-

Posts

11,163 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Everything posted by Will27

-

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

All Aussie Related Stuff (excluding the old age pension)

Will27 replied to Will27's topic in Home Country Forum

Where does it say that in the link you provided? Seriously. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

All Aussie Related Stuff (excluding the old age pension)

Will27 replied to Will27's topic in Home Country Forum

No. You have posted several time that people were stopped from leaving the country. "I have provided a link where they are stopping people with HECS debts leaving the country at the airport". More scare mongering from you again. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

All Aussie Related Stuff (excluding the old age pension)

Will27 replied to Will27's topic in Home Country Forum

People are still getting issued passports now despite having debts. I can't see that changing. Going on your theory, they will deny people getting a passport for any debt to the government. That's just crazy, not to mention unworkable. BTW, still waiting for that link where people were stopped from leaving the country due to their hecs debt. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

All Aussie Related Stuff (excluding the old age pension)

Will27 replied to Will27's topic in Home Country Forum

Comparing unpaid fines and licence renewals to being banned from getting a passport is a stretch. Even for you. Again, can you post a link where people with hecs debts were stopped from leaving the country? I've seen nothing that says that. You keep saying your stuff is a possibility. It's possible I will win a million dollars on the lotto tomorrow using your theory. Possibility, likely, no. I think we all keep an eye out for the future. Keep telling people all of this craps is scare mongering. If you're basing people being denied a passport to people not getting a licence renewal, you're in Laa Laa land. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

All Aussie Related Stuff (excluding the old age pension)

Will27 replied to Will27's topic in Home Country Forum

You've posted twice now about people leaving country with HECS debt stopped. Unless I misread the link, I never saw anything about people being stopped leaving the country. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

Australian Aged Pension

Will27 replied to VOICEOVER's topic in Australia & Oceania Topics and Events

"Doesn't Centerlink already withhold some pension if you are out of the country for more than 6 weeks, or you tell them you will be? If so, if you are outside Australia indefinitely, I guess they will just withhold the non resident amount." Read what I posted again. I said you will be paid the pension you're entitled to. Obviously if you're out of the country for 6 weeks, you're not entitled to it. "I guess they will just withhold the non resident amount." That's all you do, guess. There's no law bought in as yet, And it if was, it would be managed by the ATO. "The 183 day rule takes away some of that self assessment, doesn't it?" Of course it doesn't. You will still be asked if you're a resident for tax purposes. It will be up to the individual to decide what box to tick. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

All Aussie Related Stuff (excluding the old age pension)

Will27 replied to Will27's topic in Home Country Forum

Nice call. Although I wasn't talking about the bankruptcy process, which is entirely different to what KH way saying. He was inferring that the government wouldn't issue new passports to someone with an ATO debt and people overseas would be stuck. Another "proposed change" I guess. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

All Aussie Related Stuff (excluding the old age pension)

Will27 replied to Will27's topic in Home Country Forum

Can you explain how someone who lives full time in Thailand, doesn't go back to Oz and has maybe a bank account and the pension as income, is a resident? Other than just ticking you're a resident when you're obviously not. People wanting to be non-residents would be in the extreme minority on here you'd think -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

All Aussie Related Stuff (excluding the old age pension)

Will27 replied to Will27's topic in Home Country Forum

I still haven't heard of the government refusing someone a passport for a tax debt. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

All Aussie Related Stuff (excluding the old age pension)

Will27 replied to Will27's topic in Home Country Forum

We were talking about government debt. A debt to the ATO. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

All Aussie Related Stuff (excluding the old age pension)

Will27 replied to Will27's topic in Home Country Forum

Don't tell me you're not scare mongering when you're pretty much saying the government will refuse you a passport if you have an outstanding debt. You're making this stuff up. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

Australian Aged Pension

Will27 replied to VOICEOVER's topic in Australia & Oceania Topics and Events

Once again you twist things to suit your narrative. I do vote at the Embassy actually, but that doesn't mean a thing. You said "the "Gov" will just pay around 30% less a fortnight. I've told you Centrelink and the ATO are obviously different. Centrelink will pay your full pension that you're entitled to. What the ATO does is a different matter. Our tax system is still "self assessement" and I'm sure peope will still tick they're a non-resident for tax purposes even if it's incorrect. It will then be up to the ATO to decide what to do. You're like a dog with a bone mate. I've asked you before to stop asking me why the proposes changes won't come in. You don't think papers will run with "pensioners to be hit with extra tax charges"? LOL Of course they will. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

All Aussie Related Stuff (excluding the old age pension)

Will27 replied to Will27's topic in Home Country Forum

Again, you're just making stuff up to suit your narrative. You were taking about people leaving the country with debts. Those were the court orders I was talking about. If the ATO wants to chase a debt whilst someone is out of the country, who as you said is making money, it's easy for them to garnish wages and bank accounts etc. Now you're making stuff about the possibility of the government refusing passports. There is nothing about the government refusing Australians passport. Stop making this nonsense up. You're fear mongering. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

Australian Aged Pension

Will27 replied to VOICEOVER's topic in Australia & Oceania Topics and Events

No matter how many times you keep saying it, doesn't mean it's going to happen. The government cannot reduce your pension by 30% at all. They have to pay you the standard pension that you're entitled to. If you're deemed to be a non-resident by the ATO, they will tax you accordingly. You're just making stuff up to suit your argument. If you don't think there will be a backlash when the headlines read " Government slashes income for our most vulnerable", "Pensioner kills himself as new tax laws would've forced him to leave his family and return to Oz", etc. You've got your head in the sand. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

