-

Posts

37,227 -

Joined

-

Last visited

-

Days Won

6

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by TallGuyJohninBKK

-

In my experience, a lot of Thai bank branches are resistant to doing counter withdrawals using foreign debit cards, and they'll often make up all kinds of excused for they supposedly can't. My opinion is that's just a lot of bogus excuses aimed at getting people to use their ATMs so the bank can pocket the 220b ATM fee. For anyone who has a non FCF, no cash advance fee credit cards, the various Thai bank branches seem more willing to do counter withdrawals with those... But you really have to doublecheck that your credit card won't seriously ding you with fees for that kind of foreign transaction.

-

Schwab brokerage accounts operate pretty much the same as any other U.S. brokerage account, including these days typically no transaction fees on stock purchases and sales. Schwab Bank mainly has their checking account and debit card, with no foreign currency fees and reimbursing foreign bank ATM charges. Schwab makes it easy thru online banking to move cash back and forth between the two different sides of their operation, but both are available through the same Schwab online interface. Schwab Bank deposits are FDIC insured just as with any other U.S. bank. In the past, anytime anyone wanted to open a Schwab Bank account, Schwab would automatically include a companion brokerage account, even if people never wanted to use that.... But in the end, many do end up using the brokerage side and holding very substantial investments there. They make it easy, including easy to move funds between their bank and brokerage, and likewise easy to do online typically next day ACH transfers to and from other linked U.S. FI's that the account holder may have.

-

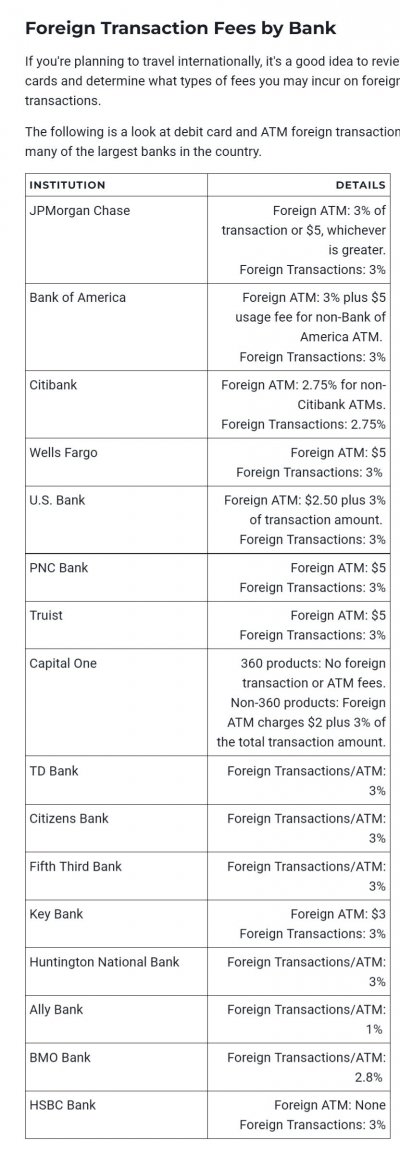

there certainly are other U.S. banks and credit unions out there that have lower or sometimes no FCFs, but you pretty much have to venture outside the world of the various U.S. mega banks. An expat first has to understand and be aware of just what FCFs are, and then do their bank shopping with FCFs as part of the equation.

-

Actually, Charles Schwab the corportation does have its own licensed bank, Charles Schwab Bank, that operates much like any other bank.. though more narrow in their offerings in that they're focused on being a cash management solution for people who also have Schwab brokerage accounts. https://www.schwab.com/resource/why-i-created-schwab-bank PS - account holders at Schwab definitely can do SWIFT international wire transfers from their Schwab brokerage account at least. I can't recall if that same international transfer capability is available on their banking side.

