OJAS

Advanced Member-

Posts

8,754 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by OJAS

-

Yep, yet more sports channels guaranteeing yet more wall-to-wall coverage of yet more pointless badminton, tennis, basketball & golf tournaments televised live from China, South Korea and Japan with solely local lingo & Thai commentary, I strongly suspect.

-

Report Thailand Eases Alcohol Restrictions on Buddhist Holidays with Exceptions

OJAS replied to snoop1130's topic in Thailand News

Indeed, there are - so any relaxation of booze restrictions on account of Visakha Bucha 2568/2025 also falling tomorrow will presumably be trumped in this instance. After all, we can't run the risk of having voters commit VUI, can we? On the other hand, campaigning pick-ups promoting particular candidates' manifestos with amplified announcements made at top volume interspersed with loud boom-boom music which make our window frames rattle (and which have been the bane of our existence these past few weeks on my moobaan) are cheerfully tolerated - nay gleefully encouraged, I strongly suspect - by the powers-that-be.🤬 -

Converting Retirement OA visa to O

OJAS replied to JetsetBkk's topic in Thai Visas, Residency, and Work Permits

As well as totally illegally - meaning that you could then find yourself running the risk of eventually ending up in deep, deep doo-dah with IMM. Much better to follow the procedure set out by @DrJack54 IMHO. -

Taxable income threshold amount.

OJAS replied to notrub's topic in Jobs, Economy, Banking, Business, Investments

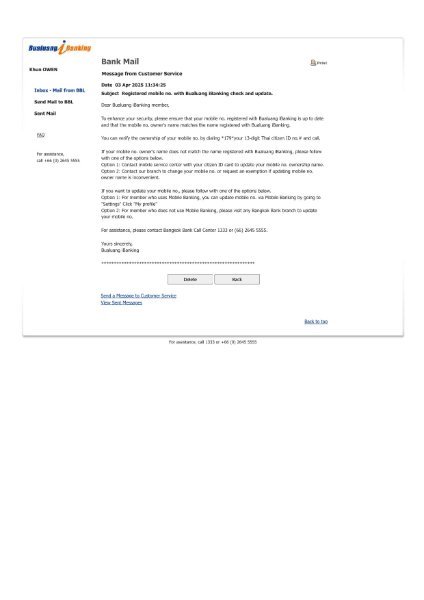

.. of which this is one: -

I managed to get my SIM card identity-verified following a trip to my local AIS shop this morning (which proved a much smoother process than I had been fearing). However, one question to which you may have the answer given your comment above is "Will we need to go through this palaver again each time after we've renewed our passports?". After taking a snapshot of my passport page, the AIS staffer then appeared to extract info from it for their system, including, in all likelihood, the passport's expiry date.

-

It would appear from the very brief video included with the OP that the government and banks are only planning to go after foreigners with gleeful zeal and gusto on this particular issue. On the other hand, Thai nationals will, presumably, still be cheerfully permitted by the powers-that-be to have their bank accounts linked in complete impunity to SIM cards registered in the name of any Tom, Dick or Harry they might choose.

-

British passport renewal in Bangkok

OJAS replied to kidneyw's topic in UK & Europe Topics and Events

For which the responsibility lies fairly and squarely with those clueless HMPO clowns in Corby IMHO. But, if perchance, they have, in fact, determined, for their inscrutable reasons, that fictitious police reports of lost and stolen passports (along with certified English translations + completed LSO1 forms) are now to accompany all passport renewal applications submitted from Thailand as a matter of course, then they also need to communicate this fact to those responsible for administering the gov.uk website so that those of us who are about to renew our passports are aware of this particular new requirement up front. Personally I rule nothing out as far as HMPO are concerned when it comes to crass stupidity! -

British passport renewal in Bangkok

OJAS replied to kidneyw's topic in UK & Europe Topics and Events

Glad to hear that you finally managed to get your passport renewal woes sorted out. Given the extreme level of clueless idiocy on the part of HMPO's office in Corby with which you have been faced throughout this nightmare process, you may wish to consider lodging a complaint with HMPO about the unacceptably abysmal treatment you have been on the receiving end of, through following this link: https://www.passport.service.gov.uk/help/what-do-you-want-to-do -

