OJAS

Advanced Member-

Posts

8,725 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by OJAS

-

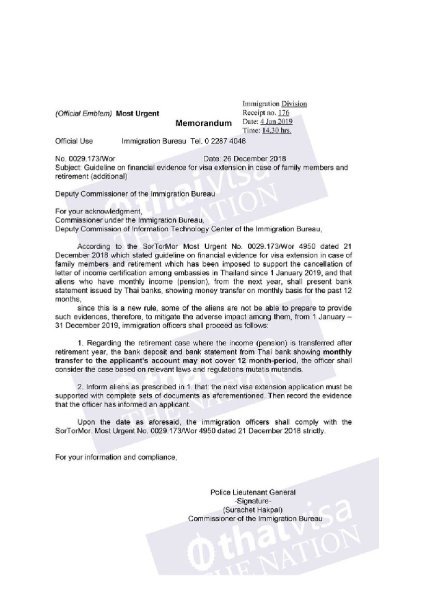

Yes, the Immigration Bureau did issue a memorandum urging leniency in the first year back in 2018 - English translation attached. However, whether individual offices actually took any notice of it was another matter - certainly mine (Rayong) did not, and it was only by pure luck and chance that I had already been making monthly 65k+ transfers for a full year prior to my next retirement extension application in any event.

-

Non-Imm-O: Marriage vs. Retirement based

OJAS replied to XGM's topic in Thai Visas, Residency, and Work Permits

Likewise if you were to find yourself in the same unfortunate position as the OP of this thread: -

Not sure that you won't, in the event, be faced with exactly the self-same situation once again this time next year, though, unfortunately. Maybe a good idea for you to follow the lead of @Pumpuynarak and @MartinL by lodging a formal complaint with HMRC, laying particular emphasis on the totally unsatisfactory need for you to have to contact them each year in order to get things sorted: https://www.gov.uk/complain-about-hmrc

-

I'm sure that quite a few of us would be most interested to hear of the address you used for emailing HMRC! Reverting to this 2023 comment, the link you quoted related to a consultation exercise launched by the Coalition Government in 2014, which, in the event, was subsequently booted into the long grass, thankfully. However, I must admit that I was, more recently, worried by the possibility of Rachel Reeves reviving this proposal as a means of offsetting the £22bn black hole she allegedly inherited from her Tory predecessors, but thankfully the 30 October Budget came and went with no specific announcement on this point as far as I can tell. That's not to say, of course, that she or her successors would not seek to revive it at some point in the future, despite the fact that we are, in practice, probably talking about a drop in the ocean when compared to the overall finances of UK plc.

-

Recently sold house in UK

OJAS replied to kevtheblue's topic in Jobs, Economy, Banking, Business, Investments

In that case, as far as the Thai taxation position is concerned you need to refer to Article 14 of the double taxation agreement between the UK and Thailand: https://assets.publishing.service.gov.uk/media/5a80bddc40f0b623026953eb/uk-thailand-dtc180281_-_in_force.pdf -

Recently sold house in UK

OJAS replied to kevtheblue's topic in Jobs, Economy, Banking, Business, Investments

https://www.gov.uk/tax-sell-home -

Recently sold house in UK

OJAS replied to kevtheblue's topic in Jobs, Economy, Banking, Business, Investments

In particular, he now only has until 22 Feb to make any CGT payment to HMRC if he hasn't already done so! https://www.tax.service.gov.uk/capital-gains-tax-uk-property/start/report-pay-capital-gains-tax-uk-property?_ga=2.31492087.898625034.1633235870-1552680673.1629876543 -

Is It Just Me, Or Are Thai Staff Getting Ruder By The Day?

