-

Posts

1,973 -

Joined

-

Last visited

Recent Profile Visitors

16,791 profile views

Gaccha's Achievements

-

TrueMoney usage abroad

Gaccha replied to Gaccha's topic in Jobs, Economy, Banking, Business, Investments

I'm not worried about domestic usage. I'm just trying to see if anyone has had experience of using it abroad, particularly for complex transactions as I described above. -

I've set it up and got verified so that I'm Advanced status, and I've got a virtual True MasterCard. I'm interested to know any experiences with using the card abroad. There appear to be an enormous number of possibilities. One seems to be using it at 7-Eleven in Japan via Alipay Plus network through the TrueMoney App scan option. And another seems to be using it contactless for the London Tube via the Google Wallet and True Mastercard; this would be like having an Oyster card. Anyone done this? I don't especially want to plan to use it on a trip, only to find it is pretty useless.

-

TM30 password nonsense

Gaccha replied to Zaphod Priest's topic in Thai Visas, Residency, and Work Permits

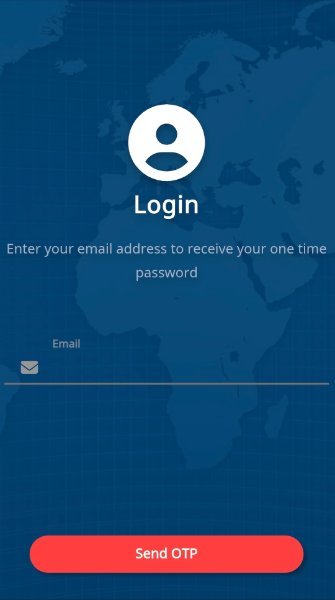

Incidentally, there is a one time password system in operation for booking appointments now. I'm not sure this was always the case. -

Options for investing Thai baht

Gaccha replied to Keith5588's topic in Jobs, Economy, Banking, Business, Investments

This seems to be limited to Thais only. Just 10 years ago this would have been almost impossible. But thanks to Fintech (the finance technology revolution of the last 10 years) you do have some limited options. "Stashaway" opened a branch in Bangkok a few years back (2022?). And this is the option I'd use in your position (i.e. want to keep money in Thailand to keep things simple but want access to the World's ETFs and mutual funds). Obviously it is always wiser to follow the ABC rule when an expat (live in A come from B invest in country C) and it is also always wiser to invest in a first-tier country (e.g.Singapore or Hong Kong) to ensure your money is safe. But obviously only you can determine your priorities. I doubt this is possible. HSBC does not have regular customer account options anymore. Although they have recently opened premier customer account option in Bangkok. But I don't think this offers mutual funds etc. to foreigners. A basic problem you face is that regulations restrict where you can invest. As you've probably discovered you will not be able to make greater investments in the UK if you are a resident in Bangkok, although you will be allowed to keep investments already made in the UK. These stifling rules can be very frustrating. Again, the typical solution is to put money in the more 'relaxed' locations of Singapore or Hong Kong. All of this can seem tiresome but compared with 15 years ago this is absolute paradise. Back then the only real options for international investments were insurance company based investments which were often dreadful. The other options were to invest in local mutual funds etc with often pitiful returns. -

There are two new vaccines for Chikungunya with impressive results: IXCHIQ and VIMKUNYA. But are they available in Thailand? How much?

-

I can answer that because I wanted to check who signed for my delivery. It turns out that the delivery driver can sign for the delivery!

-

I have been a very long time user of Lazada and Shopee. Lazada in particular has demonstrated a superb responsiveness to refunds. It has always provided a refund to a claim. I always avoided AliExpress for years because I got the impression they had a dodgy refund mechanism. But it's actually worse than I thought. I received a notice yesterday (7th of August) in the App of delivery of an item on the 28th of July. Having made sure that nobody else accidentally picked up my item (which is an occurrence that has never happened in the whole time I have had home deliveries), I then claimed a non-delivery. The AliExpress app states that before a complaint is made you contact the logistics company. I checked with the logistics company which then said It cannot deal directly with the receiver. The AliExpress then says to contact the seller if the logistics company does not provide information. They did not respond back to my message (It clearly is not in their interest to respond) since any refund would be against them. After putting in my claim, AliExpress AI bot makes a determination against me. It requires that if I want to continue the claim I must provide evidence. And the evidence is proof of non-receipt from the logistics company or police evidence. I figured my CCTV would be good evidence but in fact my CCTV only goes back 10 days. Since the delivery notice arrived 10 days after the claimed delivery date I did not have any CCTV. This is absurdly Kafkaesque. The system uses its complete incompetence against you. If you are going to use AliExpress make sure your CCTV has a long storage system.

