-

Posts

11,671 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Will27

-

High Desert Peggy, a former addict, who decides to make a new start after the death of her beloved mother with whom she lived in the small desert town of Yucca Valley, California, makes a life-changing decision to become a private investigator.

-

Missing: Dead or Alive? Follow officers from a South Carolina sheriff’s department as they urgently search for individuals who've disappeared under troubling circumstances.

-

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

Australian Tourist Visa Application

Will27 replied to David48's topic in Visas and migration to other countries

When did you apply for the previous visas? If you can cut and paste or post the reasons for refusal, that would be handy. -

Steeltown Murders New one from the Beeb just started. It centers on the hunt to catch the killer of three young women set in both 1973 and the early 2000s, contrasting the policing methods of the 1970s with the forensic breakthroughs of the early 2000s.

-

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

Agents to open bank account

Will27 replied to ian carman's topic in Thai Visas, Residency, and Work Permits

Fair enough. But it was just to advise the people who are having difficulty opening a bank account without being on a visa. Some people were asking about other provinces. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

Agents to open bank account

Will27 replied to ian carman's topic in Thai Visas, Residency, and Work Permits

For those discussing the merits of agents. A mate from Oz arrived into Thailand last week (VOA). Intends to go the retirement route. Went to Kamphaeng Phet Immigration for details. They gave him a certificate of Residency. He went to Bangkok bank and was able to open an account no problems. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

Australian Tourist Visa Application

Will27 replied to David48's topic in Visas and migration to other countries

You will get some decent information if you give some details about your relationship. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

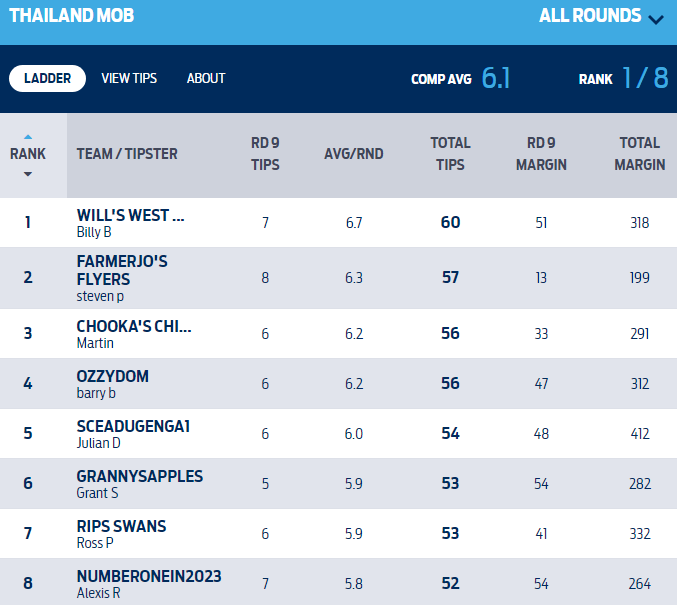

Australian-rules-football-afl-chatting-tipping-and-news

Will27 replied to BookMan's topic in Sports, Hobbies & Activities

Well Peeps That's it for round 9. FJ continues his good form by picking 8. He gets the Cadbury Caramello bars this week. He also has stormed up the ladder to 2nd place. Until next time. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

Australian-rules-football-afl-chatting-tipping-and-news

Will27 replied to BookMan's topic in Sports, Hobbies & Activities

You're sitting second on the ladder. I wish we had a slump like that. -

Been looking forward to this one. Follows the history of shoe salesman Sonny Vaccaro, and how he led Nike in its pursuit of the greatest athlete in the history of basketball, Michael Jordan.

