thai bank documentation.....various immigration offices in Thailand who handle this issue a little differently....not shortage of AseanNow posts over the years describing the different problems people have had with their particular immigration office regarding proof of monthly transfers....some immigration office are anal strict; others not so strict.

-

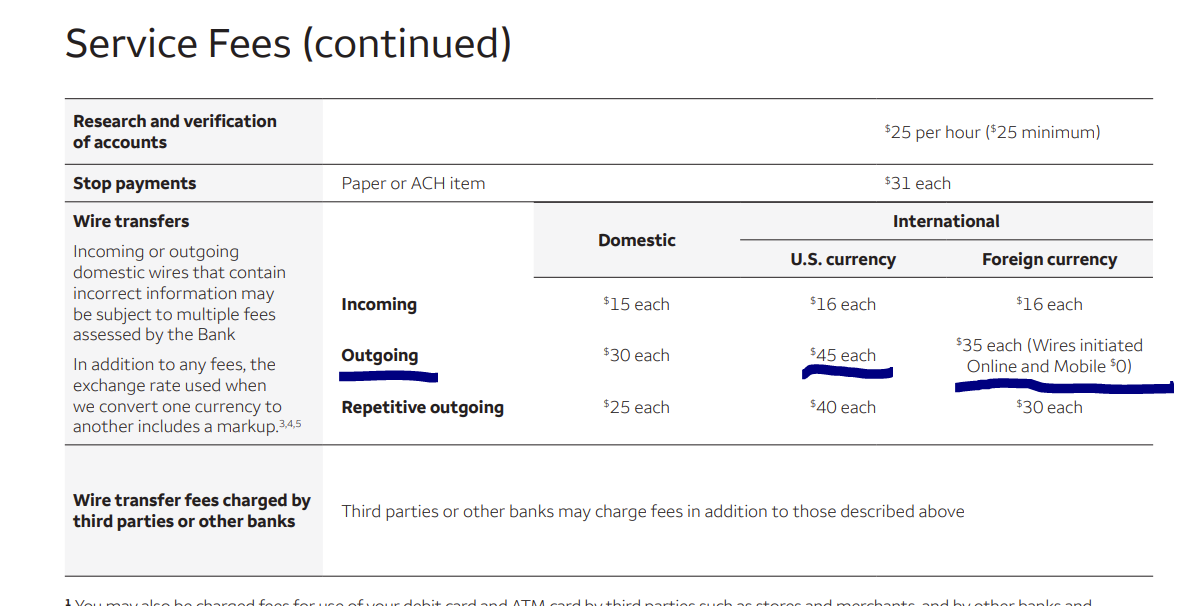

While I guess it's possible Wells Fargo provides you a waiver maybe because your have a BIG balance of financial assets with Wells Fargo under some type of premier account, the normal Wells Fargo international wire/SWIFT fee is shown below. And there will also be the K-Bank international transfer (i.e., SWIFT) "receiving fee" of 0.25% (Bt200 min, Bt500 max) applied before posting to your account which is pretty common for Thai banks. Snapshot from Wells Fargo Fee Schedule.

-

That is indeed true in most cases for folks using U.S. banks to fund a transfer. I did it many times for numerous years to ACH "push" funds from the particular U.S. bank I use for such purposes. However, but, when Wise switched to their new U.S. partner bank for the Wise multi-currency acct late last year and issued new multi-currency bank routing/account numbers while I could set up/validate the ACH transfer link when I attempted an actual push of funds the U.S. bank would reject the transfer the next day. After the first reject I actually deleted the validated transfer link and set it up again....trial deposits arrived Wise OK...were pulled back from Wise OK....ACH transfer link validated with my U.S. bank....but when attempting an actual transfer the bank would reject the transfer next day and freeze the transfer link. Talked to both the U.S. bank and Wise about the issue....what it boils down to is apparently my bank considers Wise new partner bank as a pass-thru bank into an acct actually "owned by" Wise and not me---which is correct....therefore, the bank ends up rejecting an actual push transfer. The push transfer worked fine with Wise's previous partner bank; but not with the new one with the particular U.S. bank I use. However, I can use Wise to ACH "pull" funds from my U.S. bank.