One Year Extension / new passport timing

OJAS replied to Burgo1979's topic in Thai Visas, Residency, and Work Permits

Here is another current nightmare thread about the complete and utter bloody shambles that is the UK passport renewal process from Thailand: https://aseannow.com/topic/1356355-uk-passport-renewal-email-received-send-us-your-passport-2-weeks-after-applying/ And here is another stating that the processing time for UK passport renewals from Thailand is now 9-11 weeks, despite 4 weeks still being quoted on the gov.uk website: https://aseannow.com/topic/1359941-british-passport-renewal-in-bangkok -

Report retirement extension CW - bank method

OJAS replied to cormanr7's topic in Thai Visas, Residency, and Work Permits

Are there any other offices which insist on this IMHO rogue requirement for retirement extensions? -

In that case, one thing you may need to bear in mind in connection with Clause 5 of my attachment is that Jomtien require the 800k to be seasoned for 2 months, as for retirement extensions (officially no seasoning is needed for non-O conversions, so this is a local rule which Jomtien have dreamt up). But, seeing as you have stated that you are already compliant for extension of stay purposes, this presumably won't be an issue for you in any event. Or maybe you could go down the monthly income route instead, assuming that your European country's embassy in Bangkok is one of those which still issues income confirmation letters or affidavits?

-

Strikes me that the best course of action in your case would be to do a border run, exiting on your Caribbean passport and then re-entering visa-exempt on your European one, which you could then convert to a non-O visa at your local immigration office before then resuming annual retirement extensions. How you go about seeking a non-O conversion for retirement is set out in the following link: https://www.immigration.go.th/wp-content/uploads/2022/02/9.FOR-RETIREMENT-PURPOSES-50-YEARS-OLD-NON-O.pdf This is how a number of retirees went about dumping their original non-OA visas for replacement non-O visas in order to avoid the mandatory health insurance requirement, so it is a path reasonably well-trodden in fairly recent times. Incidentally, would I be correct in inferring from your username that your local immigration office is Rayong?

-

TDAC - Another Brilliant Thai Made Platform

OJAS replied to Nickcage49's topic in Thai Visas, Residency, and Work Permits

They will if you've hitched a ride in Dr Who's Tardis to travel back up to 3 days in time!😉 -

First and foremost, you need to be a tax resident of Thailand in order for Thai taxation requirements to apply - which means that you will need to stay in Thailand for at least 183 days in any relevant calendar year (it's not crystal clear - to me at any rate - from your posting as to whether you are currently based in Thailand or the USA). Secondly, the source(s) of the income covering your family transfers might then come into play. If exclusively American Social Security payments for instance, these are specifically exempted from being liable to Thai tax as a result of the USA/Thailand Double Taxation Agreement.

-

Their new forms are now available online for download: https://assets.publishing.service.gov.uk/media/67160776e94bb9726918ee90/Life_Certificate.pdf

-

Non Imm O Retirement Extension - Jomtien

OJAS replied to scubascuba3's topic in Thai Visas, Residency, and Work Permits

Yep, seems to be a uniquely Jomtien thing. Not aware of any other office that also does this. -

Might be worth bearing in mind that the "combo" method of proving finances (monthly income + seasoned bank balances) could mitigate the effect of any increases for those on retirement extensions - particularly if they are not already using this method. But, alas, not for those on marriage extensions, though.

-

Yep, confirmed by the following thread on the Phuket forum - to which there was a surprisingly muted reaction:

-

Thai Tax on UK pensions

OJAS replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

I suspect that we might, in practice, be reliant on the TRD establishing a formal process for issuing tax credits in the case of the UK State Pension and company occupational pensions at least, as alluded to by @topt. Given what HMRC have said in their DTT Digest note I have my doubts as to whether they would themselves be prepared to issue any tax credits in respect of these pension types, regardless of what Article 23 might say. This is, I think, all the more reason for the need for the State Pension and company pensions to be formally codified in the DTA - preferably in the same way as Government pensions have been in Article 19, which would, of course, eliminate the need for tax credits! -

Thai Tax on UK pensions

OJAS replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

Indeed - and not helped, of course by differing tax year periods! -

Thai Tax on UK pensions

OJAS replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

How do you square Article 23 with the DTT Digest note* I referred to previously? * Treaty does not include an article dealing with Non-Government pensions. Also, no relief for State Pension or ‘trivial commutation lump sum’.