-

Posts

18,024 -

Joined

-

Last visited

-

Days Won

3

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by sirineou

-

Are you thinking of buying a BYD EV?

sirineou replied to DUNROAMIN's topic in Thailand Motor Discussion

Not sure what you did there, but I researched average insurance for Toyota Corolla Cross and BYD Atto 3 and could only find stats from Malesia. The lower replacement value Toyota Cross average insurance for a 2023 Toyota Corolla Cross is RM 4,005 a year. And the higher replacement value of the BYD atto3 had an average insurance for a 2023 BYD ATTO 3 is RM 4,611 a year. As you can see, adjusting for the replacement value difference, the insurance for both is virtually identical. https://www.wapcar.my/car-insurance/model-byd-atto-3 https://www.wapcar.my/car-insurance/model-toyota-corolla-cross -

Are you thinking of buying a BYD EV?

sirineou replied to DUNROAMIN's topic in Thailand Motor Discussion

Thank you!! If you want to know what is happening, watch what insurances are doing. . they have no bias other than the bottom line. -

Sure I agree , but when Willie Sutton was asked why he stole from banks, answered: “Because that's where the money is." So, if it's going to start somewhere as you said, then it got to start where the money is . With wealth inequality in Thailand being where the richest 1% owned almost 67% of the country's wealth.(2018, survey by Swiss bank Credit Suisse ) So for max return Where do you go for the money? Do you go to the bank that has 33% of the money, or do you go to the bank that has 67% of the money?

-

Bad Biden polls stoke third-party angst for Democrats

sirineou replied to Social Media's topic in World News

Here we go with legacy candidates again. First they gave us Hillary who in turn gave us trump, Now the want to give us Biden who in turn could give us trump again. American politics are a joke that is not funny. -

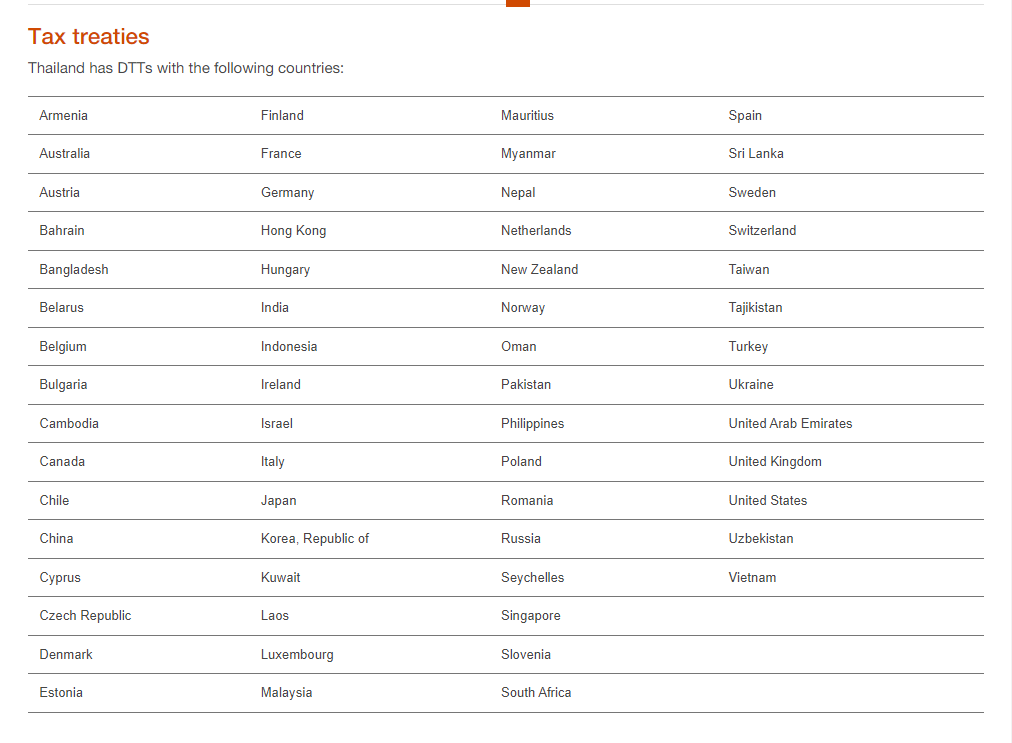

You are right about AI answers. First when I ask about the US Thai tax reciprocity treaty, it told me that the isnt one , then when I said that's not true and that one was signed 1996 it apologised and gave me the answers below. I did say that the below seems to be a cursory synopsys Can you please post that link, I have not seen it.yet How about private company pensions, and income from bonds and such. One thing for sure, if this thing goes into affects we will all need a specialized accountant. or a plan B