-

Agree with gamb00ler...a person can login into their online acct without a VPN connection....just a plain ol' Thailand connection. The wife and I have logged into our SSA acct quite a few times like that when we forgot to use a VPN connection "which we like to do"....don't have to do...but just typically use a VPN connection with U.S. IP address. However, some people using certain Thai Internet service providers do sometimes have a problem connecting to the SSA website with a Thailand IP address....but that's a Thai internet service provider problem and not the SSA blocking the connection. Heck, it even happened to me around a half dozen years ago when I was with True internet and for about a six month period I simply could not reach the SSA public website or SSA acct logon unless using a U.S. VPN connection. Then the problem just went away. It was just a "True" problem; not the SSA blocking Thai IP addresses. Now for the last half dozen years or so I have been with AIS Internet and never experienced such a problem. Like below SSA login page is reached with a plain ol' Thailand IP/non VPN connection a minute ago.

-

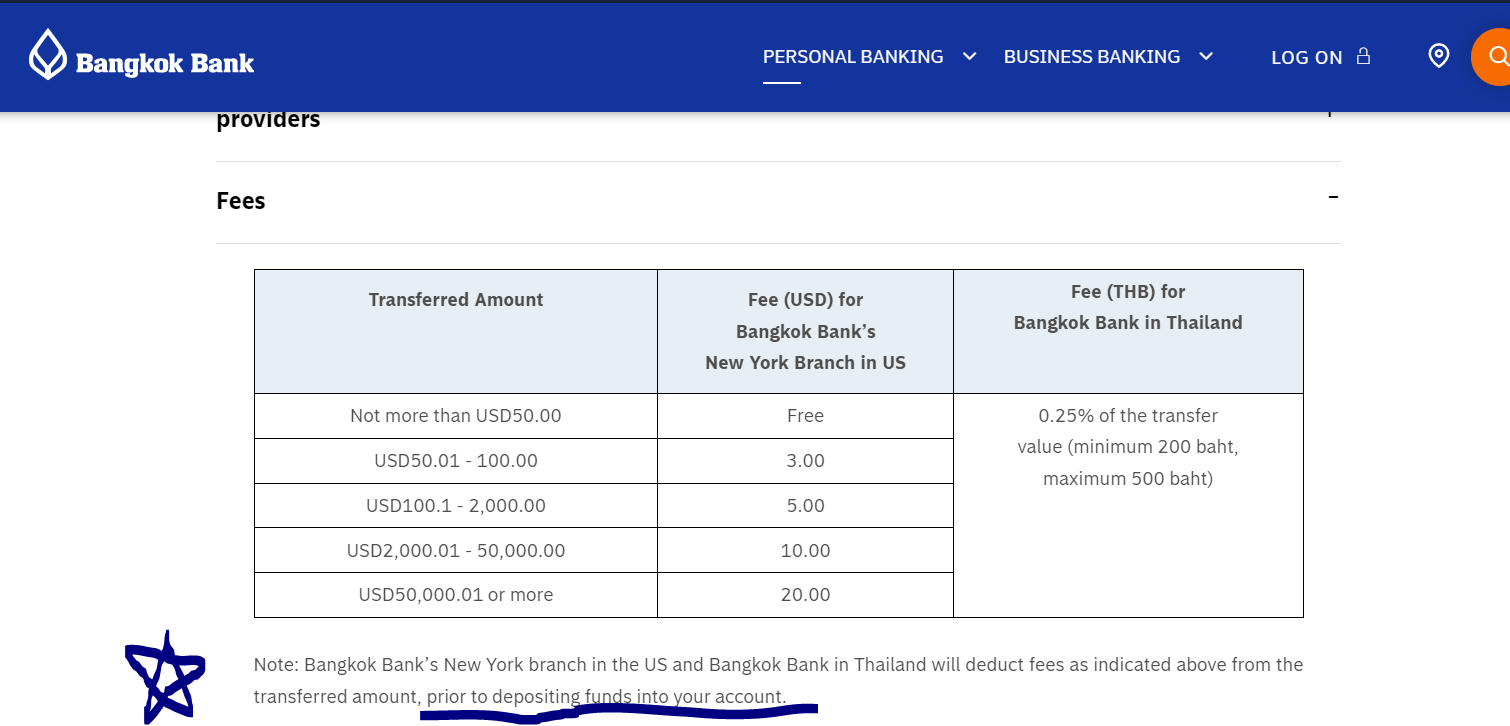

OP, Two ways to have a person SSA pension direct deposited to a Thai bank such as Bangkok Bank. Method 1: Transfer via the Automated Clearing House (ACH) transfer method which uses an ACH/ABA routing number such as the Bangkok Bank New York branch routing number to your in-Thailand Bangkok Bank account number. Info on the Bangkok Bank acct. Only, repeat, only Bangkok Bank has ACH receiving capability among Thai banks. But basically it boils down to the Bangkok Bank NY branch slicing off a fee as it flow thru them to your in-Thailand Bangkok Bank acct...typically a $5 or $10 fee depending on the amount. So, say your monthly payment is $2,100....the NY branch will slice off a $10 fee and forward $2,090 on to Thailand. Once it arrives your in-Thailand Bangkok Bank branch they will first use their "TT Buying Rate" exchange rate (usually the bank's daily opening TT Buying Rate) to covert those dollars to baht....then they apply their fee of 0.25% (Bt200 min, Bt500 max) and the remaining amount is posted to your acct. IMPORTANT NOTES: above mentioned fees are applied "prior to" posting to your acct and will not be reflected anywhere which fools some folks into thinking no fees were applied but the fees were indeed applied. And for reoccurring U.S. govt payment like social security they must be direct deposited into a special/restricted Bangkok Bank acct which require the acct owner to physically visit any Bangkok Bank bank branch to withdraw/transfer-out funds and no debit card allowed. Bangkok Bank Fees for ACH transfer....whether for govt payments, personal transfer from a U.S. bank, etc. https://www.bangkokbank.com/en/Personal/Other-Services/Transfers/Transferring-Into-Thailand/Transfer-money-from-US-to-Thailand-via-Bangkok-Bank-NewYork-branch Method 2: Payment of the SSA pension via "International Direct Deposit (IDD)" which does not use the ACH transfer system but uses the SWIFT transfer system. The U.S. Treasury/Federal Reserve Bank sending the SSA payment