-

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

Australian Aged Pension

Will27 replied to VOICEOVER's topic in Australia & Oceania Topics and Events

Incoming: A 5000 word reply on why he's right and most everyone else is wrong. Followed by a paragraph asking what have you contributed to the forum followed by a put me on ignore sign off. -

Ferdinand von Schirach - Glauben AKA The Allegation Halfway through this one and it's excellent. TPB with hard-coded subs. Summary: In the small German town of Ottern, a pediatrician diagnoses "chronic sexual abuse", while examining a young girl, setting events in motion that lead to a judicial scandal of devastating proportions.

-

Thanks for letting me know........

-

Guy Ritchie's movies are usually pretty good. Summary: During the war in Afghanistan, a local interpreter risks his own life to carry an injured sergeant across miles of gruelling terrain.

-

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

Australian-rules-football-afl-chatting-tipping-and-news

Will27 replied to BookMan's topic in Sports, Hobbies & Activities

Can't believe JVR didn't get off. Reckon Melbourne will appeal it. -

Andrew: The Problem Prince https://www.theguardian.com/tv-and-radio/2023/may/01/andrew-the-problem-prince-review-a-deliciously-vicious-reminder-of-the-dire-state-of-the-monarchy

-

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

Australian-rules-football-afl-chatting-tipping-and-news

Will27 replied to BookMan's topic in Sports, Hobbies & Activities

Well Trend Setters That's it for another round. Not that bad for West Coast. Only an 8 goal loss and lost one of our promising youngsters with an ACL. Both Ozzydom and Chooka picked the card, with Chooks winning the Snickers bars by the barest of margins. Some strange fixturing for next week. A double header on Friday night for some reason. Bring back Thursday night footy I say. Until next time. -

Storyville: Attica: America’s Bloodiest Prison Uprising RAR On September 9th 1971 inmates at Attica maximum security facility in New York State rioted and seized control of the jail, taking guards hostage. When negotiations failed, the authorities stormed the prison, dropping tear gas from helicopters and firing hundreds of live rounds. At least 39 people were killed, including nine of the hostages.

-

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

Australian-rules-football-afl-chatting-tipping-and-news

Will27 replied to BookMan's topic in Sports, Hobbies & Activities

What's changed is that your champions have gotten older and some of the group with premierships have probably lost 5% of their hunger. Not sure if you've been watching WC but we're no chance today. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

Australian Aged Pension

Will27 replied to VOICEOVER's topic in Australia & Oceania Topics and Events

What's sad is he will come back with a 10 000 word reply on why he's right and you're not. -

Dark Water: The Murder of Shani Warren RAR Twenty-six-year-old Shani Warren was found drowned in Taplow Lake, Buckinghamshire, with her hands tied and feet bound together in 1987, with the case becoming known as that of 'the Lady in the Lake". After years of investigation that failed to find the killer, police drew a blank, leaving the family to endure many frustrating years. Then, in 2020, a forensic breakthrough by the Thames Valley Police cold case team finally revealed the terrible truth about what had happened.

-

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

Australian-rules-football-afl-chatting-tipping-and-news

Will27 replied to BookMan's topic in Sports, Hobbies & Activities

Now to decide if we're going to have an 18 or 20 team competition. I hope it's the former. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

Australian Aged Pension

Will27 replied to VOICEOVER's topic in Australia & Oceania Topics and Events

I had to call Medicare a few months ago and like you, gave up after a what seemed like an hour. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

Australian Aged Pension

Will27 replied to VOICEOVER's topic in Australia & Oceania Topics and Events

I've acknowledged he messed up his dates. There's nothing childish at all in the comment, because that's what he did! It's no big deal IMO. I was just asking if he had to inform centrelink when he goes overseas, nothing more. So if you either don't want to or can't answer the question, just move on. I Don't need a lecture. You're not the mouthpiece for Centrelink. -

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

Australian Aged Pension

Will27 replied to VOICEOVER's topic in Australia & Oceania Topics and Events

He was in Australia when he applied. I can't see why it wouldn't be approved. Like I said, it's not a complicated application and I just assume they're busy. I can't see him changing his flights. Hopefully he hears soon.