-

My comment was regarding the largest U.S. banks where most people typically will have their accounts. This chart below is from June 2023, so some may have increased theirs by now, but as you can see, 3% was most common at the time of the following report: https://www.usnews.com/banking/articles/foreign-transaction-fees-by-bank

-

just fyi, foreign currency conversion fees, if charged, are not generally charged as a flat dollar amount. They're almost always charged as some % amount of the transaction. On the other hand, a lot of U.S. banks also do have a different flat charge, which can be anywhere from $3 - $5, for using an out of network ATM -- which can mean an ATM belonging to a different U.S. banking company or any foreign ATM. If you want to know for sure, you can look at the actual exchange rate on your transactions, and see how that compared to the VISA or MC networks exchange rate websites listed earlier in this thread. If your bank is charging no foreign currency fee, then your actual exchange rate should be very close to the VISA/MC network rates.

-

US Medicare - what do most expats do?

TallGuyJohninBKK replied to ding's topic in Health and Medicine

But.... a similar requirement to be a "U.S. resident" also applies to the Medicare Part B coverage that you have and have used, correct? Not geographically specific like Medicare Advantage plans, but general U.S. residency for Part B (technically) as opposed to being an "expat"? -

US Medicare - what do most expats do?

TallGuyJohninBKK replied to ding's topic in Health and Medicine

For that episode you recount, was that the U.S. price at the time for that procedure, or the price for having it done here in Thailand? -

US Medicare - what do most expats do?

TallGuyJohninBKK replied to ding's topic in Health and Medicine

Sheryl, so, you're talking about scheduling those kind of preventive and diagnostic procedures covered by Medicare specifically when you're traveling back to the U.S. periodically for whatever reasons? And here, silly me, as a soon to be eligible for Medicare person, I've always thought of my trips back to the U.S. as vacation and having fun times -- not going for colonoscopies!!! 🙂 I guess I'm going to have to reconsider that outlook, once I get my Medicare card!!! -

I have an existing, decent Thai private med insurance policy that I've paid for and kept ever since I moved to Thailand, but one that is getting increasingly more expensive as I get into my mid 60s and beyond... Never really had to use it for anything big yet, fingers crossed. But now I'm looking at probably keeping the Thai policy for the time I'm continuing to live in Thailand, but also getting and paying for Medicare (some combination of A, B and beyond), just to cover in case I move back any time in the future or need to go back for some kind of treatment I want or can only get in the U.S. Then layer on top of that, the issues related to the Thai government's plans to start taxing worldwide income of anyone living here for more than half the year, and that at least creates some planning scenarios where I might decide to be out of Thailand for some periods of time... Who knows how all that's going to turn out.

-

One thing I'm confused about...if anyone knows the answer.... --for the initial open enrollment period just before and after a person turns 65, and you sign up for Medicare Parts A and B then... Do you also HAVE TO sign up for a Medicare Advantage plan during that same open enrollment period? Or, you can add on a Medicare Advantage sometime time later without any penalties? Anytime, or only during the annual open enrollment period at the start of the calendar year? TIA!

-

@GinBoy2 Hey, can you clarify a couple things re your comment above? --When you say "emergency" coverage, I'm assuming that means for things like accidents and such? Not that you go to the doctor for tests and find out you have cancer, right? --Is the $500,000 a lifetime policy cap for that coverage, and did you really mean $500K? That seems very high. I've seen other mentions of Medicare Advantage overseas coverage that talked about a $50,000 maximum overseas benefit.

-

And now the Republicans, and unfortunately the U.S., are left with the following as the far worst of two options. A guy who can't even keep straight what Democrat he's running against, as documented in the YT video I posted above on his sorry performance on the Sean Hannity interview. Biden's exit makes Trump the oldest nominee in U.S. history President Biden's endorsement of Vice President Kamala Harris for the Democratic nomination could defuse the age question dogging the Democrats: Harris will be 60 on Inauguration Day — 22 years younger than Biden. ... Trump, at 78, becomes the oldest nominee in U.S. history if Harris or someone else younger than Trump succeeds Biden atop the Democratic ticket. https://www.axios.com/2024/07/21/kamala-harris-age-presidential-nominee I can't imagine the ranting and raving Trump in the White House TODAY -- much less four+ years into the future when he'd be 82 or so. But still Putin's poodle at any age.