will convert to baht on their end....Thai baht is sent to your Thai bank where the receiving Thai bank will charge a Bt100 BAHTNET receiving fee and possibly another bank inter-region transfer fee of another Bt50 to Bt100. My wife receives her SSA pension via IDD...we live in Bangkok....only a Bt100 BAHTNET fee is applied. Remember IDD does not use the ACH system like routing it thru Bangkok Bank NY branch....it sent via the SWIFT system.....there are no intermediary/correspondent bank fees on its way to Thailand......but since the last leg of the SWIFT transfer uses the BAHTNET system which is a Bank of Thailand transfer system there is the Bt100 receiving fee. Additionally, the Thai bank receiving the IDD will code it as a BAHTNET payment (typically BTN) which is considered a domestic transfer vs coding as an international transfer where Bangkok Bank uses FTT coding to indicate the transfer was international. And one last thing, since the ACH and IDD methods use different "exchange rates and fee structures" at around $1,150 or less a person would receive slightly more baht to their Bangkok Bank acct (or any Thai bank) when using IDD.......and if using the ACH method to their Bangkok Bank acct at around more than $1,150 they would receive slightly more via ACH than IDD due to how the exchange rate and fees work out. Cheers

-

Money in the Bank-A friend has confused me

Pib replied to geejay's topic in Thai Visas, Residency, and Work Permits

OP, As Jingthing said, sounds like a communications disconnect.....your friend was probably confused/never clear as to why his SCB acct was frozen--if it ever was "really frozen." Your friend probably misunderstood something the bank or immigration (or maybe an agent) told him about income requirements to qualify for a visa extension. Before I switched to a LTR visa late last year I did around a dozen Non OA retirement/marriage extensions using the bank deposit method...and the acct I used always had a little more than 1 million baht in it as it served as my annual extension and emergency money pot. Now while immigration has requirements as to how long and how much money needs to be in a bank acct to meet the retirement/marriage extension of stay requirements those requirements had no effect on my bank acct....immigration does not reach out to your bank to freeze funds for x-amount of time when you renew your visa extension. A bank will only freeze an acct when a possible/actual fraudulent transaction is detected, the account goes dormant, police/govt agency submits a court order or other official govt order to freeze the acct because of some law violation, etc. Expect your friend who appears to be using the deposit income method vs monthly income method was told to ensure his acct does not drop before a certain amount for X-months after receiving his retirement extension of stay, otherwise, he would violate the extension income requirements and his next extension renewal will be disapproved because of it. But your friend misunderstood this requirement to be a freeze on his bank acct when actually it was not....just a heads-up to keep his acct balance above a certain level. -