-

Report Thailand Moves to Legalise Poker as a Sport

Gaccha replied to webfact's topic in Thailand News

It is long been recognised as a sport, at least since the 1940s. This recognition looks very similar to the recognition now just granted to poker. If a bridge game is played without the authorisation of the bridge club body of Thailand (CBLT) then it can still fall into the trap of being regarded as illegal. The question arises as to whether the Pattaya Bridge Club were recognised by the national body for bridge in Thailand. Although the details are sketchy it seems that the bridge club when it was raided in 2016 was defended by the CBLT. This could have two meanings: they were in fact authorised and recognised by the CBLT, or on their behalf, the CBLT claimed that bridge is not a card game known culturally within Thailand for gambling. The latter is a defence under the gambling laws of Thailand for when an activity is not specifically banned. -

Report Thailand Moves to Legalise Poker as a Sport

Gaccha replied to webfact's topic in Thailand News

Poker was never and has never been specifically outlawed in Thailand. Having read all the relevant legislation, and knowing the terrible explanations I've found on various websites I'll explain it below. Poker, as a card game, is only regarded by the Thai legislation as illegal if it is considered to be traditionally regarded as normally played in the pursuit of gambling. Poker is not, unlike many other games, named and banned by the legislation. Probably because Poker, and certainly the Texas Hold'Em variant were not known in Thailand/Siam at the time. This means, even if you play with plastic tokens and with no intention to pay out with money it is still illegal since poker itself is traditionally regarded as a game played in the pursuit of gambling. You'll notice that for similar reasons those pensioners playing Bridge in Pattaya got arrested. They were eventually let off because they convinced the police/prosecutors that Bridge is not a game normally played in the pursuit of gambling. By my reading of the law it seems the relevant named Minister can write declarations allowing certain games at certain times without any new legislation. And that seems to be the plan here. Hope this helps. -

Bangkok housing/condo sales worst in 20 years

Gaccha replied to ronnie50's topic in Political Soapbox

Hardly surprising given the terrible combination of the response to the pandemic, poor GDP growth fuelled by political instability, and an economically illiterate millitary government running the country for around a decade. Thailand had the opportunity to attract the huge amount Western industry moving from China but instead it relocated to Vietnam and India. Thailand's ability to grasp defeat from the jaws of victory is always quite something. -

It's remarkable looking at the work of the Australian Strategic Policy Institute. They have gone back in time looking at the satellite maps and they can identify the exact moments of explosions and troop movements. Never has a conflict being so clearly the fault of one side: Cambodia. You can clearly see troop movements in mid-February, to fortify strategic hill stations, as well as strengthening military road networks within Cambodia. You can then see that the first shots were fired into Thailand. But it is equally shocking how bad Thailand has done on the communication front. The whole international media is alight with Cambodian representatives pleading their innocence. Whilst Thai diplomats sound aggressive and obstinant.

- 126 replies

-

- 16

-

-

-

-

Wow. This isn't a mere border clash anymore. Military movements to breach lines is conflict in depth. Wtf. 100?? That's a company of soldiers. This is completely escalating out of control.

- 126 replies

-

- 12

-

-

-

-

Ok. That YouTuber in Rayong makes it clear that they are cracking down on DTVs and other new visas which ambiguously sit between the old so-called residence visas (non-O, non-B etc) and the tourist visas. They clearly want extensions of 1 year. This suggests at worst there is some local change in Pattaya, and at best some great misunderstanding. Most of us understand the complexities of the visa system (most of us are here based on extensions to visas rather than a visa) so you can imagine how formidably confusing it is to some clerical staff at the DLT. Edit: Japan has recently very aggressively cracked down on tourists applying for Japanese licence. They had a major problem with enormous numbers of Chinese tourists seeking to obtain the licence because the Chinese licence has no IDP provision. I wonder if Thailand is facing a similar problem.