-

What you say might be correct, but I have delt with this issue in other countries who have Tax reciprocity treaties and in the countries I looked into the above was not true, So I guess we will have to wait and see. if this proposal is approved and if so what form it will take. So asked chat GPD "what are the rules of the reciprocity tax treaty between the US and Thailand " Below is a cursory synopsys . I am sure each aspect is pages and pages long. The tax treaty between the United States and Thailand, officially titled the "Convention for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income," sets out various rules and provisions to prevent double taxation of income and to promote cooperation in tax matters between the two countries. Please note that tax treaties can be complex, and it's essential to consult the treaty's text or seek advice from a tax professional for specific details. However, I can provide a general overview of some key provisions commonly found in tax treaties: Residency: The treaty defines who qualifies as a resident of each country for tax purposes. Residents are generally subject to tax in their country of residence. Taxation of Business Profits: The treaty provides rules for the taxation of business profits, including rules for determining when a business has a permanent establishment (PE) in the other country and how such profits are taxed. Dividends, Interest, and Royalties: The treaty often reduces or eliminates withholding tax rates on dividends, interest, and royalties when certain conditions are met. For example, withholding tax rates on dividends may be reduced to a specific percentage. Capital Gains: The treaty may include provisions on the taxation of capital gains, especially gains from the sale of immovable property. Independent Personal Services: Rules for taxing income from independent personal services, such as consulting or professional services, may be outlined in the treaty. Pensions and Annuities: Provisions related to pensions and annuities may be included, specifying which country has the primary taxing rights. Elimination of Double Taxation: The treaty typically outlines mechanisms for eliminating or reducing double taxation. This can include allowing taxpayers to claim a foreign tax credit or providing an exemption method. Non-Discrimination: Tax treaties often include provisions to ensure that residents of one country are not subject to discriminatory taxation in the other country. Exchange of Information: There may be provisions allowing the two countries to exchange tax-related information to prevent tax evasion. Mutual Agreement Procedure: The treaty may establish a procedure for resolving disputes between the tax authorities of the two countries. Please note that the specific details of the U.S.-Thailand tax treaty, including tax rates and thresholds, can vary depending on the nature of the income and the specific circumstances of the taxpayer. It's crucial to consult the actual treaty text or seek advice from a tax professional to understand how the treaty applies to your situation. Additionally, tax treaties can be subject to updates and amendments, so it's essential to ensure you have the most current information. Regenerate Send a message

-

Kindle Users – which (country-specific) Amazon site to you use?

sirineou replied to ReloTH's topic in General Topics

I am sorry to hear that. Have you called the Amazon customer service? (+1 888-280-4331 , I use skype to call them and they are always very helpful. If you have not done so already, give them a call and perhaps they can help you remove the device. I was using a tablet but i did not like the glare , and found it difficult to read in the sunlight, ( laying at the beach) The Scribe and other paperwhite devices do not have that problem. Also I find them not affecting my sleeping patterns anymore. Now I only use my Kindle Scribe and my iphone if I am waiting at a doctors office or other functions where I want to kill time. -

Here are 11 top moments from Trump's 'Meet the Press' interview

sirineou replied to Social Media's topic in World News

Me thinks White Man speaks with forked tongue You said"I think you have over-estimated the impact that Trump had or could have on anything that actually could have any real impact on the US. " Do you think Covid had a real affect on the US? and if so, do you thing trump has any impact on the affect covid had on the US ? -

Goodbye Alcoholism, Hello Sobriety!

sirineou replied to bob smith's topic in ASEAN NOW Community Pub

Good for you man. best of luck. With painkillers keep an eye on kidney function. -

Here are 11 top moments from Trump's 'Meet the Press' interview

sirineou replied to Social Media's topic in World News

You think trump did not do anything that any real impact on the US? Did you take one too many hockey pucks to the head? ???? -

Kindle Users – which (country-specific) Amazon site to you use?