Facial recognition required for some online services from Thai banks

Pib replied to snoop1130's topic in Thailand News

I have a Krungsri acct....I live in Bangkok. After getting the Krungsri SMS and also getting a notification when logging into my Krungsri acct, today/4 May 2023 I went to a small Krungsri branch in a Lotus Mail close to my home (not my my home branch which is in another part of Bangkok) and did the facial recognition thingie. The Krungsri rep first confirmed my phone number and passport number matched what is in their system.....the rep made a copy of my passport main/photo page and page showing my current visa/extension....had me sign those copies....took my picture.....typed some stuff into her IT system screen...and it's done. Fast and easy.....took about 5 minutes. Before accomplishing the facial recognition registration above starting about a week ago every time I logged onto my Krungsri acct via the mobile app I would get a notice about the upcoming facial recognition requirement. But right after the Krungsri rep finished my facial recognition registration the notice stopped whenever I logon which indicated to me my account had to been updated to show I had accomplished the facial recognition thingie. Yea, it turned out to be fast and easy. -

Krungsri 50k+ transfer photo requirement

Pib replied to scubascuba3's topic in Jobs, Economy, Banking, Business, Investments

I have a Krungsri acct. Got the SMS from Krungsri about the upcoming facial recognition requirement...and also when logging into my acct using the mobile app I would get the same notice. The notices said I could go to "any" Krungsri branch for the facial recognition thingie. My Krungsri home branch is the little hole-in-wall-branch in the Chaeng Wattana (CW) government complex building in northern Bangkok....the same building that CW Immigration is in. However, since I live in western Bangkok I just went to a Krungsri hole-in-the-wall branch in a Lotus's Mall close to where I live. All went fine. The Krungsri rep first verified my phone number and passport info matched what is in their IT system. The rep made a copy of my passport's main page and visa/extension page....and then took my picture. A minute or two later I'm done....the setup went fine. And now when I log onto my acct via mobile app the notice I was getting no longer appears so that indicates to me their system sees I have done the facial recognition thingie. Pretty painless and fast. -

Tips on dealing with the regional SSA office in Manila

Pib replied to JTXR's topic in US & Canada Topics and Events

Did you contact Bangkok Bank to see if a payment(s) had indeed been sent to your acct "BUT" maybe Bangkok Bank rejected it back to SSA. Bangkok Bank will reject or place on hold a reoccurring U.S. govt payment sent via the ACH system (i.e., using the NY Branch ACH routing number) if the payment is sent to a Bangkok Bank acct that is not setup as a special/restricted acct to receive U.S. govt reoccurring pension payments via ACH. If Bangkok Bank did reject the payment(s) then the SSA will wait for you to contact them and/or they will send you a letter saying your bank rejected the payment and you need to work that issue....get back with SSA with a good payment account. Now if you setup your SSA payment as an International Direct Deposit (IDD) which uses the SWIFT system then the SSA payment can go into a regular Thai bank acct (any Thai bank)....even a regular Bangkok Bank acct. Since you do not seem to be a person who is "unbanked" (i.e., do not have any bank acct) going the Direct Express card route is kinda an expensive way to go due to card fee and foreign transaction fees. Going the Direct Express card if living outside the U.S. should be a last resort type affair. -

LTR and the 800,000 Baht Bank Account

Pib replied to HerewardtheWake's topic in Thai Visas, Residency, and Work Permits

OP, As Misty and khunjeff said earlier your current visa (like a Non OA visa/extension) is cancelled just before issue/inking of the LTR visa to your passport. With your current visa cancelled all requirements like an 800K baht deposit requirement are gone.... now irrelevant....you can immediately withdraw that 800K if desired. Then, once the LTR visa is issued/inked into your passport you now fall under the LTR income requirements. Typically to cancel your current visa (like a Non OA) a person would do that at the immigration office that issued it; "however," the BoI immigration office at Chamchuri Square in Bangkok can also cancel the current visa....as Misty said they have almost magical powers when it comes to transitioning to a BoI sponsored visa such as the LTR visa. -

Yeap...that's the answer. While some Thais go to the unemployment office to register as unemployed in hopes of benefits (few to none) and a finding a job many do not and/or fall off the unemployed rolls after a few months because they do not keep the unemployed office informed they still don't have a job. Once they stop reporting to the unemployed office the govt then takes them off the unemployed roll---great for low unemployment stats....almost everyone in Thailand is gainfully employed if you believe Thai govt stats regarding employment.

-

How is the software fix coming? I sure hope not like most election promises.