-

Perhaps it's because of the parasitic worm that ate part of RFK Jr.'s brain.... or his other "numerous" health problems, as recounted below. Strangely enough, I didn't find that news even slightly surprising, given how far out in the looney space RFK Jr. is. RFK Jr. claims a doctor told him a worm ate part of his brain, reports New York Times 05/08/2024 "Robert F. Kennedy Jr. claimed numerous health problems, including that a parasite possibly ate part of his brain, during a deposition made during a contentious divorce from his second wife about a decade ago, according to the New York Times. The Times reported that Kennedy told attorneys in 2012 that a surgeon at NewYork-Presbyterian Hospital reviewed his brain scans after suffering from memory loss and fogginess. The surgeon, he said, believed the issue “was caused by a worm that got into my brain and ate a portion of it and then died.” POLITICO has not independently reviewed the deposition. https://www.politico.com/news/2024/05/08/rfk-jr-brain-worm-00156794 He's a fit, alright.....

-

It's the Trumpers' continuing, unfulfilled dream that they'd still get to face Biden in November, and not have to face the actual Democrat nominee, Kamala Harris. Heck, doty old Trump just the other day still mentioned about candidate Biden in November, then he stuttered a pause, and then finally corrected himself to say "Harris." But then, at his advanced age, it's not surprising he'd be having those kinds of mental / cognitive problems -- as he's often reminded us about elderly politicians in recent years. Analysis: Trump’s fury over Harris’ switch with Biden is increasingly driving his campaign August 16, 2024 (CNN) — Deep into his ranting news conference on Thursday, former President Donald Trump told a truth that explained everything : “I’m very angry at her.” He was referring to Vice President Kamala Harris, whose late entry into the general election race has left him bitter, disoriented, and mourning the loss of the old campaign — the one he was winning against President Joe Biden. Trump’s discombobulation was laid bare in a self-pitying and raging stream of consciousness delivered at his New Jersey golf club that raised serious questions about the future trajectory of his quest to return to power. https://www.cnn.com/2024/08/16/politics/trump-fury-harris-switch-campaign-analysis/index.html With Trump just lately, during the Sean Hannity interview, saying.... "anybody in New Hampshire that votes for Biden....."

-

Yep, for those and other reasons, I prefer to keep all my U.S. banking and FI profiles with my U.S. address, and never do anything U.S. official with my TH address. Because there are too many past stories of people's U.S. FIs closing or freezing people's accounts after determining they were no longer "U.S. residents." Every FI handles the residency issue based on their own internal practices.. So there's no one size fits all standard for that... What you can get away with at one FI you'll end up getting grief from a different FI... And the problem is, you'll never know in advance UNTIL the bad news potentially arrives some day. It's a risk.

-

Understand that those are the standard MC and VISA network exchange rates.... BUT, your U.S. bank can and often does charge foreign currency transaction fees on ATM withdrawals, purchases, cash advances/counter withdrawals and fund transfers in/to foreign countries such as Thailand. Generally in the 3-4% range for many of the larger U.S. banks. Because the U.S. banks basically are oriented toward a domestic U.S. audience and not an expat audience, they typically don't do a very good job of disclosing whether they charge FCFs and if so at what rates. You often have to delve into their often buried online fee schedules to find that kind of detail. So in the case of a U.S. debit card withdrawal here in Thailand, it will be processed at the then current VISA or MC foreign exchange rate, MINUS any FCFs charged by the U.S. FI that issued your debit card. Sometimes those fees are listed separately in online banking, and in other cases, they're simply rolled into the broader transaction, depending on the FI.

-

Last time I checked, for their regular consumer checking accounts, Chase U.S. wasn't refunding foreign bank ATM fees and WERE charging foreign currency fees. But they did used to offer those kinds of perks for certain of their very high balance accounts or ones with other relationship elements. Has something changed in that regard with Chase more recently?