sirineou replied to ReloTH's topic in General Topics

For me It is an economic imperative, and I do pay for them by my subscription. Some authors offer the first book of a trilogy on the unlimited account to induce interest on the following books,or to get exposure, They get a small amount per book but they sell more books. Also given the self publishing option available to many authors some circumvent the publisher and for self publish on Amazon. But , Given the amount of self publish trash , and the ability of authors to buy reviews it would suck to pay a lot for something you would not even waste your time finishing. Almost every book on Amazon Unlimited has a 4.5 star review. Coincidence? It is funny that one of the option of searching for books on Amazon is by review rating, the highest option is "by 4 stars" . But since every book has a 4.5 or higher rating.............. ???? -

Each country has it's own tax laws given their particular economic situation. This is how reciprocal tax treaties work. A) Exclusion: If you pay tax situation in your home country is such where you are not taxed on a particular activity, then you are excluded from paying tax on that activity in the host country. B) Credit : If you pay tax for a particular economic activity in your home country, you receive credit for that amount. If the amount is equal or greater that the tax liability in the host country. you pay nothing, If the amount is lover that the required tax in the host country, you pay the difference. C) Inducement: some countries lower or eliminate the tax liability for expats to persuade expats to move there. For example , even though tax for Greek citizens is different, to induce expats to move there it has a lower tax rate of 7% for them. I know that because greece is my plan B. So let's all seat back and wait to see how the proposal is structured. It is possible that there would be a credit, an inducement, an exclusion, or a reduction for retirees , those here on a marriage visa , etc. Thailand has a progressive tax police with brackets based on Thai incomes. Foreign income rates being much higher than Thai incomes would place most expats in the high income brackets with a 30% tax rate , Obviously that would not be viable because everyone would leave, and no one will come here. I and sure adjustments and exclusions will be implemented.

-

Kindle Users – which (country-specific) Amazon site to you use?

sirineou replied to ReloTH's topic in General Topics

I use the US site, not sure is there is any difference in the library size, Unless there are copyright issues, I don't see why they would not have the same content available in every country sites. I have kindle unlimited, I think now it is $11.99. Being retired I read a lot, without it would be too expensive. Not every title is available in the unlimited subscription, but with 11 million books I am sure you can find something, and you also get a discount on many of the "for pay " books , so if you read a lot it quickly pays for itself. Another benefit of the unlimited plan is that if you don't like a book , you simply return it and get another one. I just got the new Kindle 10 scribe. I had it delivered to my sister in Florida, and she brought it to me when we meet up during our Greek vacation. If you have a chance get it. Miles ahead of my old kindle with a phenomenal battery life. I got it during Prime day and saved a bit of coin, they will probably have similar or better sales during the black friday sale. -

I wish that was true but the article states "It is unclear at this point how this will apply to foreigners living in Thailand on a retirement visa. This is a developing story and will be subject to update. " or how about those living here on a marriage visa.? In other words , we don't know one way or another, So stay tuned.

-

I hope you are right, but I don't think you are as far as I know, retirement income is taxed in Thailand and in the US. The only difference is the tax rate and the progressivity. Some other countries such as Australia does not tax the over 60 retirement tax. So it remains to see if since they pay zero tax on that income and Thailand taxes retirement if they will pay the full tax here. Some countries to encourage retirement there, develop a reduced tax for expats. I think in Greece where I looked into retiring is 7%, Perhaps Thailand will develop such tax system. Don't panic yet let's see how this thing develop .

-

Have you been back to the States lately? No been there in Three years but going in two months, Life in the US has got a lot more expensive in the last few years, a lot more expensive!! Before we all start getting upset over this lets wait and see how this plays out. Depending on the tax rate and at what level of income it kicks in , you could pay nothing and stay here. There are negatives to Thailand but also there are a lot of positives .

-

It all depends on how foreign income will be taxed in Thailand. Usually these tax treaties subtract the tax you pay in your home country, from the required tax in the country you are an expat. If the tax you pay in your home country is higher or equal to the tax in the expat country then you don't pay anything. But if the tax you pay in your home country is lower than the tax in the expat country , then you pay the difference. So if the tax rate in Thailand is lower than your home country you pay nothing, but if it is higher you will pay the difference. So let's wait and see how this thing plays out, One good thing that could come out from paying tax here, is that you might get some residency benefits. I would not mind some sort of scheme where we could use the Thai national insurance plan.