-

I haven't flew out of Thailand in many years....it's my understanding the current "departure/exit" fee (tax) is included in the airline ticket vs a person paying the fee separately at the airport to to the govt when leaving like it use to be many years ago. Or said another way the airlines collect the departure fee when selling the ticket and later pass the fee the Thai govt versus the Thai govt directly collecting fee at the airport. Assuming the departure fee is collected by the airlines are there currently any exceptions? If none I can understand why airlines don't kick-and-bite too much about collecting such a fee as administratively/software programming-wise it's a lot easier than trying to collect a fee that may have a lot of exceptions....a lot of exceptions like the new proposed "entry" fee. Now if the govt can't convince/steamroll the airlines into collecting the new entry fee "with exceptions" (and remember the airlines don't doing such a fee with exceptions) the govt might delete the exceptions just to get the airlines to start collecting the fee OR the govt would have to start collecting the fee themselves as you entered Thailand....another obstacle to get thru....obstacles like immigration, customs, and now payment of any entry fee.....AND/OR the govt could collect the fee on everyone but then offer a refund process for Thai's and some other exceptions....a refund process nobody would probably like. OR the govt could ???????? Will be interesting to see what the govt and airlines finally agree to (or continue to disagree on). This entry fee has already been delayed several times due to problems--like how to collect the fee. Time will tell. Fortunately it's not an issue in the LTR application process....instead, just some folks wondering if the new fee would apply to those with LTR visas.

-

I expect you would be "if", repeat, if you got the Digital Work Permit with your LTR. Accepting or declining the work permit was an option when applying for the LTR. I expect authorities will be looking for a current/valid work permit stamp in a person's passport and/or however the new digital work permit can be shown to authorities. Like for me when I applied for my LTR Pensioner visa I declined the work permit since I'm retired, didn't want to submit the extra paperwork required, didn't want to pay the extra Bt3K per year for the work permit where if I understood a previous poster (Misty I think it was) a person had to pay Bt15K for the work permit since the LTR visa is issued in 5 year increments. One of main reasons of the date push back to Sep 2023 is because airlines don't want to get involved in trying to figure out which people would not have to pay the fee. Thai govt trying to get the airlines to do the govt's job.

-

LTR and 90-day Reports

Pib replied to HerewardtheWake's topic in Thai Visas, Residency, and Work Permits

I just saw this thread....they only need your latest 90 day address report; not all of them since last entry. When I was doing 1 year Non O/OA retirement and marriage extensions, Bangkok/CW immigration would usually ask for a copy of my latest 90 day report also. Just a request that's typical at most immigration offices. BoI Chomchuri Square Immigration requires your latest 90 day report for issue of the LTR. They will also ask for a TM6 although you may not have one....if not having a TM6 because one was never issued you just respond that one was never issued especially if your arrived by air over the last few years. Unless something has changed recently you are not required to upload a 90 day address report in the initial application although you can upload it as as Other doc during the application. But based on my experience (i.e., when I got my LTR Pensioner visa approved Dec 2022) unless BoI has your latest 90 day address report they will request it before final endorsement since immigration wants to see it. It's just your latest 90 day report they want to see; not all of them since last entry. And as mentioned by JackGats above it possible you may have recently entered/reentered Thailand and a 90 day address report is not due yet. You would just explain that to BoI in a memo pointing out your last entry date and a 90 day report is not due yet. And I see in the main LTR thread you got your LTR visa approved & issued....congrats. -

Above I earlier said, "And I think it also shows Bangkok Bank and Kasikorn Bank are putting out a welcome mat to LTR visa holders as they know BoI, Immigration, and other govt agencies will have thoroughly vetted LTR visa holders and the higher than average income an LTR visa holder often processes." When I was scanning thru the government "Elite Visa" website site I stumbled across an Elite visa FAQ talking about opening a bank account and apparently the Elite Visa folks have a contract with Bangkok Bank and Kasikorn Bank which allows Elite visa members to easily open bank accounts (see snapshot/quote at bottom). I expect the BoI LTR agency just piggy backed on/duplicated the contract to also allow LTR visa holders to also easily open bank accts with Bangkok Bank and Kasikorn bank. https://www.thailandelite.com/faq/

-

HerewardtheWake, Congrats. Total time from application submittal to endorsement/approval was 1 month 4 days.....that's pretty fast considering the long Songkron holidays occurred during that time frame. Heck, a person couldn't even login into their BoI LTR online acct from 13-17 April due to BoI shutting down login capability supposedly "for maintenance" but I expect it was purely a manning issue/all employees on holiday. I'm assuming you got a LTR "Pensioner" visa since the BoI asked for some Form 1099R Pension/Annuity documentation? Congrats again.