Australian-rules-football-afl-chatting-tipping-and-news

Will27 replied to BookMan's topic in Sports, Hobbies & Activities

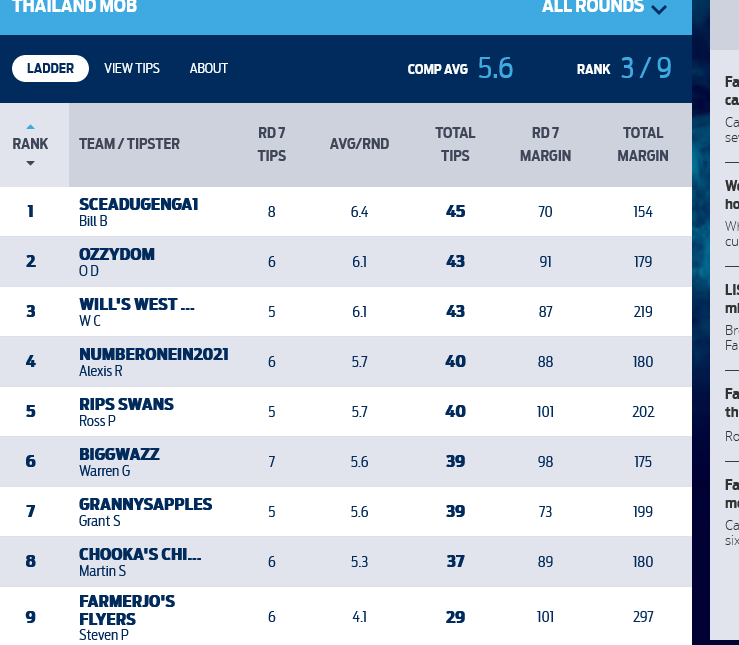

Well gents That's it for round for another round. A stand out winner this week with Scea picking a sensational 8. He gets the Cadbury's. Some movement at the top with Scea going to first and Ozzydom second. Until next time. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

Australian-rules-football-afl-chatting-tipping-and-news

Will27 replied to BookMan's topic in Sports, Hobbies & Activities

Great tipping by Scea today. Freo and Port. Well done big fella. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

All Aussie Related Stuff (excluding the old age pension)

Will27 replied to Will27's topic in Home Country Forum

The only thing the guy was guilty of was not lodging tax returns. I don't know what passports have got to do with anything. I know you like to fear monger on here, but the ATO and CSA have been able to stop people leaving the country for years. They need to have a court order, it's not on every debt. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

Australian-rules-football-afl-chatting-tipping-and-news

Will27 replied to BookMan's topic in Sports, Hobbies & Activities

Nice work FJ. Also one of the most likeable players going around IMO. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

All Aussie Related Stuff (excluding the old age pension)

Will27 replied to Will27's topic in Home Country Forum

It's not only his residency situation. By the sounds of it, the OP was earning $30 000 per year. He should've been lodging tax returns for the past 12 years or so. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

All Aussie Related Stuff (excluding the old age pension)

Will27 replied to Will27's topic in Home Country Forum

What has age got to do with it? -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

What Movies or TV shows are you watching (2022)

Will27 replied to CharlieH's topic in ASEAN NOW Community Pub

The Murder of Rikki Neave. RAR https://www.theguardian.com/uk-news/2022/apr/21/guilty-verdict-for-1994-of-rikki-neave-ends-27-year-mystery -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

All Aussie Related Stuff (excluding the old age pension)

Will27 replied to Will27's topic in Home Country Forum

If you are a non-resident for tax purposes, and it seems you probably are, there is no tax free threshold at all. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

Australian Aged Pension

Will27 replied to VOICEOVER's topic in Australia & Oceania Topics and Events

That (Covid) might come under the "Anything else we think is relevant" part. Having said that, I don't think it's that hard to establish residency for their purposes. I don't know if it has any implications for pensioners, especially if you have portability, unlike the ATO residency. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

Australian Aged Pension

Will27 replied to VOICEOVER's topic in Australia & Oceania Topics and Events

I don't know if you receive any government pensions, but their residency tests look pretty similar to the ATO's. How we decide When we're deciding whether you live in Australia, we’ll look at all of the following: where you live and who you live with if you have family in Australia or overseas your employment, business or financial ties in Australia and overseas your assets in Australia and overseas how often and how long you travel outside Australia anything else we think is relevant. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

What Movies or TV shows are you watching (2022)

Will27 replied to CharlieH's topic in ASEAN NOW Community Pub

Navalny RAR This was just superb. Along the lines of The Man Putin Couldn't kill. Summary: In August 2020, a plane travelling from Siberia to Moscow made an emergency landing. One of its passengers, Russian opposition leader Alexei Navalny, was deathly ill. Taken to a local Siberian hospital and eventually evacuated to Berlin, doctors there confirmed that he had been poisoned with Novichok, a nerve agent implicated in attacks on other opponents of the Russian government. President Vladimir Putin immediately cast doubt on the findings and denied any involvement. While recovering, Navalny and his team unravel the plot against him, finding evidence of the Kremlin’s involvement, and prepare to go public with their findings. https://www.bbc.co.uk/programmes/m0016txs

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)