OJAS replied to SoCal1990's topic in ASEAN NOW Community Pub

Yeah, right. And catch food poisoning from undercooked meat instead. -

How to send an Alzheimer's patient back to the U.K.? - From Bangkok

OJAS replied to Furioso's topic in Health and Medicine

Unfortunately a major stumbling-block here is that: The Embassy would only be prepared to issue him with an Emergency Travel Document (ETD) if he had specific plans for travelling to the UK. And it is, I think, unlikely that Immigration would be prepared to issue him with a temporary medical extension in an ETD in any event. -

How to send an Alzheimer's patient back to the U.K.? - From Bangkok

OJAS replied to Furioso's topic in Health and Medicine

Might be worthwhile @Furioso checking specifically with relevant airlines what their policies are on transporting severely-handicapped individuals unaccompanied. Assuming that the answer to your "silly question" is in the affirmative, these would likely be THAI or EVA (although BA do, I gather, now operate flights between BKK and LGW). -

How to send an Alzheimer's patient back to the U.K.? - From Bangkok

OJAS replied to Furioso's topic in Health and Medicine

So what alternative suggestion do you have, then? -

How to send an Alzheimer's patient back to the U.K.? - From Bangkok

OJAS replied to Furioso's topic in Health and Medicine

These people might be worthwhile contacting: http://heathrowtravelcare.co.uk/ -

Whilst you may well be physically able to make such exotic trips at the moment, despite your age, it does not always follow that this will still be the case at some point in the future.

-

Passport validity - visa renewal

OJAS replied to 1948wjm's topic in Thai Visas, Residency, and Work Permits

Certainly makes a complete mockery of the claim persistently made by His Majesty's Passport Office back in the UK in the case of British passports that passports are produced according to international standards, I think! -

Passport validity - visa renewal

OJAS replied to 1948wjm's topic in Thai Visas, Residency, and Work Permits

Agree with you both, but it does IMHO underline the excessive cumbersomeness and awkwardness of the procedures to which we Brits are subject at passport renewal time, when compared to other Western nations. From what I can gather from various reports on here over the years, nationals of no other Western country are subject to similarly cumbersome and awkward passport renewal procedures which require the services of an agent (at a not insignificant cost of around 5,000 THB, by the way) in order to make reasonably tolerable. -

Nightmare at the Prachuap tax office

OJAS replied to thesetat's topic in Jobs, Economy, Banking, Business, Investments

@GroveHillWanderer - correction with apologies: the actual amount above which a tax return might be required in your case is, in fact, 120,000 THB (which currently converts to around £2,850). See page 23 of 122 in the following link: https://www.pwc.com/th/en/tax/assets/thai-tax/thai-tax-booklet-2023-24.pdf -

Nightmare at the Prachuap tax office

OJAS replied to thesetat's topic in Jobs, Economy, Banking, Business, Investments

Assuming that you are not married and that the UK State Pension is your sole source of assessable income, you may need to file a tax return if your SP payments exceed the equivalent of 20,000 THB per annum (around £475 on the basis of current exchange rates). -

And they are by no means alone in HMG in that regard. So are HMPO when it comes to renewing passports from Thailand.

-

IMHO DWP surpass even Thai Immigration these days when it comes to excessive pedantry!

-

Late to renew retirement visa

OJAS replied to john smith's topic in Thai Visas, Residency, and Work Permits

As confirmed on the basis of personal experience by @billd766 in this thread: -

My Thai Tax Office Tax Filing Experience...

OJAS replied to WingNut's topic in Jobs, Economy, Banking, Business, Investments

Clearly you didn't get as far as 14:02 where ol' Ben uttered the following immortal words, did you? "It does not look like standard retirement visa holders need to concern themselves so much with this". And, of course, in order to propagate your scaremongering on here, you have conveniently chosen not to include any mention of DTV holders being ol' Ben's principal target audience in this video, haven't you? -

IMHO it is essential that this letter clarifies specifically (even at the expense of making it a bit - but not too much - longer than might otherwise be desired) why the OP is not accompanying his wife on this occasion, contrary to the information she provided in support of her visa application. In other words, how and why has the plan changed in the meantime?

-

Ah, another example of the "joys" of mobile banking apps by the look of things! They're really not worth all the hassle, I think.

-

WISE just shut me down!

OJAS replied to PumpkinEater's topic in Jobs, Economy, Banking, Business, Investments

A Google search of the Asean Now website I've just conducted has revealed a third culprit in the form of NatWest - see @MangoKorat's posts in the thread linked below. But, that apart, just a tsunami of complaints about 1 bank (Barclays). -

Some tax filing issues

OJAS replied to Barney13's topic in Jobs, Economy, Banking, Business, Investments

So what answer did the tax lady give you on this?